The victory of Donald Trump in the US presidential election, coupled with a lacklustre COP29 climate conference in Baku, has prompted concerns about the state of the energy transition, with some fearing progress may slow or even reverse. Such concerns are underscored by the 2024 average global temperature reaching 1.8°C above pre-industrial levels in 2024 – marking it as the first year to surpass the 1.5°C target limit.

Despite rising global temperatures and the Trump administration withdrawing the US from the Paris Agreement for the second time, we still see opportunity for investors to profit from the prevailing trends underlying the energy transition.

Rising corporate commitment to net zero

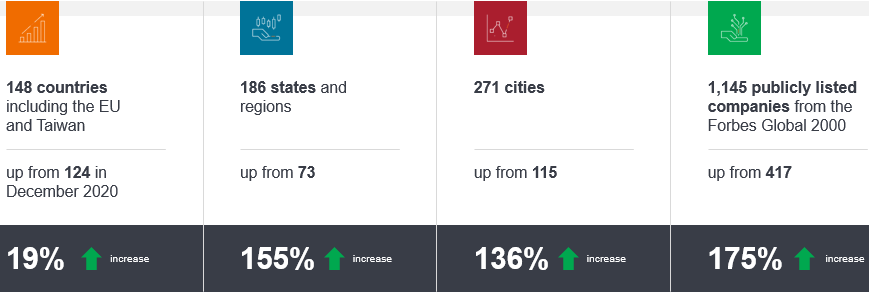

Exhibit 1 offers a snapshot of how net zero commitments have grown over the past five years. What stands out is the notable surge in Forbes Global 2000 corporations committing to net zero over the past few years. This is significant, since these 2000 companies are responsible for approximately 20% of global embodied emissions, considering both their operations (scope 1 and 2) and supply chains (scope 3) emissions.

Exhibit 1: Commitments to net zero have grown since 2020

Source: Net Zero Tracker, as at September 2024.

While the nature of these companies’ net zero commitments varies widely, with some aiming for carbon neutrality, some for zero emissions, and others focusing on Scope 1 (direct) and 2 (indirect) emissions but not Scope 3 (value chain), the overall trend is one of growth, both in the number of commitments and the entities making them. Further, there has been a significant rise in targets enshrined in national policy in the past few years, with 88% of global emissions, 89% of the global population and 90% of global GDP covered by some form of national commitment or net zero target.

The ‘glass half full’ perspective is a significantly higher level of ambition, but with the average global temperature in 2024 already 1.8°C above pre-industrial levels, the need for countries to address greenhouse gas (GHG) emissions faster and deeper is mounting. As it stands the race against time to net zero is arguably being lost if we want to keep below 2°C, and many entities still lack emissions reduction targets.

The triple challenge

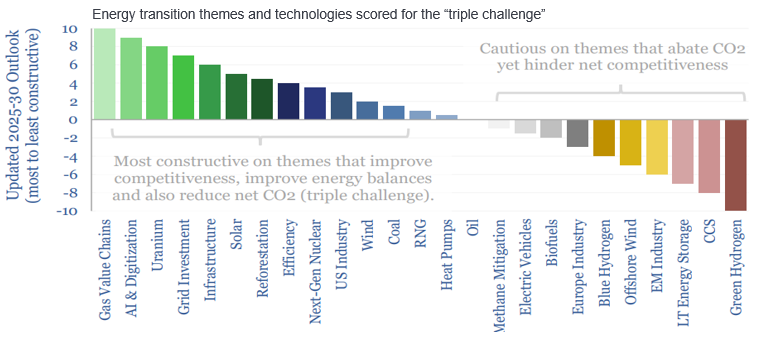

When we examine the state of the energy transition from both a pragmatic and investment perspective, the three axes of the ‘triple challenge’ need to be considered. This encompasses the challenge of enhancing competitiveness by providing cheap energy, improving the energy balance by providing more energy, and simultaneously addressing the GHG emissions present in our atmosphere. A useful analysis from Thunder Said Energy (Exhibit 2) of various energy technologies and themes within the context of decarbonisation, ranks them by how much they address the triple challenge, with those on the left side improving competitiveness and those on the right side reducing competitiveness based on current economics.

