In the years before the pandemic, interest rates were at historically low levels dating back to the Great Financial Crisis. But following the economic recovery from the global pandemic, which was exacerbated by Russia’s invasion of Ukraine last year, inflation returned and has thus far proven to be particularly sticky here in the UK.

This means that in real terms, investors have endured a significant reduction in purchasing power, as higher prices have eaten into their incomes. As a result, investors may understandably be looking toward income-generating assets as a means of offsetting this shortfall and diversifying their revenue streams.

This is where the Henderson High Income Trust may add value.

Managed by David Smith, CFA, the Trust has an excellent track record of delivering income stability and growth, through a strategy of diversification, and has significantly outperformed its benchmark over the past decade. The investment thesis of the Trust centres around identifying companies that have robust business models, with healthy balance sheets and strong cash flows. It aims to deliver a sustainable yield to investors, and therefore the stock selection process places great emphasis on a company’s ability to grow its dividend over time. This is important in a higher inflationary environment as growth in dividends helps maintain the real value of income.

To do this, the fund manager, supported by the Janus Henderson Global Equity Income team, performs rigorous due diligence to identify companies that are investing appropriately in long term opportunities to drive profit, cash flow and ultimately dividend growth.

Where are we seeing opportunities today?

A key current trend is energy transition, the desire to diversify our energy sources away from the more traditional, and finite, methods of gas and oil, toward more sustainable, renewable energy generators, such as wind, solar and hydro.

This process has gained considerable traction in recent years, initially as a response to the climate crisis and the international push toward Net Zero, but more recently in response to the war in Ukraine. In the months following the invasion, gas and oil prices spiked due to concerns surrounding supply, particularly in light of the international community’s subsequent sanctions upon Russia – one of the world’s foremost suppliers. These fears were realised later in 2022, as the Nord Stream pipeline, the continent’s principal gas supplier from Russia, was temporarily shut down, leading to widespread concern and the spectre of energy rationing in continental Europe.

The energy transition project was injected with renewed urgency as a result, with nations seeking to expedite their respective schemes to claim energy independence more swiftly and ease their reliance on others in the future.

From an investment perspective, this adds further credence to the case for energy transition, now underpinned by not only a unified international objective (net zero) but also an arguably more urgent push at a national level for greater energy diversity.

With this in mind, the investment team has increased exposure to companies that are investing to accelerate the energy transition. Two such companies that met this criterion were SSE and National Grid, both of which are entrenched in the shift towards renewable energy from either investment in clean energy generation (SSE) or through investment in energy infrastructure to connect new renewable energy sources to the grid (National Grid). Both these long-term investment opportunities could possibly underpin attractive future dividend growth from the companies, with SSE guiding to dividend growth of 5% to 10% from next year out to FY2027 and National Grid reaffirming its aim to grow annual dividends in line with inflation (as measured by CPIH).

While the notion of energy transition may naturally conjure up images of wind turbines and solar farms, there are companies outside of clean energy construction that could benefit from its momentum. For instance, a recent addition to the portfolio was DCC, an international sales, marketing, and distribution company. The shares have materially derated on fears that its energy division, and specifically the distribution of oil products to households not connected to the grid, will come under significant pressure due to shift away from fossil fuels. However, this has created an opportunity to buy a company that has a credible energy transition strategy at an attractive valuation. The company’s ability to distribute alternative, lower carbon intensive energy sources (LPG, biofuels and heat pumps/solar solutions) to customers at low cost through its existing infrastructure is underappreciated and should help the company to sustain its high returns on invested capital and maintain is enviable 29-year dividend growth track record.

The energy transition theme is just one example of how the Henderson High Income Trust looks for opportunities at a macro level and then utilises stock knowledge, alongside the deep breadth of expertise within the Janus Henderson Global Equity Income team, to identify the companies set to benefit but that they believe are undervalued. The team pairs this analysis with frequent engagement with senior management teams to create a rounded picture of each company’s investment characteristics and its ability to generate income and dividend growth.

It is through this process that the Trust may appeal to those investors now seeking additional income with a high dividend income strategy, and the prospects of dividend and capital growth.

