Seeking to capitalize on insurance’s extended cycle

Portfolio Managers Brian Demain, CFA, and Cody Wheaton, CFA, along with analyst Ian McDonald, CFA, explain factors driving an extended insurance pricing cycle in the U.S., where to find growth opportunities, and how to navigate risks in this evolving landscape.

6 minute read

Key takeaways:

- The U.S. insurance industry is experiencing a prolonged period of rising prices, driven by new risks to cover, inflation, higher jury awards, and limited new entrants.

- This extended pricing cycle is creating above-average growth opportunities in a traditionally stable sector that also offers dividend income and portfolio diversification benefits.

- We believe the most compelling investment opportunities in the industry exhibit three key criteria: active adaptation to market changes, disciplined underwriting standards, and sustainable advantages and/or exposure to specialty lines benefitting from secular trends. Insurers that exhibit these characteristics may be uniquely positioned to outgrow competitors throughout pricing cycles.

If you own a home, you’ve probably noticed that insurance premiums are on the rise. But for those investing in insurance companies, the picture is much bigger. The insurance industry is evolving as a mix of long-term and more traditional cyclical factors are driving up prices and opening the door for growth opportunities.

Catalysts for growth

The insurance market is currently experiencing a “hardening cycle” characterized by rising premiums and tightening capital market conditions. Several factors have contributed to this cycle, but it’s helpful to consider its origins.

Before the COVID-19 pandemic, the insurance industry was grappling with cracks in reserves and higher-than-expected losses. The pandemic then exposed unexpected correlations across insurance lines, forcing carriers to reevaluate their risk models and diversification strategies. This shock has contributed to a prolonged hardening cycle, revealing that many insurers with seemingly diversified portfolios were under-reserved relative to historical loss-cost trends.

Post-COVID, several other factors are contributing to the hardening market and creating opportunities for growth in coverages and higher premiums:

Emerging perils: Cybersecurity risks, intellectual property protection, and business interruption insurance have gained prominence and increased demand for new coverage types. Climate change is also prompting businesses to seek more comprehensive protection and has made it more difficult for carriers to forecast losses. Global losses from natural disasters have significantly outpaced global GDP over the last 30 years.1

These difficult-to-insure risks have led to significant growth for excess and surplus (E&S) specialty lines. Further, many of these risks, such as climate change and cybersecurity risk, are long-term in nature. We believe insurers with coverage lines benefitting from these secular trends may be uniquely positioned to outgrow competitors, especially those with “moats” such as data, scale, and information advantages.

Economic and social inflation: Rising material and labor costs from construction to automobile repair are increasing claim payouts. Social inflation, characterized by an increase in lawsuits, higher jury awards, and more liberal treatment of claims, is further driving up costs. Inflation can negatively impact insurers’ profitability in the short term because reserves need to be increased and premiums can only be adjusted gradually.

However, at this stage of the insurance cycle, pricing has adjusted, and bottom-lines are improving. While some areas like property insurance may be nearing peak pricing, we believe casualty lines still have room for growth due to ongoing social inflation trends.

Limited new entrants: Unlike past hardening cycles, there has not been a significant influx of new insurance companies or alternative capital entering the market. Higher interest rates and market volatility are pushing some capital out of the industry, leaving remaining companies to adjust pricing and risk appetite. As capital becomes more constrained, insurers are forced to be more selective in underwriting new policies, and that leads to higher prices and growth opportunities for existing players.

