- Company borrowings around the world surged to a record $8.3 trillion in 2019, up 8.1% year-on-year, the fastest increase in at least 5 years

- Companies borrowed to fund takeovers, share buybacks and dividends, as well as to invest

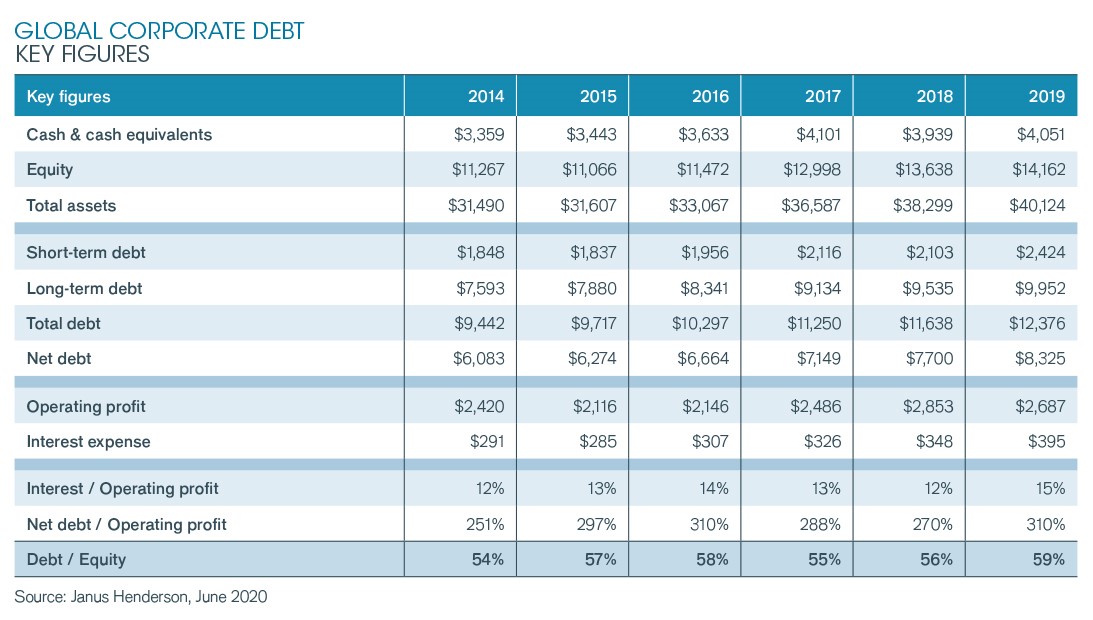

- Debts have risen significantly faster than profits over the last 5 years

- In 2020, bond market analysis shows a sharp increase in borrowing to meet challenges posed by the pandemic

