Trade friction

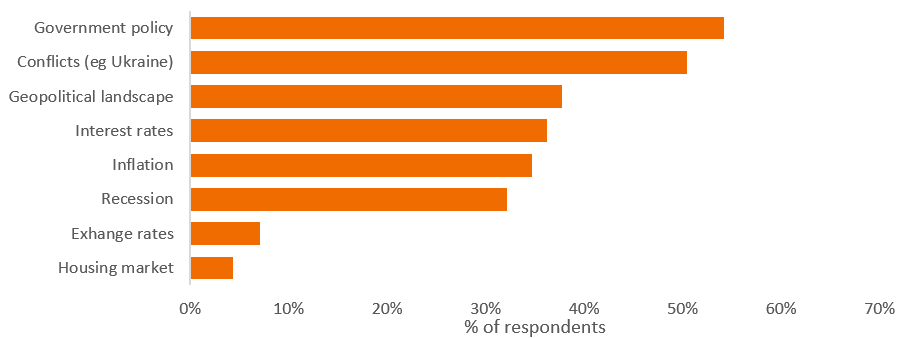

1. What are your top investment concerns? (Select up to three)

We asked you what your top investment concerns were. Government policy jumped into first place, with conflicts dropping into second place from first place six months ago. Trump’s re-election and the Budget were probably front of mind when respondents answered. A notable decline was concerns about inflation, with only 35% of respondents selecting this, compared with 49% six months ago.

2. The incoming US president, Donald Trump, has suggested tariffs (tax on imports) of up to 60% on goods entering the US. Which sentence best describes your view?

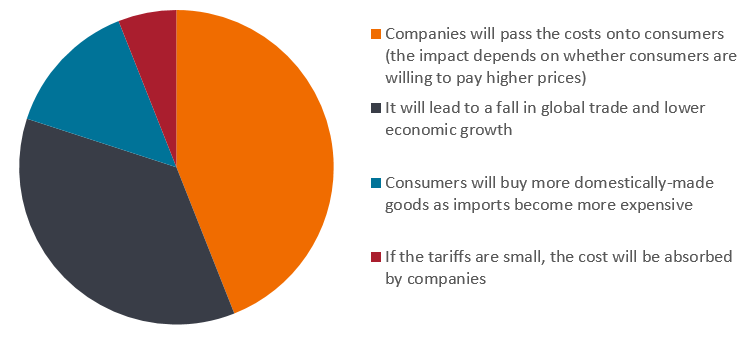

3. If tariffs are enacted, what do you think will be their impact? (Select one that best describes your view)

“It remains to be seen whether the most aggressive of Trump’s proposals are merely a negotiating tactic. The effects of tariffs would vary. Some export demand, e.g., semiconductors, is less sensitive to price changes so export volumes could remain stable even if tariffs push prices higher. Lower value and commoditised exports, however, could lose market share to domestic alternatives should tariffs reach punitive levels. In nearly all instances, higher tariffs inhibit global growth and tend to be inflationary.”

-Daniel Graña,

Portfolio Manager,

Emerging Market Equities

Customer Panel

If you are interested in participating in the Customer Panel Surveys, please email customer.panel@janushenderson.com with your name and email address and we will get in touch with you. Existing members will continue to be included and do not need to reapply. To join the Panel you must be 18 years of age or over and hold an investment directly with Janus Henderson Investors. The survey is conducted a few times each year; participation is voluntary. Please note that your individual responses are confidential and remain anonymous but we may publish the aggregate results from time to time.

The Customer Panel Survey was conducted between 12 December 2024 and 31 December 2024. 323 respondents took part online.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.