It may have taken decades, but this year Japanese equity indices came the closest they ever have to surpassing the record highs of 1989 – the same year the Berlin Wall fell and George Bush (senior) took the oath as U.S. president. After all this time, investors may naturally wonder, what has changed? And importantly, will it last?

A few catalysts can help explain the recent rally. One came in late January, when the Tokyo Stock Exchange (TSE) finalized a market restructuring plan to address the roughly 50% of listed companies with a price-to-book ratio of less than one.1 According to the TSE, these businesses must focus on enhancing corporate value and profitability or risk being delisted as soon as 2026. (Many of the firms have traded below book value for years, a sign that investors do not expect future earnings growth.)

Economic factors have also helped. This year, global pricing pressures pushed inflation to multidecade highs in Japan. In turn, major corporations agreed to big wage hikes – the largest of their kind in 30 years – raising hopes of a boost in consumer spending.

Meanwhile, the Bank of Japan has kept the country’s benchmark rate near all-time lows even as other central banks hiked rates. This policy divergence has caused the yen to weaken as investors seek higher yields outside the country, making Japanese exports more attractive.

Finally, in June, famed value investor Warren Buffett increased Berkshire Hathaway’s stake in five Japanese trading firms from an average of 7.4% to 8.5% – viewed as a vote of confidence for the market as a whole. As such, year to date, the Nikkei 225 Index, a benchmark of large top-rated Japanese firms, has climbed 25.6% in local currency terms, versus 18.4% (USD) for the S&P 500® Index.2

Market reforms reach a tipping point

Skeptics might argue they’ve heard this story before. A decade ago, Prime Minister Shinzo Abe rolled out a series of reforms to revive Japan’s moribund economy. These included policies meant to disentangle the large network of mutual shareholdings that exists among Japanese corporations, which effectively helps shield businesses from the repercussions of poor investment decisions or shareholder demands. However, details about how to execute the reforms were vague, and high-profile scandals – such as claims of inflated profits and retribution against whistleblowers – continued.

Still, progress occurred, and today the fruits may finally be coming to bear. For one, the cross-holding system is beginning to break down as more outside investors gain a foothold. Shareholder proposals, in turn, are getting traction and corporate governance is improving. Although more needs to be done (for example, women make up only 7.5% of directors at Japanese firms3), mandates such as that introduced by the TSE could mean change is accelerating. (Case in point: Since the TSE announcement, the number of companies committing to share buybacks and dividend payouts this year has multiplied.)

Investors may need to refresh the playbook

For investors, we think there’s significant opportunity to be had given Japanese equity valuations. The key, in our view, is to recognize that, regardless of what recent index performance might suggest, change will likely be uneven. For example, on a recent trip to Japan, we met with one entrepreneurial tech firm that was wasting no time taking advantage of new tax breaks to spin out an ancillary (and non-accretive) business. In contrast, another firm appeared to be soft-pedaling share repurchases despite having a sizable cash balance and resented the attention of activist investors.