- Janus Henderson expects company debts to rise by $1 trillion in 2020

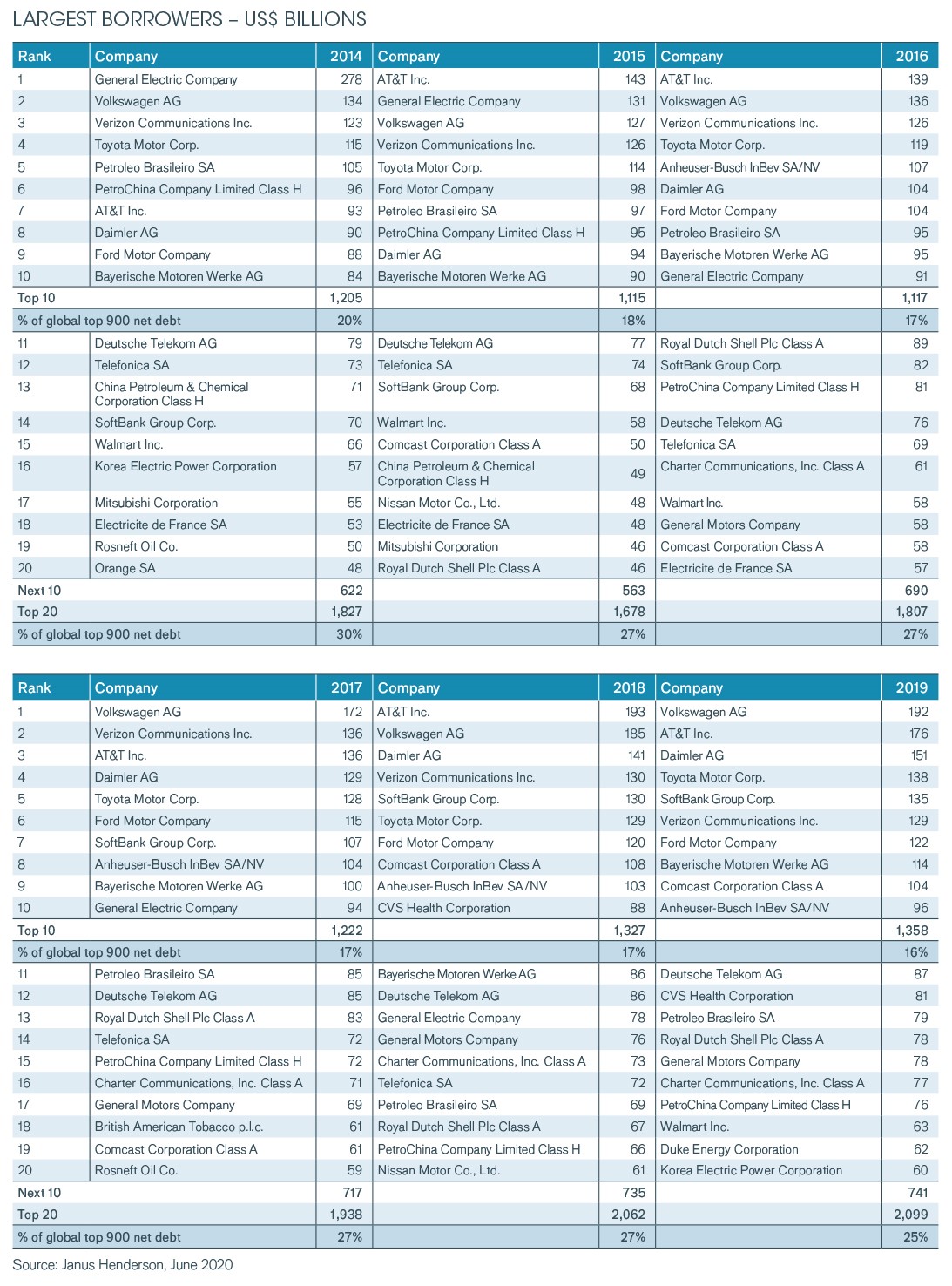

- Volkswagen is the world’s most indebted company, owing almost as much as South Africa though this partly reflects a huge car finance business

- Company debts have grown fastest in the US and Switzerland

- German debts are the second highest in the world after the US, thanks to the car manufacturers and their financing businesses

Even before the pandemic began to batter company balance sheets, company debts were soaring to new highs, according to the new annual Corporate Debt Index from Janus Henderson (JHCDI). Net borrowings[1] around the world surged to a record $8.3 trillion in 2019, an increase of 8.1% year-on-year. Company resources were depleted by debt-financed acquisitions, large share buybacks, record dividends, and the chilling effect on profits caused by trade tensions and a global economic slowdown. Collectively net debts jumped by $625 billion last year, easily the largest increase of any of the last five years. Growth in borrowing has been spurred on in recent years by very low interest rates that make servicing debts cheap, urged on by central-bank attempts to stimulate economies.

Companies included in the Corporate Debt Index (the largest 900 non-financials in the world) today owe almost two fifths (37%) more than they did in 2014, and growth in debt has comfortably outstripped growth in profits. Pre-tax profits for the same group of companies have risen a collective 9.1% to $2.3 trillion. Gearing, a measure of debt relative to shareholder finance, rose to a record 59% in 2019, while the proportion of profit devoted to servicing interest payments also rose to a new high.

