ISG Insight: Be careful what you wish for

In the Fixed Income Investment Strategy Group (ISG)* meeting debate centred on tighter financial conditions in the economy and how the banking crisis was likely to have exacerbated recession risks. This provoked discussion around regulation, vulnerabilities in high yield and what could shape central bank direction.

2 minute read

Key takeaways:

- Tighter credit conditions were evident on both sides of the Atlantic before troubles erupted in the banking sector – recession remains the most likely outcome.

- The banking crisis is symptomatic of late-cycle flare-ups when market and economic developments become non-linear; this crisis appears contained, however, rather than systemic.

- The trade-off between price stability and financial stability is still weighted towards fighting inflation but yields and spreads can pivot sharply so it is important to stay nimble.

The wake-up call

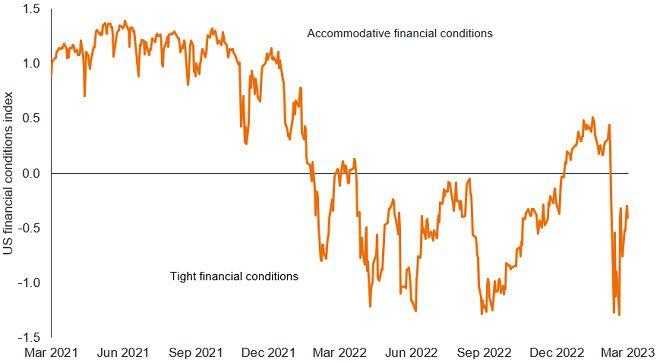

A key requisite for central bank policy success was to tighten financial conditions to slow the economy and thus dampen inflation. The market strength earlier in the year was unhelpful to their cause as higher values for risk assets such as equities and tighter credit spreads were offsetting some of the tightening from higher interest rates. The banking crisis in March was a rude awakening for markets, although in shifting behaviour it may have granted central bankers their wish.

Figure 1: Bank crisis restored tightness to financial conditions

Source: Bloomberg, Bloomberg US Financial Conditions Index, 31 March 2021 to 31 March 2023. The index is a Z-score that indicates the number of standard deviations by which current financial conditions deviate from normal (pre-crisis) levels. It tracks stress in money, bond and equity markets to assess availability and cost of credit.

It was widely expected that central banks would need to break things to restore price stability. Bank collapses in March threw an obstacle into the mix by reigniting concerns around financial stability – the Global Financial Crisis (GFC) casts a long shadow – but what impact might the recent banking stress have on credit and rates?

*The Fixed Income Investment Strategy Group (ISG) brings together investment professionals from across the global fixed income platform and other Janus Henderson teams, providing a forum for debate around the fixed income asset class and key drivers of the market. The ISG Insight seeks to provide a summary of recent debate within the group.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.