Absolute Return: No time for plaudits

With markets beset by weaker growth, high inflation and geopolitical uncertainties, the Portfolio Construction and Strategy team considers the potential benefits of an allocation to liquid, equity diversifying strategies, such as absolute return, capable of generating a return in both good times and bad.

3 minute read

This article is part of the latest Trends and Opportunities report, which outlines key themes for the next stage of this market cycle and their nuanced implications across global asset classes.

Harnessing volatility will be key for equity absolute return strategies when taking advantage of opportunities on the short and long side.

2022 Recap

- In a year marked by weaker growth, high inflation, and multiple geopolitical risks, bonds and equities sold off concurrently, something that has happened on only three previous occasions since 1928.

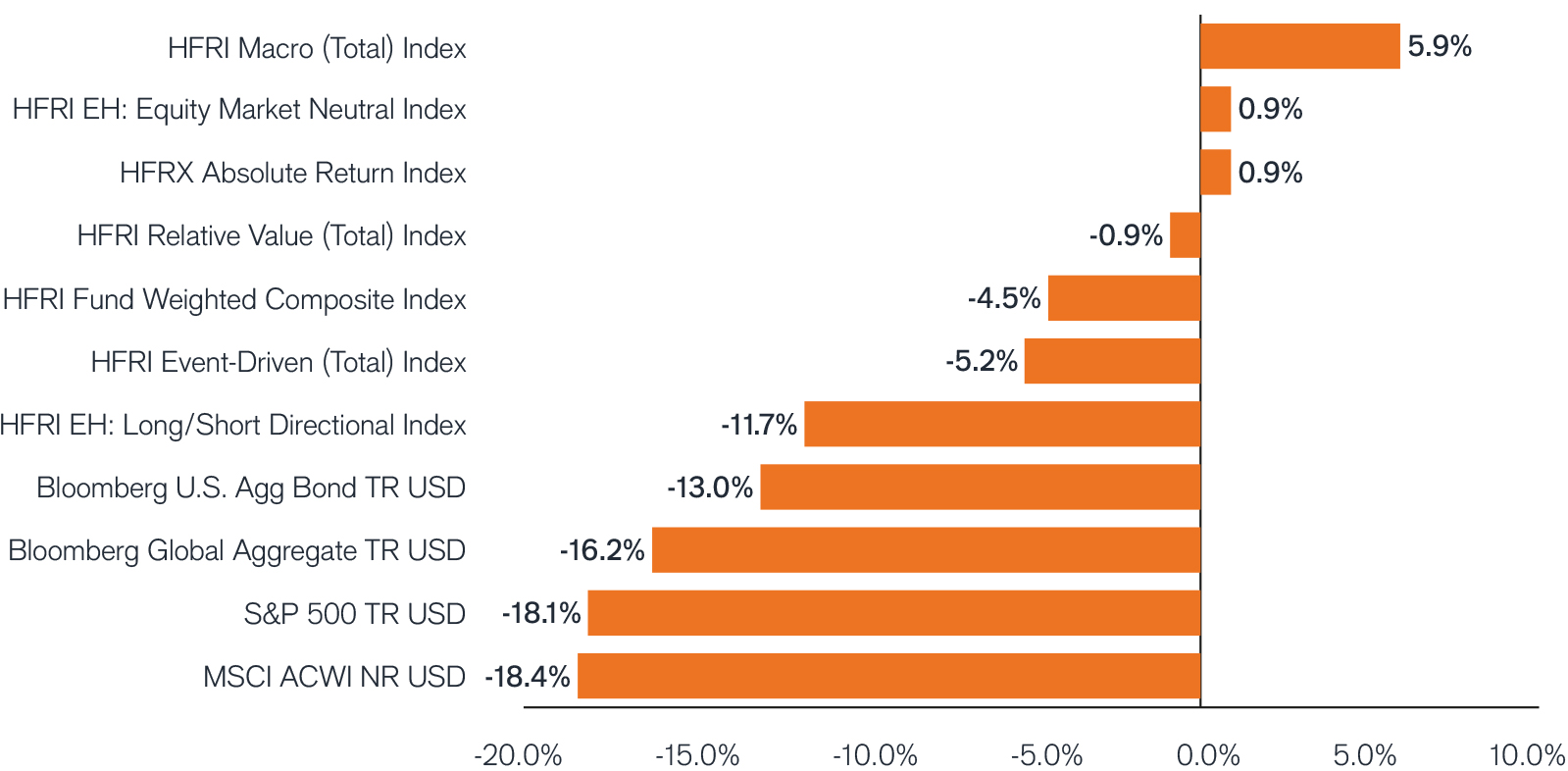

- Besides having lower correlations, liquid alternatives have shown lower volatility and drawdowns than stocks and bonds, with equity-diversifying strategies like absolute return producing small, albeit positive returns.

- Portfolios with exposure to liquid alternative strategies such as absolute return generally fared better than those without, highlighting that a strategic allocation to liquid alternatives should be considered, regardless of an investor’s investment horizon.

2022 returns: Alternatives versus major market indices

Source: HFR and Morningstar. Data as at 31 December 2022.

Outlook

- Global central banks battled inflation by aggressively raising rates. We expect further, yet smaller increases, with terminal rates set to be higher than in the recent past, triggering further equity market volatility.

- Tighter conditions suggest that that we should expect greater divergence in market returns compared to recent years, with as many companies that are winners as losers.

- Stock/bond correlations have markedly increased, while absolute return/equity correlations have moved significatively lower. This is a trend we expect to hold well into 2023.

The effect of Absolute Return in a 60/40 portfolio

| Global Bonds | Global Equities | Absolute Return | Portfolio 11 | Portfolio 22 | Capture of Port 2 vs Port. 1 |

|

|---|---|---|---|---|---|---|

| Lowest 5 year return | -2.38% | -4.49% | -4.33% | -1.01% | -0.52% | 51% |

| Average 5 year return | 3.83% | 7.48% | 1.13% | 6.23% | 5.61% | 90% |

| Highest 5 year return | 8.31% | 20.45% | 6.49% | 14.91% | 13.43% | 90% |

Source: Morningstar, analysis by Janus Henderson PCS. Data as at 31 December 2022.

Note: Table shows 5-year rolling annualised returns based on all 5-year periods from Jan 1990 to Dec 2022. Global Bonds = Bloomberg Global Aggregate TR USD; Global Equities = MSCI ACWI NR USD; Absolute Return = HFRX Absolute Return Index.

PCS Perspective

- With higher correlations across major asset classes and volatility expected to remain elevated, investors’ appetite for alternatives has increased.

- Harnessing volatility will be key for equity absolute return strategies when taking advantage of opportunities on the short and long sides.

- The short side is expected to be driven by consumers and corporates adjusting to higher costs, while demand likely weakens; the long side could present opportunities among companies with sound fundamentals, able to absorb shocks, which now show lower valuations.

- The short side is expected to be driven by consumers and corporates adjusting to higher costs, while demand likely weakens; the long side could present opportunities among companies with sound fundamentals, able to absorb shocks, which now show lower valuations.

- Absolute return strategies can adapt to unusual situations by managing their net market exposure, providing some potential for downside protection when the market turns, while opportunistically capturing returns throughout the market cycle.

Footnotes

1Portfolio 1 = 60% Global Equities 40% Global Fixed Income

2Portfolio 2 = 50% Global Equities 40% Global Fixed Income 10% Absolute Return

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.