These trends all accelerated in 2020 as the Covid-19 pandemic struck. Janus Henderson’s analysis of bond markets shows that companies in its index owe half their debts in the form of listed bonds. They issued an additional $384bn in bonds between January and May, an increase of 6.6% compared to the end of December balances. Borrowing from banks has also increased sharply, though precise figures are not yet available. Janus Henderson estimates net borrowings overall will jump by up to $1 trillion this year, an increase of 12%.

More than half of the companies in the index took on more borrowing in 2019, but a very large impact was made by relatively few of them. Just 25 companies between them borrowed an additional $410bn last year, equivalent to one third of the increase in borrowings of all those companies that added to their debts.

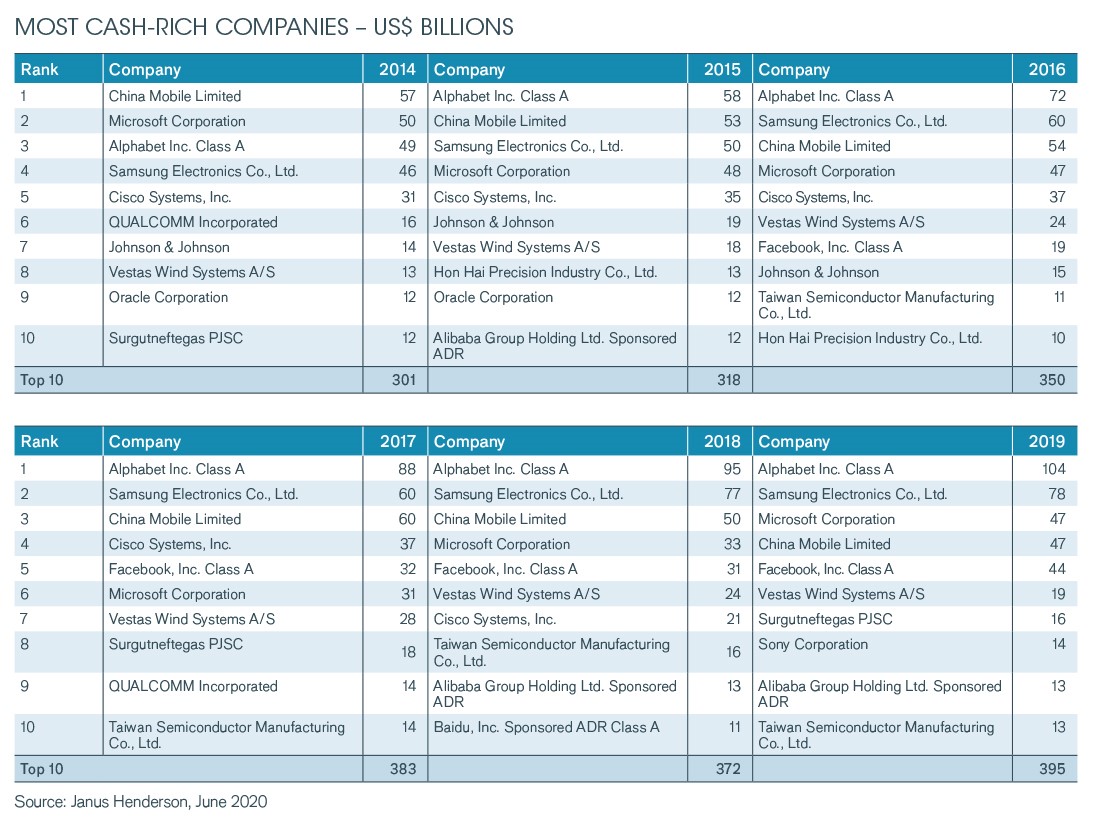

The most indebted company in the world is Volkswagen – its eye-watering $192bn net borrowing is not far behind the sovereign debt of South Africa or Hungary, though this is inflated by its large car finance business. Not all companies borrow. A quarter of the companies in Janus Henderson’s index have no debt at all, and some have vast cash reserves. The biggest of these stands at $104bn and belongs to Google’s owner Alphabet. What seems like prudence, however, is often unpopular with shareholders, who may have better uses for this capital.

