Are global small caps a big draw for 2024?

Portfolio Manager Nick Sheridan considers the prospects for global small caps in 2024 and addresses why, for many investors, smaller companies are still out in the cold.

7 minute read

Key takeaways:

We continue to see negative sentiment towards smaller companies, which tend to be more sensitive to changes in the economy. Investors are split between concerns about increased geopolitical risks and slower Chinese growth and optimism about a potential ‘soft landing’ scenario.

In our view, a lot of risk of a negative economic outcome is already priced into small caps – various sectors of the market are still being valued as if a recession is imminent. We also expect a revival of M&A activity in 2024, with cash-rich private equity firms seeking buying opportunities.

We believe investors should consider an allocation to faster-growing small-cap companies with sustainable competitive advantage and robust cashflows. A robust process of stock selection remains key.

“Don’t buy small caps ahead of a recession”. This traditional piece of investment advice is hard to dispute – smaller companies tend to be more sensitive to changes in the economy, growing more than global GDP during prosperous times but contracting more during periods of economic weakness.

So why would we argue that the start of 2024 represents a good time for small cap investors to consider increasing their allocation?

Because this current market cycle is not following a typical pattern.

The expected recession did not materialise in 2023, and indications suggest that any downturn from here might not be as severe as anticipated. Despite this, various sectors of the market, particularly small caps, are still being valued as if a recession is imminent.

In the US and Europe, we are at historic levels of relative valuation of small caps versus large caps, while we expect many smaller businesses in Japan to undergo dramatic business transformations over the next few years, prompted by stricter governance rules and under pressure from shareholders. This is arguably a positive entry point for the asset class.

Critical time for the economy

The next few months will determine whether the current aggressive interest rate cycle could lead to a deep recession and a ‘hard landing’ scenario, which many bond investors have been warning about since 2021, citing increased geopolitical risks, slower Chinese growth, and weak Purchasing Manager Indices (PMIs). Alternatively, the market might experience a ‘soft landing’ scenario, where central banks successfully tame inflation and economies adjust to a non-zero interest rate environment – a prime basis for earnings upgrades in the small-cap arena.

In our view, a lot of risk of a negative economic outcome is already priced into small caps. While small caps are naturally more volatile than large caps, since 1980, the average performance of the US small cap market in the 12 months after the bottom of the bear market is over 60%, exceeding the performance of large caps by more than 20 percentage points.[1]

Increased M&A activity could help to unlock valuations

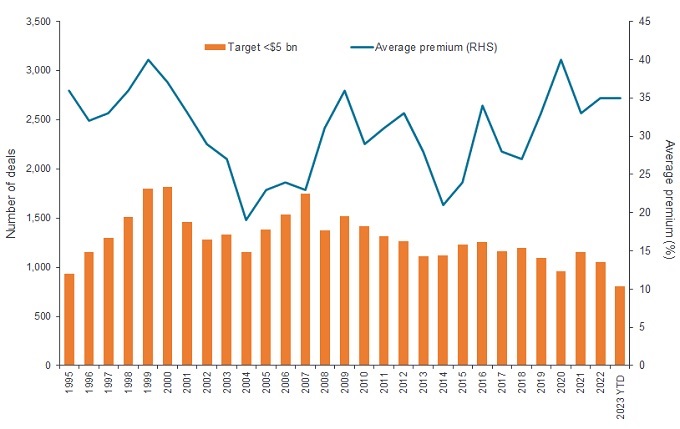

We also expect a revival of merger and acquisition (M&A) activity in 2024, with cash-rich private equity firms seeking buying opportunities. This could be particularly interesting in the places like the UK, where persistent capital outflows have left many stocks looking attractively priced. Globally, while M&A activity remains below its long-term average, deals are being completed at an average 35% premium to the prevailing share price, ensuring that investors are being well remunerated.

Exhibit 1: M&A prospects looks healthy for global small caps

Source: Bloomberg, Factset, JP Morgan calculations, Janus Henderson Investors Analysis, as at 31 December 2023. Shows merger and acquisitions among publicly listed companies with a total market cap below US$5 billion.

Long-term growth themes from the US

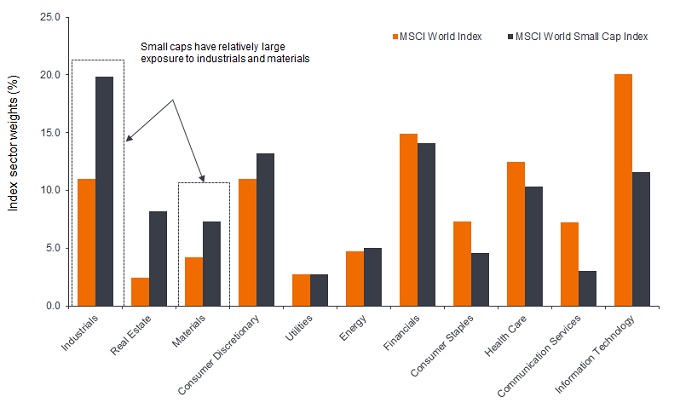

The US appears to look relatively well positioned internationally, with a reasonably robust economy, favourable demographics and some additional favourable secular drivers. For example, the deglobalisation of supply chains seems likely to help US small-cap companies disproportionately more than their larger counterparts, given their greater exposure to industrials and materials – areas that we expect to benefit from the onshoring of supply chains over the next decade (Exhibit 2).

Exhibit 2: Global small caps are well positioned to benefit from onshoring

Source: Bloomberg, Janus Henderson Investors Analysis, as at 31 July 2023.

While the US Federal Reserve has held its key interest rates steady, the committee has pencilled in the expectation for at least three rate cuts in 2024[2]. We would expect such an environment to be accompanied by meaningful earnings upgrades in the small cap space.

The biggest risk to this view is the possibility we end up with a bifurcated market, where a particular investment style, such as ‘growth’, drives market performance ahead of company fundamentals. The flipside of any such market divergence is that, with so many companies trading at historically low valuations, there is great potential to identify companies that we think can compound their revenue and cash flows, trading at multiples that we have not seen for a couple of decades.

Is a ‘soft landing’ scenario key to European small cap performance?

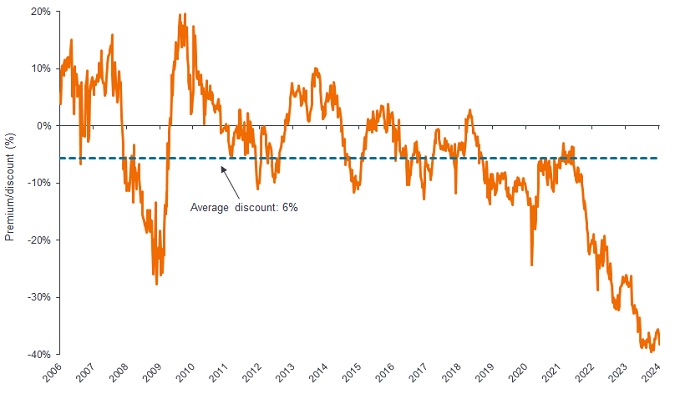

In Europe, where core inflation is on track to meet the ECB’s 2% target, we believe that small-cap stocks could outperform as investors become less risk averse. Over the past couple of years investors have shown concern about the risk of economic contraction in Europe, given current geopolitical uncertainty. This has prompted many investors to reduce their exposure to smaller companies, causing share prices to fall. Valuations on European small caps are now arguably extremely low, with the largest discount on record relative to US large-caps – Exhibit 3.

Exhibit 3: Relative valuations on European small caps are at extreme lows

Source: Bloomberg, Janus Henderson Investors Analysis, as at 11 January 2024. Index: MSCI Europe Small Cap, S&P 500 Index. There is no guarantee that past trends will continue, or forecasts will be realised. Past performance does not predict future returns.

In our view, if the economy expands from here, small caps are well positioned for growth due to their less mature nature and greater potential for expansion. However, we believe that earnings upgrades for 2024 will be crucial to see significant progress. Appealing valuations have also prompted many European companies to initiate share buy-back programmes.

An eye on demographics in Japan

In terms of Japan, we see a range of domestic challenges, including an ageing population, a low economic growth rate, competition with rapidly growing Asian companies, digitalisation, and ESG requirements. However, this also offers opportunities. We see great potential for Japanese small- and mid-cap firms to undergo drastic business transformations in the years ahead, accelerated by stricter governance rules and pressure from shareholders.

This potential is exhibited in the examples of Japanese businesses that have announced management buy-outs in 2023 – at a significant premium to the prevailing share price – aimed at reforming operations to drive future growth. We see deals seen in areas like drug manufacturers as indicative of the growing pressure on Japanese smaller companies to look at ways to improve shareholder value.

Throughout this, stock selection is key. We believe a fundamentally driven investment process focused on identifying attractively priced small-cap companies with sustainable competitive advantage and robust cashflows is the right process to help drive outperformance relative to any benchmark or peer group over time. The former normally allowing for higher returns on capital, the latter affording the funds to drive growth via reinvestment.

Glossary:

Bear market: A financial market in which the prices of securities are falling. A generally accepted definition is a fall of 20% or more in an index over at least a two-month period. The opposite of a bull market.

—–

Important information

Smaller capitalization securities may be less stable and more susceptible to adverse developments, and may be more volatile and less liquid than larger capitalization securities.

Volatility measures risk using the dispersion of returns for a given investment.

[1] Source: Bloomberg, based on data for the Russell 2000 Index and Russell 1000 Index. The period includes the 12 bear markets (-20% or more) for the Russell 2000 since 1980. The Russell 2000 Index is a small-cap U.S. stock market index that makes up the smallest 2,000 stocks in the Russell 3000 Index. The Russell 1000 Index, also a subset of the Russell 3000 Index, represents the 1,000 top companies by market capitalization in the United States. Past performance does not predict future returns.

[2] Source: https://www.cnbc.com/2023/12/13/fed-interest-rate-decision-december-2023.html#:~:text=Along%20with%20the%20decision%20to,what%20officials%20had%20previously%20indicated.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.