How did European markets fare in 2024?

European equity markets have fared reasonably well in 2024, delivering something in the region of a high single digit returns to investors. Meanwhile, broad global indices have delivered more than 20% returns, led by a very strong US market returning over 30%.

It is notable that the spread of European sector performance has been stark. The best performing sectors have included the slightly odd bedfellows of banks and telecommunications companies. Usually, you would expect these sectors to be negatively correlated – i.e. outperform at different points in the market cycle. Banks’ income is boosted by higher rates, while the valuation of telcos’ long duration cash flows is damaged by higher rates.

However, in 2024, the European banking sector managed to continue to deliver earnings upgrades in a mixed interest rate environment. Banks benefitted from strong capital positions (low levels of leverage) and relatively low levels of defaults on loans. Telcos have largely outperformed due to offering investors inexpensively valued earnings streams, which are not expected to be impacted by an economic downturn at a time of macroeconomic concern.

The sectors that have really struggled this year have been autos and consumer staples. The auto companies have suffered growing competition from Chinese electric vehicle companies. This has increased consumer price sensitivity at the same time as car financing has become less affordable. The consumer staples companies have suffered from a raft of issues. We view the most meaningful of these to have been an inevitable fall in sales volumes following strong price increases under Covid and in the immediate aftermath.

What has been the impact of a tumultuous year politically on the region’s markets/the portfolio?

Politics has had a larger-than-normal impact on equity markets this year. Towards the start of the year, we had the surprise decision by the French President Emmanuel Macron to dissolve Parliament due to his party’s weakening grip on power. This resulted in a sell-off in French shares and political instability that has continued through the year.

Later in the year, the UK elected a centre-left government after more than a decade of increasingly unpopular Conservative rule. The new government has significant economic challenges to deal with; its ability to gain investors’ confidence will be key to the outlook for UK-focused companies.

We then had the ‘main’ political event of 2024, the re-election of Donald Trump in the US. The immediate reaction of investors has been to buy US assets and the dollar and sell non-US assets and non-US currencies. This sensibility of this response is unclear, but it has partly explained European equities’ underperformance against US equities during 2024. As we head into 2025, we have a German election to contend with, including the prospect of increasing vote share being won by the right wing. It is just as well that we can invest in high quality European companies rather than invest in the stability of European politics.

How do interest rates impact your portfolio?

There have been several moments during 2024 when it has felt ‘obvious’ that interest rates were heading down or, in fact, that interest rates were going higher. As we exit 2024, sentiment has swung towards the latter, with high government debt and deficits, stubborn inflation and a ‘soft/no landing’ narrative dominating investor opinion.

We have tried to maintain some sort of balance in our portfolio throughout the year and we retain this stance. There are parts of our portfolio that should be beneficiaries of higher interest rates and parts that should act in the opposite way. We do not bet on interest rates. Instead, we invest in what we see as attractive stock-specific, sector or thematic opportunities.

What are the biggest challenges facing your portfolio in 2025? And where are the opportunities as you see them?

From a broad market and macroeconomic perspective, the biggest challenges at this stage look to be: how we deal with the impact of Trump tariffs, how we navigate a more selective consumer, how we manage evolving policy in China and a very unpredictable and changeable interest rate cycle.

In terms of the biggest opportunities we face, we are excited by a disparate array of uncorrelated themes. These include:

- Ongoing consolidation in product testing.

- Relative pricing power in beer versus other consumer sectors.

- A continued recovery in short-haul travel within Europe.

- A potential bottoming in sentiment towards European semi-conductor companies

- Ongoing strength in US-focused cement, paper & catering

- A recovery in freight-forwarding markets.

Glossary

Capital ratio

A measure of the funds a bank has in reserve against the riskier assets it holds that could be vulnerable in the event of a crisis.

Deficit

A deficit occurs when expenses exceed revenues (or taxation), imports exceed exports, or liabilities exceed assets, over a specific time period.

