Yield on the table: Why multisector may make sense in 2025

In his 2025 investment outlook, Portfolio Manager John Lloyd shares his views on the attractiveness of a multi-sector approach to fixed income investing.

6 minute read

Key takeaways:

- The prevailing tailwinds of the strong U.S. economy and the Federal Reserve’s (Fed) rate-cutting cycle are likely to drive fixed income returns in the year ahead.

- The multi-sector category is offering attractive yields in the mid-to-high single digits, and we believe a multi-sector approach may offer better access to the wide array of opportunities available in fixed income markets.

- Moreover, we believe allocating to sectors that are trading at cheaper relative valuations – such as loans over high yield, or collateralized loan obligations and asset-backed securities over corporates – will be key in 2025.

Looking toward 2025, we believe investors should seek to take advantage of two prevailing tailwinds driving fixed income returns: The strong U.S. economy and the Federal Reserve (Fed) having initiated its rate-cutting cycle.

In our view, investors may better capitalize on these tailwinds through a multi-sector approach – versus investing in money markets or static benchmark indexes – for the following three reasons:

1. Multi-sector portfolios may offer exposure to a wider selection of fixed income sectors.

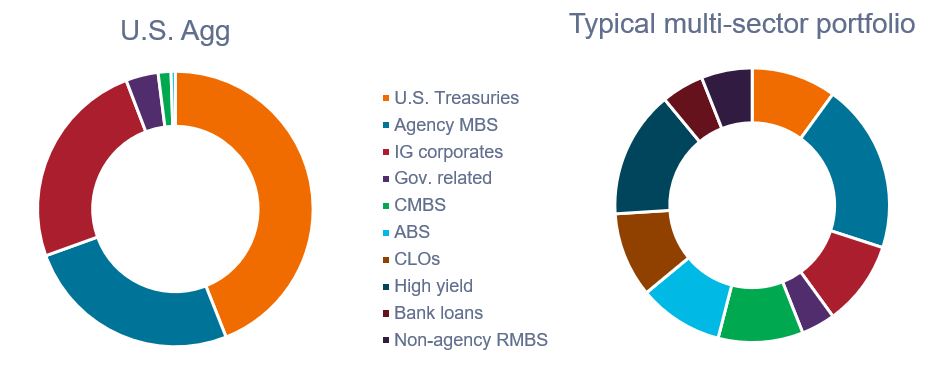

As shown in Exhibit 1, the Bloomberg U.S. Aggregate Bond Index (U.S. Agg) is overwhelmingly weighted in U.S. Treasuries, agency mortgage-backed securities (MBS), and investment-grade (IG) corporates. In contrast, typical multi-sector portfolios may provide exposure to a broad array of fixed income sectors, offering better diversification of risk exposures, borrowers, and sources of yield.

Most importantly, a multi-sector approach might seek to capitalize on attractive opportunities that typically cannot be accessed through benchmark indexes. These include collateralized loan obligations (CLOs), which has been the best-performing fixed income sector behind high-yield corporates over the past 10 years.

Exhibit 1: Sector weightings: U.S. Agg vs. a typical multi-sector portfolio

Multi-sector portfolios may provide better access to an array of fixed income opportunities.

Source: Bloomberg, Janus Henderson Investors, as of 31 October 2024.

2. Multi-sector funds may provide a better mix of interest-rate and credit-spread risk

U.S. Treasuries and agency MBS make up around 70% of the U.S. Agg. Both Treasuries and MBS are backed by the U.S. government, offer no credit spread return, and tend to be longer-duration assets. Therefore, as shown in Exhibit 2, U.S. Agg-like portfolios are highly exposed to interest-rate risk, while offering little exposure to credit-spread risk.

Managers of multi-sector portfolios may aim to strike a balance between interest-rate and credit-spread risk, resulting in a portfolio’s yield source being less one-dimensional. This balance may also help to improve risk-adjusted returns, as rates and spreads have historically been negatively correlated when inflation is below 3%. (Negative correlation can reduce overall volatility, as a rise in rates may be somewhat counterbalanced by a narrowing of credit spreads, and vice versa.)

Exhibit 2: Risk factor decomposition (Sep 2019 – Sep 2024)

Multi-sector portfolios may offer a more balanced mix of risk factors.

Source: Bloomberg, Janus Henderson Investors, as of 31 October 2024.

