The fortunes of European equities have turned thus far in 2025, with European indices like the STOXX Europe 600 Index and MSCI Europe Index hitting their highest level this century after a long period of stop-start progress and setbacks. The last decade has been tough for European equities, but can this glimmer of hope become something more meaningful and longer lasting?

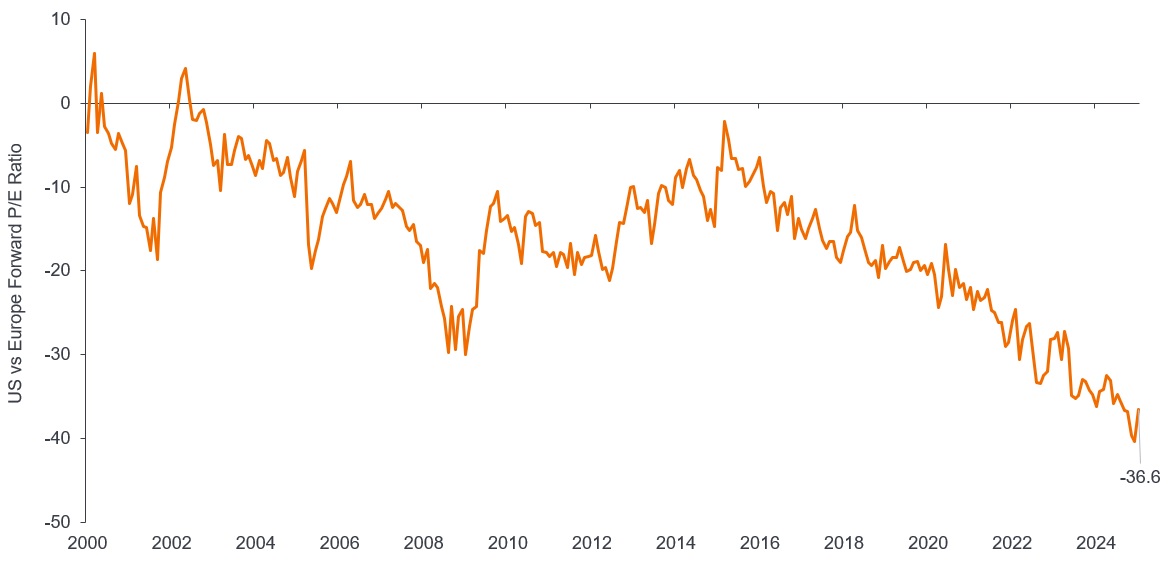

Attractive European stock valuations (Exhibit 1) and very low international investor positioning seemingly provide a safety net for further progress.

Europe remains deeply discounted versus the US (P/E ratio)

Source: Refinitiv DataStream, Janus Henderson Investors Analysis, as at 31 January 2025. The price-to-earnings (P/E) ration is a popular data point used to value a company’s shares, compared to other stocks, or a benchmark index. Past performance is not a guide to future performance. There is no guarantee that past trends will continue, or forecasts will be realised.

Various supportive initiatives are underway, although time is needed for true structural reforms to improve Europe’s competitiveness. Investors also get the upside of any potential peace on the horizon for Ukraine. But as always, the devil is in the detail. Here, we give a brief oversight of our current thoughts on various factors at play, both positive and potentially negative.

The ‘pros’ for European equities

Germany’s fiscal debt brake: One of the most debated impediments to European growth – the stringent German fiscal debt brake – is being released. Germany is the last remaining major economy with fiscal stimulus headroom, and the proposed infrastructure investment package is large. We are hopeful that incoming Chancellor Friedrich Merz can convince his future coalition partner to combine higher spending with other measures, boosting Europe’s biggest economy.

Cuts to bureaucracy: The one area where Europe is arguably world champion is bureaucracy. We are now seeing a shift in the other direction, with European Commission President Von der Leyen hinging her second term in office on deregulation. This would be good news for European stocks, although not something as radical as DOGE in the US. In February this year, Von der Leyen presented the first of two ‘Omnibus’ packages, the first of which contains important steps to make sustainability reporting more efficient, simplify due diligence for responsible business practices and strengthening the carbon border tax mechanism. The package has entered the European Parliament legislative process but may take all of 2025 to pass.

Lending capacity: While the Omnibus packages offer the prospect of long-term change, we expect quicker progress on the European Commission consultation on the securitisation market. This is crucial for strengthening the lending capacity of European banks and creating deeper capital markets. Too much regulation has contributed to shrinkage of the European securitisation market, from c €2trn at its peak before the 2008-09 Global Financial Crisis, to only €1.2trn at the end of 2023. We would expect a functioning securitisation market to free up bank balance sheets and lead to higher lending capacity.