Earnings per share (EPS)

EPS is the bottom-line measure of a company’s profitability, defined as net income (profit after tax) divided by the number of outstanding shares.

Equity

A security representing ownership, typically listed on a stock exchange. ‘Equities’ as an asset class means investments in shares, as opposed to, for instance, bonds. To have ‘equity’ in a company means to hold shares in that company and therefore have part ownership.

Free cash flow (FCF)

Cash that a company generates after allowing for day-to-day running expenses and capital expenditure. It can then use the cash to make purchases, pay dividends or reduce debt.

Inflation

The rate at which the prices of goods and services are rising in an economy. The Consumer Price Index (CPI) and Retail Price Index (RPI) are two common measures. The opposite of deflation.

Leverage

The use of borrowing to increase exposure to an asset/market. This can be done by borrowing cash and using it to buy an asset, or by using financial instruments such as derivatives to simulate the effect of borrowing for further investment in assets.

Macroeconomics/Microeconomics

Macroeconomics is the branch of economics that considers large-scale factors related to the economy, such as inflation, unemployment or productivity. Microeconomics is the study of economics at a much smaller scale, in terms of the behaviour of individuals or companies.

Soft landing

A situation in which a central bank succeeds in bringing down inflation without significantly harming employment and economic growth levels.

Disclaimer

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

There is no guarantee that past trends will continue, or forecasts will be realised.

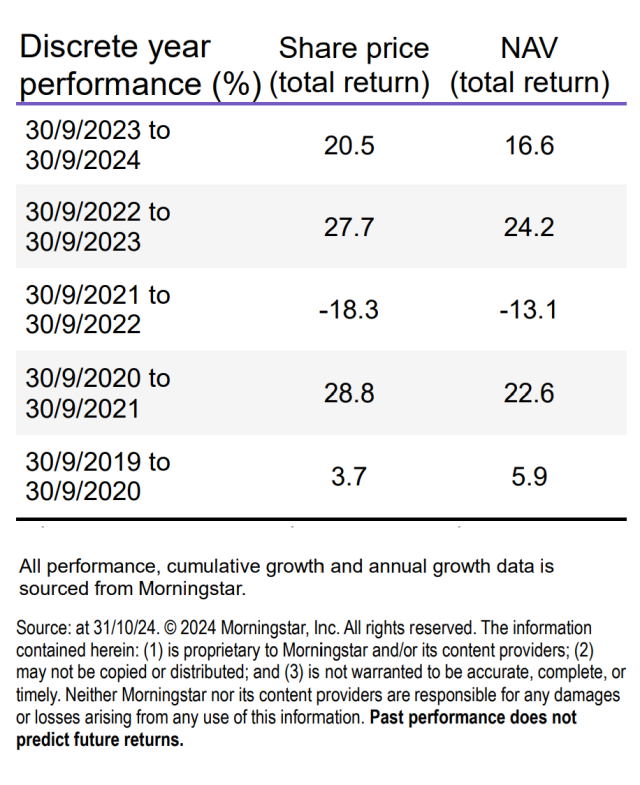

Past performance does not predict future returns.

Not for onward distribution. Before investing in an investment trust referred to in this document, you should satisfy yourself as to its suitability and the risks involved, you may wish to consult a financial adviser. This is a marketing communication. Please refer to the AIFMD Disclosure document and Annual Report of the AIF before making any final investment decisions. Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Tax assumptions and reliefs depend upon an investor’s particular circumstances and may change if those circumstances or the law change. Nothing in this document is intended to or should be construed as advice. This document is not a recommendation to sell or purchase any investment. It does not form part of any contract for the sale or purchase of any investment. We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes.

Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority), Tabula Investment Management Limited (reg. no. 11286661 at 10 Norwich Street, London, United Kingdom, EC4A 1BD and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg no. B22848 at 78, Avenue de la Liberté, L-1930 Luxembourg, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier).

Janus Henderson is a trademark of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc