Data center boom: Navigating the power crunch

As the data center expansion driven by artificial intelligence (AI) forges ahead, Portfolio Manager Aaron Scully explores growth opportunities and how investors can navigate electricity bottlenecks.

6 minute read

Key takeaways:

- The global expansion of data centers is largely being driven by advancements in artificial intelligence (AI), leading to a surge in electricity demand that could outpace the existing grid infrastructure’s ability to supply sufficient power.

- Potential electricity bottlenecks create both risks and opportunities for investors. They could hinder growth for companies in data center, AI, and related industries, but may also open up opportunities among renewable energy, energy efficiency, and component providers.

- In our view, investors should prioritize companies that are contributing to data center expansion while actively monitoring looming electricity bottlenecks and looking for specialized companies addressing infrastructure limits.

Data centers are highly specialized facilities housing infrastructure like servers and storage devices for online services, AI platforms, and more. As data needs increase globally, major technology companies are projected to invest $1 trillion in new data centers over the next five years1 to meet the current and anticipated data creation, which is expected to rise 21% in 2024.2

This rapid expansion is boosting electricity demands. In the U.S., data centers accounted for 4% of electricity usage in 2022. By 2026, that is expected to grow to 6%3 as the shift toward more power-intensive AI data racks – requiring up to seven times more power than traditional setups – accelerates industry-wide electricity demand growth to 10% annually through 2030.4

Globally, electricity demand is poised for an inflection point, with projections calling for 3.4% average annual growth through 2026.5 This growth should be supported by economic tailwinds, residential and automotive electrification, new clean energy manufacturing facilities, and data center proliferation. This global growth stands in contrast to relatively subdued growth since 2018, and a modest 0.4% realized U.S. growth from 2010 to 2022.6

The critical question is, can current electricity supply keep up with this soaring demand?

Bottlenecks

The situation is especially acute in the U.S., home to over half of the roughly 9,000 data centers worldwide.7 Over the next five years, the U.S. is expected to need more generation capacity for AI-specific data centers than the transmission grid’s capacity.

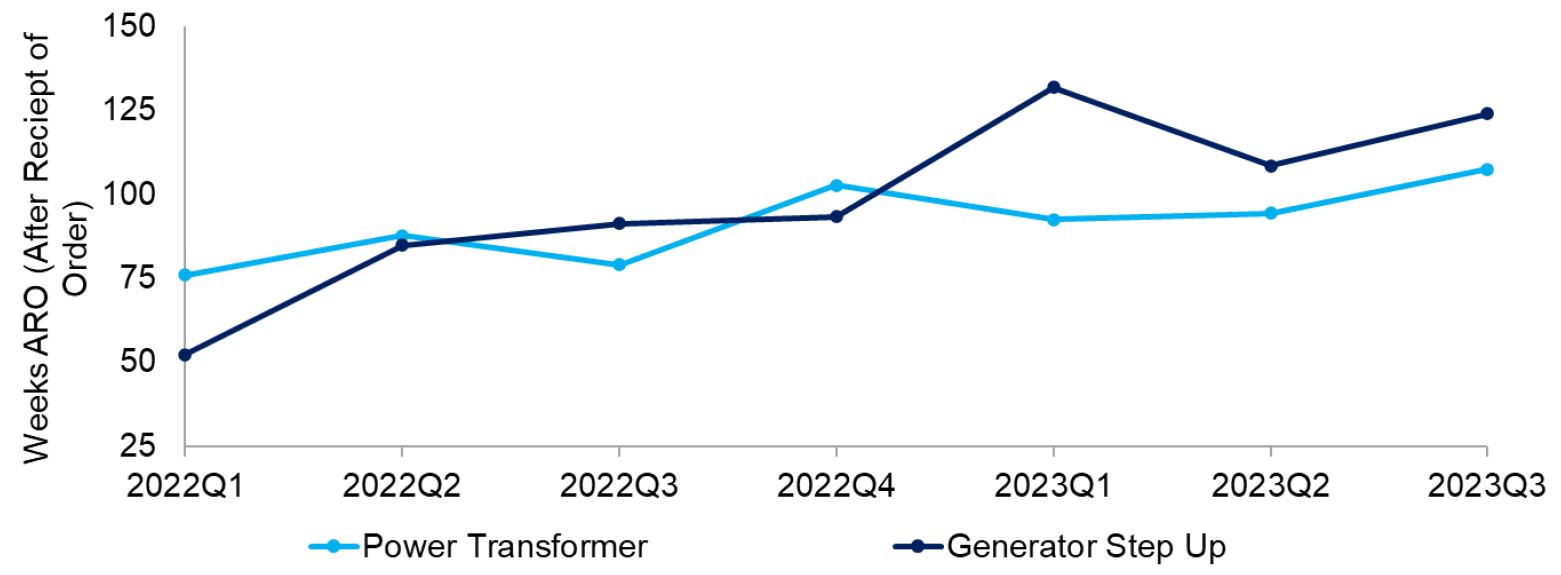

Grid capacity is already a limiting factor in several U.S. Tier 1 market locations, including Northern Virginia, Arizona, and Santa Clara, California. Even if sufficient electricity can be generated, bottlenecks in transmission lines, transformers, and other essential components could stall data center buildouts.