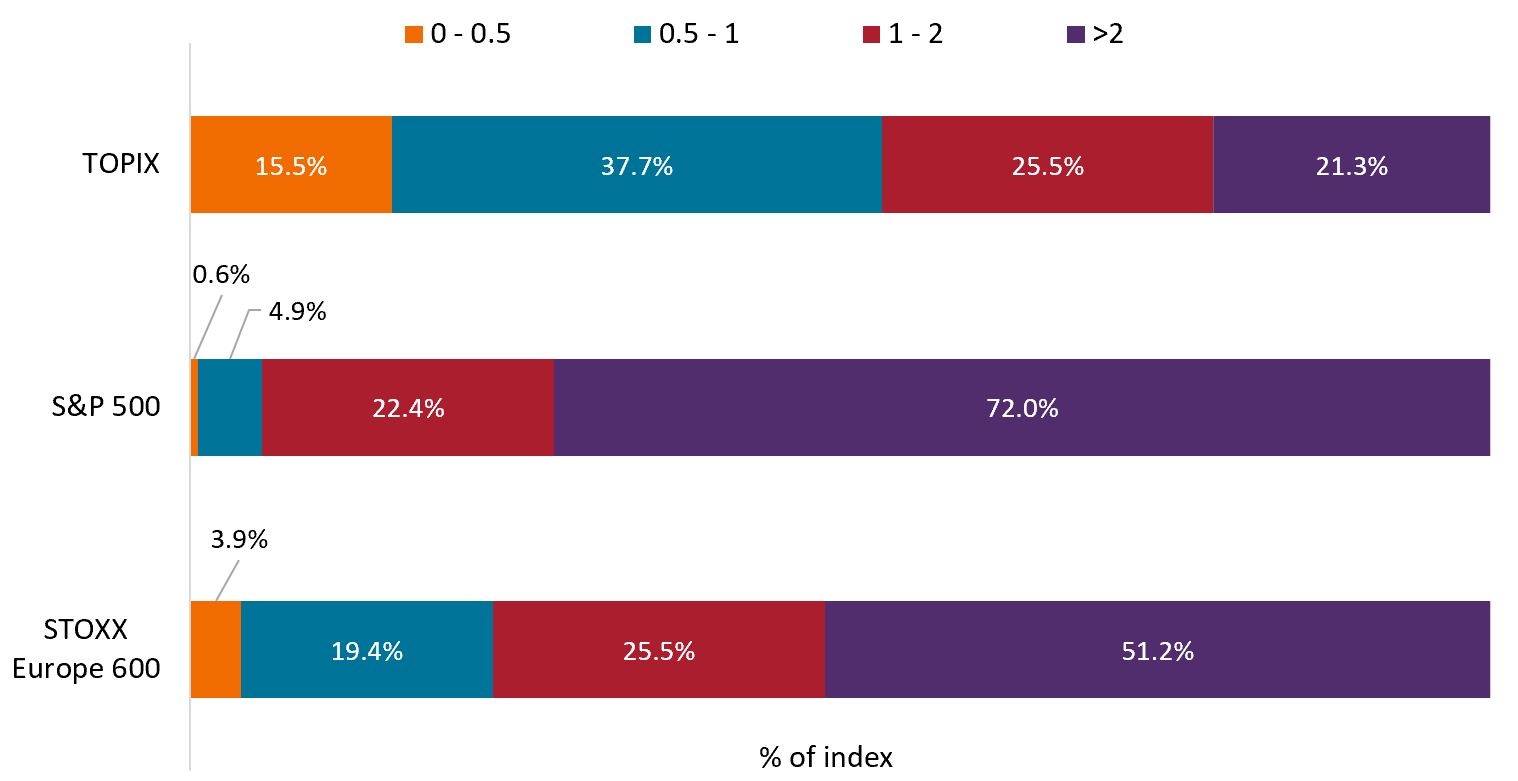

Price-to-book ratio comparison

Source: Bloomberg, as of 31 March 2023. The TOPIX, also known as the Tokyo Stock Price Index, is a capitalization-weighted index of all companies listed on the First Section of the Tokyo Stock Exchange. The STOXX Europe 600 Index consists of a fixed number of 600 components representing large-, mid-, and small-capitalization companies across 17 countries of the European region.

Also, given the weakness of the yen, we would encourage non-Japanese investors to consider the impact of the exchange rate on returns. While in local currency terms the Nikkei 225 was up nearly 26% for the year through mid-July, in USD, the return was closer to 18%.

There may be technical factors to consider as well. The Topix, a broader, market capitalization-weighted index in Japan, has underperformed the Nikkei 225 this year, returning 13% in USD through mid-July.4 In our view, the gap could signal a surge of futures-buying in the price-weighted Nikkei as investors seek quick (and potentially fleeting) exposure to the region. In addition, with most Japanese companies having completed annual general meetings in June, the news flow around shareholder proposals could slow in the coming months, perhaps taking some wind out of the Japanese market’s sails.

All of which is to say, we could see some profit-taking in Japan later this year. Should that happen, we wouldn’t get discouraged. Japan’s market transformation is likely to ebb and flow, but we think the evidence suggests the long-term trajectory is decidedly toward change – to the potential benefit of discerning long-term investors.

Footnotes

1 Book value is the net of a company’s assets minus liabilities. A price-to-book ratio below one indicates a firm is valued at less than the sum of its assets, suggesting doubt about future profitability.

2 Bloomberg, data from 31 December 2022 to 14 July 2023.

3 Financial Services Agency, as of 31 July 2022. Data based on all listed companies in Japan and reflects board members, auditors, representative executive offices, and executive officers.

4 Bloomberg, from 31 December 2022 to 14 July 2023.

Price-to-Book (P/B) Ratio measures share price compared to book value per share for a stock or stocks in a portfolio.

Nikkei 225 Index is a measure of Japanese economic and equity market performance. The Index includes 225 of the largest companies listed on the Tokyo Stock Exchange.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

Concentrated investments in a single sector, industry or region will be more susceptible to factors affecting that group and may be more volatile than less concentrated investments or the market as a whole.