Inflation and property equities – time to get ‘real’

Property equities portfolio managers Guy Barnard, Tim Gibson and Greg Kuhl discuss the impact of rising expectations for inflation and interest rates on listed real estate.

3 minute read

Key takeaways:

- Market expectations for inflation and interest rates are rising as economies begin to recover post COVID.

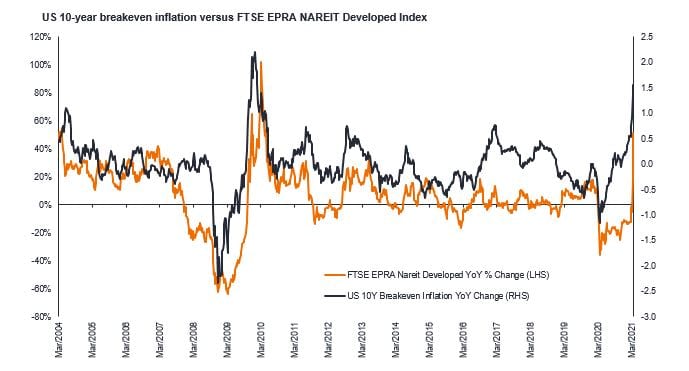

- Historically, there has been a positive relationship between returns from property equities and rising inflation expectations over the longer term.

- Listed property currently has an attractive valuation, offers structural and secular growth and has also been shown to provide protection from inflation.

Inflation remains the topic du jour, and probably for good reason. Having been in a downward trend since 1980, falling from 15% to around 2% in the last decade based on OECD data, it is now on the rise.

What does this mean for property equities, and what are the implications from rising bond yields?

Turning point

Bank of America (BofA) recently stated that they ‘believe a turning point for both inflation and interest rates has arrived and the 40-year bull market in bonds is over.’1 The investment bank’s view is based on the unprecedented supportive government policy measures worldwide, that will likely lead to inflationary pressures.

This is quite a headline-grabbing statement, and while only time will tell if it is correct, we have seen a recent pickup in inflation expectations and interest rates/10-year US Treasury (bond) yields.

How have real estate equities performed?

“Thankfully, the relationship between inflation expectations and real estate equities is a little clearer with, historically, a positive correlation existing, ie. as inflation expectations have risen, so too have real estate equities. This relationship has existed over the longer term, highlighting the potential for real estate equities to benefit from rising inflation expectations.”

But why has property performed well when inflation rises, and will a rising tide lift all boats?

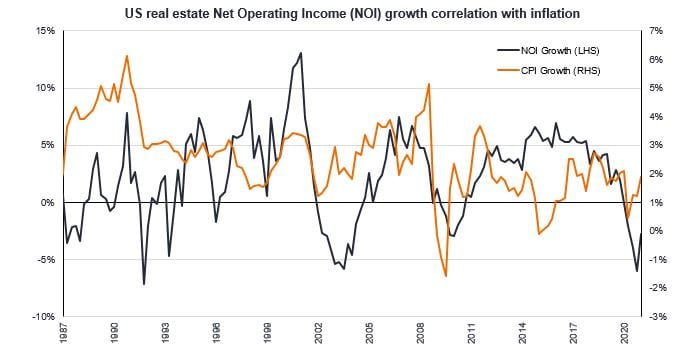

We often talk about real estate as being the ‘landlords of the economy’ whose income streams benefit from positive economic growth. A recovering economy typically leads to rising rental income and increases the value of underlying real estate assets. Rental contracts are often linked to inflation through annual uplifts or are reset when they expire, as can be seen from Figure 2.

However, there is a distinction between property sectors. When it comes to rental negotiations, rising inflation tends to have a bigger positive effect on sectors that have pricing power.

The acceleration in real estate trends as a result of COVID-19 has seen certain sectors negatively impacted such as shopping centres, regional malls and hotels. However, others have been uplifted by strong secular tailwinds, such as e-commerce, cloud computing and changing demographics. Industrial, logistics and real estate tech (eg. cell towers, data centres) are among the sectors that are likely to benefit the most.

We do not know the exact direction or magnitude that inflation and yields will take, but believe it is becoming increasingly difficult to overlook an asset class that currently has an attractive valuation, offering structural and secular growth and is capable of providing effective protection from inflation.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.