Exhibit 2: Triple challenge framework

Source: Thunder Said Energy.

The public statements from the Trump administration regarding renewable energy in our eyes seem less about being against decarbonisation per se and more about being pro-competitiveness. In this context, competitiveness equates to affordable energy, whereas anti-competitiveness is synonymous with expensive energy. Therefore, our investment focus favours companies that offer inexpensive energy solutions and contribute to lowering carbon emissions, such as the value chain of gas, including LNG, gas storage, and transport, along with AI, digitisation, and nuclear energy. Nuclear energy, in particular, is seen as a significant advantage for those seeking base load power with a minimal carbon footprint and self-sufficiency, especially considering that the US and Canada have abundant uranium resources or the potential for it, thus reducing dependence on potentially unfriendly suppliers such as Russia.

Our investments are also directed towards grid investment, solar, energy efficiency, reforestation and other areas where we see strong returns and growth prospects that address the challenges of the energy transition. Conversely, we are currently avoiding sectors that, while potentially reducing carbon emissions, could impede competitiveness. These include green hydrogen, carbon capture storage, offshore wind, and blue hydrogen. These areas represent the more costly segments of the energy market, which we are deliberately choosing not to focus on, pivoting instead towards investments that align with improving competitiveness whilst also delivering more sustainable energy solutions.

The economic case for solar energy

We were surprised to discover that during the first Trump presidency, the US experienced its fastest pace of solar installation, with Texas, an oil and gas stronghold, surpassing California in solar installations. This surge is attributed to the declining costs of solar photovoltaic (PV) systems with storage, making solar energy increasingly competitive against natural gas in the US, and even cheaper than coal-fired power in India and China on a levelised cost of energy (LCOE) basis. The reason for this cost reduction is twofold: the virtually inexhaustible nature of solar energy and the semiconductor technology it employs, which has historically seen efficiency gains and cost reductions over time.

Currently, solar panels have achieved 25% efficiency in converting sunlight to electricity, a significant improvement from 5% two decades ago, with the potential to reach 50% efficiency. This improvement, alongside increased production volume, has driven down costs to approximately four to five cents per kilowatt-hour, with projections suggesting a future decrease to between one and two cents. As a result, solar energy has become the lowest-cost form of generating electrons globally. In Europe, solar production capacity is expected to triple between 2020 and 2024, outpacing both onshore and offshore wind, due to superior economics. Similarly, cost reductions are observed globally, driven by technological advancements and increased efficiency, not solely by low-cost Chinese production.

The imposition of tariffs on imported solar panels could significantly benefit US solar companies that produce panels domestically by increasing their profitability due to higher margins. We anticipate further production expansion in the US as a result of these tariffs and view any additional tariffs as a highly positive development for domestic solar panel producers. Similarly domestic producers of key materials such as steel stand to benefit in a world of higher tariffs.