Figure 1: Power transformer and generator lead times have increased to over two years.

Source: Wood Mackenzie, “Supply shortages and an inflexible market give rise to high power transformer lead times,” 22 November 2023.

The implications could ripple across the technology sector. Without enough new data centers, AI service providers could be forced to allocate limited computational resources to only the highest-value applications. Furthermore, the unlimited demand for graphic processing units (GPUs) could be rendered irrelevant if there are insufficient data centers and electricity to leverage the products’ capabilities.

Opportunities in renewables and energy efficiency

On the positive side, the prospective shortfall in traditional electricity supply opens the door for renewable energy solutions, especially with cloud providers’ push for net-zero emissions and clean energy.

Five tech giants alone accounted for over half of corporate renewable purchases worldwide according to a 2023 S&P Global report.8 By 2026, renewables’ share of electricity generation is forecast to rise and offset demand growth in advanced economies like the U.S. and the European Union, helping to displace fossil fuels.9

In the U.S., the interconnection queue – projects awaiting connection to the electrical grid, an indicator of near-term development – surged to over two terawatts in mid-2023, which is more than the existing U.S. fleet capacity. Renewables account for nearly 95% of the mix.10

This transition spotlights the opportunity for renewable developers in North America. Specialized developers like Innergex and Boralex stand out due to their ability to navigate local government and First Nations’ approvals. In the UK, SSE Renewables is notable provider of offshore wind development. Meanwhile high-voltage cable providers like Prysmian Group, headquartered in Italy, play a crucial role in extending the grid to support renewable sites in less-populated areas.

For data center operators, securing sufficient power supply and boosting efficiency are top priorities. Strategies range from relocating operations closer to energy sources in Tier 2 markets to exploring self-generation options like microgrids, fuel cells, small nuclear reactors, and hydrogen power.

Regarding efficiency, despite substantial growth in cloud infrastructure over the past decade, global data center power consumption has risen modestly since 2015 thanks to efficiency gains. And in our view, there are reasons to believe that these efficiency gains can offset at least some of AI’s additional energy demand.

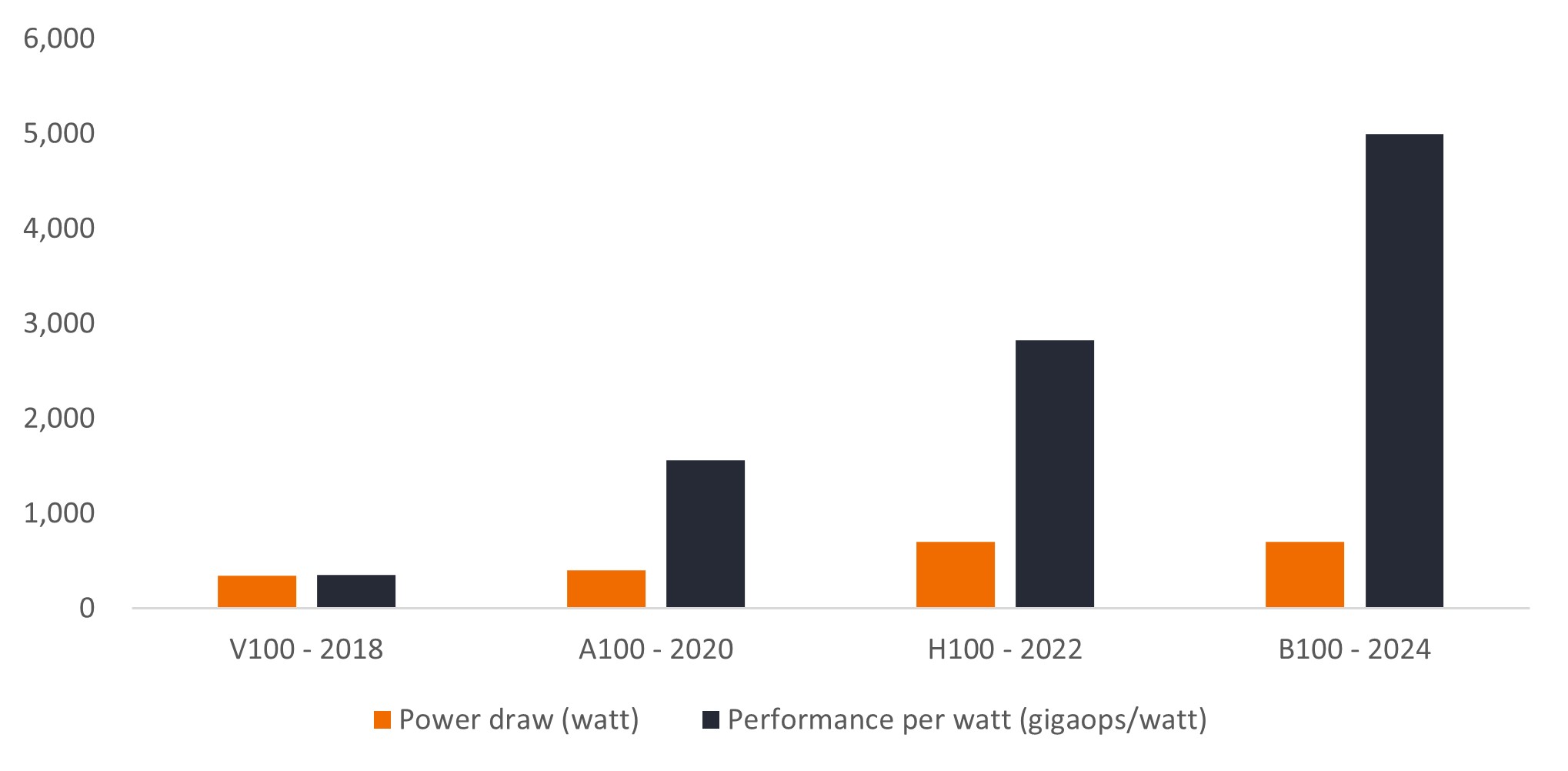

There are continual efforts to improve the efficiency of AI large language models and GPUs. For example, while Nvidia GPU power consumption increased from 350 watts in 2018 to 700 watts in 2024, performance per watt has gone up exponentially (see Figure 2 below). In a recent piece, our technology and property team portfolio managers discuss the latest Nvidia B100 GPU launch and explore data center demand from a property perspective.

Figure 2: Rapid improvements in Nvidia’s data center GPU performance per watt by generation

Source: Nvidia and Nextplatform. Janus Henderson Investors analysis based on FP16 Tensor Core.

Source: Nvidia and Nextplatform. Janus Henderson Investors analysis based on FP16 Tensor Core.

Opportunities with key data center enablers

Several key players stand to benefit from the data center boom, including Equinix, the largest data center landlord, and equipment suppliers such as Vertiv and Eaton. Implications span the broader power supply chain, including companies like Prysmian and Schneider Electric, which are poised to benefit from increased electrification needs.

Another enabler of new data centers are high-efficiency cooling systems. AI workloads demand massive computations and exponentially increase heat output in data centers. Centers adopting liquid cooling technologies can reduce power consumption by 20% compared to traditional air cooling alone.11 Specialized companies like Nvent provide these thermal solutions.

Utilities are preparing for the significant jump in the projected energy load by pursuing sharp capital expenditure budget increases to bolster grid infrastructure. Suppliers of components such as instrument transformers, cutouts, and switches could benefit from the increased spending, along with manufacturers of transmission lines.

Weighing AI energy demand with benefits

While AI’s applications are relatively nascent with many uncertainties, it has the potential to yield benefits that could justify the increased energy usage, particularly as renewables displace fossil fuels for powering data centers.

AI could dramatically enhance human productivity by reallocating resources more effectively. Furthermore, it holds potential for catalyzing breakthroughs in healthcare by accelerating biomedicine and drug discovery and by enabling personalized treatments on a mass scale.

A rapidly evolving market

The data center industry is rapidly evolving on the back of technological innovation. For investors, this presents significant growth opportunities, but also pitfalls if developments are not monitored closely.

For investors seeking to participate in the tailwinds from data center growth, we think proactive oversight of looming bottlenecks and the specialized companies providing solutions is crucial, as is managing the associated risks.

1 Stephen Tusa, Jr., et al., JP Morgan Research Note, 29 February 2024.

2 Pranay Ahlawat, et al., “A New Architecture to Manage Data Costs and Complexity,” Boston Consulting Group, February 2023.

3 International Energy Agency, “Electricity 2024 Report,” January 2024.

4 Srini Bangalore. et al., “Investing in the rising data center economy,” McKinsey & Company, 17 January 2023.

5 International Energy Agency, “Electricity 2024 Report,” January 2024.

6 Statista.com; EIA Monthly Energy Review

7 Cloudscene via Statista, as of September 2023.

8 A. Wilson, “Datacenter companies continue renewable buying spree, surpassing 40 GW in US, S&P Global,” 28 March 2023.

9 International Energy Agency, “Electricity 2024 Report,” January 2024.

10 T. Lenoir, “US Interconnection Queues Analysis 2023,” S&P Global, 28 August 2023.

11 International Energy Agency, “Electricity 2024 Report”, January 2024.

IMPORTANT INFORMATION

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

Concentrated investments in a single sector, industry or region will be more susceptible to factors affecting that group and may be more volatile than less concentrated investments or the market as a whole.

Energy industries can be significantly affected by fluctuations in energy prices and supply and demand of fuels, conservation, the success of exploration projects, and tax and other government regulations.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.