A vision of cities filled with self-driving vehicles has long been harboured by autonomous driving enthusiasts, who argue that a fully self-driving vehicle will ultimately increase road safety and reduce journey times, recapturing valuable time that would have otherwise been spent driving.

Apart from greater road safety and productivity, autonomous vehicles also promise environmental benefits. The International Energy Agency (IEA) estimates that the global transport sector needs to see a decline of around 20% in C02 emissions by 2030 to achieve net zero.1 Self-driving cars offer the potential for reduced fuel consumption from fewer traffic jams (by driving more closely together safely and freeing up space on roads, or a single autonomous vehicle eliminating traffic by subtly moderating the speed of others), engine idling, as well as car sharing.2 Access to safe, good quality and affordable transportation can also help to reduce poverty and inequality, providing greater mobility for the disabled and the rising senior demographic.

Technology is providing wide-ranging sustainable solutions for a future transport system that can move people more safely, affordably and efficiently. These include zero emission vehicles, Advanced Driver Assistance Systems (ADAS), a shift away from transport ownership towards transportation as a service (TaaS) and autonomous (self-driving) vehicles.

No smooth ride

However, focusing on autonomous driving, it’s fair to say progress has been slower than anticipated with significant technological hurdles still to overcome, coupled with the need to ensure that regulators are comfortable with a fully ‘eyes-off, hands-off’ driver.

That said, some progress has been made, particularly at the lower end of the spectrum of Advanced Driver Assist Systems (ADAS), a series of levels defined by the Society of Automotive Engineers describing different degrees of autonomy. Investors have typically relied on the taxonomy from the Society of Automotive Engineers spanning levels 1 to 5, with Level 1 including some form of automated system such as a speed monitor during cruise control, but where the driver is in full control of the vehicle, while Level 5, is full automation requiring zero human attention or interaction. However, in recent years many intermediate levels have been coined by the industry. Meanwhile, market penetration for basic features such as parking systems or highway autopilots has increased steadily over the last few years.

How far away are we from a fully autonomous driving future?

We attempted to take the pulse of the autonomous driving industry when we visited the Consumer Electronics Show (CES) in Las Vegas in January 2023. As usual, there was a plethora of autonomous vehicle technologies on display, and while the electrification of vehicles received most investor attention, autonomy and safety are also important aspects that are being rolled into internal combustion engine (ICE) vehicles.

A shift of focus to ‘eyes-on, hands-off’

More recently, and perhaps more intuitively, Mobileye, a software company developing autonomous driving technologies and products released its own taxonomy, with a useful template for the different levels of autonomy ranging through ‘eyes-on, hands-on’ all the way to ‘eyes-off, hands-off’. Wind back the clock only around five years ago, and a full ‘eyes-off, hands-off’ future for both consumer vehicles and robotaxis looked only a few years away, with investor enthusiasm reaching fever pitch. At this year’s CES event one thing was clear, that vision is still several years away and the focus of the industry for now is on moving from ‘eyes-on, hands-on’ to ‘eyes-on, hands-off’.

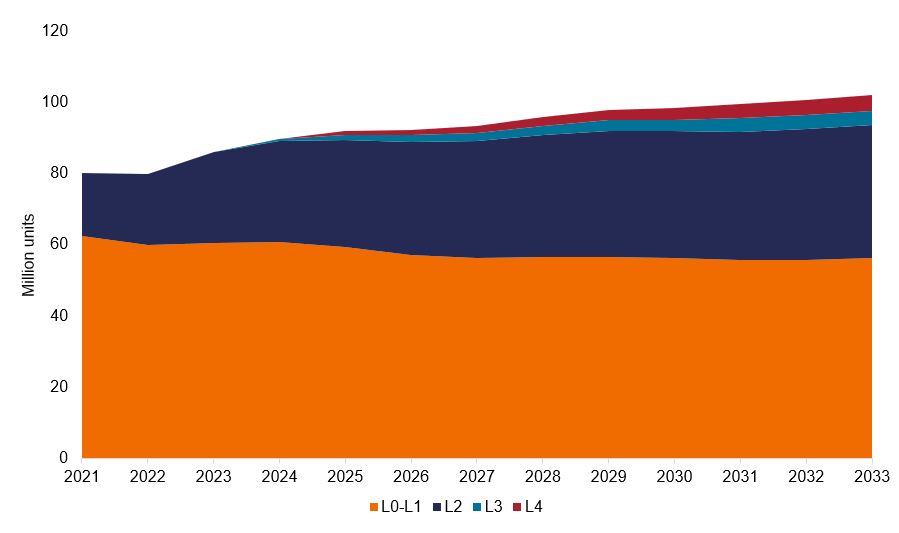

Although penetration of L1 to L2 solutions (‘eyes-on, hands-on’) has grown over recent years, IHS Markit predicts only a very small level of penetration of higher level ‘eyes-off’ solutions as a percentage of global light vehicle production over the next decade.

