Right here, right now: growth opportunities in real estate

Portfolio managers Guy Barnard, Tim Gibson and Greg Kuhl, explain why they believe the REIT 'reopening rotation' trade has created an attractive opportunity to buy quality compounders offering sustainable growth, driven by long-term structural tailwinds.

4 minute read

Key takeaways:

- The growth prospects of many real estate companies exposed to powerful secular tailwinds have improved and look to continue to improve as a result of the pandemic.

- However, in the aftermath of recent underperformance versus the wider REITs sector, ‘growth’ REITs have seen their valuation premiums disappear.

- Performance differentials between ‘value’ and ‘growth’ real estate sectors has become stretched based on fundamentals, creating potential buying opportunities.

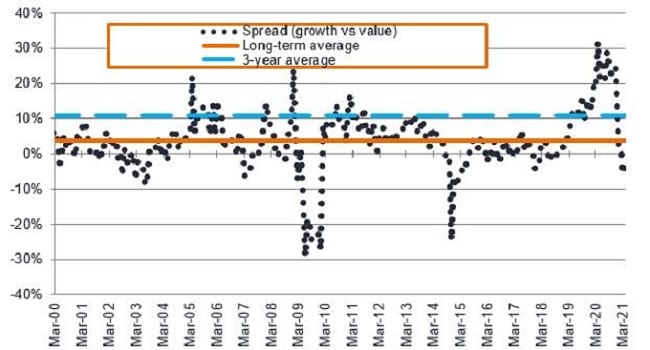

Since the announcement of the Pfizer vaccine’s efficacy against COVID-19 on 9 November, alongside the wider equity markets, we have seen a significant rotation to ‘value’ within the real estate investment trust (REIT) market. Specifically, while the overall US REIT sector has gained 14% since that day, ‘value’ REITs are up on average 52%, while ‘growth’ REITs have been declined by 7%.1 The rotation away from ‘growth’ real estate sectors that have directly benefited from COVID (industrial/logistics, cell towers, data centres, single-family rental housing, storage), towards ‘value’ sectors that have been negatively impacted by COVID (shopping centres, regional malls, hotels, office, coastal apartments) has been strong, and has happened in a very short space of time.

Identifying ‘quality compounders’

A recovery trade in the hardest hit real estate sectors was both expected and justified. Better‑than‑hoped vaccine announcements signalled the beginning of a return to normality and ongoing government stimulus cushioned the pandemic’s impact on the consumer. A focus on ‘cheap, but not broken’ names (stocks severely punished by the market but which could still offer a reasonable path to sustainable growth) has been beneficial, albeit some structurally impaired sectors, such as retail, have rallied the hardest. While the current trading momentum shows few signs of abating, we believe the performance differentials between value and growth real estate sectors have become stretched based on the underlying value of property assets; ie, fundamentals.

Growth versus value – so much has changed in a year

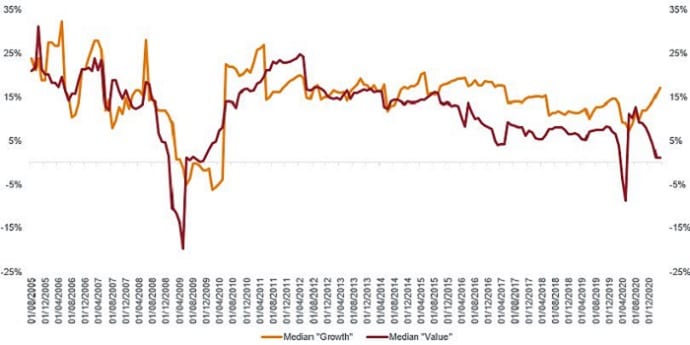

REITs in ‘growth’ sectors offer highly visible long-term compounding return potential, driven by permanent and powerful secular tailwinds such as e-commerce, mobile data, cloud computing, 5G and changing demographics. The growth prospects of many real estate companies exposed to these trends have improved, and look to continue to improve as a result of the pandemic. However, in the aftermath of recent underperformance of the wider REITs sector, these companies have seen their previously high valuation premium disappear.

Source: Evercore ISI Research, as at 1 March 2021. Past performance is not a guide to future performance. Note: Net asset value (NAV) per share represents the estimated private market value of REIT-owned properties. ‘Growth’ includes Industrial, Single Family Rentals, Manufactured Housing, Storage, Life Science Office sectors. ‘Value’ includes Shopping Centres, Malls, Traditional Office, Healthcare, Coastal Apartments, Student Accommodation.

Figure 2 shows two-year forward earnings growth expectations for growth versus value companies. Here we can see that the valuation moves of late are at odds with current market consensus expectations, with estimates for the ‘value’ sectors having come down sharply, while estimates for the ‘growth’ sectors have increased.

Source: Janus Henderson Investors, Evercore ISI Research company classifications. Data based on 2-year forward market consensus FFO per share estimates to 31 March 2021. Funds From Operations (FFO) is used by REITs to define the cash flow from their operations; ie, a measure of operating performance. The FFO per share ratio is typically used to evaluate a REIT in lieu of earnings per share (EPS) used to evaluate general equities.

Growth opportunities abound

We believe that the market is attaching a more positive outlook to certain property types, which rely more on hope and continued economic recovery momentum, rather than fundamentals. Equally, the market appears to be underestimating the long-term growth potential of best‑in‑class REITs that have the ability to grow, create significant shareholder value and potentially offer superior property returns in the coming years.

In summary, we believe this level of valuation divergence between ‘value’ and ‘growth’ has created a compelling opportunity; a rare chance to buy some of the highest quality publicly traded real estate companies, operating in sectors that look to be on the right side of change, at attractive valuations.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.