Research in Focus: Trump sets clear tone on energy policy

Research Analyst Noah Barrett, from the Global Research Team, considers the implications of the new administration’s policies on the energy sector.

4 minute read

Key takeaways:

- President Trump’s first-day executive orders on energy policy halt U.S. offshore wind development and expedite natural gas exports and federal land approvals. He has also raised the possibility of tariffs, sanctions, and refilling the strategic petroleum reserve (SPR).

- While Trump’s energy policies mark a clear shift toward fossil fuel support and deregulation, oil and gas companies aren’t in a rush to drill as economics are expected to continue driving growth in production. Smaller operators and natural gas companies stand to benefit most from regulatory relief, while offshore wind and electric vehicle (EV) subsidies face the biggest risks.

- We are expecting to see market volatility, not only from oil and gas supply and demand dynamics but also due to competing policy impacts. A key uncertainty remains how the administration will reconcile potentially inflationary policies with the goal of lower consumer prices.

President Trump’s first-day executive orders on energy policy mark a clear shift toward deregulation and fossil fuel support, but their impact on prices and production remains uncertain.

Key actions include lifting the pause on liquefied natural gas (LNG) export permits, expediting energy project approvals on federal lands, and temporarily halting offshore wind development. The administration also raised the possibility of tightening sanctions on Iran and Venezuela, implementing tariffs on Canadian and Mexican oil imports, and refilling the SPR.

Investor Takeaways

Production incentives

While these moves create a more favorable environment for oil and gas producers, it is unlikely that we will see a significant increase in U.S. production in the short term. Energy companies have signaled they won’t allocate additional capital just because of a friendlier regulatory environment, which means economics will still drive investment decisions. The U.S. onshore production sector has reached an efficient steady state, and companies appear reluctant to disrupt this balance with aggressive growth plans.

That said, the natural gas sector could see benefits from deregulation through increased export permits and pipeline development. For example, companies operating in constrained basins, like Appalachian gas producers, may find new opportunities for market expansion.

Price pressures

Multiple policies could contribute to inflationary pressures in the oil market. Plans to refill the SPR would increase demand for crude, potentially pushing prices higher. Additionally, the possibility of tightening sanctions on Iran and Venezuela, along with proposed tariffs on imported Canadian and Mexican oil, could constrain supply, further driving up costs.

In particular, proposed tariffs on Canadian oil imports could significantly affect Midwest consumers because refineries in that region are optimized for Canadian heavy crude. The tariffs would force either Canadian producers to accept lower prices or U.S. refiners to pay more for Canadian oil. Consumers would ultimately bear these higher costs through increased prices for refined products, conflicting with the administration’s goal of lowering gasoline prices.

Clean energy outlook

The administration’s pause on Inflation Reduction Act (IRA) and infrastructure law funding introduces uncertainty for clean energy investments. However, this move doesn’t signal a complete policy reversal. Many renewable projects are concentrated in Republican-led states, providing some political protection against a full repeal. Additionally, the IRA supports domestic manufacturing and the concept of domestic energy independence.

Looking ahead, EV subsidies face the greatest risk, while onshore solar and broader infrastructure development may remain relatively insulated. Utilities continue to view renewables as an important part of the future power mix, alongside natural gas and potentially nuclear, to meet growing electricity demand from data centers servicing artificial intelligence customers.

Offshore wind developers face clear U.S. headwinds, but opportunities remain in international markets. The executive order temporarily halting offshore wind developments was largely expected, but this move formalizes the administration’s stance. That said, its impact may be limited because many projects were already facing economic headwinds.

Regulatory relief

The order to expedite federal land approvals could streamline traditionally slow processes, particularly benefiting operations in the Gulf of Mexico, Alaska, and New Mexico’s Permian Basin. However, companies may direct cost savings toward debt reduction or shareholder returns rather than increased drilling.

Smaller operators stand to gain more from deregulation than larger corporations that have the resources to manage complex regulations. Meanwhile, the rollback of vehicle emission standards could support sustained gasoline demand, benefiting refiners and traditional automakers by slowing the transition to alternative fuels.

Key uncertainties remain

For energy investors, these policies suggest a potentially favorable environment for traditional oil and gas companies, particularly those operating on federal lands, where regulatory costs are declining. However, the ultimate impact on profitability will depend heavily on oil prices, which face competing pressures from various Trump policies.

