Retaining income as cash rates fall

The market consensus is that we are past peak interest rates globally, however, there remain a range of macro and political factors that make the future path of rates highly uncertain. So how can investors optimise portfolios through this uncertain environment?

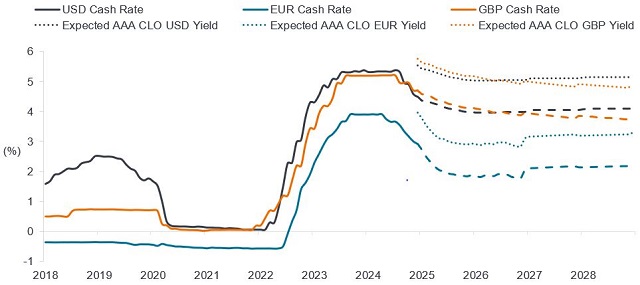

The income return from a floating rate security, such as a AAA CLO, is made up of a credit spread and an underlying cash rate based on EURIBOR. This income will therefore go up and down with moves in the cash rate. When interest rates decrease, the spread component of floating rate instruments becomes a more significant factor in their overall yield. Figure 1 illustrates how moving into AAA CLOs and earning an assumed 1% credit spread can help sustain income levels should cash rates decline as expected. This should support demand for AAA CLO investments offering attractive spread, as investors endeavour to maintain income levels in a falling rate environment in a risk-controlled way.

Figure 1: Retaining higher yields as cash rates fall

Moving into AAA CLOs can provide mitigation

Source: Janus Henderson Investors, Bloomberg, as at 31 December 2024.

Note: Chart showing historic cash rates, forward rates on USD, GBP and EUR OIS curves. Expected AAA CLO yields are the sum of the respective USD, GBP and EUR forwards curves with end of month spread level on Citi EUR CLO AAA 2.0 index. There is no guarantee that past trends will continue, or that forecasts will be realised. For illustrative purposes only. Past performance does not predict future returns.

Sensitivity to interest rate moves

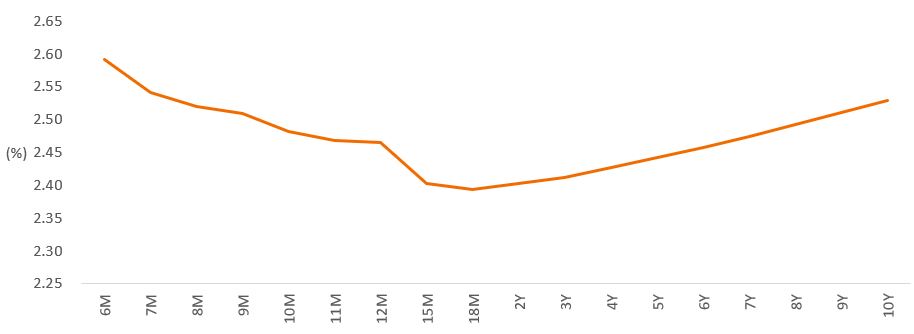

Additionally, in a flat or inverted yield curve environment (where short-term rates are similar to or higher than long-term rates), shorter duration floating rate instruments can be advantageous, providing attractive income carry opportunities without the need to take on duration risk unnecessarily. If desired, investors can then tactically manage duration risk elsewhere in their portfolio. This is shown in Figure 2, where the front end of the Euro swaps yield curve is inverted. It should also be noted that while front-end cash rates are expected to fall over the next year, even after that the curve is expected to still remain pretty flat.

Figure 2: Yield-to-maturity of the Euro swaps curve

Source: Bloomberg, as at 28 January 2025. Mid yield to maturity shown. There is no guarantee that past trends will continue, or that forecasts will be realised.

