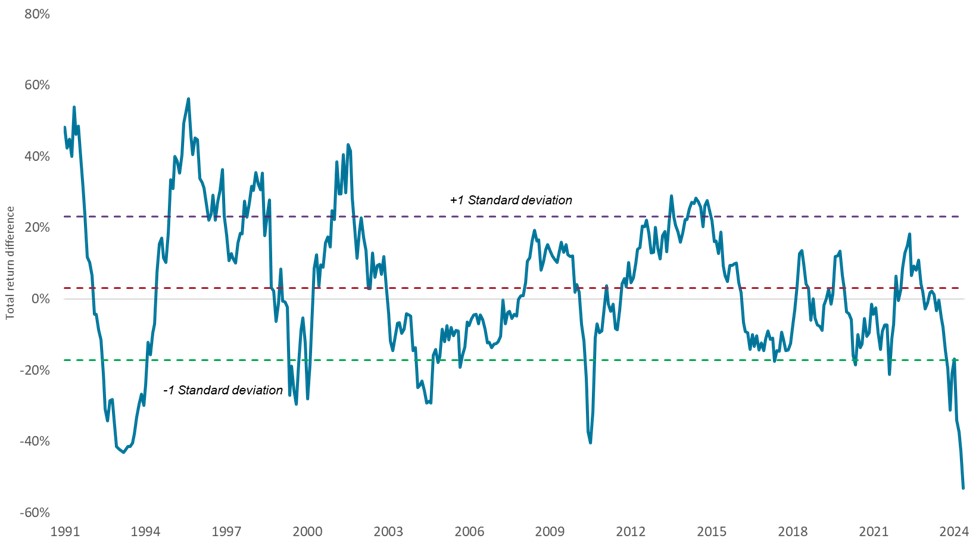

The end of 2024 marked the second year in a row the healthcare sector trailed the S&P 500® Index. While the sector can lag the market from time to time, the degree of underperformance was extremely unusual. For the two-year period through the end of last year, healthcare fell behind the Index by 53%, the biggest gap of any rolling two-year period since at least 1991 (Exhibit 1).

As a new year gets underway, investors might wonder what it will take for healthcare to get out of its slump. Some patience may be required: Uncertainty created by Robert F. Kennedy Jr.’s nomination to head the Department of Health and Humans Services (HHS) weighed heavily on the sector at the end of last year and could continue to cause volatility near term as we await his confirmation hearing, now beginning this week.

But investors might also benefit from recognizing that the sector has many other positive long-term drivers in play. Furthermore, while these near-term headwinds may prove less impactful, they have created attractive valuations for investors to take advantage of.

Putting politics into perspective

Healthcare now trades at a roughly 20% discount to the S&P 500, a gap not often seen between the benchmark and sector.1 Much of that discount was created late last year after Kennedy – an anti-vaccine activist and open critic of the Food and Drug Administration (FDA) – was nominated to head HHS. We believe the nomination and other proposals by the new Trump administration make for an unpredictable backdrop and should be watched closely over the coming months.

Exhibit 1: Healthcare’s underperformance has been unprecedented

Two-year rolling returns of healthcare sector minus S&P 500 Index

Source: Bloomberg, data are for two-year rolling periods ending starting 31 August 1991 to 31 December 2024. Healthcare is the S&P 500 Healthcare Sector, which comprises those companies included in the S&P 500 that are classified as members of the GICS® health care sector.

But there’s also a tendency for healthcare stocks to assume the worst about potential policy reform, selling off before details – often more nuanced than they first appear – become clear. We think today is no exception. The head of HHS, for example, can do relatively little to change how the FDA operates or to limit access to medicines without an act of legislation. President Donald Trump’s nominee for FDA commissioner, Dr. Martin Makary, a well-respected physician, could be a counterbalancing force. And Trump has other initiatives that will likely take priority over healthcare, including taxes, immigration, and trade.

Headwinds begin to ebb

Even before Kennedy’s nomination, the sector had contended with other headwinds. A stronger-than-expected U.S. economy meant healthcare’s traditionally defensive characteristics were less appealing to investors. Elevated interest rates caused capital markets to tighten (including initial public offerings (IPOs)), weighing on biotechnology. A handful of clinical trial setbacks for high-profile drug candidates sent the stocks of reporting companies tumbling. And a post-pandemic rebalancing of supply and demand lifted the prospects of some (e.g., medical device makers) but reduced earnings for others (e.g., insurers and Covid-19 product makers).

But some of these trends could now be turning for the better. In 2024, IPO activity (though still muted) began to pick up, and biotech delivered its second-largest year of follow-on equity issuance in the past decade. Central banks, too, are no longer aggressively hiking interest rates, while health insurers adjusted benefits and/or premiums to account for rising costs, which could take pressure off profit margins in 2025.

Spring-loaded for potential upside

Just as important, the sector has continued to deliver innovation. Last year, the FDA approved 60 novel drugs, following a record 72 approvals in 2023.2 Some products are setting new standards in patient care, including the first ever treatment for fatty liver disease (or MASH, the leading cause of liver transplant) and a hormonal replacement drug for hypoparathyroidism, a rare endocrine disorder with limited treatment options.

The advances are driving revenue growth. Some companies with new pulsed field ablation systems for atrial fibrillation, for example, reported consecutive quarters of double- or triple-digit, year-over-year growth in electrophysiology sales in 2024. Meanwhile, GLP-1 medicines for obesity and weight loss, which only launched within the last decade, are already annualizing at over $50 billion in revenues.3

Encouragingly, industry pipelines are at record levels, and in 2025, we expect a number of important late-stage trial readouts, including the first pivotal data for oral GLP-1 therapies and new treatments for cardiovascular disease caused by elevated levels of lipoprotein(a), which affects up to 25% of the global population.4

These and other novel therapies could be key to boosting mergers and acquisitions (M&A), which can make or break enthusiasm for the sector. In fact, a lack of larger deals last year (those valued at $5 billion or more) may be one reason why healthcare was overlooked in 2024. But deal volumes could pick up given the sector’s attractive valuations and if the Trump administration installs a more accommodative Federal Trade Commission, as expected. The demand for M&A is ostensibly there: Large-cap biopharma must fortify their pipelines against more than $250 billion in revenues that face generic competition by the end of the decade.

Investors are also demonstrating increased appetite for innovation in their portfolios. In 2024, biotech stocks climbed an average of 31% following a positive data readout. That compares with only 13% in 2022, when biotech was in the midst of a bear market.5 Thus, that suggests enthusiasm for healthcare could be building.

As such, we are as excited as ever about the prospects for the sector and believe investors who stay focused on intrinsic value and today’s many promising new medical advances, while keeping politics in perspective, could be well placed for potential gains.

1 Bloomberg, from 24 February 1995 to 17 January 2025. Based on forward, 12-month earnings estimates for the S&P 500 Healthcare Sector and the S&P 500 Index.

2 Food and Drug Administration, as of 31 December 2024.

3 Company reports, Janus Henderson Investors. As of 31 December 2024.

4 Lipoprotein(a) and its Significance in Cardiovascular Disease: A Review, July 2022.

5 Evercore, as of 31 December 2024.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.