The world is changing, and financial markets with it. The new environment will be very different than that of recent times, and the transition will present challenges for investors, particularly those without the experience of multiple market realities. Drawing upon Janus Henderson’s 89 years in markets, we know that change brings risks, but it also brings exciting opportunities to generate superior financial outcomes for those approaching it in the right way.

Navigating change requires expert analysis, differentiated insights, and proactive investment strategies to capitalize on opportunities. There will be shorter-term trends, as outlined in our Janus Henderson Market GPS Investment Outlook 2024, but equally as important are structural changes set to alter the investment landscape over the next decade or more. When assessing portfolio positioning, we think investors will benefit from considering three long-term, somewhat immutable, macro drivers.

1. Geopolitical realignment

Change at a geopolitical level has not been this dynamic for a long time. The balance of power across continents and countries is shifting, at times with profound consequences. This realignment has meaningful implications for the economy, global trade, and the supply chains that enable it.

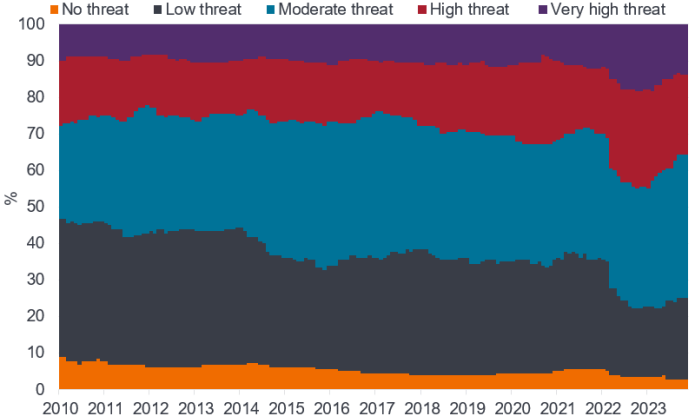

Data from the Economist’s Intelligence Unit shows a sharp rise in the threat posed by international tensions over the last 15 years. Around 40% of geographies faced ‘no’ or ‘low’ threat from international disputes in 2009; that proportion now sits closer to 20%.

Figure 1: The economic impact of geopolitical tensions is intensifying

Level of threat posed by international disputes; % of total geographies

Source: The Economist Intelligence Unit, 2023. Based on 180 geography dataset.

For investors, the impact of this shift has multiple layers, and it will be important to assess opportunities though both a macro and a micro lens. Understanding the environment in which companies operate – and whether the geopolitical backdrop is one conducive to that company and industry – is more critical now than ever, becoming as important as analyzing the company itself. For example, as supply chains move, demand for energy also moves, impacting ports, domestic energy providers, transmission companies, government regulations, and more. Geopolitics impact all asset classes and investors will need to think holistically when positioning for change in order to navigate the knock-on effects of cross-border disputes, onshoring, and supply chain adjustments, to name a few.

2. Demographic drivers

While change is occurring at a global level, there are also shifts in how people live, what they hold to be important, and the products and services they consume. Responses to the COVID-19 pandemic accelerated these changes, and momentum is not slowing.

At one end of the scale, around 40% of the U.S. population are now Millennials (born 1981-1996) or Generation Z (born 1997-2012), with this demographic comprising higher numbers in other countries. These generations are driving new ways of thinking, operating, and consuming, notably at a digital and technological level. At the other end of the scale, populations globally are aging, augmenting the demand for healthcare – and the industry is responding with innovation and medical breakthroughs, such as mRNA vaccines and point-of-care diagnostics, offering opportunities to invest.

Separately, Post-COVID, the lines between home and work have blurred, driving trends like smart cities shaped by artificial intelligence and creating new real estate demands. Urgency around climate change differs by region but is especially evident with younger demographics. The resulting change in expectations and consumption preferences is leading many companies to innovate in exciting ways.

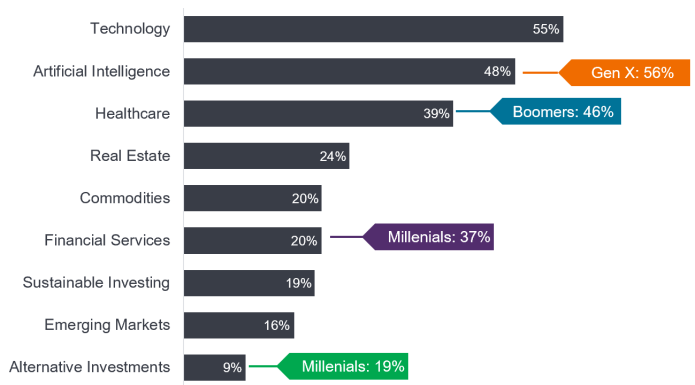

These changes to daily life are reflected in what investors consider to be the most compelling opportunities in the years ahead. For example, data from the Janus Henderson Investor Survey reflects attitudes of individual investors based in the U.S., which are echoed globally.

Figure 2: Investors are focused on the future with tech, AI, and healthcare expected to provide attractive opportunities

Source: Janus Henderson, Investor Survey as of 2023. Responses from 1,000 mass affluent and high-net-worth investors in North America. Boomers = aged 59-77, Gen-X = aged 43-58, Millennials = aged 27-42. For this question, investors were asked: Which industries/themes do you think are particularly good investment opportunities over the next few years?

Source: Janus Henderson, Investor Survey as of 2023. Responses from 1,000 mass affluent and high-net-worth investors in North America. Boomers = aged 59-77, Gen-X = aged 43-58, Millennials = aged 27-42. For this question, investors were asked: Which industries/themes do you think are particularly good investment opportunities over the next few years?

When investing in these themes and market segments, it is essential to differentiate between overhyped trends with questionable viability compared to the innovative business models and technologies that can lead to the pricing power, barriers to entry, and competitive advantages needed for genuine long-term return potential. Investors can benefit from employing approaches rooted in in-depth research and working with experienced asset managers with the ability to navigate hype cycles and build portfolios for a transitioning world.

3. The return of the ‘cost of capital’

For the last decade, whether an organization had a good or bad business model was, more or less, irrelevant; inexpensive capital was readily available to support even the most unviable businesses. The world’s cost of capital then increased significantly in a short period of time. The return of higher lending rates has dramatically changed the landscape for companies, with funding now much harder to come by and investors more discerning in where they choose to allocate capital.

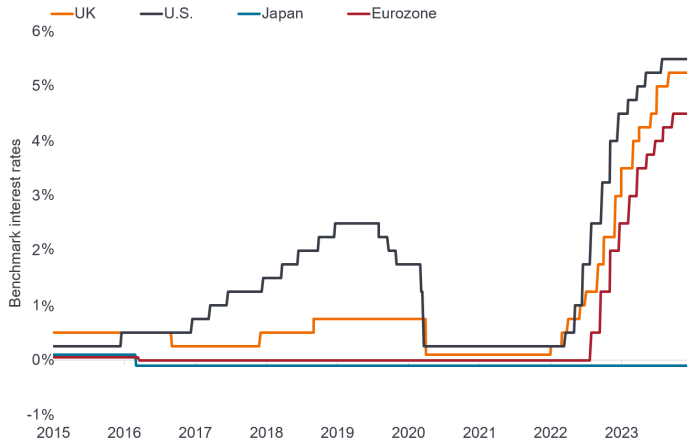

Figure 3: Hikes in interest rates have made it harder for companies to access funding

Source: Bloomberg, as of 30 September 2023.

At a corporate level it is exposing weaker companies, as seen with the US banking failures in the first half of 2023, and leading to greater dispersion between the winners and losers. It is also creating market volatility and mis-pricing opportunities. Public versus private markets is one such example, where, particularly in real estate, public markets have seen valuations correct, while private markets are yet to adjust fully. Additionally, with higher rates come more attractive yields, which has brought fixed income back to the fore.

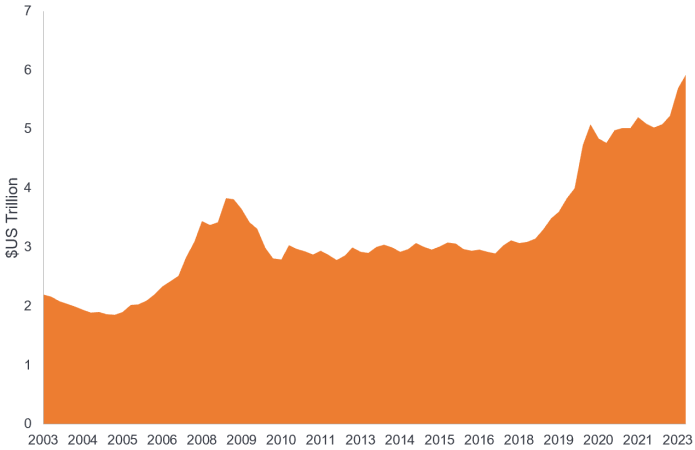

At the same time, a significant amount of cash currently sits on the sidelines. Money market assets in the U.S. have nearly doubled in the last five years as investors have opted to mitigate risk and/or take advantage of the higher rates available.

Figure 4: Money market assets in the U.S. have risen sharply but will this soon be reallocated to risk-assets?

Source: US Federal Reserve, as of 30 September 2023.

Source: US Federal Reserve, as of 30 September 2023.

The cost of capital is likely to remain higher than in recent history, but rates are now likely close to their peaks and could start to fall. This will reduce the attractiveness of holding cash and likely see reallocations to the return-generating potential of carefully selected risk assets.

This combination of increased dispersion between the “haves” and “have nots” coupled with the potential for reallocations to risk assets suggests we have entered an era suited to actively managed investment strategies. For much of the last decade returns have been fueled by cheap money and broad equity markets have generally risen, which suited passive, index-led strategies and undiscerning private equity.

The shifting macro backdrop, however, is likely to usher in an environment more suited to stock pickers, differentiated research, and a selective approach to allocating assets. This is an environment requiring investment in the right asset class and in the right securities, operating against the right backdrop.

Summary

In this time of transition, we expect continued bouts of financial market volatility. We also know that with volatility comes both risks and opportunities. Our goal is to share the differentiated insights of our investment teams and portfolio construction and strategy specialists on an ongoing basis to help investors appropriately frame key longer-term drivers as well as shorter-term market trends. For this, we draw on the expertise of 340+ investment professionals working alongside 540+ client service specialists*. In this complex world, we are ever mindful that our differentiated insights, disciplined investments, and world-class service can help achieve superior financial outcomes for our clients and the over 60 million people** who entrust Janus Henderson with their brighter futures.

*Source: Janus Henderson, as of 30 September 2023.

**Figure reflects the estimated number of individuals as of year-end 2023 where either their current assets or future benefits are invested in Janus Henderson investment products, and is based on JHI’s AUM market share by country, the size of the investing population by country, and average account sizes, using industry and government data and internal estimates.

mRNA vaccine: a type of vaccine that uses a copy of a molecule – messenger RNA (mRNA) – to produce an immune response.

Yield: The level of income on a security over a set period, typically expressed as a percentage rate. For equities, a common measure is the dividend yield, which divides recent dividend payments for each share by the share price. For a bond, this is calculated as the coupon payment divided by the current bond price.

IMPORTANT INFORMATION

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Volatility measures risk using the dispersion of returns for a given investment.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.