3. Multi-sector funds have historically generated better long-term returns

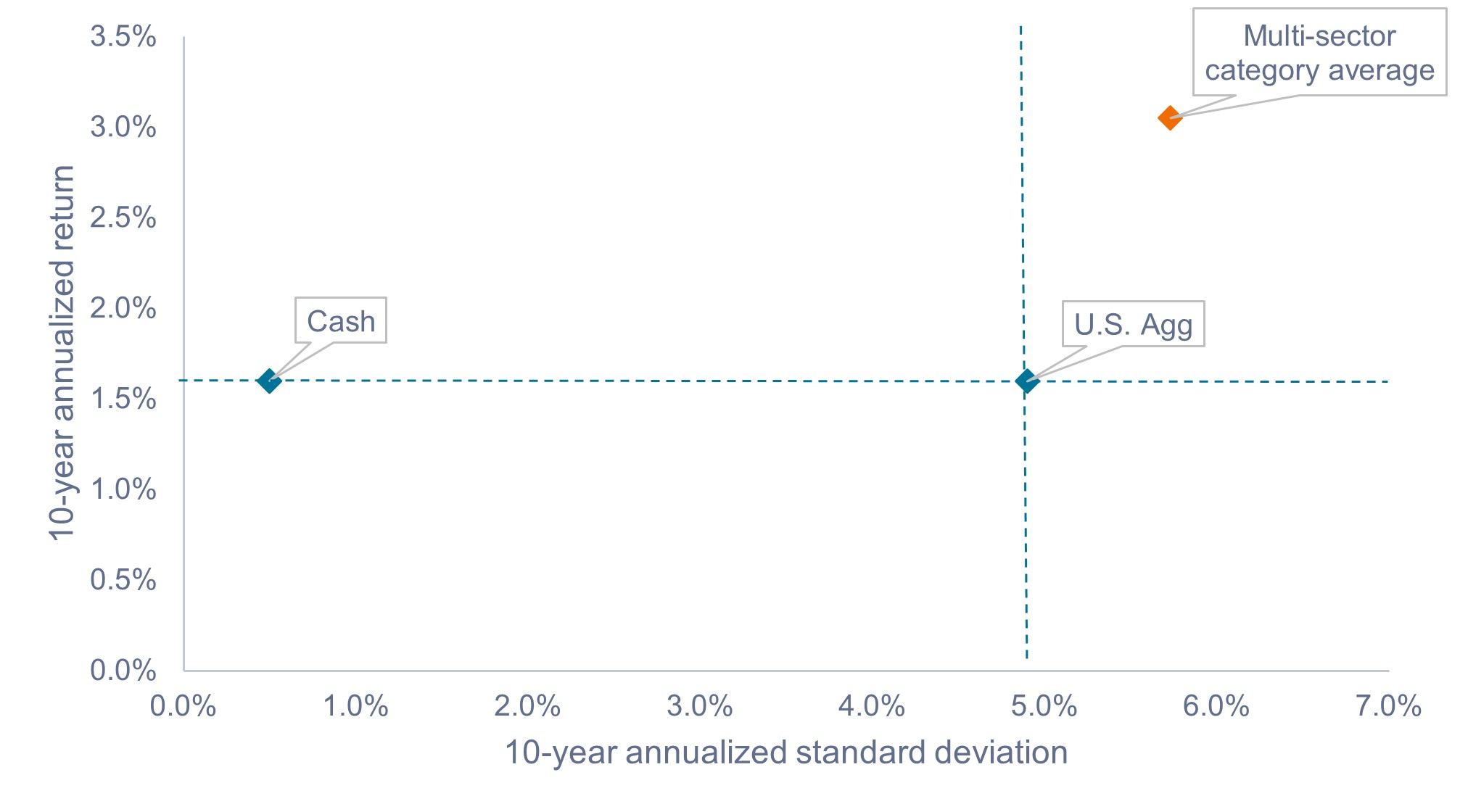

As shown in Exhibit 3, over the past 10 years, the multi-sector category has provided nearly double the return of the U.S. Agg and of cash on an annualized basis, with only marginally higher volatility than the U.S. Agg. In our view, the outperformance speaks to the benefit of having diversified income streams and a better balance of credit-spread and interest-rate risk.

Importantly, Exhibit 3 plots the risk and return for the entire multi-sector category. Because many of the funds in the category are actively managed, there is a high level of dispersion among the peer group. While some managers have lagged the average, others have consistently outperformed. We believe it is vital for investors to perform adequate due diligence when hiring a manager in the multi-sector space, as outcomes can be greatly influenced by manager selection.

Exhibit 3: Historical returns and volatility (2014 – 2024)

Source: Bloomberg, Morningstar, Janus Henderson Investors, as of 31 October 2024. Past performance does not predict future results.

In summary

In our view, it is vital for investors to maximize income per unit of risk in the current tight-spread environment. The multi-sector category is offering attractive yields in the mid-to-high single digits – a healthy premium over the roughly 4.5% available in either cash or the U.S. Agg.

Moreover, we believe allocating to sectors that are trading at cheaper relative valuations – such as loans over high yield, or CLOs and asset-backed securities over corporates – will be key in 2025. A multi-sector approach may help investors to gain better access to the wide array of opportunities available in fixed income markets so as not to leave yield on the table.

Bloomberg U.S. Aggregate Bond Index is a broad-based measure of the investment grade, US dollar-denominated, fixed-rate taxable bond market.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Investment-grade bond: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments, reflected in the higher rating given to them by credit ratings agencies.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Standard Deviation measures historical volatility. Higher standard deviation implies greater volatility.

U.S. Treasury securities are direct debt obligations issued by the U.S. Government. With government bonds, the investor is a creditor of the government. Treasury Bills and U.S. Government Bonds are guaranteed by the full faith and credit of the United States government, are generally considered to be free of credit risk and typically carry lower yields than other securities.

Volatility measures risk using the dispersion of returns for a given investment.

IMPORTANT INFORMATION

Actively managed investment portfolios are subject to the risk that the investment strategies and research process employed may fail to produce the intended results. Accordingly, a portfolio may underperform its benchmark index or other investment products with similar investment objectives.

Collateralized Loan Obligations (CLOs) are debt securities issued in different tranches, with varying degrees of risk, and backed by an underlying portfolio consisting primarily of below investment grade corporate loans. The return of principal is not guaranteed, and prices may decline if payments are not made timely or credit strength weakens. CLOs are subject to liquidity risk, interest rate risk, credit risk, call risk and the risk of default of the underlying assets.

Derivatives can be more volatile and sensitive to economic or market changes than other investments, which could result in losses exceeding the original investment and magnified by leverage.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Mortgage-backed security (MBS): A security which is secured (or ‘backed’) by a collection of mortgages. Investors receive periodic payments derived from the underlying mortgages, similar to the coupon on bonds. Mortgage-backed securities may be more sensitive to interest rate changes. They are subject to ‘extension risk’, where borrowers extend the duration of their mortgages as interest rates rise, and ‘prepayment risk’, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.

Risk assets: Financial securities that may be subject to significant price movements (ie. carrying a greater degree of risk). Examples include equities, commodities, property lower-quality bonds or some currencies.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.