Savings and Investment Union: The European Commission has released an update to its Capital Markets Union initiatives, specifically the Savings and Investment Union. The EU has a massive private savings overhang (the savings rate in the region is almost 4x that of the US) that could help to re-privatise the economy. These savings are largely channelled toward lower-return investments (eg. bank accounts and cash reserves) or are invested abroad. The European Commission’s solution is to shift these excess European household savings into investment products that benefit European companies.

Ukraine: For us, the biggest external upside risk for European equities is peace talks over Ukraine, thus far progressing without European involvement. Europe’s ‘Coalition of the Willing’ is pushing forward with defence spending increases, and plans for peace monitoring troops. Longer-term, it would be a significant positive for investor sentiment were sanctions to come off and old trade relationships see revival, with ramifications across Europe’s industries, from banking and capital goods to basic materials production and construction.

Germany is the last remaining major economy with fiscal stimulus headroom, and the proposed infrastructure investment package is large.

The ‘cons’

Macroeconomic uncertainty: External pressures on Europe have become enormous, an area where Europe is vulnerable, given that its overseas trade-to-GDP ratio is above 60%. World Trade Organisation (WTO) rules have benefited Europe (and China) over the past few decades, but this settled system is now under existential threat. Europe is very dependent on imports for critical raw materials and digital technology, while geopolitical fault lines are fracturing and being realigned without much consideration for European interests, given its lack of political or military muscle (and assertiveness).

Europe reaped the post-Cold War peace dividends for decades and now needs to adapt – quickly – to develop its own defence capabilities. The US, Europe’s long-time friend and strategic partner, is now following its own agenda in geopolitical realignment and military strategy. China is pressuring European manufacturing and intellectual property. Europe’s key automobile and semiconductor industries are now firmly in the crosshairs.

Trade conflict: The largest external downside risk for European stocks, in our view, is a trade war with the US. President Trump issued Executive Orders post-inauguration to analyse trade relations – with findings and tariffs hitting in early April. Europe has a large annual trade surplus versus the US, approximately US$230bn, that Trump is keen to address. The EU has delayed retaliatory tariff announcements to mid-April, leaving a window for negotiations. We see potential for relief if a path to negotiations is struck, and it seems in the interest of both sides, given the US economy is already showing signs of abrupt cooling and uncertainty.

Where do we see the strongest prospects in 2025?

As outlined, our positive view on European stocks is certainly not without risks, but we believe the upside prospects outweigh the downside risks, and those views extend to different sectors and industries in the region. We favour European banks, which seem very undervalued relative to the wider European market, US banks and their own (chequered) history. Secondly, we believe defence stocks represent a good prospect, given rising visibility on earnings growth from much-needed rearmament and restocking. Yet, these stocks are perceptually cheaper than their wider industrials peer group. Thirdly, we see value in certain more cyclical (economically sensitive) stocks, for example those benefiting from the wider electrification thematic, or those positioned to participate in any upside from Germany planned infrastructure investments. As always, we see active stock selection as key to positioning favourably for this shift in sentiment towards European equities.

Please note: Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. There is no guarantee that past trends will continue, or forecasts will be realised.

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

STOXX Europe 600 Index: An index of the 600 largest listed stocks in the European equity market. As such it represents a broad and diversified measure of companies across Europe’s developed economies, spanning 17 countries and 11 industries.

MSCI Europe Index: An index of stocks, capturing large and mid-sized companies listed in developed markets in Europe.

Bearishness/bear market: A bear market is one in which the prices of securities are falling in a prolonged or significant manner. A generally accepted definition is a fall of 20% or more in an index over at least a two-month period. Bearish sentiment suggests the expectations of negative market conditions.

Fiscal stimulus/policy: Fiscal measures are those related to government policy, regarding setting tax rates and spending levels. The term fiscal austerity refers to raising taxes and/or cutting spending in an attempt to reduce government debt. Fiscal expansion (or ‘stimulus’) refers to an increase in government spending and/or a reduction in taxes.

Macroeconomics: Macroeconomics is the branch of economics that considers large-scale factors related to the economy, such as inflation, unemployment or productivity.

Savings rate: The percentage of earnings saved or invested, rather than spent.

Securitisation market: Securitization is the process in which certain types of assets are pooled so that they can be repackaged into interest-bearing securities, together which constitutes a market for buying or selling. The interest and principal payments from the assets are passed through to the purchasers of the securities.

Tariffs: A tax imposed by a government on goods imported from other countries.

Trade-to-GDP ratio: The sum of exports and imports for a country, measured as a percentage of gross domestic product (GDP). It generally used as an indicator of a country’s integration into global trade networks.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.