MULTI-ASSET

Comprehensive. Risk-aware. Specialised.

Our teams manage global asset allocation strategies, applying a variety of lenses and risk management approaches.

£43.7bn

Multi-Asset Assets Under Management

15

Multi-Asset Investment

Professionals

21

Average Years' Financial

Industry Experience

As at 31 December 2025

£43.7bn

|

15

|

21

|

As at 31 December 2025

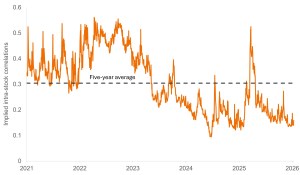

Diversification may offer a more efficient portfolio; theory and history suggest that a diversified portfolio would be expected to deliver a better return per unit of risk than a more concentrated portfolio will do. We strongly believe that any serious focus on wealth preservation or wealth accumulation should have a diversified portfolio at its core.

Featured fund

Insights

Insights

Subscribe for relevant insights delivered straight to your inbox

Important information

Please read the following important information regarding these funds.

There is no assurance that the investment process will consistently lead to successful investing.

Janus Henderson Fund

The Janus Henderson Fund (the “Fund”) is a Luxembourg SICAV incorporated on 26 September 2000, managed by Janus Henderson Investors Europe S.A. Janus Henderson Investors Europe S.A. may decide to terminate the marketing arrangements of this Collective Investment Scheme in accordance with the appropriate regulation. This is a marketing communication. Please refer to the prospectus of the UCITS and to the KIID before making any final investment decisions.

Janus Henderson Horizon Fund

The Janus Henderson Horizon Fund (the “Fund”) is a Luxembourg SICAV incorporated on 30 May 1985, managed by Janus Henderson Investors Europe S.A. Janus Henderson Investors Europe S.A. may decide to terminate the marketing arrangements of this Collective Investment Scheme in accordance with the appropriate regulation. This is a marketing communication. Please refer to the prospectus of the UCITS and to the KIID before making any final investment decisions.

Janus Henderson Capital Funds

Janus Henderson Capital Funds Plc is a UCITS established under Irish law, with segregated liability between funds. Investors are warned that they should only make their investments based on the most recent Prospectus which contains information about fees, expenses and risks, which is available from all distributors and paying/facilities agents, it should be read carefully. This is a marketing communication. Please refer to the prospectus of the UCITS and to the KIID before making any final investment decisions. The rate of return may vary and the principal value of an investment will fluctuate due to market and foreign exchange movements. Shares, if redeemed, may be worth more or less than their original cost. This is not a solicitation for the sale of shares and nothing herein is intended to amount to investment advice. Janus Henderson Investors Europe S.A. may decide to terminate the marketing arrangements of this Collective Investment Scheme in accordance with the appropriate regulation.