2024 saw equity markets perform well, although US equities dominated returns. The MSCI AC World Total Return Index rose 6.8% in sterling terms in the final six months of 2024, to take the total return for the year to 20.1%. Stripping out the MSCI USA Index’s stellar returns of 9.9% for six months and 27.3% for 12 months, the MSCI AC World excluding US Total Return Index returns were a more modest 1% for the last six months and 8% for the year. US stocks saw their valuations swell across the board, but profits of growth stocks also increased dramatically as the Artificial Intelligence (AI) race remained a key theme. Expectations for less support from the Federal Reserve in the form of interest rate cuts did little to dent market optimism. The term “American exceptionalism” crept into market vocabulary as the US continued to benefit from strong economic growth, innovation, and a roaring stock market.

After a strong start to 2024, stocks outside of the US had a more volatile remainder of the year, weakening as 2025 approached and the US dollar appreciated. Equities broadly shook off UK and French elections, but the US election created greater volatility as investors parsed likely winners and losers from a promised change in policy direction, particularly with respect to trading relationships. The uncertainty sent the price of gold soaring despite the 10-year US Treasury yield rising to 4.5% over the course of the year.

From an economic perspective, US gross domestic product (GDP) growth has continued to surprise to the upside since concerns over the summer of 2024 when job growth slowed sharply. As a result, the unemployment rate has moved lower again and other indicators suggest that job losses remain very muted. This is supporting consumer spending, along with strong returns from the stock market. However, the concern is that core inflation has continued to prove sticky and that a tighter labour market could see inflation rise.

The concern about inflation is compounded by the expectation that the incoming US administration will implement tariffs (taxes on imports) that could push up goods prices. The new government may also create further uncertainty with changes in approaches to immigration, regulation and energy policies. In addition to the more direct effects of tariffs on goods prices, these may also have effects well beyond the US itself. Policy choices are likely to elicit responses from elsewhere, whether through retaliatory tariffs or support for domestic industries, creating yet more uncertainty. This is perhaps most acute in China which has flagged its intention to stimulate its economy but is likely waiting to see the US agenda first. There are also expected to be political changes at the core of Europe over the course of the year, with new direction anticipated given the low likelihood of the incumbents remaining in control.

The backdrop has left the outlook for interest rates murky. Markets have rowed back on many of the cuts previously expected, with the US Federal Reserve only priced to cut once more in 2025, with this potentially the final move lower. Talk of when rate hikes might occur has begun filtering into conversations. The probability of multiple cuts from the Bank of England has also reduced to one or two in 2025, but the European Central Bank is still expected to cut multiple times to take interest rates down to 2% from 3% currently.1

The result has been volatility in bond markets recently, with 10-year government bond yields in the UK reaching a new cycle high in January 2025 and the US coming close. While the rise in yields has been painful, it now makes government bonds even more attractive as both a source of returns and as a diversifier should we see an economic growth shock. Yields on UK gilts and US Treasuries offer significant premiums over expected inflation, and even more if central banks can keep cost increases to the 2% target rates. In contrast, credit spreads look tight across most markets, particularly in the US. While defaults look set to remain low, there is little cushion should there be significantly weaker economic activity.

Equity markets continue to benefit from a strong US economy and signs of improvement elsewhere. Concerns that higher bond yields may become problematic for valuations have so far proved unfounded and earnings growth looks set to continue at pace. The US is expected to deliver another banner year for profits, but looks very expensive compared to history. This raises the spectre of outsized volatility in the event of disappointment in delivery. The starting point looks more favourable in terms of market pricing elsewhere around the world, but there is also less conviction in earnings growth. The rest of the world outside of the US needs a more general pick-up in activity, especially in the manufacturing sector to really shine. Lower interest rates and the prospect of greater Chinese fiscal stimulus remain the key hope.

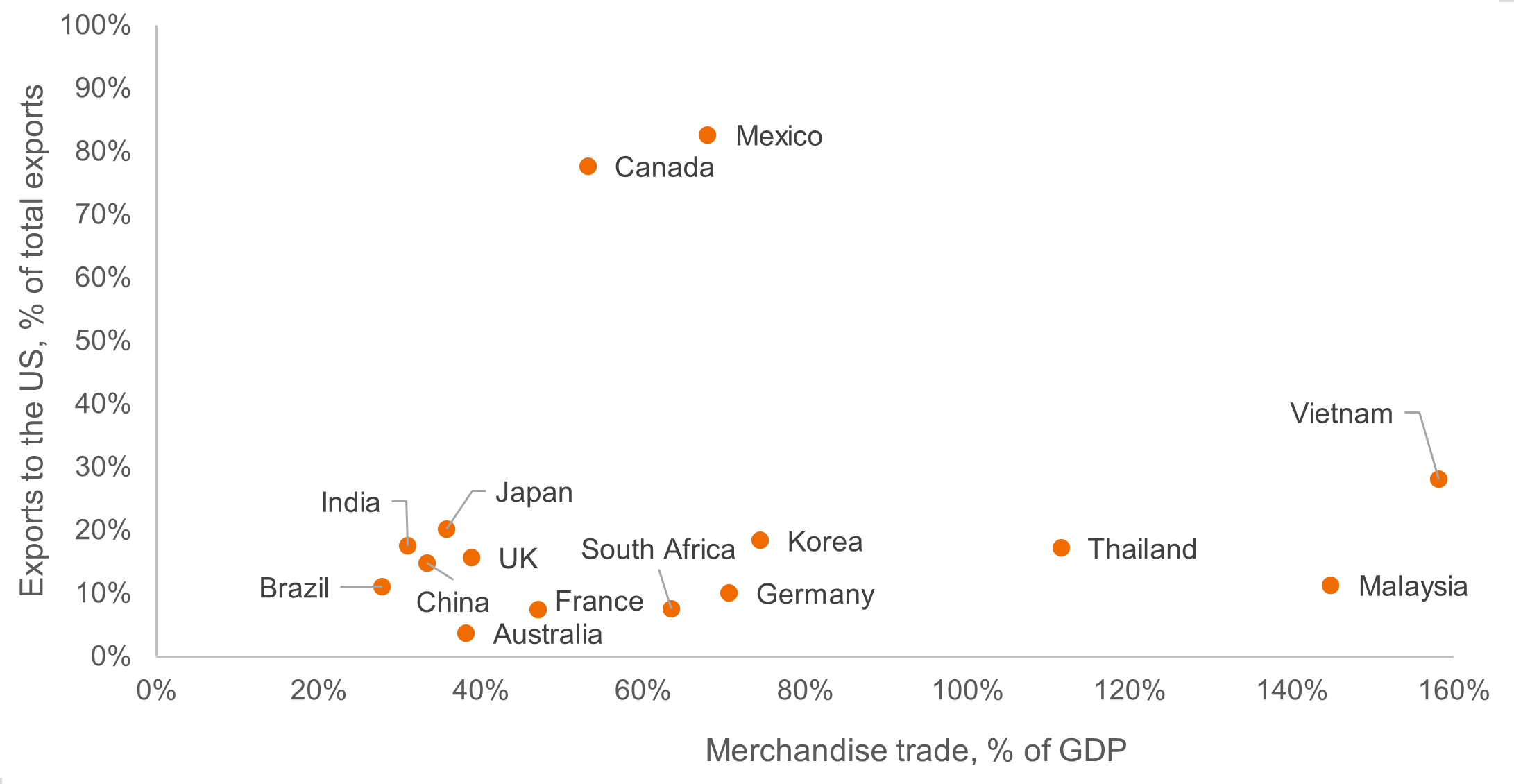

Trade vulnerabilities

Exports to the US and merchandise trade

Source: LSEG Datastream, Fathom Consulting. Data relates to 2023, the most recent comparable period for the countries shown. Note: Merchandise trade as a share of GDP is the sum of merchandise exports and imports divided by the value of GDP, so a higher figure corresponds to an economy that is more sensitive to trade. Gross domestic product (GDP) is the value of all finished goods and services produced by a country, within a specific time period (usually quarterly or annually). It is used as a measure of a country’s economy.

1Source: Bloomberg, World Interest Rate Probability, at 15 January 2025. There is no guarantee that past trends will continue, or forecasts will be realised.

All index return data is sourced from LSEG Datastream, in total returns in sterling terms, unless indicated otherwise. Past performance does not predict future returns.

Credit spread: The difference in yield between a corporate bond (a bond issued by a company) and that of a government bond of similar maturity. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, while narrowing (or tightening) spreads indicate improvement.

Default: The failure of a debtor (such as bond issuer) to pay interest or to return an original amount borrowed when due.

Growth stocks: Companies where earnings growth is expected to be superior to the market average over the long term.

Total return: The return from an investment comprising both income and any capital gain.

Yield: The level of income on a security over a set period, typically expressed as a percentage rate.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.