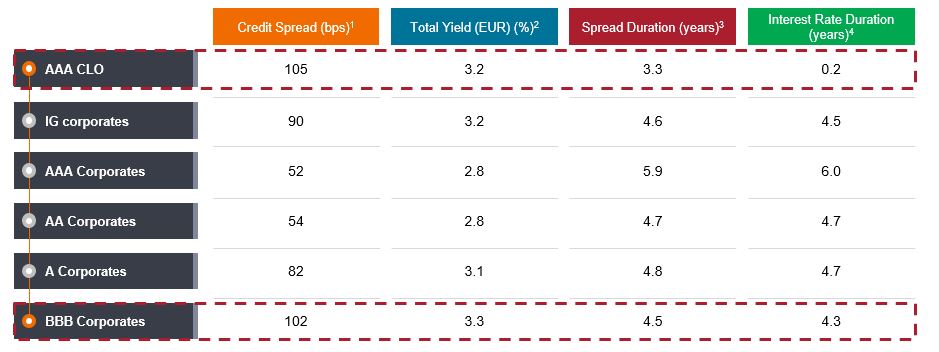

Clearly it is also the case that market expectations can be wrong and the future path of rates may prove to be very different and volatile as we have seen in recent years. The negligible interest rate sensitivity of AAA CLOs can be helpful during such volatility. Given tight fixed income spreads generally, this leaves credit markets susceptible to spread widening during volatile periods, whether that arises from politics, tariffs or other macroeconomic variables. The lower spread duration and high credit quality of AAA CLOs means reduced sensitivity to credit spread moves compared to other fixed income asset classes, such as investment grade (IG) credit. This is one of the factors that has helped European AAA CLOs deliver a smoother return profile over the long term when compared to IG credit.

The spread buffer

AAA CLOs have historically paid a higher credit spread than IG corporates. On average, over the past decade to 31 December 2024, AAA CLOs paid an additional 130bps over the risk-free rate, compared to 78bps for IG credit[1]. In a falling rate environment, relative value rises in importance given, as discussed, the spread component becomes a greater proportion of the total yield.

When we look at relative spreads today, to achieve a similar level of credit spread and yield available in AAA CLOs, investors would need to move down the credit spectrum into BBB-rated corporate credits (Figure 3). Please note these AAA CLO yields are based on conservative estimates of the forward euro rates curve that is forecast to decline over time. Today, the current yield on AAA CLOs is higher at around 4%[2].

Figure 3: Relative value favours AAA CLOs

Source: Data as at, 31 December 2024. Janus Henderson Investors, JP Morgan, Citi, ICE indices, Bloomberg. 1 – For CLO, based on discount Margin, for corporate credit, Swap OAS. 2 – For CLO, total yield is calculated as credit spread plus the swap rate corresponding to average life. This is the 4-year Euro SWAP rate. For corporate credit, Yield to Worst is presented. 3 – For CLO, based on average life estimates and spread duration for credit indices. Spread duration is a measure of how much a bond’s price changes in response to a change in its credit spread. 4 – Credit indices based on effective duration. For AAA CLO, based on estimates. Yields may vary and are not guaranteed. The above are the team’s views and should not be construed as advice and may not reflect other opinions in the organisation.

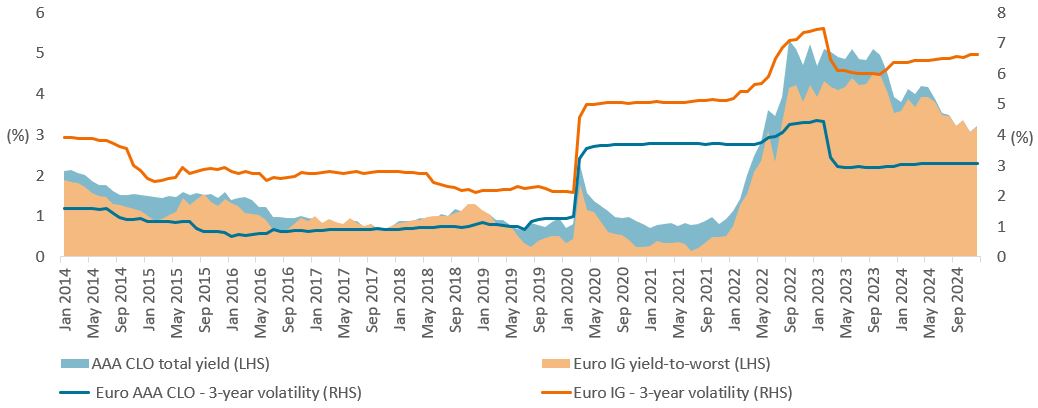

No compromise on risk

It is also the case that AAA CLO yields tend to outpace broader IG credit when we look over the past decade (Figure 4). Such return is often delivered with around half of the volatility of IG credit. Furthermore, when looking at recent extreme drawdown periods, such as the Covid pandemic and rising rates of 2021/22, AAA CLOs have shown equivalent or shallower and shorter drawdowns when compared to IG credit.

Figure 4: Better or equivalent yield from AAA CLO delivered with lower volatility

Source: Bloomberg, Citi, ICE indices, as a 31 December 2024. IG: ICE BofA Euro Corporate Index. For CLO, total yield is calculated as credit spread plus the swap rate corresponding to average life. This is the 4-year Euro SWAP rate. For IG, yield-to-worst is presented. For volatility, 3-year total return volatility for CLO is estimated using AAA CLO spread moves, assumed carry and cash returns. Cash returns are estimated using 1m Euribor. Yields may vary and are not guaranteed.

Improving diversification

As the path of interest rates is highly uncertain, we believe investors should be aware of the risk of volatility in rates and its potential impacts on portfolios, both directly and indirectly via associated credit spread moves. Adding diversification into a fixed income allocation – such as through floating rate exposure – can help ensure that it is not geared all to the same factors or risks. Diversification of risk is key to maintaining stability in returns over the long term.

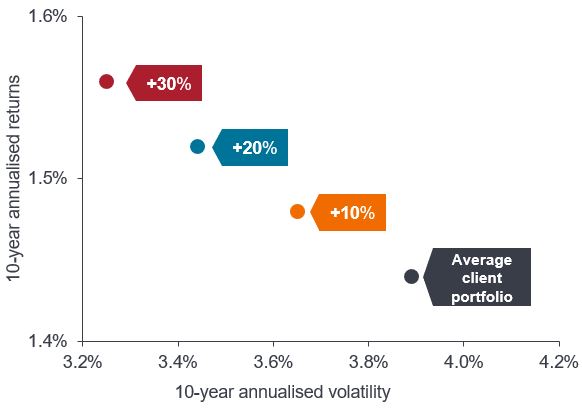

Allocating to AAA CLOs can create a cornerstone of investment portfolios with different risk and return drivers given their floating rate nature, relatively short spread duration[3], high credit quality and differentiated market technical factors. Our Portfolio Construction & Strategy Team at Janus Henderson Investors have analysed this by looking at the asset class make-up of a typical European client fixed income portfolio and how adding 10%, 20%, 30% of AAA CLOs improves the portfolio’s risk-return dynamics (Figure 5).

Figure 5: Results of adding 10%, 20% and 30% AAA CLO allocation to your fixed income portfolio (10 years)

Source: Janus Henderson Investors, Bloomberg, Morningstar, JPMorgan. As at 30 November 2024. Indices used as representative in hypothetical portfolios: Global Bonds – Bloomberg Global Aggregate TR Hdg EUR; Euro IG – ICE BofA Euro Corporate TR EUR; Euro Govt. – Bloomberg Euro Agg GvtR TR EUR; Euro HY – Bloomberg Pan Euro HY TR EUR; Global HY – Bloomberg Global High Yield TR EUR; EM Debt – Bloomberg EM Hard Currency Agg TR USD; Bank Loans – Credit Suisse Western European Leveraged Loan TR Hdg EUR; US Bonds – Bloomberg US Agg Bond TR EUR; Convertibles – Refinitiv Europe CB TR EUR; Cash – ICE BofA EURCcy 3M Dep BdRt CM TR EUR (Cash). Average client portfolio is based on the average of Janus Henderson European clients’ fixed income portfolios. Portfolios are hypothetical and performance is based on historic index returns. Investors should not assume they will have a similar investment experience. Past performance does not predict future returns.

Income and diversification likely to remain key

European AAA CLOs are expected to offer an attractive income stream for investors even as cash rates fall. Indeed, the spread component of floating rate instruments such as AAA CLOs becomes increasingly significant as interest rates decrease, providing a cushion that supports ongoing income generation. This combined with their diversification benefits underscores the value of including AAA CLOs in investment portfolios. While manager expertise is required to access this attractive portion of fixed income markets, at their core AAA CLOs are relatively straightforward and secure investments that have proven to be resilient through various periods of extreme macro and market volatility. With over 600 existing European deals from around 67 CLO managers[4] and a steady stream of primary new issuance, active managers can mine both the primary and secondary markets for compelling relative value opportunities and portfolio risk optimisation.

The ability of AAA CLOs to deliver attractive yields without compromising on credit quality highlights the asset class’s potential to improve a portfolio’s risk-adjusted returns. Their negligible interest rate sensitivity and lower spread duration also offer a buffer against volatility. As the landscape of fixed income investing evolves with central bank easing complicated by a shifting macro and political backdrop in many economies, a strategic allocation to AAA CLOs can enhance portfolio resilience, offering a balanced mix of yield, quality and stability amid fluctuating rates and ongoing economic challenges.

Footnotes

[1] Source: Bloomberg, based on the Citi EUR CLO 2.0 AAA Index and ICE BofA Euro Corporate Index, from 31 December 2014 to 31 December 2024.

[2] Source: Janus Henderson estimate, as at 31 January 2025. Current yield is the current annualised income from an investment relative to its current price. It’s a percentage that’s often used to describe the return on a bond.

[3] Spread duration is a measure of how much a bond’s price changes in response to a change in its credit spread.

[4] Source: Janus Henderson Investors, Bloomberg, Index Calc and JPMorgan Indices, as at 7 February 2025.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.