Developed Market Central Bank Outlook 2024

Portfolio Manager Dan Siluk identifies which regions have too much loosening priced in, and which have too little.

11 minute read

Global Bond Relative Value

When markets move aggressively, opportunities often present themselves. Prices can overshoot the mark and correlations among securities can deviate from historical trends. Late 2023 was one of those times. The fall in core inflation in the U.S. led to a rapid re-assessment of the Federal Reserve’s (Fed) policy stance as it shifted from tightening to easing. In the aftermath, U.S. bond yields fell significantly over the last two months of the year, dragging yields lower globally. In some cases, these moves were driven by macroeconomic developments and central bank messaging, but in other cases, market moves occurred without such catalysts. The upshot is, we believe there is a higher correlation observed in global bond yields than appears justified by expected central bank moves.

To gauge this incongruity, we sought to identify which regions have too much loosening priced in, and which have too little. First, we analyzed inflation trends – a key focus for central banks – then examined economic activity and unemployment in a Taylor-rule style analysis with the aim of forecasting official rates.

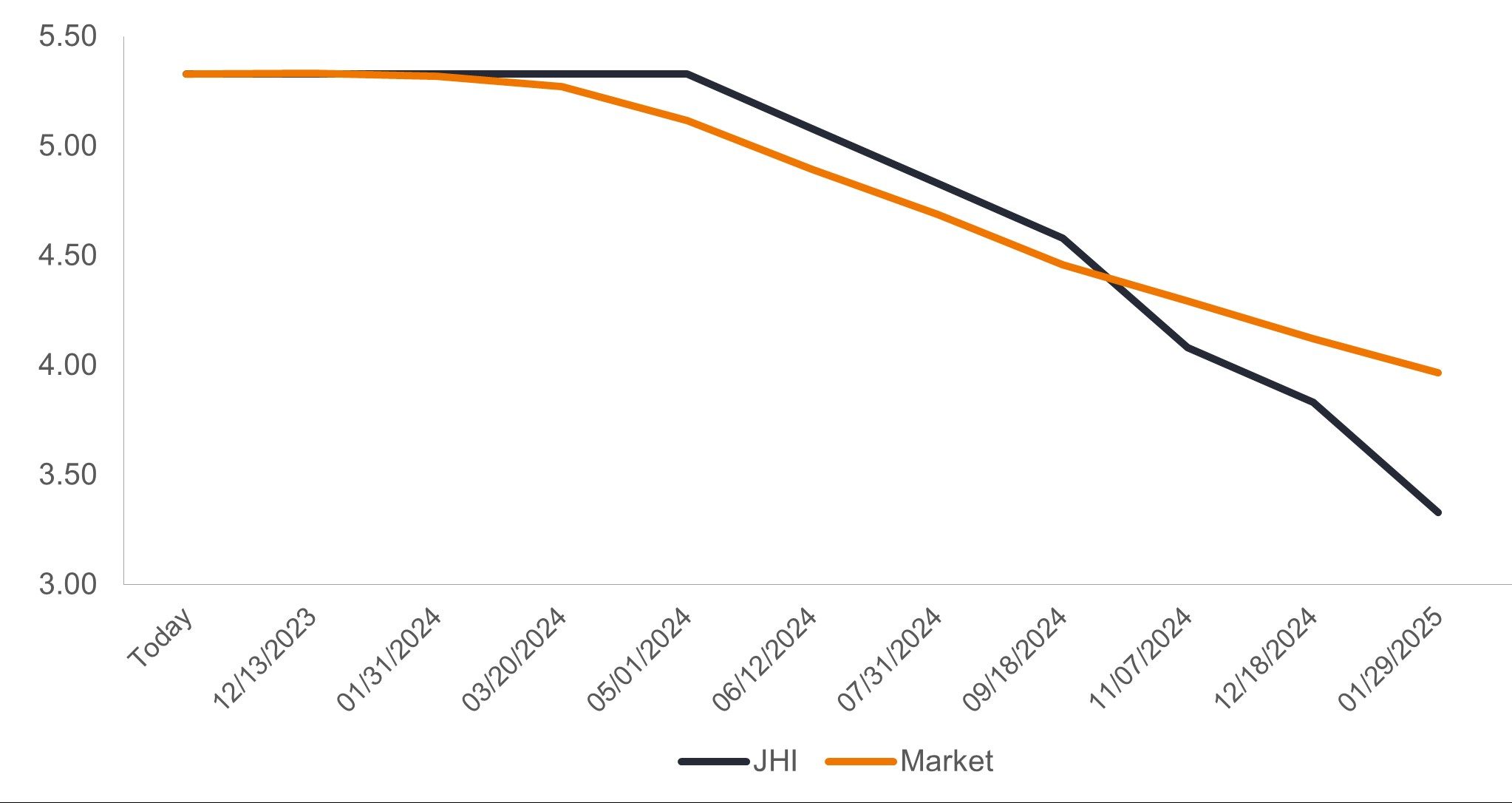

U.S.