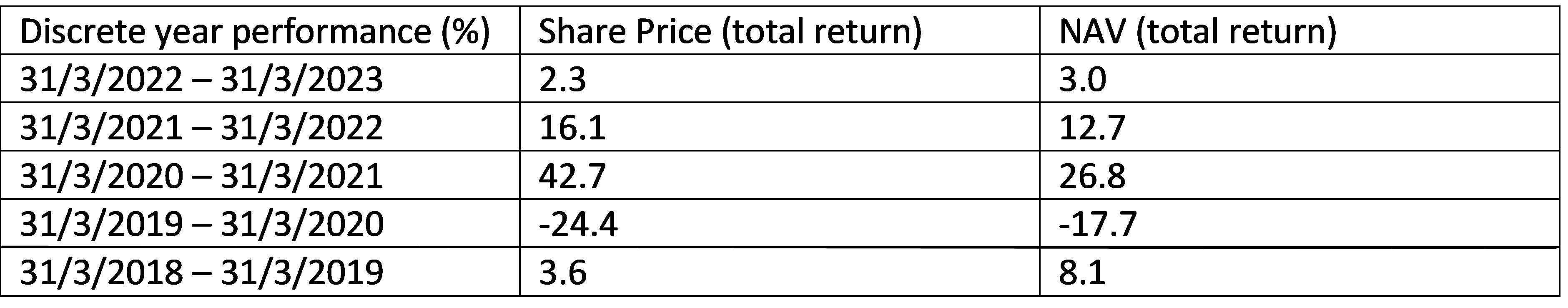

Discrete Performance Table

Source: Morningstar. Past performance does not predict future returns.

Disclaimer

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Not for onward distribution. Before investing in an investment trust referred to in this document, you should satisfy yourself as to its suitability and the risks involved, you may wish to consult a financial adviser. This is a marketing communication. Please refer to the AIFMD Disclosure document and Annual Report of the AIF before making any final investment decisions. Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Tax assumptions and reliefs depend upon an investor’s particular circumstances and may change if those circumstances or the law change. Nothing in this document is intended to or should be construed as advice. This document is not a recommendation to sell or purchase any investment. It does not form part of any contract for the sale or purchase of any investment. We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes.

Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg no. B22848 at 78, Avenue de la Liberté, L-1930 Luxembourg, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier).

Janus Henderson and Knowledge Shared are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc

Balance sheet – A financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time. Each segment gives investors an idea as to what the company owns and owes, as well as the amount invested by shareholders. It is called a balance sheet because of the accounting equation: assets = liabilities + shareholders’ equity.

Diversification – A way of spreading risk by mixing different types of assets/asset classes in a portfolio. It is based on the assumption that the prices of the different assets will behave differently in a given scenario. Assets with low correlation should provide the most diversification.

Free cash flow (FCF) – Cash that a company generates after allowing for day-to-day running expenses and capital expenditure. It can then use the cash to make purchases, pay dividends or reduce debt.

Net zero – refers to greenhouse gas production being balanced by removal from the atmosphere.

Important information

Please read the following important information regarding funds related to this article.

- If a Company's portfolio is concentrated towards a particular country or geographical region, the investment carries greater risk than a portfolio that is diversified across more countries.

- Some of the investments in this portfolio are in smaller company shares. They may be more difficult to buy and sell, and their share prices may fluctuate more than those of larger companies.

- This Company is suitable to be used as one component of several within a diversified investment portfolio. Investors should consider carefully the proportion of their portfolio invested in this Company.

- Active management techniques that have worked well in normal market conditions could prove ineffective or negative for performance at other times.

- The Company could lose money if a counterparty with which it trades becomes unwilling or unable to meet its obligations to the Company.

- Shares can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- The return on your investment is directly related to the prevailing market price of the Company's shares, which will trade at a varying discount (or premium) relative to the value of the underlying assets of the Company. As a result, losses (or gains) may be higher or lower than those of the Company's assets.

- The Company may use gearing (borrowing to invest) as part of its investment strategy. If the Company utilises its ability to gear, the profits and losses incurred by the Company can be greater than those of a Company that does not use gearing.

- All or part of the Company's management fee is taken from its capital. While this allows more income to be paid, it may also restrict capital growth or even result in capital erosion over time.