Tom Ross, Corporate Credit Portfolio Manager at Janus Henderson said:

“As the economic cycle came to an abrupt end this year, companies faced the downturn with record borrowings. They have now scrambled to issue new bonds and borrow from banks to ensure they have enough ready cash to weather lockdowns of varying severity around the world. Some companies have taken emergency government support during the worst of the crisis when funding themselves commercially became very expensive for a time. With market conditions calmer, thanks to central-bank support and a gradual reopening of economies, companies will want to reduce their reliance on state hand-outs, so we expect bond issuance to rise further.

“Acquisitions, share buybacks and dividends each funded by debt often precede an economic downturn. This has certainly been the case this time round. As the global recession takes hold, profits and cash flow will be sharply lower. Borrowing needs will be very large this year, even though companies in our index are set to cut their dividends by $140bn to $300bn[2] this year, are slashing share buybacks, putting acquisitions on hold and reducing capital expenditure. Much will depend upon the extent to which new borrowing is spent or held as cash reserves, and on how much companies issue in new shares to bolster their balance sheets. It’s clear, however, that 2020 will see net corporate debts soar to another new record, as much as $1 trillion higher than 2019.

“Borrowing is not a bad thing, as long as it’s appropriate, as it can increase shareholder returns. And bonds present interesting investment opportunities too. With interest rates low, crucially companies are on the whole able to service their debts. As long as companies have enough cash to bridge the lockdown gap, we think that corporate bonds returns may look increasingly attractive to investors.

As with all things, some companies do things better than others. As bond investors, we care most about a company’s ability to repay its debts. Most importantly we will be looking for signs that a company is strengthening its position when conditions improve – using surplus cash flow to pay down debts rather than spending it or issuing new shares to rebalance the financing mix between equity and borrowing. This pushes bond prices higher, generating capital gains for investors.”

[1] Total debts less cash and cash equivalents

[2] Source: Janus Henderson Global Dividend Index, Edition 26 May 2020

-ends-

Press Enquiries

Stephen Sobey

Head of Media Relations

T: 44 (0) 2078182523

E: Stephen.sobey@janushenderson.com

Sarah de Lagarde Lia Esbry

Global Head of Communications European PR Executive

T: 44 (0) 2078182626 T: 44 (0) 2078183521

E: Sarah.delagarde@janushenderson.com E: Lia.esbry@janushenderson.com

Past performance is no guarantee of future results. International investing involves certain risks and increased volatility not associated with investing solely in the UK. These risks included currency fluctuations, economic or financial instability, lack of timely or reliable financial information or unfavourable political or legal developments.

Notes to editors

Janus Henderson Group (JHG) is a leading global active asset manager dedicated to helping investors achieve long-term financial goals through a broad range of investment solutions, including equities, fixed income, quantitative equities, multi-asset and alternative asset class strategies.

Janus Henderson has approximately US$294.4bn in assets under management (at 31 March 2020), more than 2,000 employees, and offices in 28 cities worldwide. Headquartered in London, the company is listed on the New York Stock Exchange (NYSE) and the Australian Securities Exchange (ASX).

This press release is solely for the use of members of the media and should not be relied upon by personal investors, financial advisers or institutional investors. We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes.

Issued by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), AlphaGen Capital Limited (reg. no. 962757), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg no. B22848 at 78, Avenue de la Liberté, L-1930 Luxembourg, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier). Henderson Secretarial Services Limited (incorporated and registered in England and Wales, registered no. 1471624, registered office 201 Bishopsgate, London EC2M 3AE) is the name under which company secretarial services are provided. All these companies are wholly owned subsidiaries of Janus Henderson Group plc. (incorporated and registered in Jersey, registered no. 101484, with registered office at 47 Esplanade, St Helier, Jersey JE1 0BD).

[Janus Henderson, Janus, Henderson, Perkins, Intech, Alphagen, VelocityShares, Knowledge Shared, Knowledge. Shared and Knowledge Labs] are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc.