Secular growth drivers align for emerging market equities

Despite potential near-term headwinds, Portfolio Manager Daniel Graña believes the combination of innovation and reformist governments will prove to be durable returns drivers for emerging market (EM) equities.

5 minute read

Key takeaways:

- While trade barriers and high U.S. interest rates present near-term headwinds for emerging market equities, the asset class’s long-term prospects remain promising given their exposure to the themes of demographics and innovation.

- Reformist governments are creating business climates where innovative entrepreneurs can thrive, often by addressing EM-specific frictions.

- Harnessing favorable demographics, reform, and innovation, India’s economy is, in our view, positioned to outpace most of the world over the next decade.

The prevailing narrative surrounding emerging market (EM) equities in the wake of recent geopolitical and economic developments in one of persistent headwinds. The specter of rising tariffs is unhelpful to regions that have historically sought to export their way to prosperity, and higher U.S. interest rates limit the latitude of EM central banks to deploy accommodative policy.

While this is the landscape investors must navigate, these challenges do not overshadow the powerful secular themes that make EMs one of the most compelling – and attractively priced – opportunities within the global equities universe. Over a longer horizon, favorable demographics, reformist governments, and – increasingly – entrepreneur-driven innovation are aligning to make EMs fertile ground to deliver returns in excess of those available in many advanced economies.

Navigating uncertainty

The unwelcome march toward deglobalization began long before the recently concluded U.S. election. In this respect, an incoming Trump administration that is suspect of unencumbered trade should be seen as just the next step in a process that EM investors have been dealing with for some time.

There is little doubt that trade barriers introduce inefficiencies across the global economy. But while the reengineering of supply chains will see some companies and countries on the losing end, others will be net beneficiaries as multinationals seek to diversify industrial inputs, especially with respect to lowering their dependence on China. Within Asia, India, Vietnam, and Indonesia are all positioned to benefit from this reordering. Mexico is also a potential winner, although it bears watching the exact approach the incoming U.S. administration takes with its southern neighbor. Also to be determined is the degree to which tariff rhetoric is a negotiating tactic, with the end result being potentially less onerous than the market fears.

Not only have U.S. rates recently reset to higher levels, but so too have expectations for the policy rate in 2025. Higher U.S. rates create challenges for EMs as dollar-denominated financing becomes more expensive and these regions compete with the U.S. for investment flows. And as previously alluded to, EM central banks will find their options more limited to respond to a slowing economy lest they exacerbate rate differentials.

Still, the outlook for global rates is far from settled. No cycle lasts forever – and the global economy is by most accounts late cycle. Also clouding the picture is lingering uncertainty on how a possible new inflation range will impact terminal interest rates in the U.S. and Europe. As rate regimes in advanced economies evolve, so too will their influence on EM economies and appetite for these regions’ financial assets.

Welcome to the revolution

Growth drivers in EMs have changed. Consequently, the deleterious effects of tariffs and higher U.S. bond yields on EMs are less pronounced than they would have been in the past thanks to these regions’ increased participation in the global innovation revolution. Furthermore, innovation in EMs has a unique EM “flavor”, meaning entrepreneurs are not just copying innovative products and business models, but are altering them to address EM-centric frictions. In contrast to multinationals that may find success in higher-income layers of EM society, local entrepreneurs are creating digital solutions to reach previously underserved cohorts, whether it be access to financing, e-commerce, or healthcare delivery.

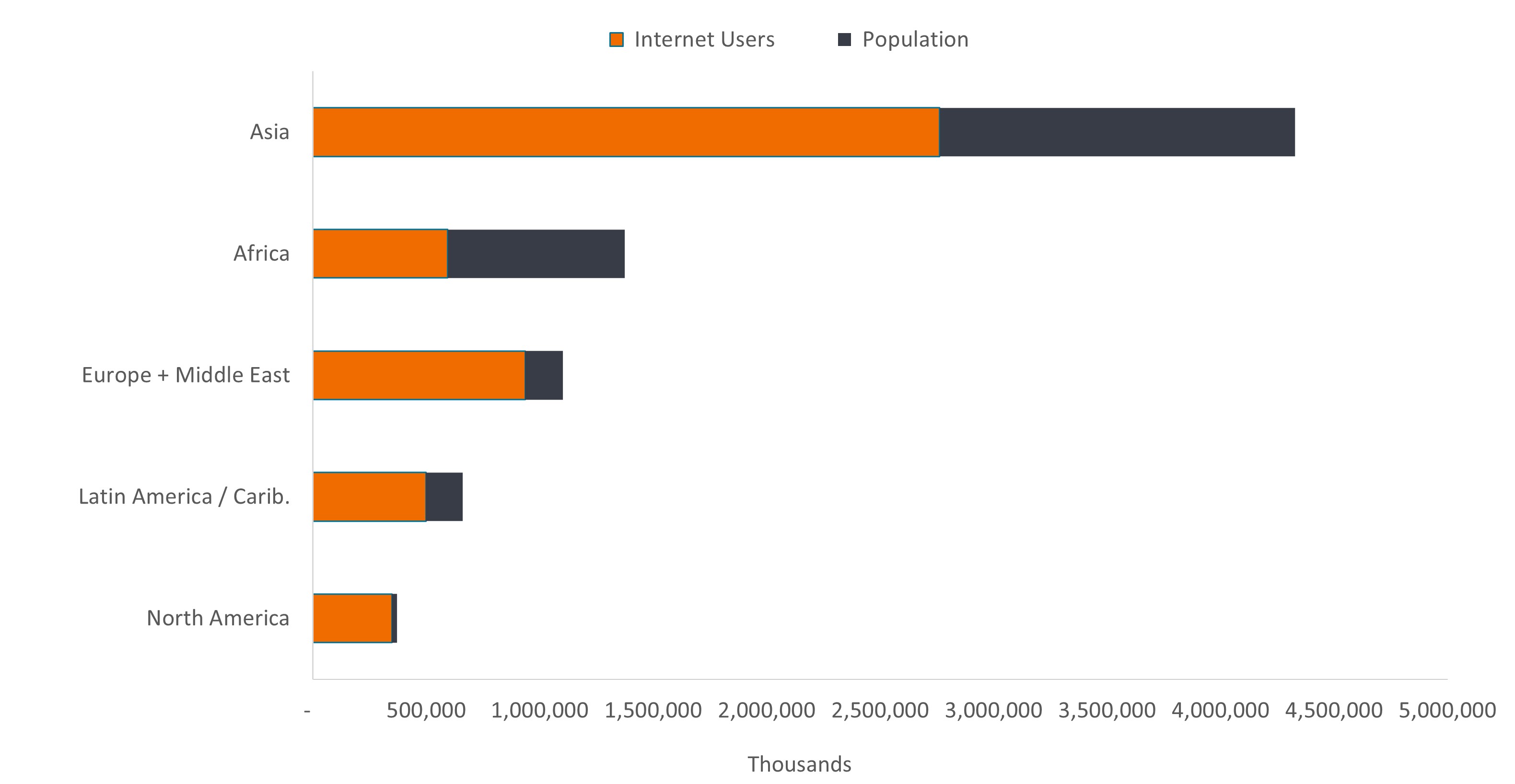

Exhibit 1: Internet users and total population by region

Entrepreneurs can tap the massive base of internet users in Asia – and, increasingly, other EM regions – to apply digital solutions to commercial and social frictions.

Source: Internet World Stats, December 2022.

As for the seminal theme of artificial intelligence (AI), the deployment of this revolutionary technology cannot occur without the material contribution of EM companies. Not only are the semiconductors necessary to power AI manufactured in EMs, but throughout this enablement phase, chip fabricators will heavily rely upon adjacent, EM-based industries to build out capacity. And rather than just contributing to the infrastructure of the AI economy, EM companies will also find business uses for AI applications to drive efficiencies and profitability.

Decarbonization is even more EM dependent. China is the world’s leading provider of solar panels, batteries, and electric vehicles.

The two giants

Diversification away from China has caused the country to look inward, not only to having consumption play a greater role in growth, but also to sourcing key industrial inputs internally. China remains investable, but investors must recognize that companies’ strategies must increasingly align with those of the central government. Investors must also accept that Chinese growth has permanently entered a lower range. Perhaps ironically, additional tariffs on the part of the U.S. may spur China to enact additional stimulus, aiding domestic growth.

In contrast, India’s favorable demographics are complemented by a reformist government agenda that understands the role played by a thriving private sector. Similarly, the country is improving the infrastructure needed to further growth and is leaning into innovation. We believe India is alone in its potential to deliver economic growth in the mid-to-high single-digits range over the next decade.

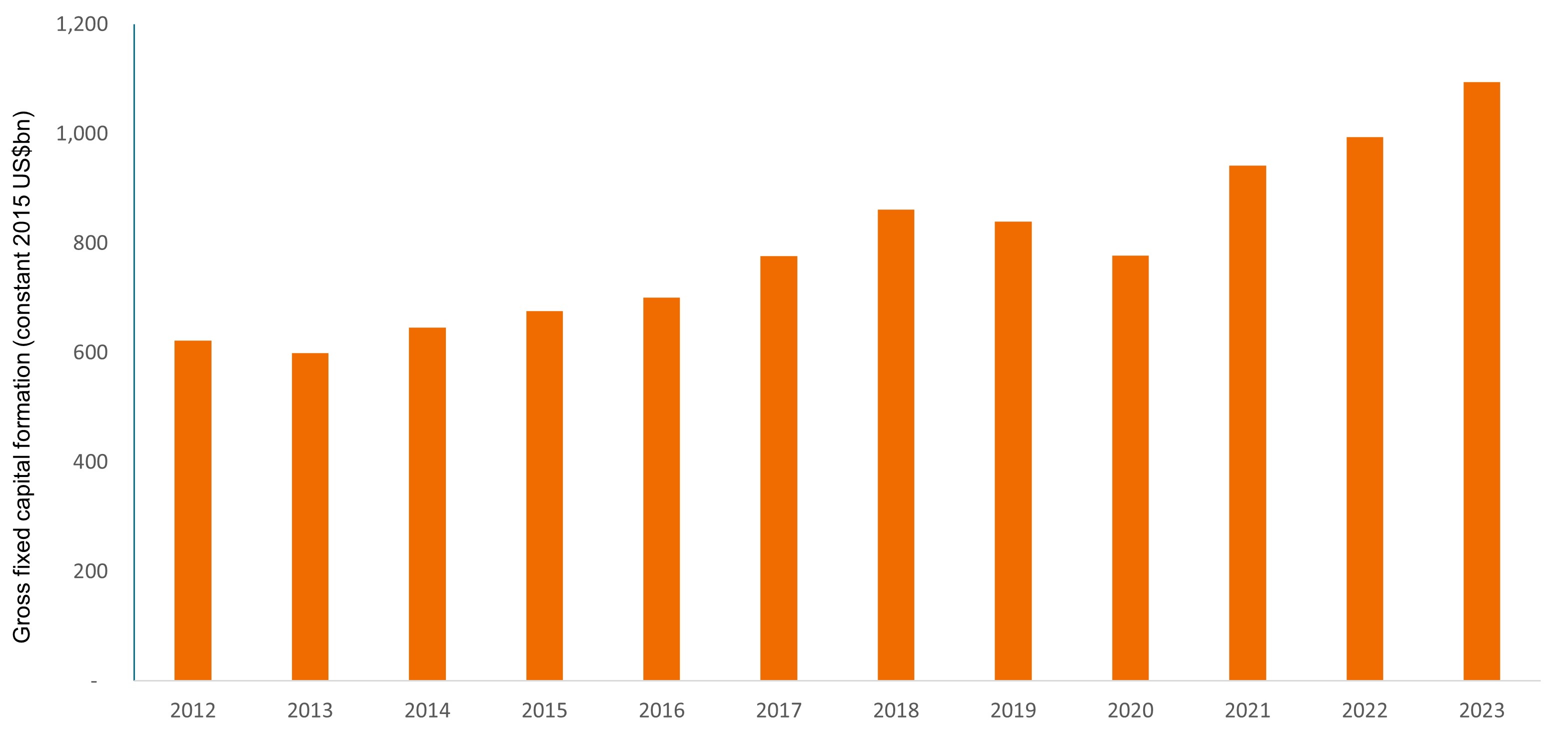

Exhibit 2: Growth of Indian gross fixed capital formation

Fixed capital investment has increased by 6.2% annually over the past decade.

Source: World Bank, as of 31 December 2023.

A generational discount

Valuation differentials between EMs and developed markets are as wide as they’ve been in 20 years. For this discount, investors can again access not only to innovation and reformist governments, but also improved corporate governance and economic growth rates higher than those of any developed market.

IMPORTANT INFORMATION

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

Emerging market investments have historically been subject to significant gains and/or losses. As such, returns may be subject to volatility.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.