Navigating new heights: Elevated yields unlock fixed income opportunities

As part of their mid-year outlook, Lara Castleton, Andrew Molinet, and Matthew Bullock from the Portfolio Construction & Strategy Team discuss how higher yields are creating positively skewed return opportunities for fixed income investors.

5 minute read

Key takeaways:

- 10-year Treasury yields are higher now than they were when the Federal Reserve (Fed) last raised interest rates in July 2023, despite several developments that have been positive for the U.S. bond market.

- Elevated yields are creating positively skewed return opportunities where the income from bonds – together with potential capital gains if interest rates fall – outweighs losses if rates were to rise.

- Considering the attractive yield levels and potential for positively skewed returns, we believe investors may benefit from rebalancing their fixed income allocation now toward their long-term target weight.

Several developments have taken place over the past 12 months that have been positive for the U.S. bond market: The Federal Reserve (Fed) raised interest rates for the last time in July 2023, Core PCE inflation (the Fed’s preferred inflation gauge) has steadily trended downward, and in December the central bank signaled its intention to move to a rate-cutting cycle.

And yet, bond yields have not declined to account for these positive developments. The yield on the U.S. 10-year Treasury is, in fact, higher now than when the Fed put through its final rate hike 10 months earlier.1

Rangebound yields have opened a window of opportunity

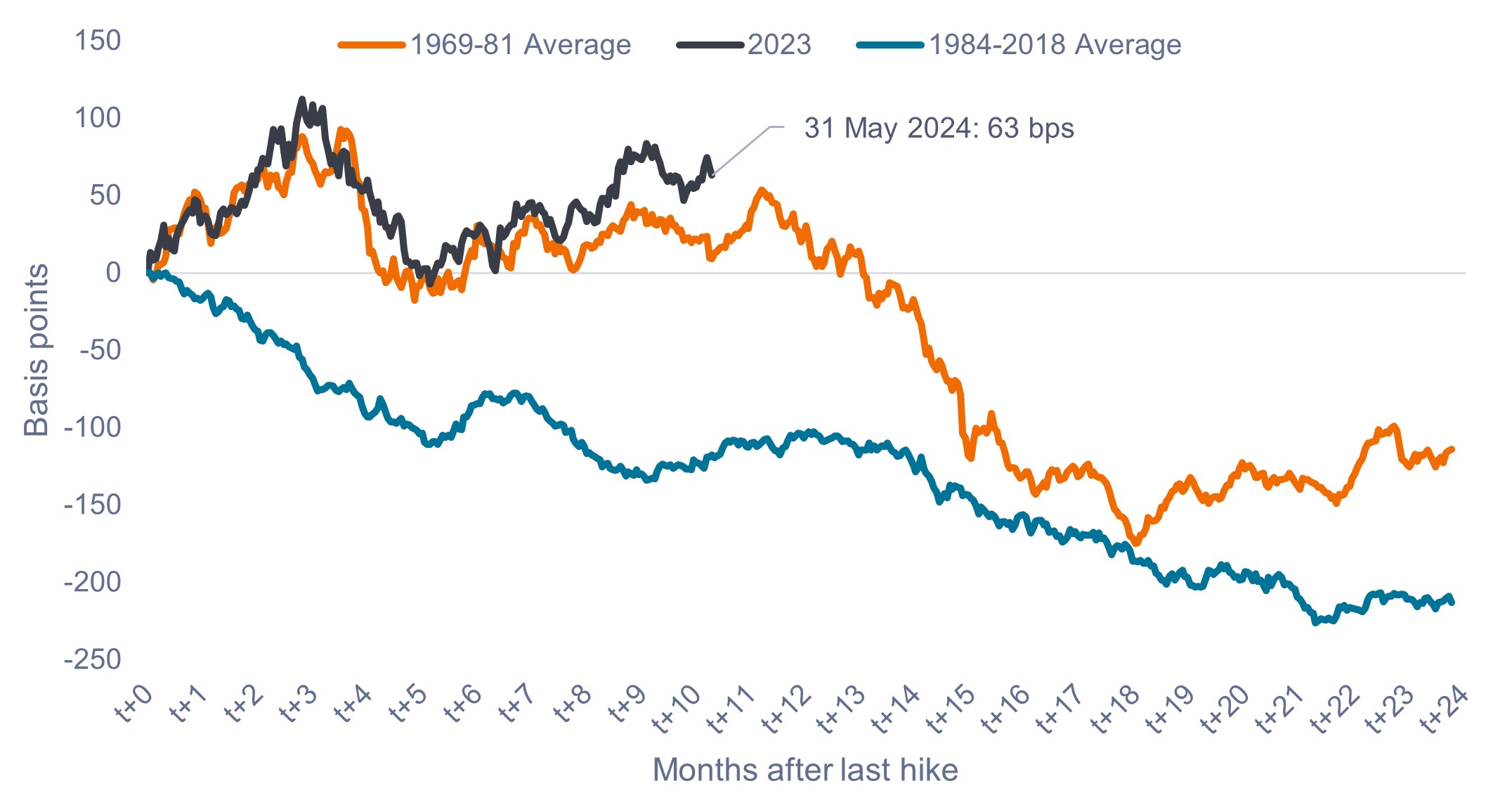

In Exhibit 1, we plot the change in the U.S. 10-year Treasury yield in the months after the Fed stops hiking interest rates. Indeed, since the Fed last raised rates in July 2023, the path of the U.S. 10-year Treasury yield has closely tracked the average of the 1970s (tangerine line). This has taken place despite the current cycle exhibiting a benign inflation outlook, which is closer to the conditions for the 1984-2018 average (teal line).

In our view, this situation is creating a window of opportunity for investors, as the conditions for yields to fall (and bonds to outperform) are firmly in place, while rates have not yet moved to fully reflect that.

Exhibit 1: A window of opportunity closing soon?

Change in U.S. 10-year Treasury yield after last rate hike

Source: Bloomberg, Janus Henderson Investors, as of 31 May 2024. Basis point (bp) equals 1/100 of a percentage point, 1bp = 0.01%. Past performance does not predict future returns. There is no guarantee that past trends will continue, or forecasts will be realised.

Higher yields creating positively skewed return opportunities

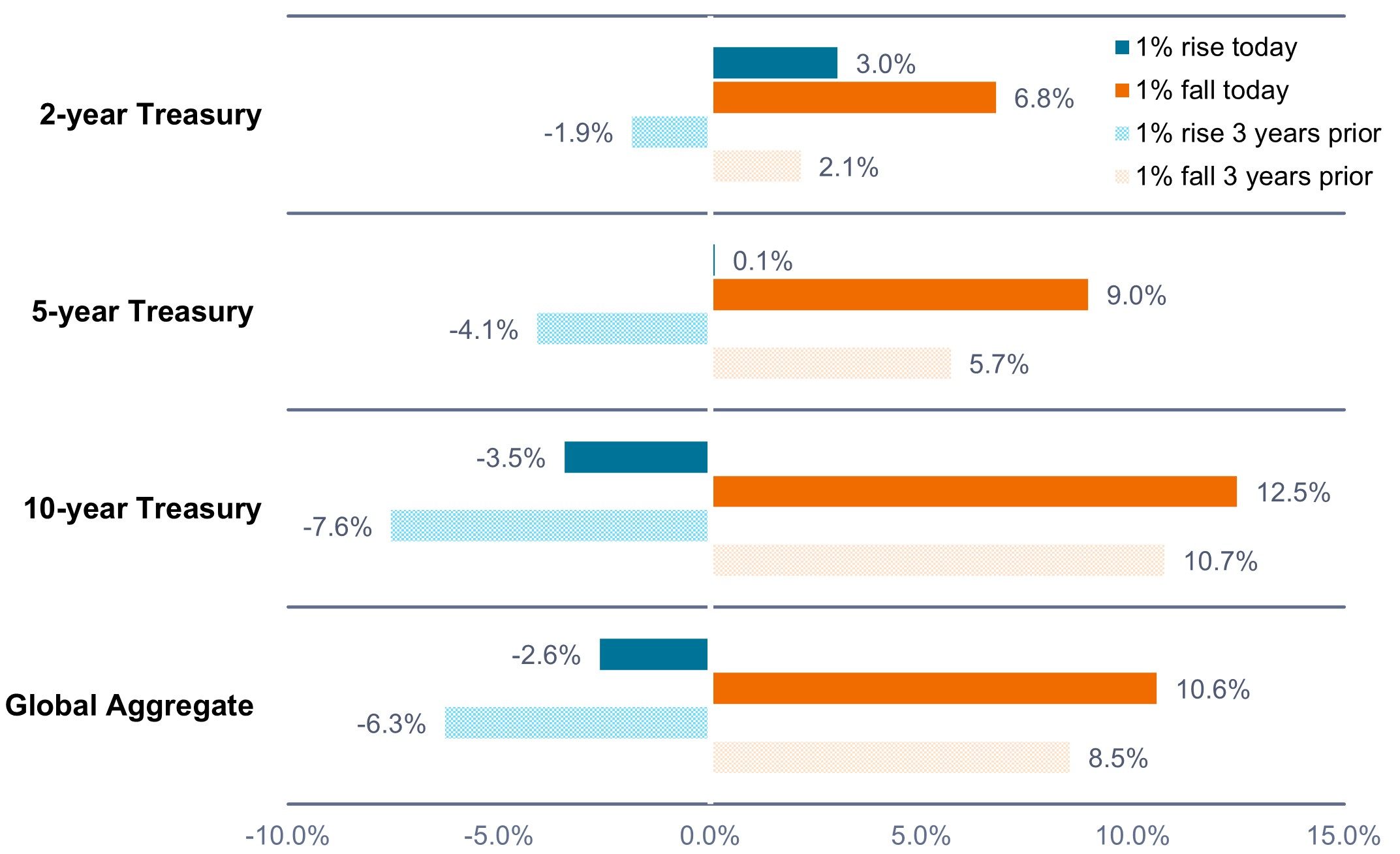

Due to higher yields, which are seemingly near their cyclical peak, the risk-return landscape has shifted. This is creating positively skewed return opportunities where the income from bonds – together with potential capital gains if interest rates fall – outweighs losses if rates were to rise.

As shown in Exhibit 2, elevated yields have significantly dampened the adverse total return impact of a potential rise in rates. Conversely, if rates fall, the expected capital appreciation would prove to be an additional tailwind, resulting in higher expected total returns.

Exhibit 2: Meaningfully improved return outcomes vs. three years ago

Potential return following a 1% change in interest rates today compared to three years ago

Source: Bloomberg, Janus Henderson Investors, as of 31 May 2024. Global Aggregate = Bloomberg U.S. Global Aggregate Bond Index. Total return in U.S. dollars. Return calculations were made using yield-to-worst and duration and are based on a 1% (100 basis points) parallel shift in the yield curve. Past performance does not predict future returns. Hypothetical examples are for illustrative purposes only and do not represent the returns of any particular investment. Actual results may vary, and the information should not be considered or relied upon as a performance guarantee.

Portfolio implications for investors

In our view, investors may capitalize on opportunities across the yield curve, whether by capturing the relatively high yields on short-term maturities, or by taking on more duration risk in return for the higher total return potential that could arise if yields fall on longer-term maturities.

Considering the attractive yield levels and potential for positively skewed returns, we believe investors may benefit from rebalancing their fixed income allocation now toward their long-term target weight.