Core inflation has rapidly fallen toward the Fed’s 2.0% target, led by an easing of goods prices. The central bank’s favored gauge – the core personal consumption expenditure deflator – has already been below target, at 1.9% annualized, for the past six months. Consequently, the real policy rate is more restrictive than previously thought.

One could argue that the federal funds rate needs to come down just to keep real rates at their intended level. If core inflation remains around target, however, there’s a strong case for official rates returning to a more neutral setting of around 3%. We therefore see the easing cycle as potentially extending further than what is priced in, although we have some reservations around how quickly this could occur given recent market moves. This ‘soft landing’ scenario is now our base case and supports being long duration even when considering current valuations. Rates get cut because inflation comes down of its own accord, rather than being an emergency response to a recession. However, the Fed will do so at a measured pace so as not to panic the market. The key message is that easing occurs initially to normalize rates rather than stimulate the economy.

U.S. monetary policy expectations

Source: Janus Henderson Investors, as of 31 January 2024. Market represents Bloomberg consensus estimates.

Source: Janus Henderson Investors, as of 31 January 2024. Market represents Bloomberg consensus estimates.

Likely giving the Fed pause is GDP growth having resisted the sharp rise in rates. A hot economy has kept the unemployment rate low relative to history and, at 3.7%, is only 0.3 percentage points above its 2022 lows. If this remains the case, we believe a return to neutral is all that is required. However, if the U.S. consumer finally succumbs to the impact of higher rates as savings dwindle, a harder landing manifested in falling GDP and rising unemployment would likely be cause for the policy rate to move below neutral. This is not a small probability, and one that the market does not appear to be placing enough weight on. Such a scenario would merit being even longer duration than what the base case suggests.

Conclusion: The U.S. remains a region where we are comfortable being long, although there is scope to have some front-end short positions in the event the easing cycle begins later than what is currently priced in. This reflects that our base-case terminal rate expectation is below the market’s, and there is a chance that rates may need to fall further in the case of a hard landing.

