As investors, we seek to maintain a thoughtful, practical and open-minded approach when conducting ESG and fundamental company assessments. We are forward-looking, with a willingness to consider how businesses and industries can change. For this reason, we on the European equities team generally disapprove of blunt ESG exclusions. A notable exception to this approach is with tobacco. Our decision to not invest in tobacco is based on two premises: 1) the industry does not provide a net benefit to society 2) nor are their business models fundamentally sustainable, needed, or seemingly able to transition to a sustainable state.

The sector has historically been kind to shareholders. The MSCI World Tobacco index annualised+7.1% since 1999 (when the index was formed) versus a return of +6.2% per annum in the broader MSCI World index. The European market leader British American Tobacco (BAT) has been even better annualising at an even higher rate, +11.5%.1 Shareholders have reaped the reward of a business centred around producing a highly addictive product at a very low cost – a model that, on face value, is the envy of many a boardroom. So, what is changing?

Demand is fizzling out

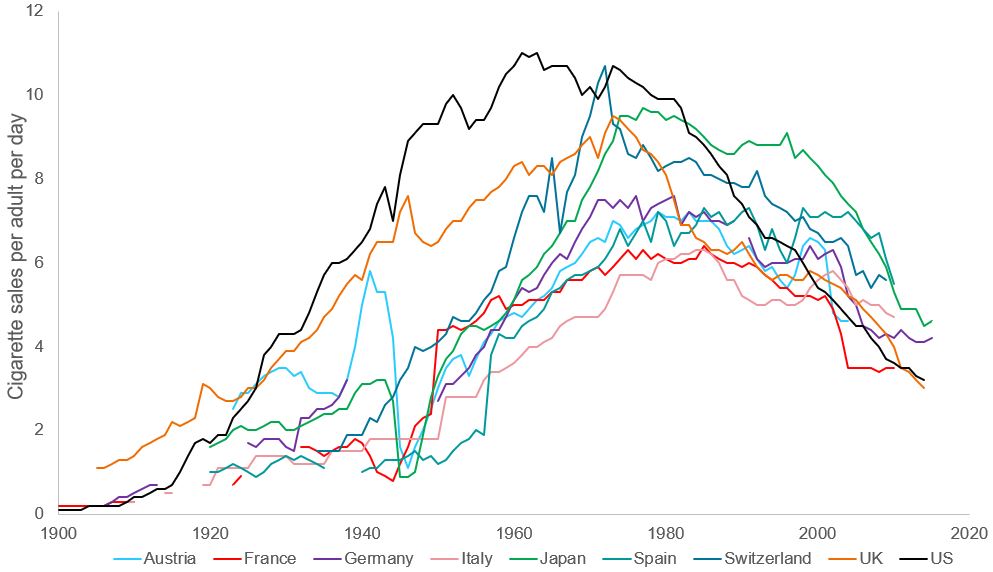

A more health-conscious society (the Instagram generation) and an ever-stricter regulatory regime leads us to question the long-term demand picture. Anti-smoking campaigns, stringent government regulations, higher taxes, the banning of menthol/flavoured tobacco, potential nicotine caps and deterrent product packaging (which is often more gruesome than a Hollywood horror) are growing in prevalence. Some countries have taken things a step further by targeting a smoke-free environment. New Zealand has announced intentions to be smoke-free by 2025 and have taken the bold step of banning the sale of all cigarettes to citizens born after 2008. A few other countries, including those in the EU, are considering similar regulation. While we do not foresee a sudden collapse in cigarette demand, we will likely continue to see the trend of people smoke less, at least in the developed world – exhibit 1.

Unlike some other ‘sinner sectors’, tobacco is neither required nor adds to society. For example, you can argue – and we have – that society cannot simply go cold turkey on oil or hydrocarbons as they have a vital role to play in an orderly transition to net zero. This is not the case for tobacco products which are neither essential goods nor contribute to human health or economic growth/stability. This means that the withdrawal of capital from ESG-minded allocators will also act as a persistent headwind for the sector.

Exhibit 1: Cigarette sales on the decline

Source: International Smoking Statistics, as at 2017. Sales of cigarettes per adult (+15 years old) per day (1875-2015).

Is product diversification the answer?