For those looking for additional total return potential, a multi-sector approach may be warranted to seek out higher income and relative value opportunities across sectors, maturities, and regions. In our view, various sectors and maturities are providing robust income and compelling total return prospects. Importantly, these opportunities cater to a range of portfolio objectives, demonstrating their versatility in meeting a diverse array of client needs.

In summary

While the Fed is in a wait-and-see mindset, we believe the risk that the central bank doesn’t begin cutting rates is low. Further, growing confidence in the end of the tightening cycle in other global developed markets is a positive sign, as rate cuts have either started (Canada, Switzerland, Sweden, Eurozone) or are expected in the coming months (UK).

While one cannot rule out the risk of a resurgence in inflation or interest rates going higher, we think this scenario is unlikely. On balance, we believe the monetary and economic landscape is shaping up for a downward move in rates globally, which should encourage investors to lean into higher yields, rebalance their fixed income allocations to target weights, and take advantage of a window of opportunity for positively skewed returns.

1 As of 31 May 2024.

10-Year Treasury Yield is the interest rate on U.S. Treasury bonds that will mature 10 years from the date of purchase.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Bloomberg Global Aggregate Bond Index is a broad-based measure of the global investment grade fixed-rate debt markets.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.

Yield to worst (YTW) is the lowest yield a bond can achieve provided the issuer does not default and accounts for any applicable call feature (ie, the issuer can call the bond back at a date specified in advance). At a portfolio level, this statistic represents the weighted average YTW for all the underlying issues.

IMPORTANT INFORMATION

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

The sale of an investment for the purpose of rebalancing may be subject to taxes.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.