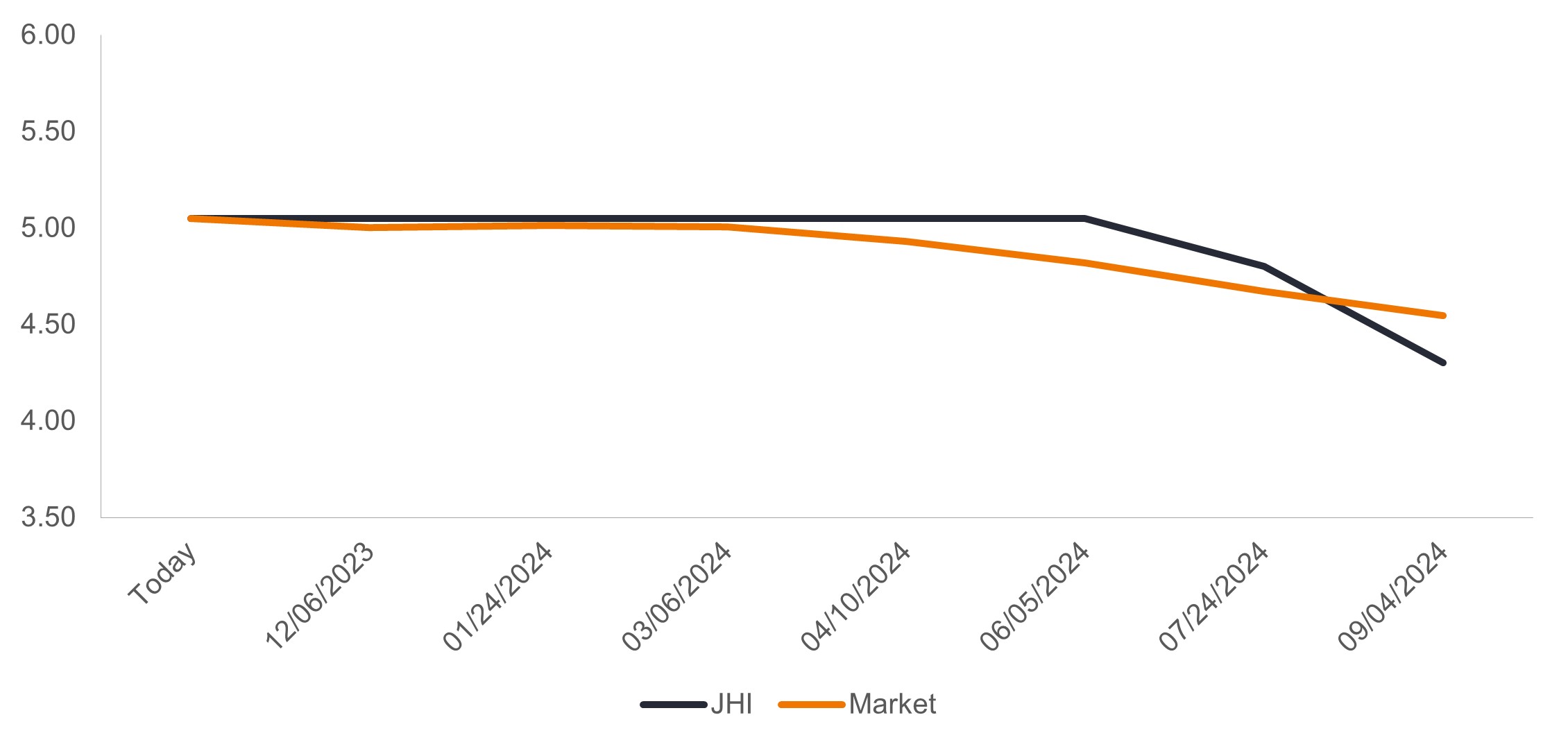

Canada

The situation in Canada is somewhat different. Inflation being well off its peak means the tightening cycle has likely finished, as in the U.S. Yet this is where the similarities end. Trimmed mean inflation started falling earlier in Canada but has since stalled at around 3.5%. On its own, this means the evidence the Bank of Canada (BOC) will need to see before easing will likely achieve critical mass later than in the U.S.

Complicating matters is economic activity below trend at 0.9% year over year and the unemployment rate already nearly a percentage point above its lows (albeit still low by historical standards). The BOC may, therefore, be comfortable cutting rates sooner than might be the expected given soft aggregate demand. A persistent rise in unemployment would suggest a move toward easier policy, and we believe a level below the neutral rate of around 3% would be merited. With 3-month trimmed mean inflation down at 2.6%, we think this move is likely to gather momentum in coming months, but our confidence on this front is somewhat lower given how volatile these 3-month measures can be.

Canada monetary policy expectations

Source: Janus Henderson Investors, as of 31 January 2024. Market represents Bloomberg consensus estimates.

Source: Janus Henderson Investors, as of 31 January 2024. Market represents Bloomberg consensus estimates.

Conclusion: Canada is another region where the move toward – or beneath – neutral is not fully priced in. Therefore, while we are uncertain about when the tightening cycle will begin relative to current market pricing, we still favor being structurally long in Canada. However, given that there are other regions where we hold higher conviction, we have tended to not be as assertive in this region.

