Sometimes you need to see something to believe it.

We can write here repeatedly that smaller companies are a diversifying part of a portfolio – and have historically beaten large caps over different stages of the stock market cycle.

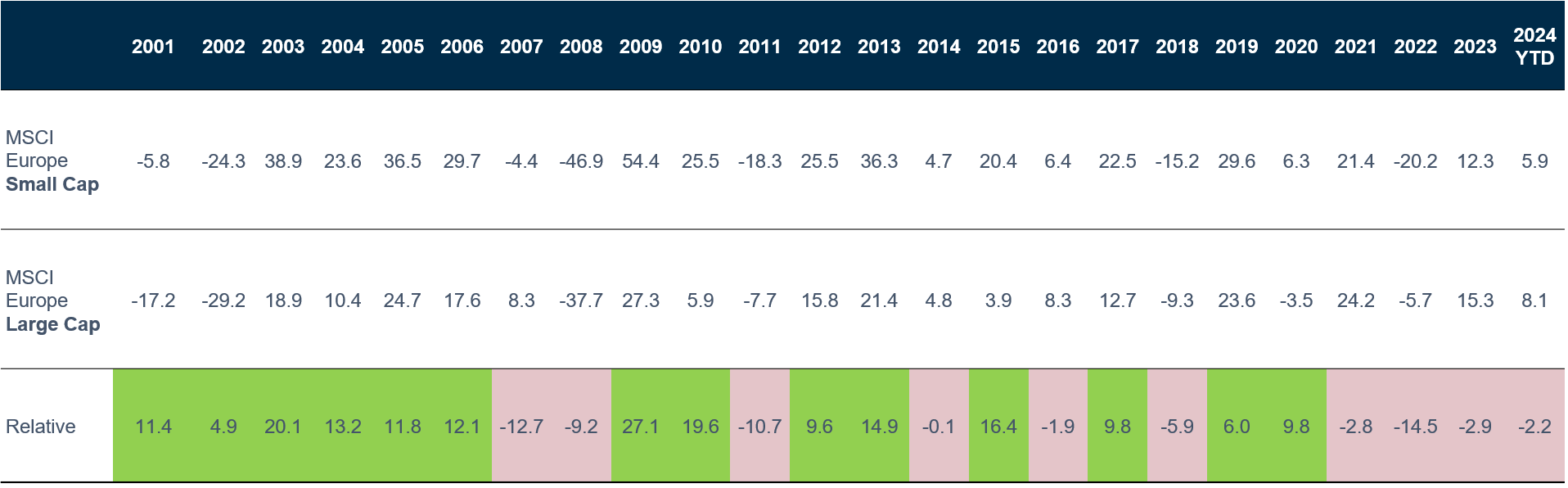

But, the chart below may convey this message more clearly.

European small caps have outperformed large caps in 14 of the last 23 years

Source: Refinitiv DataStream, Janus Henderson Investors Analysis, in Local currency, as at 11 November 2024. Note: Indices used: European Small Caps = MSCI Europe Small Cap Index, European Large Caps = MSCI Europe Large Cap Index, US Equities = S&P 500 Index. Rebased to 100. Past performance does not predict future returns.

The green years are those when European smaller companies outperformed their larger peers. The red are those when they have not.

The first, and most obvious, question this chart throws up is: why have smaller companies done so much worse in the last half decade than they did in the rest of this period?

An extended stretch of ultra-low interest rates were immediately succeeded in 2021 by a period of significant economic uncertainty, a distinctly unfavourable environment for smaller companies. As markets fall and economic growth falters, smaller companies are often the first to suffer. However, historically smaller companies have also been the first to rebound as both markets and economies recover – food for thought.

Investing in European smaller companies

When it comes to investing in smaller companies, for us the chart above sends an even clearer message. That is, that the investing context of the next 2, 5 or 10 years is hard – or impossible – to predict. Rather than attempt to do this, we opt instead to look at individual companies, what they do and how they do it.

We consistently invest in a broad spread of smaller businesses, having examined their finances, operations and management in detail. Our emphasis is on businesses that generate cash: i.e. they sell things or services and actively make money from them. We also look for cases where that profile is underappreciated by the market. These can be in their first years of existence or long-established companies experiencing a turnaround – or indeed anywhere in between.

Most importantly, these companies often operate in niches untouched by their larger peers, making them a unique investment.

Click here to find out more about The European Smaller Companies Trust

Disclaimer

Past performance does not predict future returns.

There is no guarantee that past trends will continue, or forecasts will be realised.

Not for onward distribution. Before investing in an investment trust referred to in this document, you should satisfy yourself as to its suitability and the risks involved, you may wish to consult a financial adviser. This is a marketing communication. Please refer to the AIFMD Disclosure document and Annual Report of the AIF before making any final investment decisions. Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Tax assumptions and reliefs depend upon an investor’s particular circumstances and may change if those circumstances or the law change. Nothing in this document is intended to or should be construed as advice. This document is not a recommendation to sell or purchase any investment. It does not form part of any contract for the sale or purchase of any investment. We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes.

Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), Tabula Investment Management Limited (reg. no. 11286661), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg no. B22848 at 78, Avenue de la Liberté, L-1930 Luxembourg, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier).

Janus Henderson is a trademark of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc