Global Equity Income: Dividend growth expected but mind the debt

Head of Global Equity Income, Ben Lofthouse, discusses the impact of inflation and higher rates on companies’ ability to pay dividends and his outlook for the year ahead.

6 minute read

Key takeaways:

- Dividend growth in 2023 has remained strong across a wide range of sectors and regions, with the exception of commodity-related areas like mining, chemicals, and some energy stocks.

- Continued dividend growth is expected driven by stronger earnings, but companies and sectors with high debt levels may struggle.

- Dividends can offer a stable stream of income, given they tend to be less volatile than earnings, and are less cyclical than many investors assume.

In the early days of 2023 investor sentiment was generally weak. With the ongoing Ukraine war pushing energy prices up and cost inflation feeding into businesses and consumers, there were expectations for a recession in major economies like the US and Europe. But despite spiralling inflation and rapid-fire interest rate hikes from central banks, the recession didn’t materialise. Economic growth has generally been better than expected. Europe survived the energy crisis, the US economy has tolerated rising rates well (despite its banking mini crisis), while inflation levels have been moderating.

Dividend recap for 2023

Dividend growth from companies generally has remained strong in 2023 across a wide range of sectors and regions, with the exception of commodity-related areas like mining, some energy stocks, and chemicals. We were also pleased to see better quality of dividend growth, with less reliance on one-off special dividends and exchange rate effects that were characteristic of 2022.

In Europe, investor sentiment and company results have been much better than analysts forecasted. Banking dividends were the most important driver of European growth, followed by vehicle manufacturers. US dividend growth continues to slow, following exceptional resilience during the pandemic when other regions were cutting payouts. That said, the region remains on track to reach a new record high for 2023.

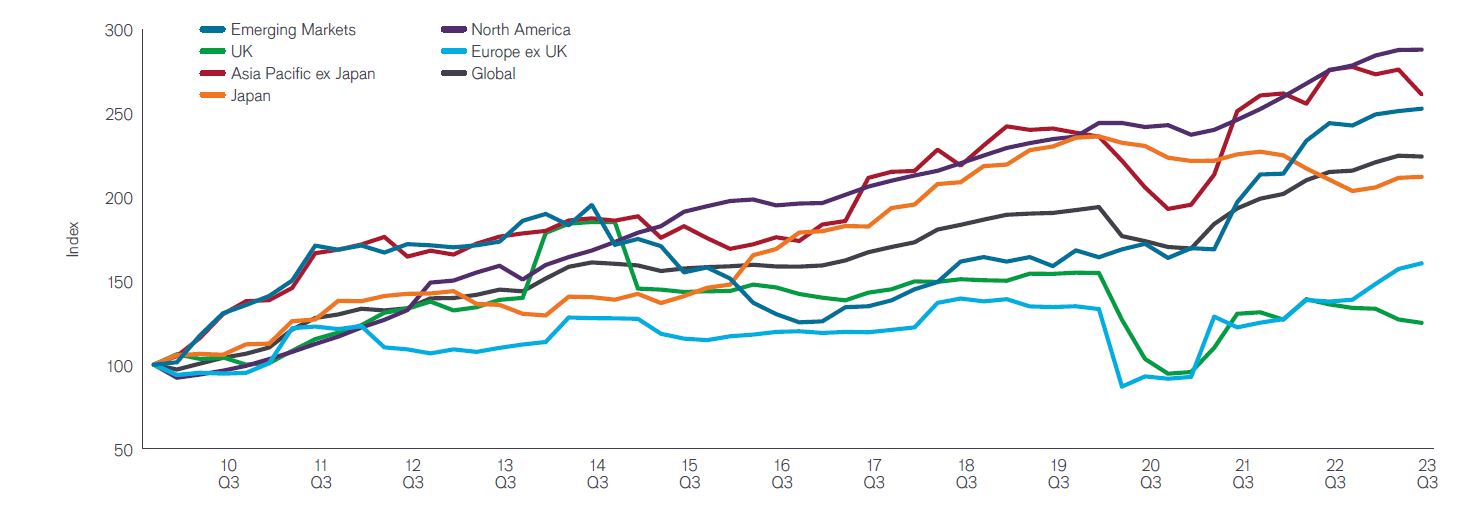

Janus Henderson Global Dividend Index – by region

Source: Janus Henderson Investors as at 30 September 2023. There is no guarantee that past trends will continue, or forecasts will be realised.

Last year, we had predicted China’s reopening from COVID would be the wild card that could ignite demand in the global economy. Whilst China did in fact reopen more quickly than expected, economic momentum in the country fizzled out, as did investor sentiment, dragging down Asia as a region with it. China continues to face challenges in its property and banking sectors, which has prompted the central bank to take action in the latter months of the year by way of rate cuts and other measures to support lending.

Given the decrease in special dividends reflecting less merger and acquisition (M&A) activity globally and the disappearance of windfall profits in sectors like mining and energy, our headline forecast for total global dividends in 2023 has fallen slightly from $1.64 trillion to $1.63 trillion, an increase of 4.4% year-on-year. We think this not a cause for concern, given there is still positive growth and the underlying quality of dividend growth this year has been better than we expected.

How are high inflation and interest rates impacting global dividends?

One of the reasons that inflation and interest rates have risen is that economic growth has recovered faster post-COVID than expected. Generally economic growth is good for company earnings, and that is good for dividends, so at a market level dividend growth has not been impacted negatively.

At a sector and region level it is more complicated. Higher rates are not all bad news. Financials, a sector that is highly sensitive to rate changes has generally suffered from low rates over the last decade. Higher rates push profit margins up for some banks and insurers as their business model is based on the differential in the cost of debt and the loans they charge to customers. Elsewhere, higher rates have mainly impacted sectors that are heavily reliant on funding like real estate, which is a small part of the overall equity market.

In a similar fashion, inflation and its impact on earnings varies significantly between company and sector. For a number of years we have focused on those companies that have pricing power, that can pass on inflationary costs to the customer, and as a result generate higher sales and revenues. We avoided more speculative, non-cash generative companies that are debt-heavy. Instead, we have identified and invested in companies that are cash generative, profitable with balance sheet strength to fund further growth, with share prices that may have not benefited so well from COVID, and have suffered from short-term price weakness.

The outlook for dividends

Looking forward, our view is positive but tempered with some caution. We believe dividends are unlikely to repeat the sharp increases seen post-COVID, as oil prices have moderated and mining payouts are likely to fall further. Among financials, banks should benefit from improved margins as a result of the higher interest rate environment. According to the Janus Henderson Global Dividend Index, so far this year more than 85% of companies have either increased their dividends or held them steady.1 That said we have seen some moderation of dividend normalisation – COVID saw some companies cut dividends or cancel them altogether, then reinstate them rapidly during the post-COVID economic recovery. As this effect has now fully worked through the system, what we believe we are seeing is more representative of the underlying earnings growth of companies.

There will be exceptions. We are likely to see more weakness in sectors like commodities and chemicals that do not have pricing power, with the opening up of global supply chains leading to dividend weakness. Therefore, we expect dividend growth to be positive in 2023, and likely through into 2024, but at a lower rate than recent years.

Areas with the most potential to deliver attractive income

The main opportunity might come from interest rates falling. Many asset classes tend to perform better when rates are falling ranging from defensive stocks with yields, through to emerging markets and real estate. However, any indication that inflation is picking up will be problematic, particularly related to energy prices; additionally the US election results could result in a significantly different political backdrop.

There are long-term trends that will drive earnings in certain sectors at a more rapid growth rate than seen in the last decade, driven by deglobalisation, geopolitics, and climate considerations. These include reshoring/nearshoring, decarbonisation, security of supply chains and energy security.

Another driver is the acceleration in artificial intelligence (AI), which is being rolled out across both the private and public sectors, entailing significant capital expenditure requirements. AI development and its application are broadening out from consumer tech, to technology and innovation across a range of sectors like industrials, agriculture, healthcare, education and local governments as its application improves efficiencies, society, products and services and customer experiences.

Conclusion

Our outlook for dividends remains constructive, albeit tempered with some caution as companies and economies adjust to a higher interest rates.

We would highlight that dividends have been less volatile than earnings over time, with the vast majority of companies increasing dividends most years. Additionally, dividends are less cyclical than many investors assume. Sectors like consumer staples, utilities, pharmaceuticals and telcos are dividend stalwarts, providing a buffer to those sectors that are more sensitive to the ups and downs of the economic cycle like banks, energy, and miners. An active, diversified approach to income investing across regions and sectors can provide some comfort in times of market uncertainty and support the building of long-term wealth.

1 Janus Henderson Global Dividend Index, Q1, Q2 and Q3 2023.

Balance sheet strength: used to gauge a company’s financial position. The balance sheet summarises the assets, liabilities and shareholders’ equity at a particular point in time.

Cyclical: in terms of dividends refers to variability of a company’s ability to pay dividends in good and bad times based on the economic environment, earnings growth, etc.

Defensive stocks: these stocks are typically less impacted during weaker market conditions or sector downturns. Given their strong fundamentals, they tend to have less volatile share prices and can deliver steady returns (in terms of earnings and dividends).

Financials industries can be significantly affected by extensive government regulation, subject to relatively rapid change due to increasingly blurred distinctions between service segments, and significantly affected by availability and cost of capital funds, changes in interest rates, the rate of corporate and consumer debt defaults, and price competition.

Nearshoring/reshoring: nearshoring involves moving operations and logistics to closer locations; reshoring refer to returning manufacturing/production back to a company’s country of origin.

The Janus Henderson Global Dividend Index (JHGDI) is a long-term study into global dividend trends. It measures the progress global firms are making in paying their investors an income on their capital by analysing dividends paid every quarter by the world’s largest 1,200 firms by market capitalisation.

The MSCI World Index captures large and mid-cap representation across 23 Developed Markets (DM) countries.

IMPORTANT INFORMATION

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.