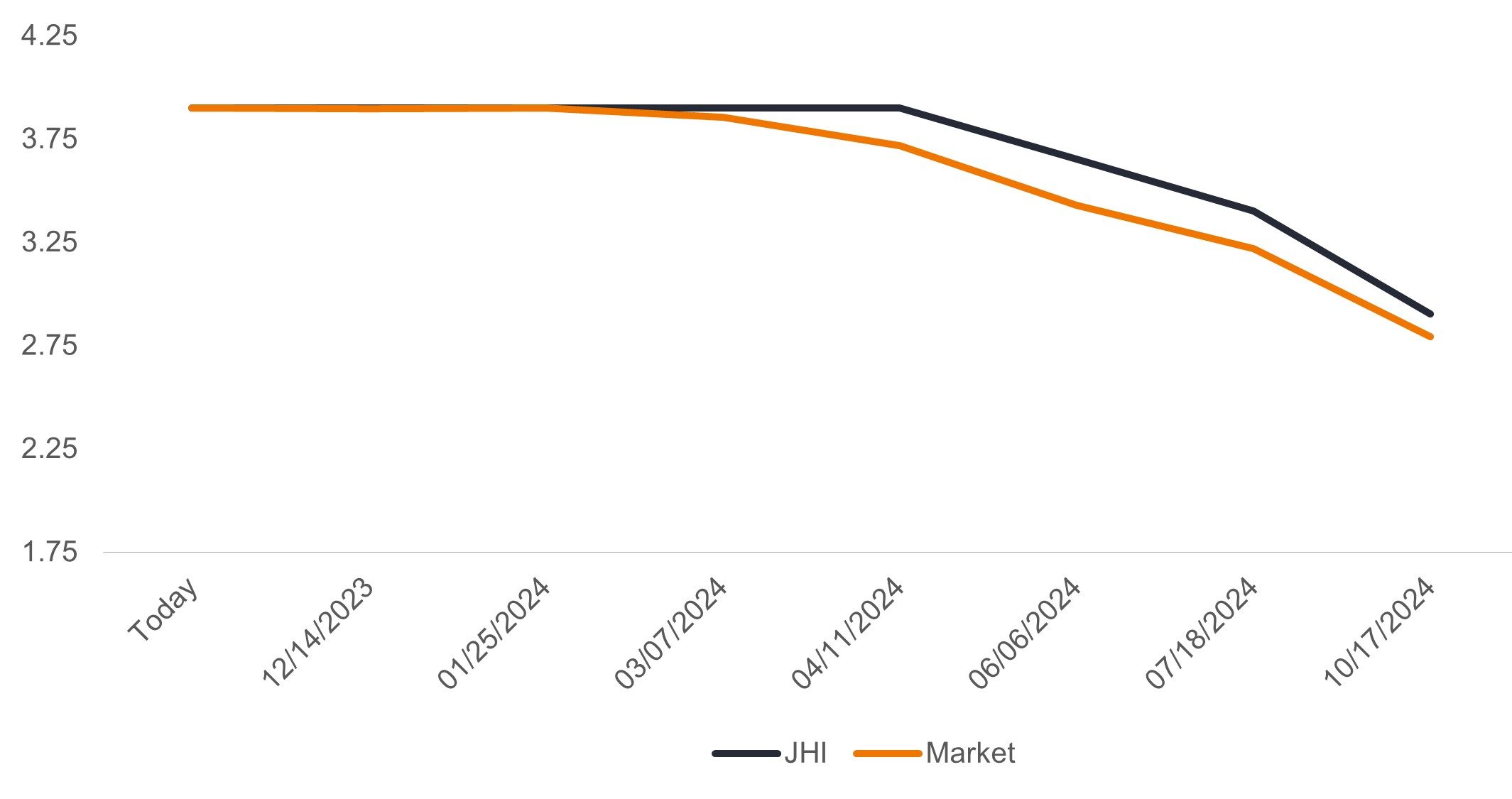

European Union

Eurozone growth notably underperformed the U.S. in 2023, and we expect sedate growth to continue this year. Domestic demand may show modest expansion, underpinned by easing inflationary pressures, a return to growth in real wages, and EU-funded investment. Consumer price inflation is likely to fall below 3% on average across major European economies due to easing supply-side conditions. However, demand-driven price pressures, due to tight labor markets, could mean inflation becomes stickier than expected. Coupled with firm global demand and an upswing in key commodity prices due to supply shortages, inflation in Europe is at risk of re-accelerating in 2024.

Nevertheless, we believe policy rates have now peaked in the euro area and that the European Central Bank (ECB) will start cutting rates before mid-2024, following its most aggressive tightening cycle ever. There will be continued contrasting performance among individual economies, with the competitiveness of German industry in particular under pressure as demand from the U.S. and China (its main trade partners) slows considerably.

EU monetary policy expectations

Source: Janus Henderson Investors, as of 31 January 2024. Market represents Bloomberg consensus estimates.

Source: Janus Henderson Investors, as of 31 January 2024. Market represents Bloomberg consensus estimates.

Conclusion: Given our view that the ECB will be forced to cut rates more than the Fed in 2024, we remain long German front-end rates and constructive on extending duration on pullbacks.