Energy storage costs continue to fall

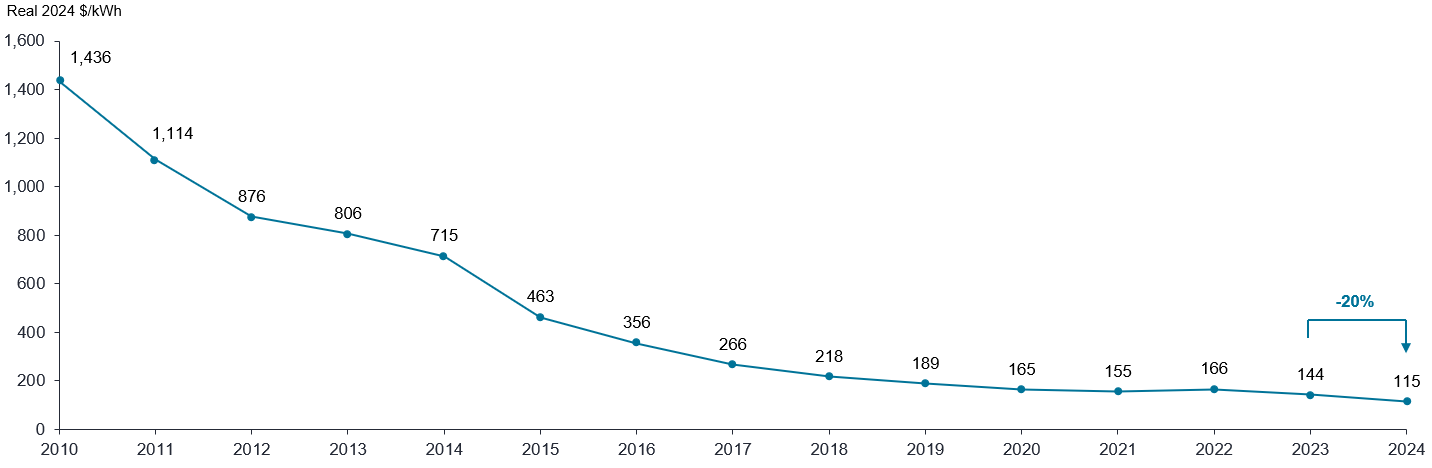

As utility scale solar installations increase the intermittent nature of the electricity causes power price volatility which necessitates effective energy storage solutions. The economic case for energy storage which enables energy price arbitrage becomes increasingly compelling as price volatility rises, while the costs associated with developing and deploying these technologies have significantly declined. For instance, the price of lithium-ion battery packs has plummeted from US$1,436 per kWh in 2010 to US$144 in 2023, marking a 90% decrease over approximately 13 years (Exhibit 3).

Exhibit 3: Lithium-ion battery pack prices

Source: Bloomberg New Energy Finance (BNEF), as at 10 December 2024. Past performance does not predict future returns.

Note: Historical figures have been adjusted to real 2024 dollars. Values are averages across passenger EVs, commercial vehicles, buses, two- and three-wheelers and stationary storage. Includes cell and pack.

Despite a seeming plateau in battery prices on the chart, prices continued to fall by 20% last year, with expectations for ongoing reductions. This cost reduction has catalysed a surge in battery storage installations. In 2023 alone, 60 gigawatts of energy storage were installed, enough to power 60 million homes representing a 120% increase year-on-year. Projections for 2024 estimate over 100 gigawatts of installations, with future expectations reaching up to 1 terawatt annually by 2030 and three terawatt-hours annually by 2050. By then, solar power with associated storage could contribute 43,000 terawatt-hours to the grid, driven primarily by economic feasibility rather than regulatory enforcement. Notably, in 2023, China led the world in energy storage installations, accounting for almost 50% of global capacity, with the US and the rest of the world trailing significantly. This highlights China’s leadership in energy storage and underscores the need for other countries to accelerate their efforts in this domain.

However, even this fast pace of energy storage deployment is arguably insufficient. To maintain alignment with the 1.5°C target, approximately 1,300 gigawatts of battery storage will be needed by 2030 according to the IEA, a goal that current estimates suggest we are unlikely to meet. Present trajectories indicate a potential global temperature increase of 2-3°C.

Trump does not necessarily put a spanner in the works

We believe that it is highly unlikely that businesses will abandon their decarbonisation efforts, as these initiatives extend beyond any single presidential term. The trend of directly sourcing clean energy is established and enduring, propelled by the economic benefits of large-scale wind and solar projects and the rising costs of grid-supplied electricity, with an added push from investments into Artificial Intelligence.

