Quick View: April U.S. CPI – positive news for the Fed

April’s Consumer Price Index (CPI) report keeps hopes for a summer rate cut alive, but are investors underestimating the rate trajectory through 2026? Head of U.S. Fixed Income Greg Wilensky discusses the most recent inflation data and the potential trajectory of monetary policy.

2 minute read

Key takeaways:

- U.S. inflation data increased 0.3% in April, cooling from three consecutive 0.4% increases in the months prior.

- April’s CPI report should be viewed positively by the Federal Reserve (Fed) and keeps the possibility of a July rate cut on the table.

- While markets are pricing in a reasonable expectation of two cuts in 2024, we think investors should be questioning whether enough cuts are priced in for 2025 and 2026.

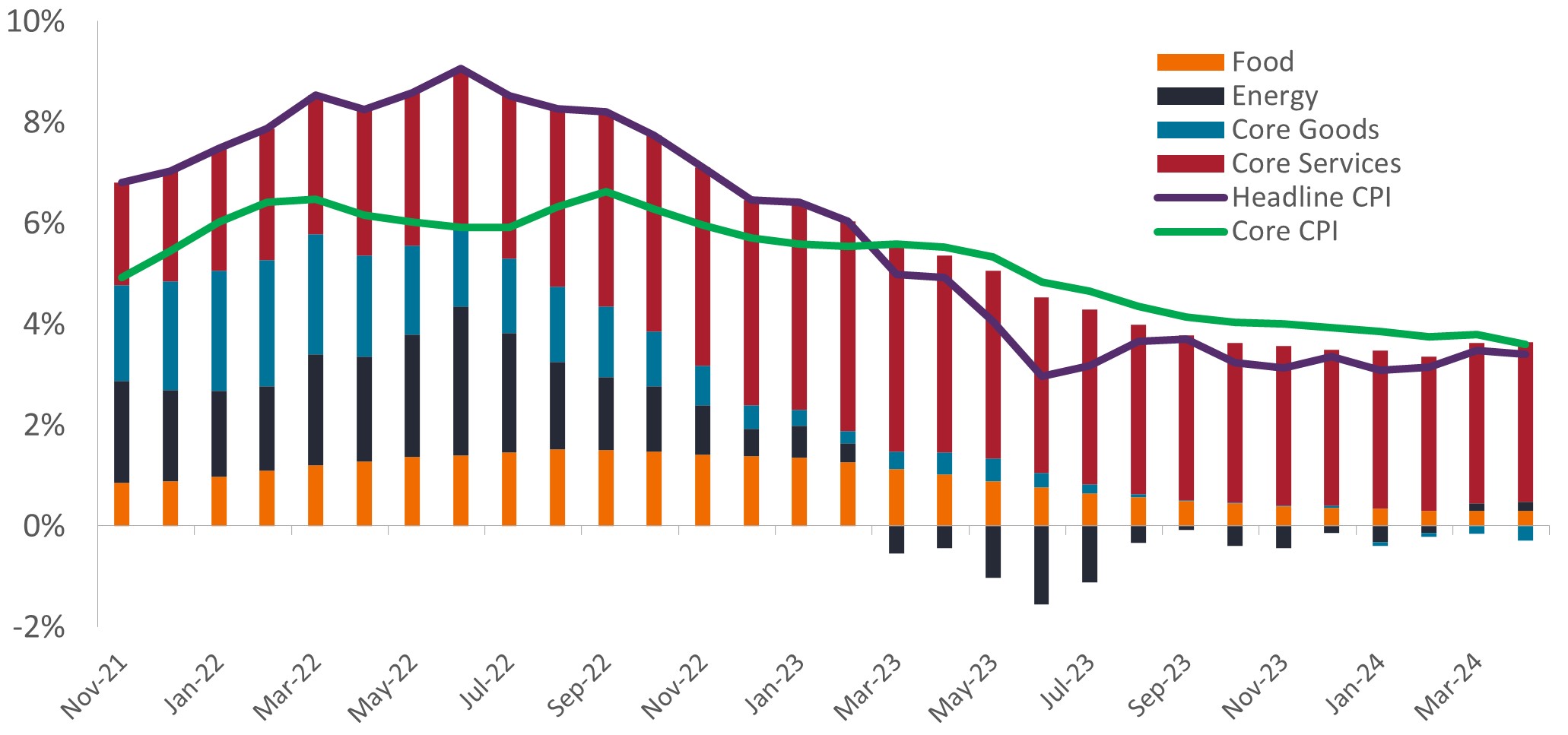

April’s U.S. Consumer Price Index (CPI) data showed inflation easing from the three months prior. Core prices – excluding food and energy – rose 0.3% on a seasonally adjusted basis, with shelter, motor vehicle insurance, medical care, apparel, and personal care prices ticking higher. Core prices were up 3.6% from one year ago, the smallest increase since April 2021.

The Federal Reserve (Fed) should take encouragement from April’s CPI report, and early positive reactions in both rates and risk markets seem appropriate. April’s inflation data keeps hopes alive for an initial rate cut in July. However, a July cut would require these small-but-positive steps toward inflation moderation to be supported by more meaningful positive inflation news and/or more concrete signs of labor market weakness over the next 10 weeks.

JHI

When combining the appropriate components from this week’s CPI and Producer Price Index (PPI), which rose 0.5% in April on a seasonally adjusted basis, reports, the read through for this month’s core PCE inflation readings supports a drop back to a 0.2% print.

Contributors to Consumer Price Index by category

Source: Bloomberg, as of 15 May 2024.

The market is now pricing in two cuts for 2024. As an average for the range of potential outcomes, two cuts in 2024 seems quite reasonable. However, we believe that markets are not yet pricing in enough cuts for 2025 and 2026. The December 2026 futures contracts suggest that the federal funds rate will be approximately 3.8%. In our view, the Fed will need to bring its policy rate meaningfully below this level, either because inflation will ease back toward target into a softish landing, or because a weaker economy will bring inflation down below target.

Notwithstanding the tug-of-war taking place in rates markets in the short term, we believe the current monetary and economic environment sets up well for a favorable multiyear outlook for fixed income returns. We expect that the recent strong demand for the fixed income asset class should continue – and potentially accelerate once the Fed starts cutting rates – as investors aim to lock in attractive yields and benefit from the diversification that bonds may bring to multi-asset portfolios.

Consumer Price Index (CPI): An unmanaged index representing the rate of inflation of the U.S. consumer prices as determined by the U.S. Department of Labor Statistics.

Producer Price Index (PPI): A family of indexes that measures the average change over time in the selling prices received by domestic producers of goods and services.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

IMPORTANT INFORMATION

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.