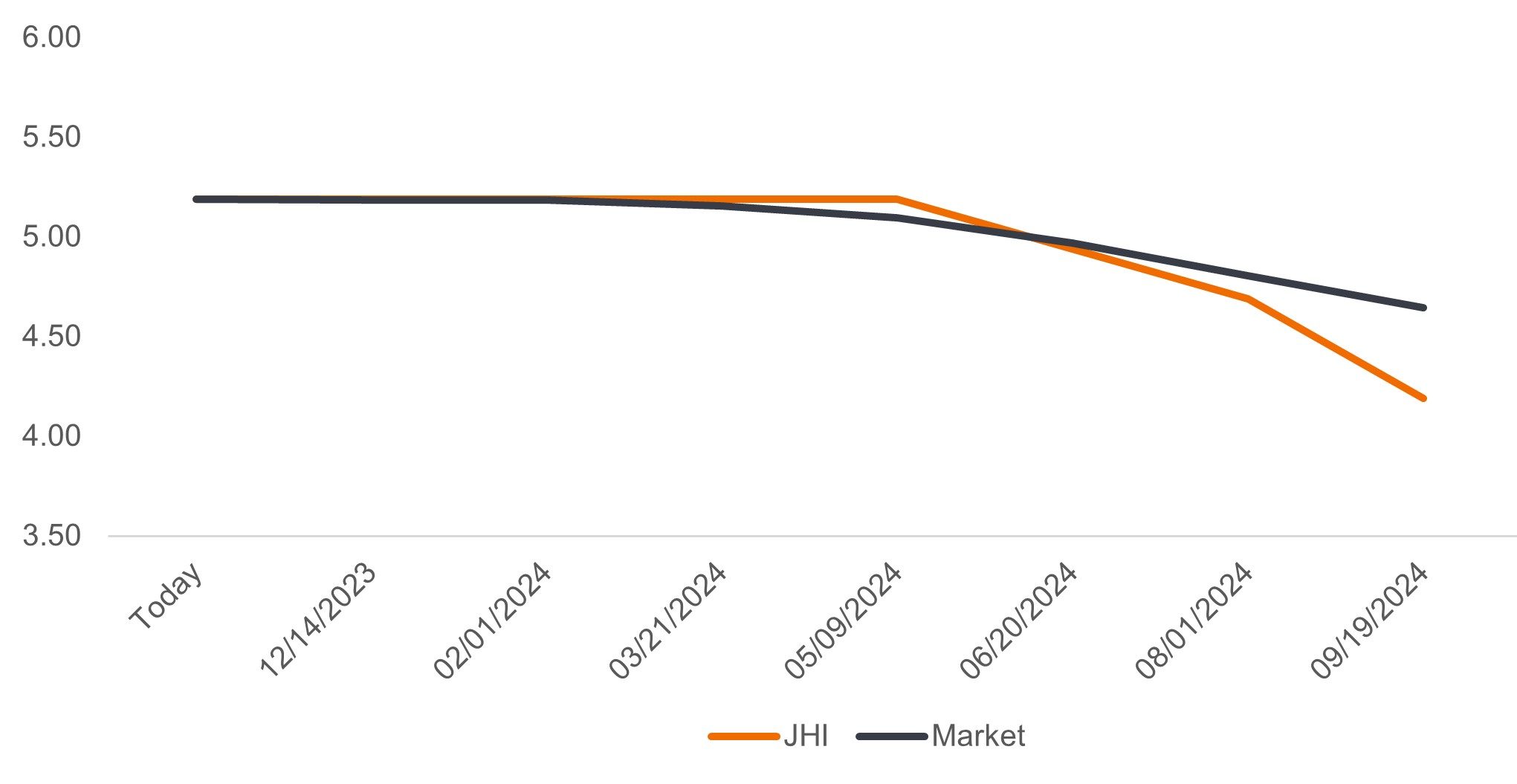

United Kingdom

Inflation has been volatile in the UK. After falling off their peaks in late 2022, prices re-accelerated in the first half of 2023, only to rapidly decelerate later in the year. This has led to a commensurate spike in volatility (uncertainty) in rate hike expectations, which have more recently followed the U.S. and mainland Europe in moving sharply lower. Yearly core inflation rates have fallen from over 7% as recently as May 2023 to roughly 5.1%, but when one looks at six-month rates (admittedly not seasonally adjusted, which waters down the implications), UK inflation is running at 2.4%. This is 4 percentage points lower than the corresponding six-month period a year earlier.

Bank of England (BoE) Board members, however, remain acutely aware of the ongoing tightness in labor markets and are seeking clarity on both labor supply and a further easing of wage pressures, which remain well above the pace of consumer price inflation, before committing to cut rates. Nonetheless, arguments that interest rates could return to at least neutral are gaining momentum. With economic activity soft at just 0.3% year over year and unemployment rising, we see a more persuasive case for moving rates toward a neutral level.

UK monetary policy expectations

Source: Janus Henderson Investors, as of 31 January 2024. Market represents Bloomberg consensus estimates.

Source: Janus Henderson Investors, as of 31 January 2024. Market represents Bloomberg consensus estimates.

Conclusion: While we now view UK duration more favorably, it remains behind the EU in terms of our preference. However, its attractiveness has improved somewhat given the sharp turnaround in inflation, along with market pricing suggesting an easing potentially sooner than expected.

Japan

We see 2024 as an important year in Japan in terms of testing the sustainability of inflation and wage growth. Our view is that core inflation is likely to stay above 2%. We think growth, however, is highly likely to slow from the 1.9% registered in 2023, particularly given our outlook for the U.S. economy, which portends softer global growth. We expect the Bank of Japan (BoJ) will shift monetary policy toward a tightening bias in the first half of 2024, which could leave them as the only developed-market central bank tightening policy in 2024.

The BoJ, however, will likely take its time, for three reasons: 1) The three adjustments made to yield curve control (YCC) in 2023 were operational adjustments to ensure the sustainability of monetary easing and did not signal an early end to negative interest rate policy (NIRP), 2) The BoJ has not established that upward inflation momentum is due to higher wage growth (demand-side), but is rather a reflection of higher raw material costs (supply-side), which policy cannot control, and, 3) There is risk of destabilization within the financial system if an exit strategy is not carefully communicated.

