The key role of securitisation

After the Global Financial Crisis (GFC), the securitisation market became the subject of intense regulatory scrutiny. Numerous regulations have since been adopted to increase transparency, promote standardisation, as well as ensure full alignment of interest between issuers, transaction participants and end investors. The sector has since been recognised as a channel to revive the real economy and boost EU competitiveness, given its role as a financing bridge between consumers, businesses and investors.

Given the securitisation industry’s strategic role, this update offers practical insight into the securitisation frameworks in the EU and the UK. We focus on the original EU Securitisation Regulations (or EUSR) introduced in January 2019 – the Securitisation Regulation (SECR) and the Capital Requirements Regulations (CRR) – and the more recent UK Securitisation Regulatory Framework (UK SRF), implemented in November 2024. Our aim is to help investors navigate these markets and foreshadows potential simplification ahead.

We summarise what we see to be the core principles of the regime in both the EU and the UK, including investor due diligence, issuer transparency requirements, risk retention, and ongoing monitoring. We also discuss the scope of institutional investors that we understand to be affected by these regulations.

Background: a GFC response

The EU introduced the EUSR primarily to revitalise the European securitisation market (which had stagnated since the crisis) and to address the negative consequences of the GFC. By introducing new rules, the aim was to enable the securitisation market to be a conducive channel for financing the economy, ensuring that it contributes positively to growth and financial stability.

The regulations aimed to protect investors and foster trust in the financial system by establishing clear frameworks around securitisation. This included measures around due diligence, risk retention, and transparency (or disclosure requirements), reflected in the different principles of the regulation, which we cover next. Additionally, it lays out the criteria for identifying transactions that qualify as simple, transparent, and standardised (STS) securitisations[1]. If a securitisation qualifies for STS treatment, then certain institutional investors may achieve preferential capital and/or liquidity treatment in regulatory tests.

Securitisation rules have always been fairly complex. After Brexit, navigating these rules became more complicated because of differences that emerged between EU and UK regulation. From November 2024, the UK’s approach to securitisation has changed, with regulations being divided between the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA), based on the type of entity and its activities related to securitisation.

This division added duplication and the possibility of different interpretations of the rules, even within the UK itself. Despite these changes, the core principles of the securitisation regulations in both the UK and EU remain largely in agreement. The new UK rules under the UK SRF slightly eased some of the regulations, particularly regarding investor due diligence, but has mostly kept the rules as they were before.

What do they cover?

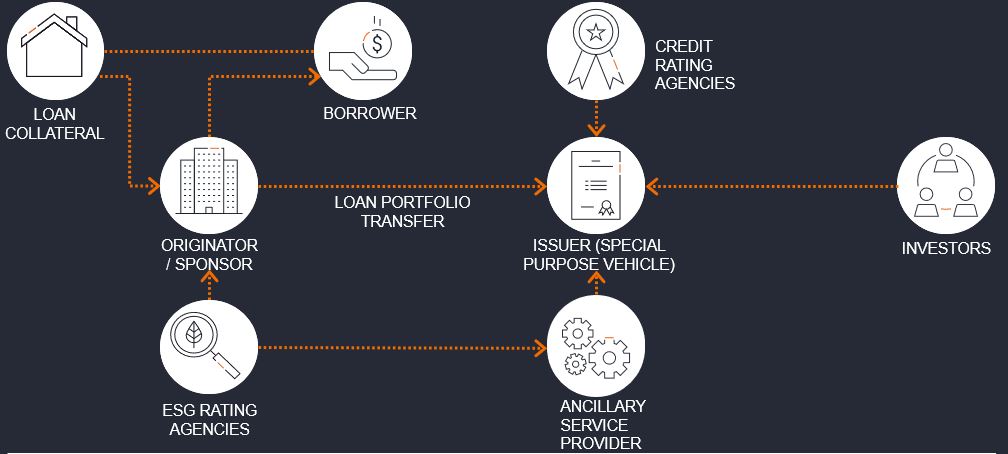

Figure 1: A securitisation transaction has multiple parties

Note: While a single entity can serve as both the originator and the sponsor of a securitisation transaction, the roles are distinct. The originator’s primary function is related to the initial creation of the assets being securitised, whereas the sponsor is more involved in the transaction’s structuring (setting up a Special Purpose Vehicle or SPV that will issue the securities) and execution. In some cases, the sponsor might also manage the portfolio of securitised assets or appoint a third party to do so, such as an ancillary service provider. In a securitisation transaction, ancillary services refer to various supportive functions and roles that are necessary for the operation, management, and administration of the securitisation structure.