The key unknown remains how the administration will reconcile potentially inflationary policies with the goal of lower consumer prices. This tension, along with uncertainty about tariff implementation, could drive market volatility in the coming months.

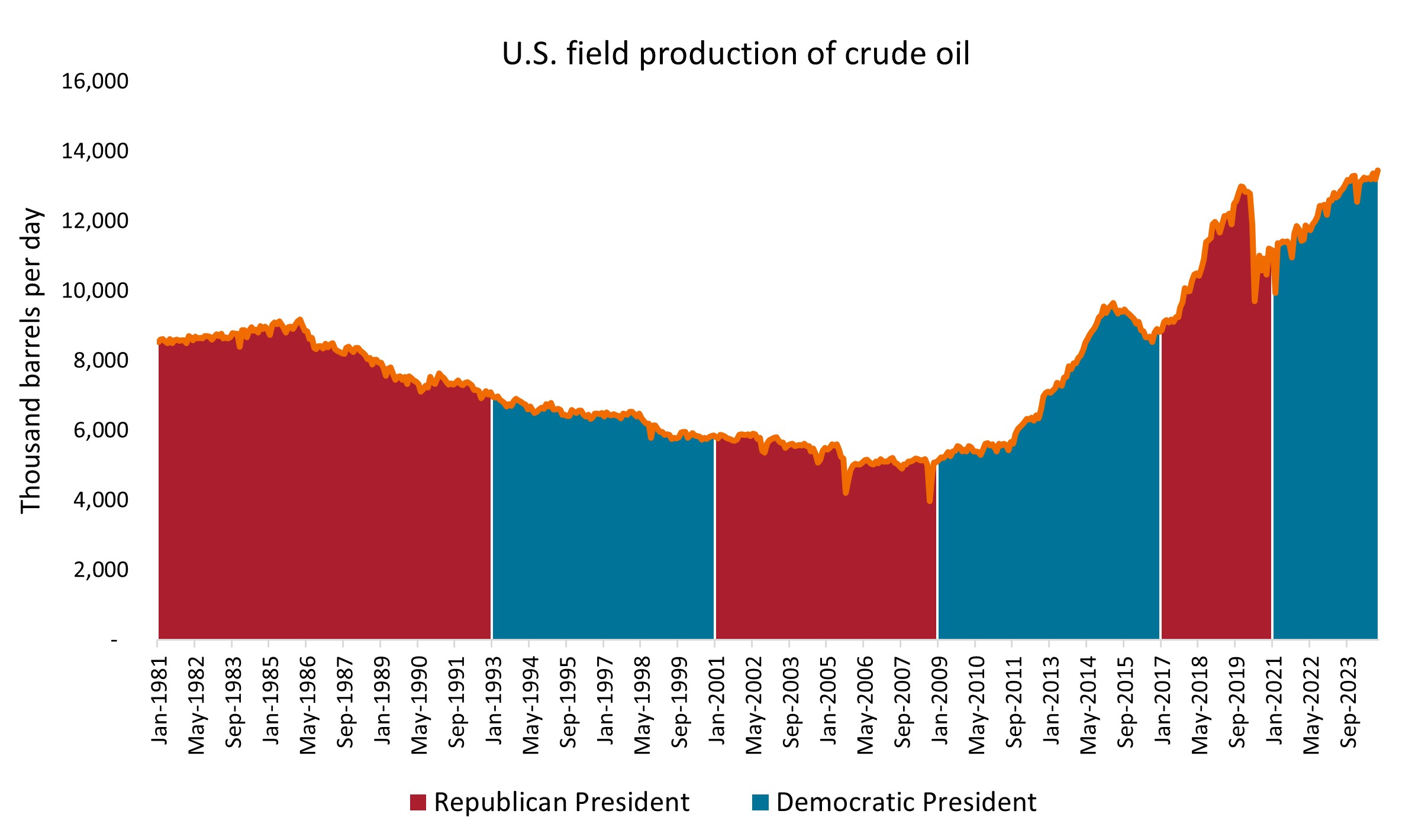

By the numbers – U.S. oil production by presidential administration

Production trends show that companies have historically responded to market conditions, operating independently of whether an administration’s policies favor or oppose the industry.

Source: U.S. Energy Information Administration, January 1981 to October 2024.

Volatility measures risk using the dispersion of returns for a given investment.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.