As the BoJ becomes comfortable with these themes over the course of 2024, we believe it will end NIRP and further lift YCC, guided by an affirmation of a cycle whereby wage increases lead to higher and more sustainable service price inflation. There is still uncertainty on this point, however.

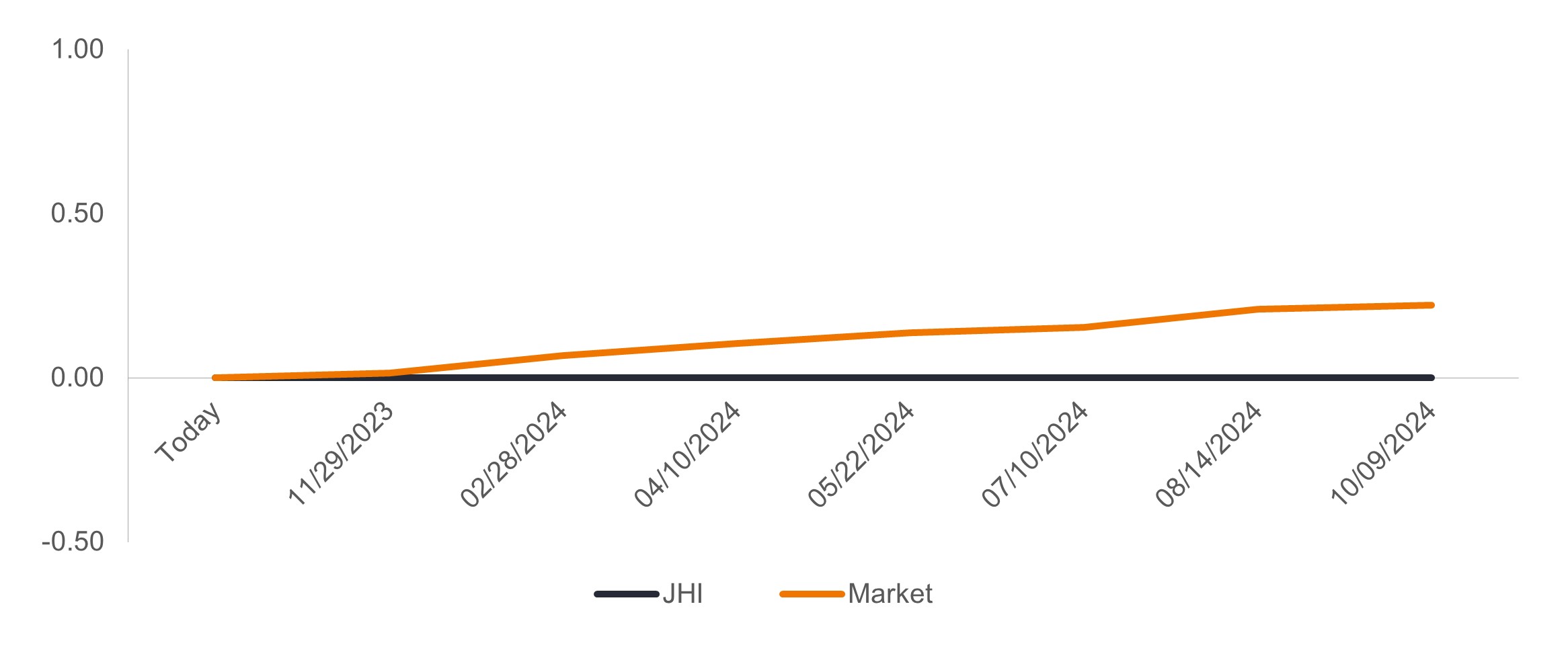

Japan monetary policy expectations

Source: Janus Henderson Investors, as of 31 January 2024. Market represents Bloomberg consensus estimates.

Source: Janus Henderson Investors, as of 31 January 2024. Market represents Bloomberg consensus estimates.

Conclusion: Policy normalization is inevitably coming to Japan, but the timing is a challenge. Unlike other regions, changes to monetary policy and specifically YCC should impact the longer end of the curve, particularly 10-year government bonds. Therefore, positioning may be better expressed through shorting 10-year government bond futures, as well as currency-based trades such as buying out-of-the-money (OTM) USDJPY put spreads, which are cost-effective.

Australia

The most notable aspect of Reserve Bank of Australia (RBA) policy in recent years is that it has lagged global trends. This partly reflects economic conditions – inflation took a little longer to be observed, resulting in the tightening cycle starting later. However, it also reflects that, among most of the developed world, the RBA has increased official interest rates notably less in response to inflation, with the official rate ‘only’ rising to 4.35%.