In an attempt to ease their impact on public health, tobacco companies have sought to introduce ‘reduced risk products’ such as heat-not-burn, vaping and, more recently, the cannabis market. But again, it is unclear to us how these products could bring about less ‘S’ & ‘G’ risk and subsequently more sustainable cash flows. The full health implications for these products will likely take a human lifetime to be sufficiently understood. Public Health England states ‘heated tobacco products are likely to expose users and bystanders to lower levels of particulate matter and harmful and potentially harmful compounds. The extent of the reduction found varies between studies.’

Unintended consequences of these new products have also emerged, such as the prevalence of youth vaping. JUUL, a prominent vaping brand, not only attracted youths with its flavoured tobacco products but also violated regulations by containing nicotine levels multiple times higher than the agreed-upon dose, even surpassing levels delivered by a cigarette. This made its products extremely addictive, especially among young people, many of whom had never smoked a cigarette. Consequently, JUUL was fined $1.2 billion by regulators for exacerbating the vaping problem in the US.2 The US subsequently banned cartridge-based e-cigarettes that contained mint and fruit flavours.

Forty countries are reviewing the US’ recent regulatory action and are considering putting similar bans in place. In a few markets, there were upwards of 16,000 unique tobacco flavours available.3 For us, this is an example of a product that was purported to transform and improve the social impact of the industry but in some areas has achieved the opposite, and with it, further financial risk for the companies involved.

The four largest tobacco companies – Altria, Philip Morris, British American Tobacco, and Imperial Brands – have all established a presence in the cannabis market, with a focus on investing in cannabidiol and biopharmaceutical R&D companies primarily located in the US, Canada and Germany (where cannabis has been legalised). In our view, this does little to lessen the ESG risk for the sector but it will be interesting to see how this nascent market develops.

The environmental implications of the tobacco industry

While the detrimental social consequences of tobacco use are widely acknowledged, the lesser known yet still material environmental impacts of tobacco production and consumption often remain overlooked and warrant greater attention. The sector contributes towards deforestation, chopping down 600 million trees each year, and is particularly water-intensive, with each cigarette consuming 3.7 litres of water throughout its lifecycle (mainly due to the crop).4,5 This considerable water usage is particularly concerning given the escalating worries about water scarcity in a warming world.

As the industry shifts from combustible products to Next Generation Products (NGPs) such as vapes and e-cigarettes, substantial waste is generated due to the use of plastics and batteries in these devices. For instance, the battery in one company’s vape is comparable in size to that of an iPhone 13 Pro Max. The disposal of this waste presents significant environmental challenges and has emerged as a gap in industry reporting as there is limited information available regarding recycling programmes. However, governments are increasingly pressuring tobacco companies to assume greater responsibility for waste management.

Unlike other high ESG risk areas such as oil, steel and cement – society can undoubtedly function with an immediate ‘cancelling’ of cigarettes, in our view. And as a result, the regulatory pressure will remain a constant. The industry’s efforts to transition to next-generation products and cannabis have introduced further complications. Some value-minded investors may argue that the tobacco sector is already priced for decline and that the cash generation is attractive. There is merit to this argument, but for our clients we can find many other areas of the market with more clearly sustainable cash flows whilst also contributing positively to society and the environment.

1 Bloomberg, from 31 December 1998 to 31 March 2023, in USD terms.

2 Reuters, ‘Juul agrees to pay $1.2 bln in youth-vaping settlement – Bloomberg News’, 9 December 2022

3 Reuters, ‘Young lured to tobacco addiction via e-cigarettes – WHO’, 27 July 2021

4 World Health Organisation, ‘WHO raises alarm on tobacco industry environmental impact’, 31 May 2022

5 World Health Organisation Q&A, ‘World No Tobacco Day 2022’, 31 March 2022

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Environmental, Social and Governance (ESG) or sustainable investing considers factors beyond traditional financial analysis. This may limit available investments and cause performance and exposures to differ from, and potentially be more concentrated in certain areas than, the broader market.

MSCI World Index℠ reflects the equity market performance of global developed markets.

Net zero carbon: a commitment to reduce GHG emissions to as close to zero as is possible, with any remaining emissions re-absorbed from the atmosphere, by oceans and forests.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- The Fund follows a value investment style that creates a bias towards certain types of companies. This may result in the Fund significantly underperforming or outperforming the wider market.