Vehicle autonomy penetration forecast

Source: IHS Markit, Deutsche Bank Autos & Auto Technology research note, 17 January 2023. Reproduced with permission. Level 0-2 (simple ADAS to hands off eyes on assistance); Level 3-4 (eyes off); L5 (fully autonomous).

Technology, the provider of solutions

Achieving the upper echelons of vehicle autonomy requires powerful custom silicon chips combined with a range of cameras, radar and lidar (remote sensory using pulsed laser), pulled together by specialist software that performs rapid sensor fusion and processing to direct the vehicle. Companies such as Ambarella, Nvidia, Qualcomm and Mobileye all had chips on display at CES offering a range of functions that could enable the relatively complete set of hardware available in the market today to drive a car with less driver input. We now see a clear move to standardise the hardware in modern vehicles and more differentiated software – essentially, software-defined vehicles.

Similar to the development of smartphones, the pathway ahead points to more centralised computing in the vehicle, with chips and software designed with ample performance headroom to enable their upgrade to a full ‘eyes-off, hands-off’ system in the future. There is no one size fits all solution and the industry is looking to develop a robust decision-making framework alongside the hardware and software required to reach an autonomous driving future.

“Self-driving cars are the natural extension of active safety and obviously something we should do.” Elon Musk

Safety first

One of the key hurdles to overcome for wider adoption of higher levels of autonomy is achieving acceptable levels of safety in all driving domains. Currently, we see ‘eyes-on, hands-off’ products operating on highways where roads are generally long, straight and free of pedestrians or other unpredictable hazards (edge cases). However, things get more complicated when navigating through urban environments where edge cases can be more common, which the ADAS system must learn to deal with.

To work around this, companies are developing vast databases of the world’s road networks, mapping features, and learning how to navigate around unpredictable scenarios. The most well-known, albeit not the biggest, is Tesla’s FSD, or Full Self-Driving system, which has now accumulated circa 90 million miles driven by Tesla customers. However, these mapping databases that will ultimately lay a path to higher levels of autonomy are not yet in the eyes of the regulator sufficient to pass muster, and intense scrutiny remains on any reported incident from autonomous or semi-autonomous vehicles that are on the road. Ultimately, we expect to see some intermediate levels of autonomy proliferate in the medium term, perhaps focused on highway driving or geofenced areas where the driver must remain alert.

Investing beyond the hype

We view the progress in the world of autonomous driving as a positive step towards a more sustainable and safer future for global personal mobility. Achieving higher levels of autonomous driving is taking longer than investors had expected. We have seen Ford disband its Argo autonomous division and Waymo, the self-driving car division of Google’s parent company Alphabet, scale back ambitions and cut approximately 8% of staff.

But in recent months we have also seen some progress from high-profile players in the industry, most notably General Motors (GM)-sponsored Cruise, which expanded its fully autonomous robotaxi service to Phoenix, Arizona and Austin, Texas, adding two further cities to their existing nighttime robotaxi service in San Francisco.

This leads us to take a pragmatic view – as long-term technology investors we are acutely aware of the hype cycle around autonomous driving. This means a focus on the competitive moats of these companies and strong valuation discipline are essential to identifying the key technology enablers of the next generation of autonomous vehicles that can accelerate fully autonomous transportation.

1 IEA, Global CO2 emissions from transport by sub-sector in the Net Zero Scenario.

2 Coalition for Future Mobility, benefits of self-driving vehicles; UC Berkeley: Eliminating Traffic Jams with Self-Driving Cars, https://ce.berkeley.edu/news/2537

Advanced Driver Assistance Systems (ADAS): electronic systems in a vehicle that use advanced technologies to assist the driver. ADAS uses sensors in the vehicle such as radar and cameras to perceive the world around it, and then either provides information to the driver or takes automatic action based on what it perceives.

Geofencing: a feature in a software programme that uses the global positioning system (GPS) or radio frequency identification (RFID) to define geographical boundaries.

Hype cycle: represents the various stages in the development of a technology from conception to widespread adoption, with investor sentiment being a key driver of valuations of that technology and related stocks during the cycle.

Net zero: refers to the balance between the amount of greenhouse gas produced and the amount removed from the atmosphere. Net zero is reached when the amount of greenhouse gas added is no more than the amount taken away.

IMPORTANT INFORMATION

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund follows a sustainable investment approach, which may cause it to be overweight and/or underweight in certain sectors and thus perform differently than funds that have a similar objective but which do not integrate sustainable investment criteria when selecting securities.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.