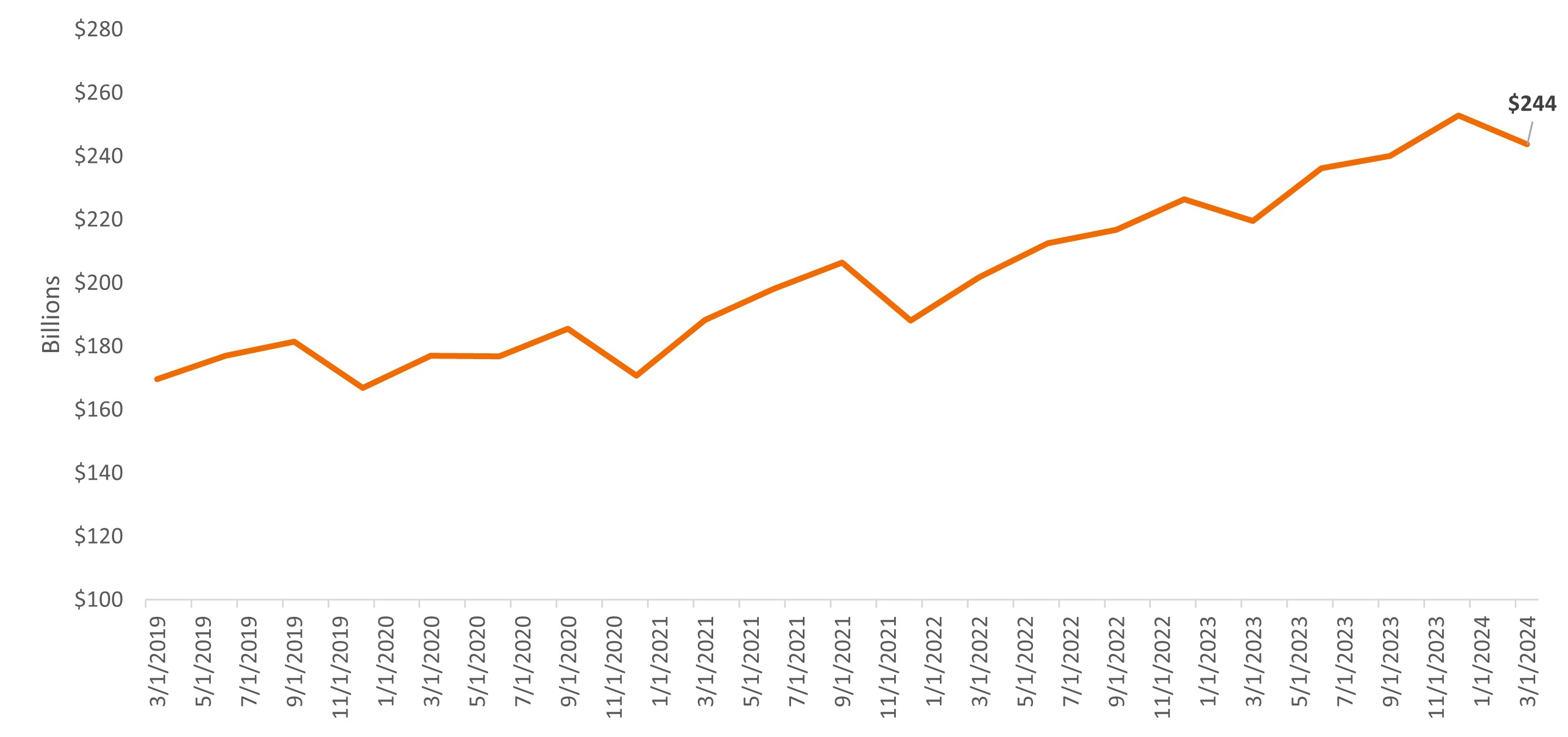

Figure 1: Since the onset of COVID-19, there has been a material shift in the volume of premiums written

Property & casualty insurance total direct premiums written

Source: Bloomberg, A.M. Best. Data in USD. As at 29 July 2024.

Source: Bloomberg, A.M. Best. Data in USD. As at 29 July 2024.

Navigating risks

While these growth catalysts are creating compelling investment opportunities, insurers are simultaneously facing a number of challenges that could present pitfalls for investors.

Unpredictability of costs: Insurance companies book revenue upfront, but the true costs of claims may not be known for months or years. This is particularly true for long-tail claims like those in life insurance. Small changes in actuarial assumptions for long-duration policies can have outsized impacts on profitability, making companies that write shorter-term policies generally more attractive.

Loss reserves: Assessing the adequacy of an insurer’s loss reserves is notoriously difficult, even for industry insiders. Unexpected reserve charges can hit stock prices hard. Given the complexities in reserving and pricing risk, it’s critical to analyze underwriting practices, reserve adequacy, and risk culture to identify sound business practices.

Concentration risk: Insurers that are diversified across business lines, geographies, and customer types are typically better able to offset overexposure to specific risks.

Regulation: The regulatory landscape is complex and subject to change. There’s potential for increased government intervention or regulation in markets facing affordability and high-risk challenges. For example, homeowners’ insurance in wildfire- or flood-prone areas is becoming increasingly problematic. In some cases, there is risk that private insurers could be pushed out by state-run programs.

To help mitigate these varied risks, we believe evaluating a management team’s track record and ability to navigate the intricacies of the industry is crucial to identifying the strongest players.

Valuation and portfolio considerations

Despite strong recent performance, we believe many quality insurers still have underpriced growth prospects relative to other market segments. Companies growing top-line revenue in the high single digits to low double digits are often trading at low- to mid-teens multiples of earnings – a significant discount to the market for comparable growth prospects.

Figure 2: Growth prospects have improved, but insurers remain inexpensive relative to the broader market

Relative Price to Earnings: S&P 500 Insurance Index relative to S&P 500 Index

Source: Bloomberg, as at 16 September 2024.

Source: Bloomberg, as at 16 September 2024.

Insurance stocks can also play a valuable role in portfolio construction, offering diversification as their risks often have a low correlation to the broader economy. The insurance pricing cycle doesn’t move in lockstep with economic cycles, providing some insulation during downturns. Many insurers also pay attractive dividends, enhancing total return potential.

Despite a reputation for slow growth and low returns on equity (ROE), the industry’s wide dispersion in stock performance creates a fertile ground for stock pickers. And within the industry, there are competitively advantaged companies that have long track records of outperforming their peers in both growth and profitability.

Capitalizing on market dynamics

The insurance industry currently offers favorable conditions for growth-oriented investors. We believe companies adapting their business models, utilizing data effectively, and practicing disciplined underwriting are best positioned to navigate this evolving market.

Firms with sustainable edges – such as those with scale advantages, niche target market expertise, or efficient customer acquisition and servicing capabilities – are well positioned to outgrow competitors throughout pricing cycles.

1 Swiss Re Institute, New record of 142 natural catastrophes accumulates to USD 108 billion insured losses in 2023, 26 March 2024. Note: From 1994 to 2023: global GDP grew by 2.7% while insured losses from natural catastrophes averaged 5.9% per year (adjusted for inflation).

Return on Equity (ROE) is the measure of a company’s annual return (net income) divided by the value of its total shareholders’ equity, expressed as a percentage. The number represents the total return on equity capital i.e., the profits made for each dollar from shareholders’ equity.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

S&P 500 Insurance Index reflects the performance of stocks in the S&P 500 Index that are classified in the GICS Insurance Brokers, Life & Health Insurance, Multi-Line Insurance, Property & Casualty Insurance and Reinsurance sub-industries.

Volatility measures risk using the dispersion of returns for a given investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.