A ‘dividend hero’ isn’t just a trust that pays an attractive dividend today. Rather, it is a trust that pays consistent dividends over the long term. The Bankers Investment Trust has achieved the latter, paying a dividend to shareholders every year for the past 133 years. This means we haven’t missed a dividend despite two world wars, two major global pandemics and many market crashes to name just a few obstacles. We have even increased the trust’s dividend in each of the past 56 years, growing on average at twice the rate of inflation, as measured by the CPI, in the UK.

This consistent desire to pay a dividend means we must continually seek new dividend-paying opportunities that fit the portfolio, ones that we can hold over the long term. We do this by looking far and wide for strong companies that are continually generating healthy cash flows.

With our global mandate, we are not geographically restricted. This not only widens our universe of investment opportunities but also means we can better diversify our risk exposure. We have six regional portfolios, or ‘sleeves’, in the trust, each with its own specialist fund manager who has substantial depth of knowledge of their specific markets.

North American equities are predominant in the portfolio, accounting for 39%, but the rest is quite evenly split. We have between 13% to 17% allocated to companies from each of Japan, the UK, Europe and Asia Pacific. Over the past few years, we have increased our US exposure, while simultaneously allocating away from UK and European names.

Being able to look further afield can provide the edge when seeking income. For instance, our 13% exposure to Japanese companies – including a top 10 holding in Toyota – has meant we could benefit from Japan’s newfound era of shareholder engagement, with numerous buybacks and dividends. This kind of exposure is of benefit as finding reliable dividend payers has become more challenging in popular locations such as the UK and Europe.

We are mindful that the performance of our US equity market exposure is starting to look stretched. The post-pandemic reopening boom is fading, with US retail sales declining, bank lending conditions tightening to recessionary levels and high valuations relative to history. Fortunately, for holders of high-quality US stocks like ourselves, evidence suggests that these kinds of stocks outperform when profit cycles decelerate as they have the cash-generating ability to maintain income during downturns and have attractive balance sheets that can provide a buffer in these periods.

Our diversified, global approach doesn’t just mean we are able to mitigate risk but also helps us generate greater consistency with our dividend payments. We do not pay dividends out of capital, instead purely out of the earnings we receive from our companies. Importantly, our trust structure also means we can retain income in anticipation of challenging periods. The year following the Covid-19 pandemic was a challenging period to maintain dividends for even the strongest companies, but we were still able to pay an increased dividend through retained income.

Income consistency cannot be achieved through geographical diversification alone, so it’s important to have exposure to a range of sectors. In technology, we have investments in areas such as semiconductor manufacturing (KLA Tencor and TSMC), AI (Microsoft) and networking (Cisco) and this gives us good coverage of the fast-evolving trends dominating that space. Elsewhere, we are investing to help support an ageing population through healthcare companies, targeting dividend-paying companies such as Stryker, AstraZeneca and United Health that are at the forefront of innovation in that area.

In addition, although we have allocated away from industrial names due to margin and demand concerns, we are invested in the themes of electrification, re-shoring supply chains and decarbonisation. We do so via companies that are growing dividends, such as Rockwell Automation, Hitachi and Honeywell International.

The Bankers Investment Trust does not aim to grow dividends higher than inflation (measured by the Consumer Price Index) in every single year, but rather to secure income growth above inflation over the long term. This means every portfolio decision we make isn’t just for the dividend today, but for dividends tomorrow and beyond.

Our long-term view, and commitment to consistency, means we are on track to grow our dividend at a healthy rate for the current fiscal year. This is evident in our third interim dividend for the year to 31 October 2023 growing 10% from last year, an especially favourable position when UK CPI grew at 4.6% in the year to October 2023. We will continue to maintain a long-term view, targeting not just this year’s dividend but dividends for the next generation too.

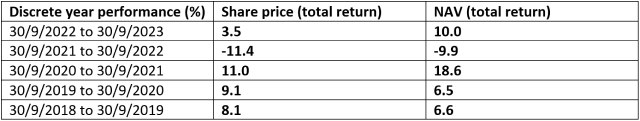

Performance

Past performance does not predict future returns.

Disclaimer

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Not for onward distribution. Before investing in an investment trust referred to in this document, you should satisfy yourself as to its suitability and the risks involved, you may wish to consult a financial adviser. This is a marketing communication. Please refer to the AIFMD Disclosure document and Annual Report of the AIF before making any final investment decisions. Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Tax assumptions and reliefs depend upon an investor’s particular circumstances and may change if those circumstances or the law change. Nothing in this document is intended to or should be construed as advice. This document is not a recommendation to sell or purchase any investment. It does not form part of any contract for the sale or purchase of any investment. We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes.

Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg no. B22848 at 78, Avenue de la Liberté, L-1930 Luxembourg, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier).

Janus Henderson and Knowledge Shared are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc