When investors think of UK smaller companies, the mind often goes first to fledgling businesses with limited scope. However, our remit allows us to invest in any company outside of the FTSE 100 index. That definition encompasses a broad array of industries and subsectors.

The variety available to us is neatly captured by the stocks we have added to the Henderson Smaller Companies Trust portfolio in the last few months. From a high street retailer through to a specialist healthcare provider, these stocks emphasise just how varied smaller companies can be.

Currys sells home technology online and in 727 stores across the UK and Nordics. It has focused on improving customer experience in both channels and ensuring the omnichannel experience is seamless. It benefits from the increasing penetration of technology into customers’ everyday lives. It also highlights the post-pandemic technology replacement cycle as a key opportunity for growth over the next few years.

Niox Group makes devices used in the treatment of asthma. While the stock is more expensive relative to earnings than other smaller companies, it is much cheaper than the average of its healthcare sector peers.

Cohort is a specialist electronics and warfare equipment company. Governments worldwide are investing in defence in the context of deteriorating international relations. As such, Cohort has a solid outlook for its business and a strong order book. The company recently strengthened its market position in Australasia by acquiring EM Solutions, an Australian provider of high-end naval satellite communication systems.

Which leads us on to what unites all three businesses; these are companies that are often overlooked, despite smaller companies having a potentially greater path to growth than their larger peers.

This is a permanent theme – smaller companies are often little-covered by analysts, requiring investors to conduct deep research to have a chance at success. However, it has also manifested in the historically low valuations of smaller companies relative to larger peers over the last few years. This valuation gap has persisted despite strong fundamental performance from the smaller companies in question.

The differences between these three businesses – and the rest of our portfolio – are interesting for investors too. They are each subject to varying demand drivers so experience the phases of the economic cycle differently. This diversity, in turn, should help the trust capture returns through the cycle – although, as we have said, recent years have been unusually challenging for UK smaller company share prices.

Click here to find out more about The Henderson Smaller Companies Trust

Glossary

Diversification

A way of spreading risk by mixing different types of assets/asset classes in a portfolio, on the assumption that these assets will behave differently in any given scenario. Assets with low correlation should provide the most diversification.

Economic cycle

The fluctuation of the economy between expansion (growth) and contraction (recession), commonly measured in terms of gross domestic product (GDP). It is influenced by many factors, including household, government and business spending, trade, technology and central bank policy. The economic cycle consists of four recognised stages. ‘Early cycle’ is when the economy transitions from recession to recovery; ‘mid-cycle’ is the subsequent period of positive (but more moderate) growth. In the ‘late cycle’, growth slows as the economy reaches its full potential, wages start to rise and inflation begins to pick up, leading to lower demand, falling corporate earnings and eventually the fourth stage – recession.

Index

A statistical measure of group of basket of securities, or other financial instruments. For example, the S&P 500 Index indicates the performance of the largest 500 US companies’ stocks. Each index has its own calculation method, usually expressed as a change from a base value.

Portfolio

A grouping of financial assets such as equities, bonds, commodities, properties or cash. Also often called a ‘fund’.

Price-to-earnings (P/E) ratio

A popular ratio used to value a company’s shares, compared to other stocks, or a benchmark index. It is calculated by dividing the current share price by its earnings per share. It is calculated by dividing the current share price (P) by its earnings per share (E).

Valuation metrics

Metrics used to gauge a company’s performance, financial health and expectations for future earnings, eg. price to earnings (P/E) ratio and return on equity (ROE).

Disclaimer

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

There is no guarantee that past trends will continue, or forecasts will be realised.

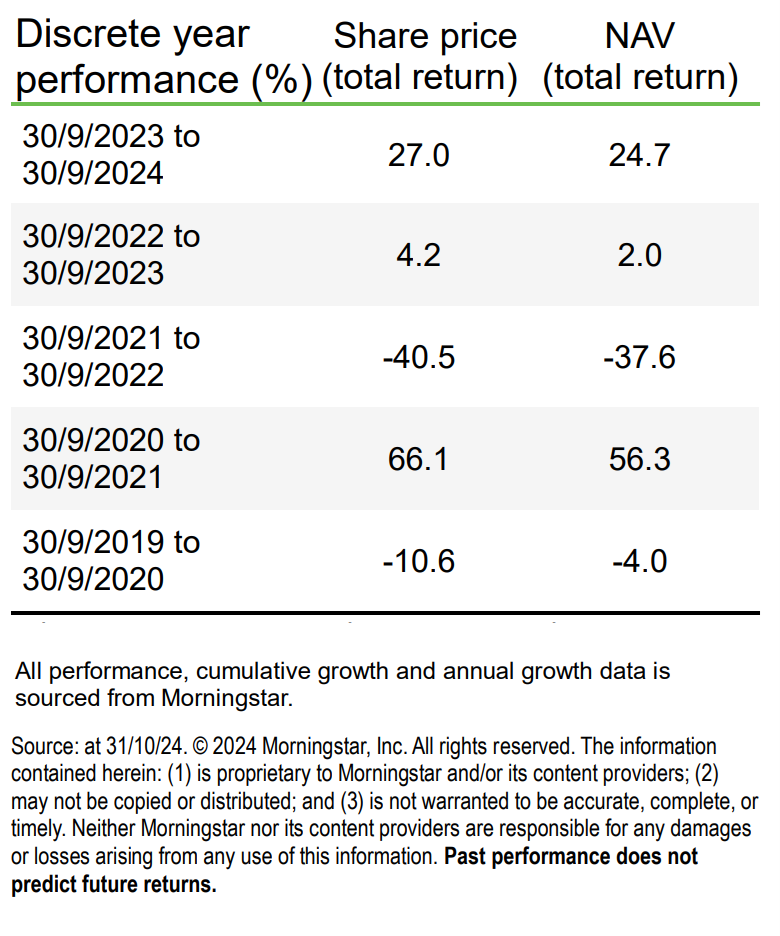

Past performance does not predict future returns.

Not for onward distribution. Before investing in an investment trust referred to in this document, you should satisfy yourself as to its suitability and the risks involved, you may wish to consult a financial adviser. This is a marketing communication. Please refer to the AIFMD Disclosure document and Annual Report of the AIF before making any final investment decisions. Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Tax assumptions and reliefs depend upon an investor’s particular circumstances and may change if those circumstances or the law change. Nothing in this document is intended to or should be construed as advice. This document is not a recommendation to sell or purchase any investment. It does not form part of any contract for the sale or purchase of any investment. We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes.

Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority), Tabula Investment Management Limited (reg. no. 11286661 at 10 Norwich Street, London, United Kingdom, EC4A 1BD and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg no. B22848 at 78, Avenue de la Liberté, L-1930 Luxembourg, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier).

Janus Henderson is a trademark of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc