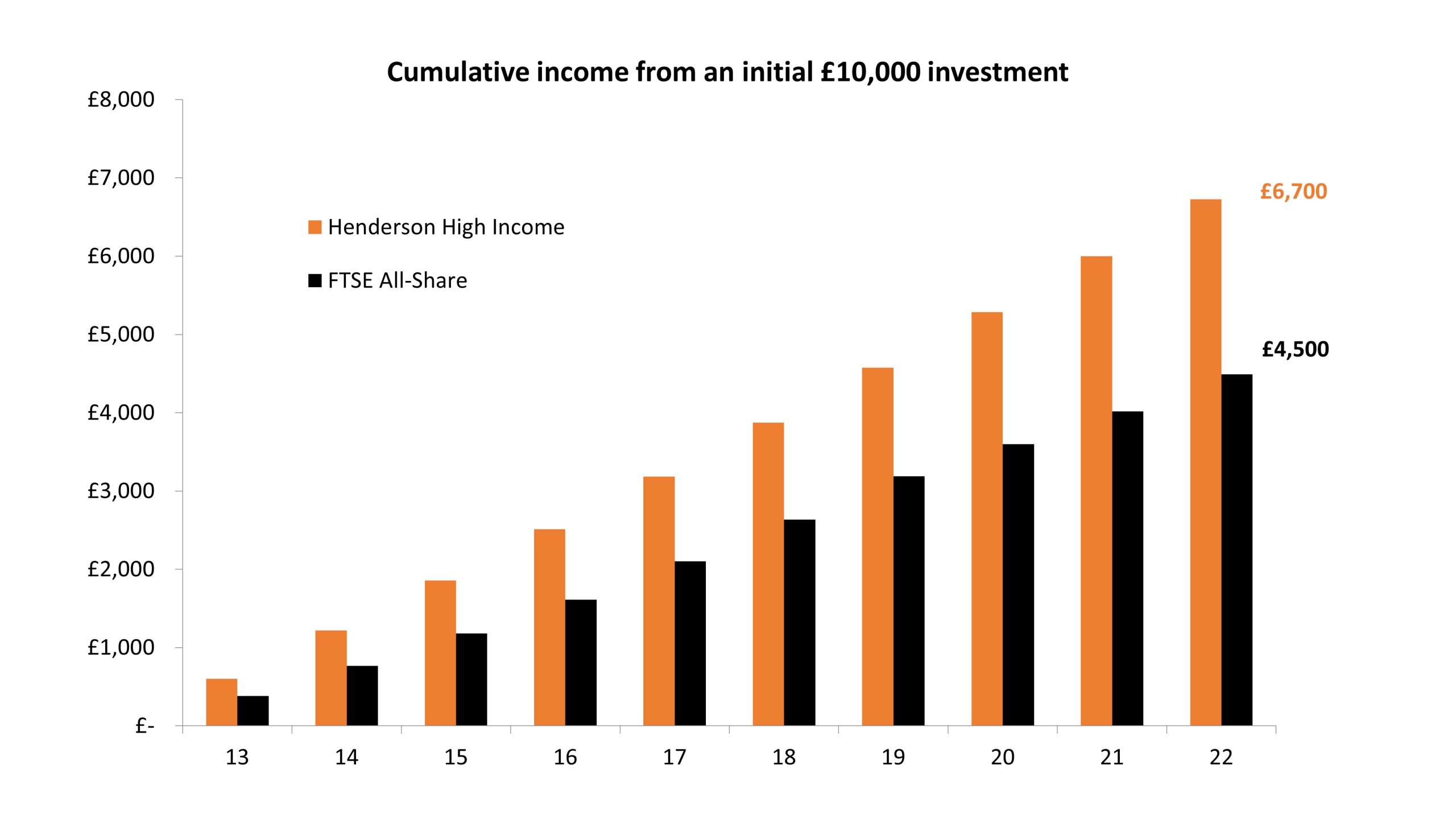

In 2022, Henderson High Income increased its dividend for the 10th consecutive year in a row. Over that period, the Company has grown the dividend by a compound average growth rate of 2% per annum, in line with the long-term historical average for UK inflation (as measured by CPI). With 2% dividend growth per year combined with a high starting dividend yield, it has produced a significant return for income seeking investors. For example, a £10,000 initial investment in Henderson High Income shares 10 years ago has generated a gross dividend income of £6,700.1 This is almost 50% more than the income an investor would have earned from an investment that tracks the FTSE All-Share over the same period.

Source: Janus Henderson Analysis and Datastream, 2023

Reaping the benefits of the investment trust structure

The Company has utilised the investment trust structure well to be able to deliver these sorts of returns to shareholders over the long term. One of the main advantages of investment trusts is the ability to retain surplus income to create revenue reserves. The manager can add to these reserves in profitable years and pay them out in the leaner years. Henderson High Income was able to utilise its reserves in 2020 and 2021 to continue to pay and grow its own dividend despite the significant dividend cuts and suspensions experienced across the UK market during the pandemic. The good news is that the Company’s revenue reserves are still at a healthy level of £8.6m – over 65% cover of the annual dividend payment.2

The second advantage is an investment trust’s ability to utilise borrowings or gearing to enhance both income and capital returns. Henderson High income deploys the majority of its gearing to fund the bond portfolio, which helps boost the headline level of income. This means that within the equity portfolio, some of the higher yielding areas of the market, where value traps and dividend cuts are more prevalent, can be avoided. It also means the Company can invest in some lower yielding companies which offer more in terms of dividend growth. Some of those companies – held in the portfolio for over 10 years – have contributed to Henderson High Income’s dividend growth track record.

Two such companies in the large-cap area of the market are Diageo and RELX. Diageo is one of the global leading spirits producer with strong brands such as Johnnie Walker, Smirnoff, Baileys, and Don Julio. Under the current management team, the company has significantly invested in its business (brand marketing, new categories, and innovation) to broaden and strengthen its brand portfolio to drive higher and more sustainable organic growth. This has led to dividend growth of 80% over the last 10 years and 164% total shareholder returns.3

RELX is a global provider of information and business analytics with 4 main divisions: Professional Publishing, Risk and Business Analytics, Lexis Nexis, and Exhibitions. The company is a global market leader in 3 out of the 4 divisions and has strong brands, significant exposure to recurring revenues and high barriers to entry. The business has invested significantly in its technology capabilities, such as data analytics and workflow integration which has driven attractive and sustainable earnings growth. The Company has grown its dividend by 127% over the last 10 years and delivered 390% total returns.3

The equity portfolio has also held companies in the mid-cap area of the market for over 10 years with significant dividend growth records. Cranswick produces and supplies pork and chicken products to retailers and food service companies and has grown its dividend by 165% over the last 10 years.3 Through continued investment, a strong focus on quality and operational excellence supplemented by sensible acquisitions, the business has grown profits, cash flow and dividends over the longer term. In fact, the company has one of the longest dividend growth track records in the UK market, with 32 years of consecutive dividend increases. As a result, Cranswick has not only delivered strong income growth for Henderson High Income over the last 10 years but also capital appreciation with a total return of 374%.3

Key ingredients for long-term dividend growth

While it is easy to show the companies in the portfolio that have delivered the best dividend growth historically, it’s more difficult to judge the companies that will produce the best dividend growth over the next 10 years. However, there are some common attributes that we look for in companies that can help identify potential investments in this regard:

1) Business models that can produce resilient earnings. One common trait of the stock examples mentioned above is that their earnings profiles are generally less cyclical, albeit not completely immune to economic downturns. While cyclical companies can pay out attractive dividends at certain points in the economic cycle and, therefore, shouldn’t be dismissed from a portfolio, they probably won’t be able to sustain a consistent level of dividend growth in more challenging environments. Conversely, those companies that are less impacted by economic downturns are more likely to be able to sustain dividend growth through a full economic cycle and typically remain at the core of the equity portfolio.

2) Having a sensible dividend policy well covered by cash flow. While dividends are attractive to shareholders, management teams need to correctly balance a company’s need to invest to sustain its existing business and grow its future profits. Being wedded to an excessively high dividend payment could lead management teams to underinvest in their businesses to maintain the dividend leading to long term issues. In contrast, a negligible dividend payment could see poor capital allocation as management teams awash with excess cash could deploy it on low returning projects or expensive acquisitions.

3) Maintaining a strong balance sheet. One of the critical parts of the investment process is to check a company’s financial health, which starts with analysing its balance sheet. As income managers, we favour businesses with solid balance sheets as it gives them flexibility in more difficult times. Shareholders rank below all other creditors within a corporate structure; hence dividends are only paid after interest and coupons are paid on loans and bonds. Therefore, if a company gets into financial difficulties, the dividend is often cut or cancelled first to help save cash. With strong balance sheets, companies have the financial flexibility to maintain and potentially grow their dividends in more difficult times.

The last 10 years have been quite volatile for equity markets, starting with the aftermath of the GFC and Eurozone Debt Crisis, travelling through Brexit and the pandemic and ending with a war in Europe and inflation levels not seen for 40 years. Despite that, Henderson High Income has grown its dividend for 10 consecutive years, aided by a focus on owning good quality companies that can grow their own dividends whilst also utilising the advantages of the investment trust structure in terms of revenue reserves. While the economic outlook may remain uncertain, the disciplined investment process and healthy revenue reserves put the Company in a good position going forward.

1Source: Source: Janus Henderson Analysis and Datastream, 2023

2Source: Henderson High Income, Annual Report 2021

3Source: Factset as at 23/01/2023

Balance sheet – A financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time. Each segment gives investors an idea as to what the company owns and owes, as well as the amount invested by shareholders. It is called a balance sheet because of the accounting equation: assets = liabilities + shareholders’ equity.

Consumer price index (CPI) – A measure that examines the price change of a basket of consumer goods and services over time. It is used to estimate ‘inflation’. Headline CPI or inflation is a calculation of total inflation in an economy, and includes items such as food and energy, in which prices tend to be more prone to change (volatile). Core CPI or inflation is a measure of long-run inflation and excludes transitory/volatile items such as food and energy.

Cyclical – Companies that sell discretionary consumer items, such as cars, or industries highly sensitive to changes in the economy, such as miners. The prices of equities and bonds issued by cyclical companies tend to be strongly affected by ups and downs in the overall economy, when compared to non-cyclical companies.

Dividend Yield – The level of income on a security, typically expressed as a percentage rate. For equities, a common measure is the dividend yield, which divides recent dividend payments for each share by the share price. For a bond, this is calculated as the coupon payment divided by the current bond price.

Inflation – The rate at which the prices of goods and services are rising in an economy. The CPI and RPI are two common measures. The opposite of deflation.

Gearing – Gearing is the measure of a company’s debt level. It is also the relationship between a company’s leverage, showing how far its operations are funded by lenders versus shareholders. Within investment trusts it refers to how much money the trust borrows for investment purposes.

Revenue reserves – Investment trusts (also called closed-ended funds) are allowed put aside up to 15% of their income to support dividend payments during harder times, which is called the revenue reserve.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.