The regulations outline the actions required from the various parties in a securitisation transaction, details on transaction structure and underlying assets to be disclosed, and essential characteristics that all securitisations must possess. In summary, the regulations cover:

- broadly all issuers, originators and sponsors of securitisations issued in Europe and UK. Figure 2 illustrates the main parties typically involved in a securitisation.

- European and UK institutional investors in securitisations, regardless of where the securitisations have been issued. The definition ‘investor’ may cover both direct investment by an institution or when investment is made on its behalf by a third party, for example through a managed account or an investment fund.

- certain aspects of the securitisations themselves. The definition of what is a securitisation is quite technical and differs from the definition that might apply in other jurisdictions, such as the US. The rules apply to public and private transactions.

Figure 2: Three principles of the European Securitisation Regulations

Note: High level description of EU securitisation regulation (EU 2017/2402). Does not constitute complete description of the regulation. For any legal guidance relating to the eligibility of an investment or compliance obligations, consult with a legal professional.

Risk retention rules – ‘skin in the game’

Risk retention relates to the form and amount of risk that originators or sponsors are required to hold in the securitisation or underlying assets, often colloquially referred to as having ‘skin in the game’ and specifically a material net economic interest. This requirement is intended to maintain alignment of risk between originators and sponsors of securitisations and investors.

The rules apply to all securitisations, except for securitisations guaranteed by central governments, such as US Agency mortgage-backed securities, which are excluded from the key principles of the regulation – and may not even be defined as securitisations for the purposes of the regulation, depending on structure.

While there are technical nuances, the rules can be met by:

- the originator of the debt obligation (mortgage, consumer or corporate loan, etc), or the sponsor of the securitisation must retain a 5% exposure to that transaction for life:

- either by holding the first loss tranche[2] of at least 5% of the nominal value of the securitised exposures (“horizontal” retention);

- or a 5% slice of every tranche sold to investors (“vertical” retention).

- holding a representative (randomly selected) sample of the types of debt obligations being securitised, with a nominal value equivalent to 5% of the securitised exposures.

- retaining a first loss exposure outside of the securitisation of at least 5% of each of the individual securitised exposures.

Investor due diligence and issuer transparency requirements

Investor due diligence and issuer transparency requirements were introduced to ensure investors have access to all necessary information to make informed investment decisions on securitisations.

Europe

The EUSR clearly outlines the specific documents and data that need to be shared with investors regarding their securitisation investments, detailing both the content and format. It also mandates that investors must review this information before investing and on an ongoing basis.

Unlike the pre-2019 regime, the obligation to ensure compliance with the requirements is imposed on both the sell-side (originator/sponsor) and the buy-side (investor) parties. Investors are required to fulfil their due diligence obligations, including verifying that transparency and disclosure requirements are met, even if sell-side parties are not legally bound to comply. These requirements apply not just to EU securitisations, but also to ‘third-country’ transactions – where neither the issuer nor the originator is based in the EU – to allow EU institutional investors to participate in these deals.

UK

The UK SRF follows a similar approach to due diligence, but it has moved to be more principles-based, in terms of the required specific information and its form. There is a ‘sufficient information’ test, which only necessitates an investor to assess whether there is sufficient information to allow independent assessment of the risks, regardless of the format. This implies that UK institutional investors can now invest in ‘third-country’ securitisations without the need for ongoing reporting in a specific template, marking positive progress in the UK. Nevertheless, UK investors, in our view, still need to consider secondary market liquidity implications if data is not being provided in a form that satisfies the EUSR, restricting investment by EU institutional investors.

Ongoing monitoring and regular stress testing

The requirement to monitor the performance of securitisations is a crucial aspect of both the UK and EU securitisation frameworks. The aim is to promote market stability and positive outcomes for investors. This necessitates:

- Conducting cash flow stress tests periodically.

- Ensuring that senior management is fully aware of the risks associated with owning securitisations.

In contrast to the UK SRF’s principles-based approach, EU guidelines remain quite detailed and prescriptive. Nonetheless, in practice, the foundational principles of ongoing monitoring and stress testing are consistent across both the UK and EU. These include:

- Requiring institutional investors to establish internal policies and procedures that govern the investment process.

- Setting specific procedures for informing senior management and oversight bodies about the results of stress tests and monitoring activities, ensuring:

- Accountability

- Strong governance

- Thorough documentation

- Auditability

Who is in scope?

The EU and UK securitisation frameworks are effectively all encompassing by scope of institutional investors. Those subject to the rules include:

- Credit institutions including banks and other financial institutions that accept deposits and provide loans.

- Investment firms that offer investment services to third parties, such as managing portfolios or providing investment advice.

- Insurance and reinsurance undertakings help to manage and mitigate risks for individuals, corporates and within the financial markets.

- Alternative Investment Fund Managers (AIFMs) including hedge funds, private equity funds and real estate funds.

- Institutions for Occupational Retirement Provision (IORPs) or pension funds that manage retirement savings and provide pension benefits. Trustees or managers are required to implement written procedures for investments in securitisations, covering both pre-investment and ongoing due diligence. This applies even when investments are made through segregated accounts named after the pension scheme. While due diligence tasks can be delegated, trustees or managers remain accountable unless an FCA or PRA authorised party takes on the responsibility.

- UCITS Management Companies manage ‘Undertakings for Collective Investment in Transferable Securities (UCITS)’, which are investment funds regulated at the European level.

- Internally-managed UCITS – those that are managed internally rather than by an external management company.

The new UK SRF has clarified the rules on responsibility for verifying compliance with due diligence obligations where it has been delegated by an asset owner to an asset manager. Where that asset manager is subject to the UK SRF, it will be responsible for ensuring compliance with the due diligence rules. However, if the asset manager is not subject to the rules (such as a non-UK AIF), responsibility for compliance with the UK SRF will remain with the asset owner.

The requirement for institutional investors (including potentially those within the scope of the regulation through their exposure to securitisation positions via managed accounts and investment funds), to assure themselves that the securitisations they are investing in comply with the regulations, brings all securitisations into scope, regardless of where they are originated.

So, for example, a ‘third-country’ CLO – say from the US – would need to be compliant with the respective regulations for European and UK institutional investors to participate. While the Australian market earlier adopted creating securitisations that are compliant with EU and UK regulations, appetite from the US to do so appears to be increasing.

The spirit remains clear to us

Despite the complexity in the detail of the regulations, the spirit behind why they exist is clear to us. They were implemented as a response to the GFC to:

- address information asymmetry between sell-side parties and investors.

- ensure alignment of interest between originators of securitisation collaterals, securitisation sponsors and investors in securitisation transactions, by requiring sell-side parties to retain ‘skin in the game’.

- increase the robustness of the market by putting guardrails around underwriting and origination standards.

For investors, this arms them with sufficient information to make informed investment decisions. For the securitisation market, it improves the robustness of standards, transparency of structures, underlying asset quality and redirects market confidence to the sector, all positive drivers for its growth.

Nevertheless, the detailed and prescriptive European securitisation framework and differences to those in UK has made the regulatory environment complex for issuers and investors, creating high barriers of entry for newcomers. Enhanced regulatory oversight promotes market integrity, but also requires robust mechanisms from market participants to effectively monitor compliance.

Simplification ahead?

Thankfully, there is a growing effort to simplify and alleviate some of the challenging and demanding aspects of securitisation regulations. Positive progress has already been made in the UK and is now potentially extending to Europe. High profile reports from EU establishment figures Christian Noyer, Enrico Letta, and Mario Draghi have all highlighted the importance of securitisation in strengthening the lending capacity of European banks, creating deeper capital markets, and increasing the EU’s competitiveness. The Draghi report, in particular, emphasised that securitisation can make banks’ balance sheets more flexible by allowing them to transfer some risk to investors, release capital, and unlock additional lending. This is crucial for the EU, which relies heavily on bank financing. The report also points out that securitisation can act as a substitute for the lack of capital market integration by allowing banks to package loans originating in different Member States into standardised and tradeable assets that can be purchased by non-bank investors. These insights are shaping the future of the securitisation market and are essential for the EU’s strategy to boost its economic growth and competitiveness.

The EU has launched several consultations to gather feedback from market participants on the effectiveness of the current securitisation framework and potential areas for improvement. These include a targeted consultation, launched in October 2024, which sought feedback on various aspects, including due diligence requirements, transparency, and the STS standard. This consultation aimed to refine and enhance the market’s functionality, ensuring it meets the needs of all stakeholders.

Additionally, the European Securities and Markets Authority (ESMA) has consulted on revised disclosure requirements for private securitisations, proposing a simplified disclosure template to improve proportionality in information-sharing processes, while ensuring effective oversight. Further consultations have been announced, with the overarching aim to increase securitisation market efficiencies by overhauling regulations in the near term. A relaxation of the due diligence rules around ‘third-country’ securitisations – as achieved in the UK – would enable European investors to invest in US securitisations that may not qualify due to detailed reporting differences, but where substantively the information available is sufficient.

We agree with PCS (Prime Collateralised Securities), an independent, not-for-profit initiative whose aim is to support and strengthen the European securitisation market as a safe and sound tool for the financing of the economy. They succinctly state that the regulatory framework should be “Proportionate, Principles-Based and Pragmatic”. This approach ensures that regulations are appropriate to the risks involved, based on high-level principles, rather than prescriptive rules, and practical for market participants to implement.

Why active?

Against such signs of positive momentum, when considering the detail of the regulations and how to interpret them we do not lose sight of why they were introduced. At JHI, detailed fundamental due diligence and comprehensive monitoring and stress testing of our exposures has always been at the core of our securitised investment processes.

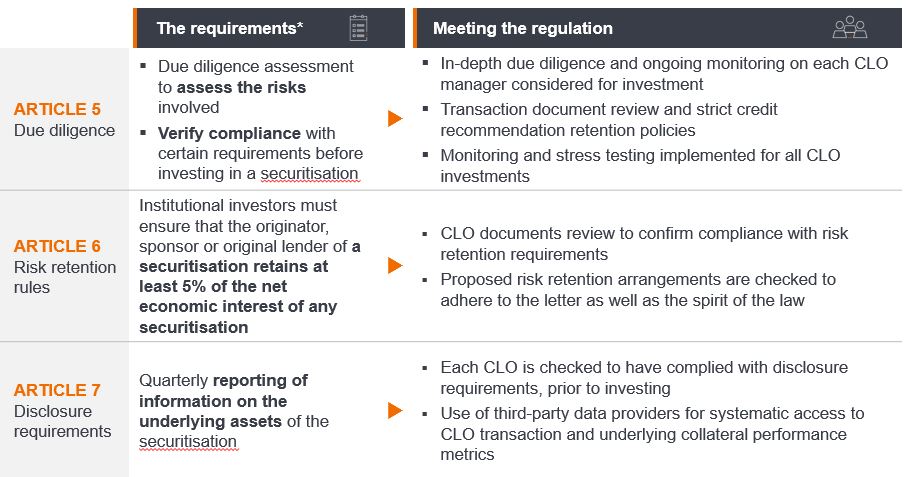

Each investment is subject to our strict independent pre-trade compliance verification against EU securitisation regulation. In Figure 3, we take an example of a collateralised loan obligation (CLO) – a securitised managed portfolio of leveraged loans – and show how we meet the regulation both prior to investment and on an ongoing basis.

Figure 3: Meeting the European securitisation regulations

*Note: High level description of EU securitisation regulation (EU 2017/2402). Does not constitute complete description of the regulation. For any legal guidance relating to the eligibility of an investment or compliance obligations, consult with a legal professional.

With approximately 67 CLO managers overseeing more than 640 unique CLO deals[3], each CLO transaction is distinct. Robust due diligence can help differentiate between CLO managers’ risk management approaches and the risk/reward potential of individual CLO deals, enabling control over manager concentration and improving optimisation of portfolio construction.

We believe that a combinatio of quantitative and qualitative expertise is essential to this process, as well as meeting EU regulatory standards. Collateral quality is one of the key facets we focus on, as it drives credit risk in junior tranches and market risk in senior tranches during market dislocations. A clear understanding of the variations in collateral quality, often referred to as CLO manager ‘tiering,’ is crucial for effective risk management. In stable market conditions, price differences among senior tranches, like AAA CLOs, may not be apparent, but differentiation arises during volatile periods.

For investors looking for long-term stability in returns, an active management strategy that factors in CLO manager ‘tiering’ can help to mitigate downside risks and maximise the diversification benefits that securitisations offer. Each investment we make is continuously stress tested to ensure it can withstand defaults, even in the most severe scenario, while critical metrics are analysed to understand the potential impact on individual CLO and overall portfolio performance.

Active management, in our view, must have the tools and processes to effectively invest in securitised markets as well as adhere to prescriptive regulations. It also must have the experience to navigate markets, not only to evaluate opportunities and risks, but also to adapt to new frameworks and rules as they arise.

Footnotes

[1] Criteria on simplicity include requirements on homogeneity of the underlying exposures, underwriting standards and collateral credit quality. Standardisation requirements include early amortisation triggers, performance trigger-based reversion to sequential paydown, and “appropriate” mitigation of interest rate and currency risks. Transparency requirements include provision of a liability cash flow model and at least five years’ historical default and loss data for assets similar to the transaction’s underlying collateral. Meeting such criteria means the assets are eligible for preferential capital treatment.

[2] This means that the party holding the retention will absorb the first losses up to the retained percentage.

[3] Source: Janus Henderson Investors, Bloomberg, Index Calc and JPMorgan Indices, as at 21 March 2025.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.