RBA is also among the more recent to hike, having resumed tightening in November with a 25 basis-point (bps) increase after a four-month pause. Behind the bank’s renewed hawkishness was inflation not falling as quickly as desired. The six-month trimmed mean inflation rate, at 4.3% (well above the 2.5% midpoint target), is receding much more slowly than in the U.S. and EU. With inflation forecasted to fall to a still elevated 2.9% by the end of the forecast horizon, any upward surprise in prices would likely see additional rate hikes, thus pushing cuts much further down the track. We see this as inconsistent with current market pricing, which signals no chance of further hikes and a cut by June. This is an example of a region where the rising tide that lifted all boats should not have lifted this one.

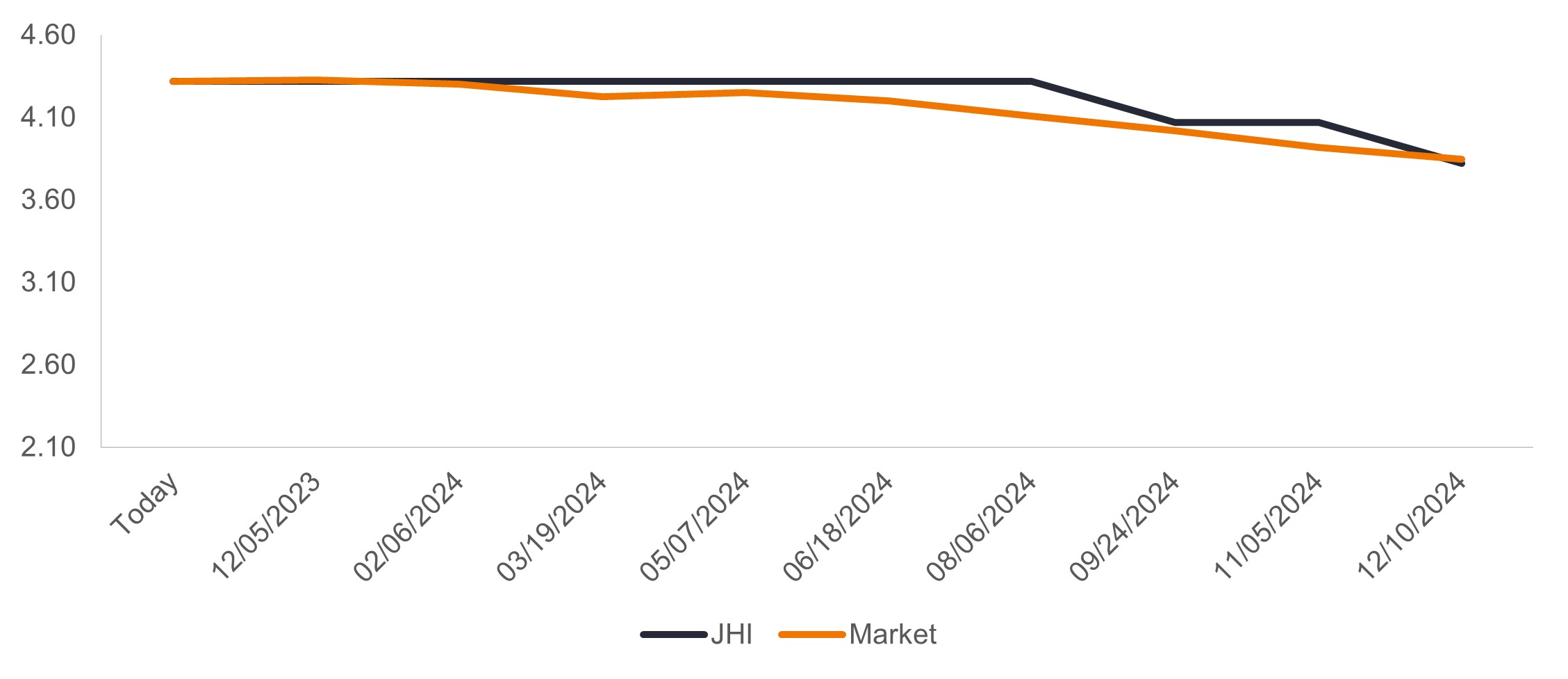

Australia monetary policy expectations

Source: Janus Henderson Investors, as of 31 January 2024. Market represents Bloomberg consensus estimates.

Source: Janus Henderson Investors, as of 31 January 2024. Market represents Bloomberg consensus estimates.

Conclusion: Australia is a region where we are comfortable pushing back against market pricing of cuts. As a result, we are short this region relative to other markets and on an outright basis.

New Zealand

In contrast to Australia, New Zealand was an early adopter of the tightening cycle. We originally thought this meant the country would be among the first to ease, but the inflation data have not supported that thesis. The rise in the consumer price index has not slowed as in the U.S and Europe, with inflation rates still high, at 5.6%.