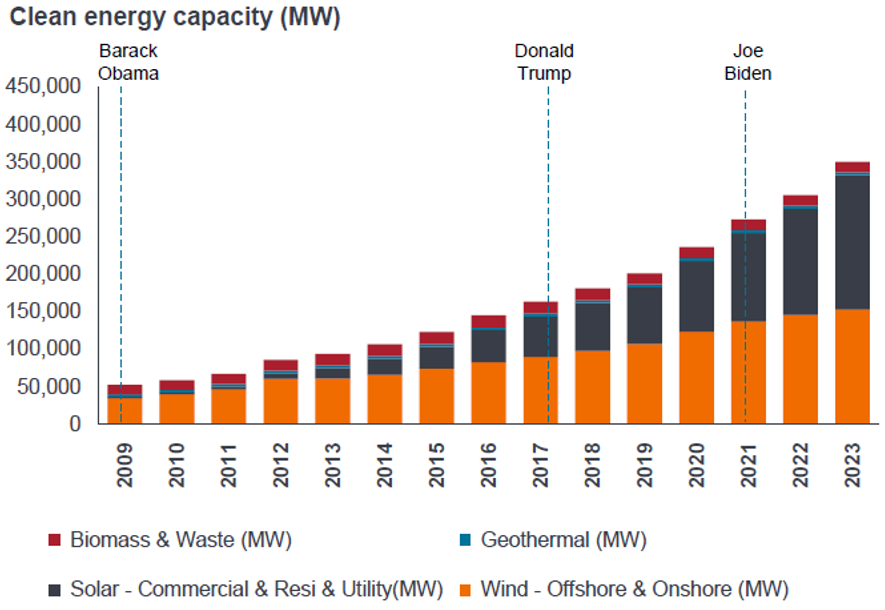

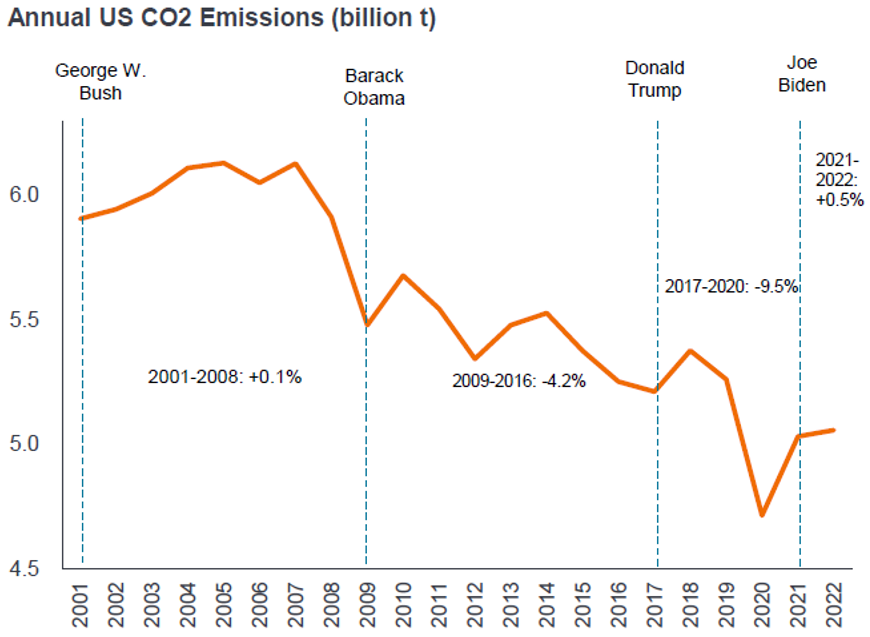

Despite news of the US once again exiting the Paris Agreement and reducing subsidies, the momentum towards electrification, digitalisation, and decarbonisation is likely to continue in areas that support growth and competitiveness. As Exhibit 4 shows, clean energy capacity has grown and annual carbon emissions have fallen under both Democrat and Republican administrations in the US.

Exhibit 4: US clean energy capacity vs. annual CO2 emissions

Source: ARNnet; IEA; World Economic Forum; Dean H. Barrett and Aderemi Haruna, Molecular Sciences Institute, School of Chemistry, University of the Witwatersrand; US Department of Energy; Jefferies Research, as at 30 November 2024.

An increasing role for nuclear power

We firmly believe in nuclear energy as a technology capable of providing low carbon base load power. Our current exposure to nuclear energy via uranium producers exceeds that of solar, although we plan to increase our investments in solar. However, timing is crucial, especially considering the potential negative headlines associated with solar under certain political climates.

Interestingly, major corporations like Microsoft have engaged in substantial agreements with nuclear energy providers, such as the deal with Constellation Energy to restart Three Mile Island, at prices significantly higher than those of solar energy. This indicates a willingness among the world’s wealthiest corporations to invest in reliable low carbon energy sources.

Bottlenecks for growth

From an investment perspective, we focus on identifying bottlenecks in energy supply chains, as these areas tend to offer excess economic returns, leading to high returns on investment and positive share price performance. One such bottleneck is the increased demand for critical metals required by nuclear and solar technologies, as well as electric vehicles, compared to traditional energy sources like coal and natural gas. This demand encompasses a variety of metals essential for the transition to green energy, including rare earth metals, zinc, graphite, nickel, lithium, and copper (Exhibit 5).

Exhibit 5: Critical Minerals used in selected clean energy technologies

Source: IEA Critical Miners Report, as at December 2023. The Role of Critical Minerals in Clean Energy Transitions, IEA, Paris https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions, License: CC BY 4.0

Further, several factors contribute to the rising demand for these metals, including the shift towards de-globalisation (onshoring) and localisation of supply chains, changes in consumer behavior, increased military spending, and the expansion of data center capacity, which alone requires significant amounts of copper. However, the mining industry is likely to face challenges in meeting this demand, unless real investment increases significantly. This suggests a need for higher commodity prices to incentivise increased production. Historical data on commodity price cycles indicate potential for significant growth in the coming decades, offering an attractive investment opportunity in the resources sector. This sector not only provides diversification and inflation protection but also trades at a valuation below the historic average compared to the broader market.

Navigating the complexities of the energy transition

Our responsible resources strategy focuses on the critical enablers of the energy transition, but we also have a climate transition strategy that takes a diversified approach to capitalising on these growth dynamics, focusing on green solutions, enablers of these solutions, and improvers who apply these solutions to enhance their operations. By investing in this manner, we aim to generate returns for our investors alongside a positive impact for the planet.

The journey toward net zero presents a dynamic and evolving landscape filled with opportunities for investors to contribute to a sustainable future while seeking profitable returns. By understanding the complexities of the energy transition and strategically navigating its risks and opportunities, we believe that investors can position themselves to benefit from the shift toward a cleaner, more sustainable global economy and generate good returns.

Diversification: A way of spreading risk by mixing different types of assets/asset classes in a portfolio, on the assumption that these assets will behave differently in any given scenario. Assets with low correlation should provide the most diversification.

Inflation: The rate at which the prices of goods and services are rising in an economy. The Consumer Price Index (CPI) and Retail Price Index (RPI) are two common measures. The opposite of deflation.

Net zero: A state in which greenhouse gases, such as Carbon Dioxide (C02) that contribute to global warming, going into the atmosphere are balanced by their removal out of the atmosphere.

Scope 1 carbon emissions: Direct Green House Gas (GHG) emissions from owned or controlled sources.

Scope 2 carbon emissions: Indirect Green House Gas (GHG) emissions, such as that created through the generation of purchased energy (eg. electricity).

Scope 3 carbon emissions: Associated Green House Gas (GHG) emissions related to the entire value chain of a business that it is indirectly responsible for, from products purchased from suppliers to its own products when consumers use them.

Share price: The price to purchase (or sell) one share in a company, not including fees or taxes. For investment trusts: The closing mid-market share price at month end.