The Reserve Bank of New Zealand (RBNZ) does not expect inflation to reach the middle of its target band until late 2025. Market expectations of rate cuts were, therefore, getting well ahead of themselves, and the RBNZ recently let the market know that. However, economic activity is slowing much more rapidly than in other regions. The last quarterly and annual readings of GDP growth were negative, and the unemployment rate is likely to continue its rise. We think this is a region where rates may be cut before inflation reaches the central bank’s target in response to economic softness.

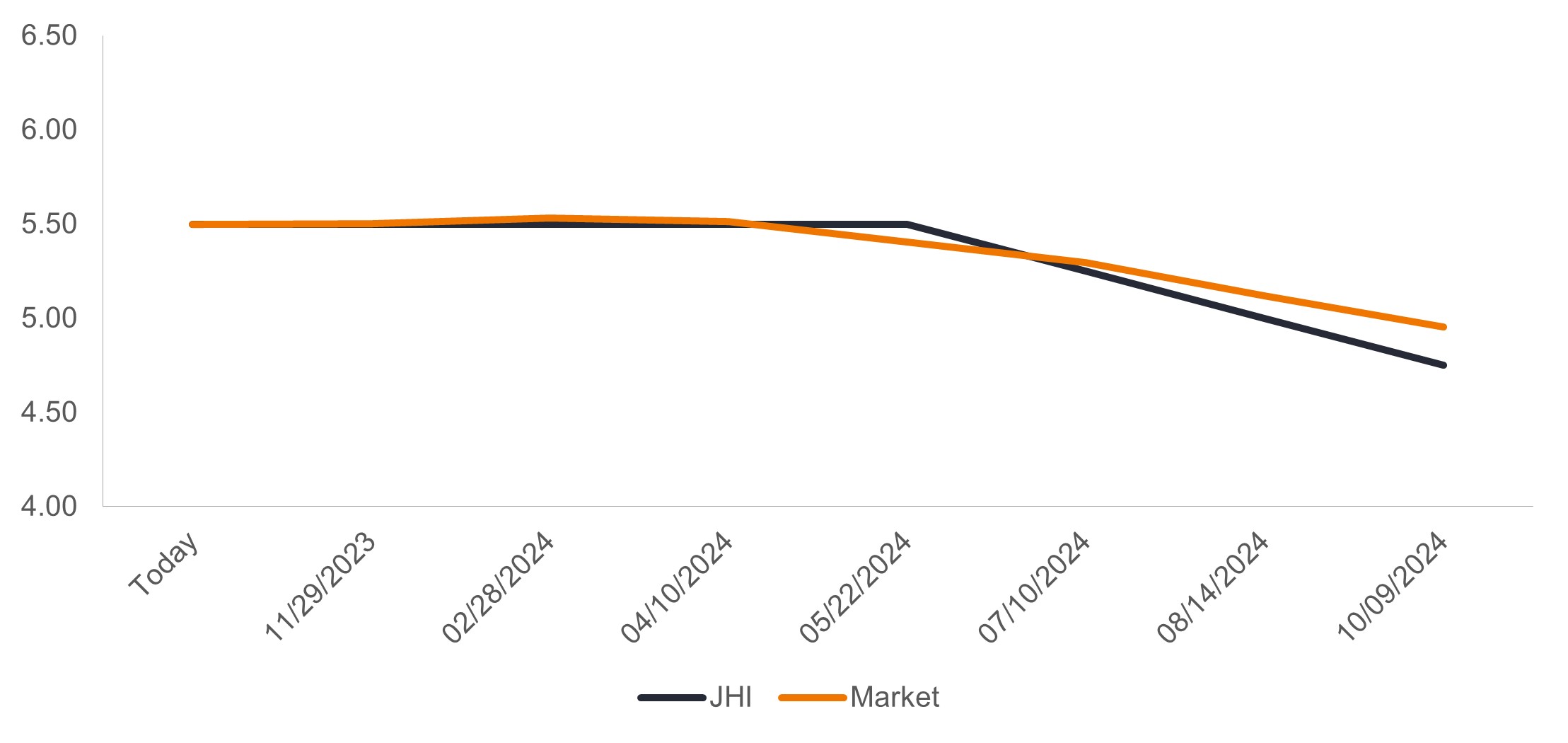

New Zealand monetary policy expectations

Source: Janus Henderson Investors, as of 31 January 2024. Market represents Bloomberg consensus estimates.

Source: Janus Henderson Investors, as of 31 January 2024. Market represents Bloomberg consensus estimates.

Conclusion: We had been long New Zealand as it was one of the first central banks to tighten. We now maintain this stance because growth has been slowing sharply. In addition to the outright long positioning to the country, we have also expressed our view via a pair trade of being long front-end New Zealand versus short Australia front end, on a duration-neutral basis.

IMPORTANT INFORMATION

Volatility measures risk using the dispersion of returns for a given investment.