Impinj is a leader in Radio Frequency Identification (RFID), a battery-less, low-power, low-cost, asset-tracking technology that can significantly improve inventory visibility and create efficiencies. The company’s integrated platform spans chips, RFID readers and software, as well as test and measurement solutions, and cloud services.

How does RFID work and what can it do?

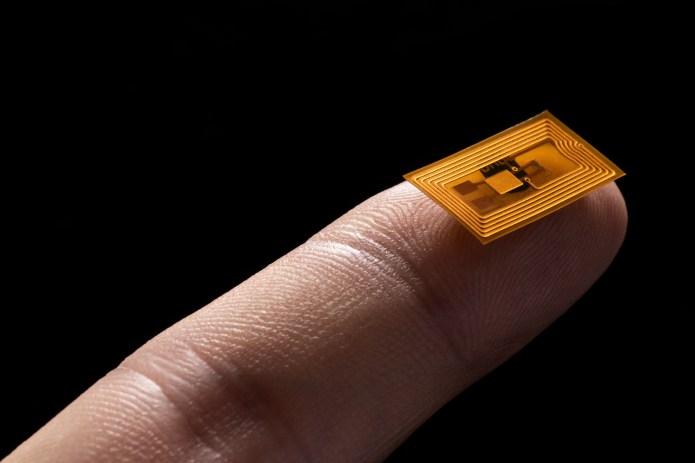

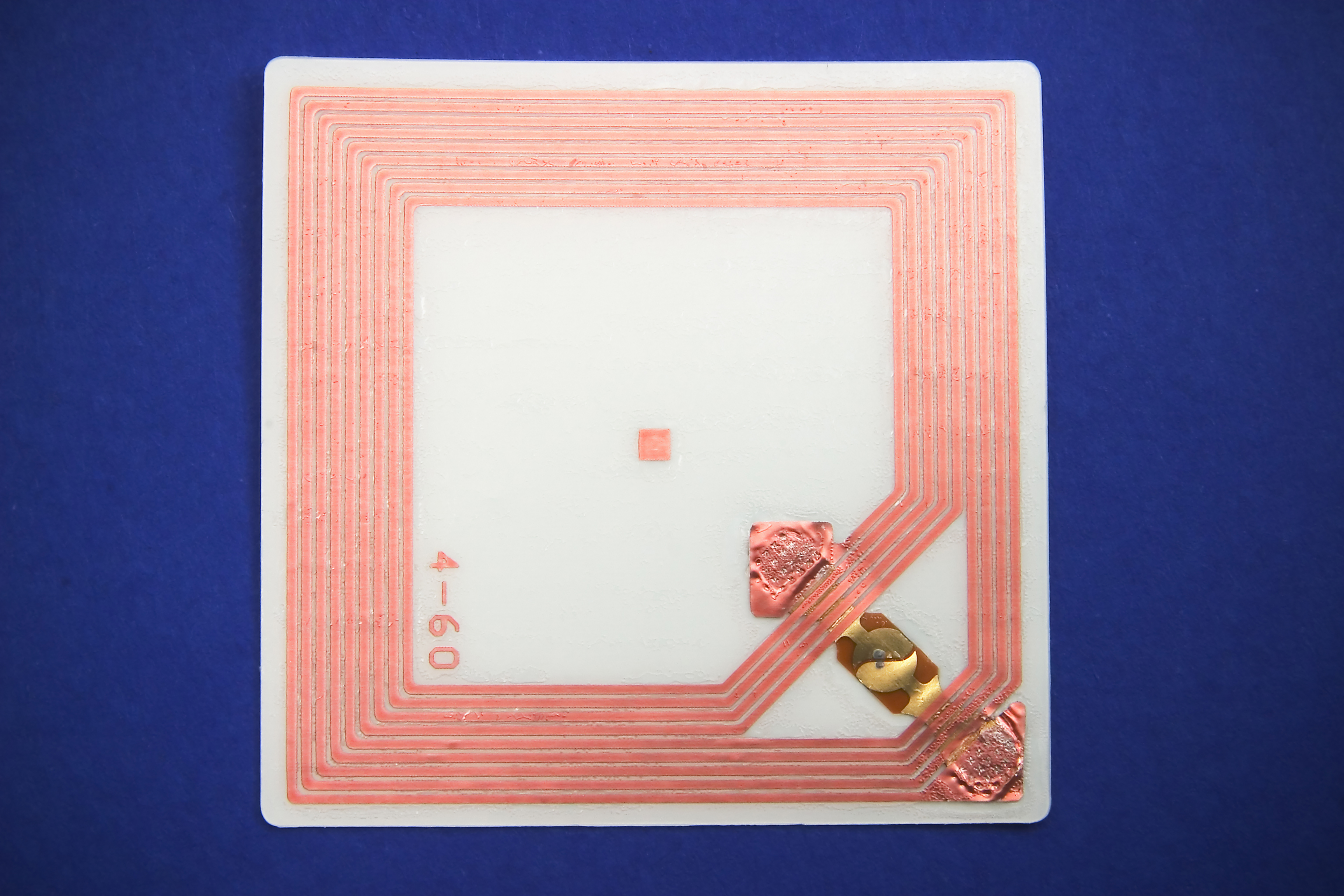

RFID uses radio waves to identify and find objects. RFID tags have chips that store data, and are powered by radio waves emitted by a RFID reader. The chips can be read at 1,000 reads per second from as far away as 30 feet (about 10 metres) without direct line-of-sight, with each chip costing just pennies. The technology reduces overstocking, transportation, waste and counterfeiting, as well as enabling self-checkout, certification, loss prevention and consumer privacy via the protected mode in the tags. Therefore, it plays a key role in enabling the circular economy, as end-of-life and recycling information, as well as carbon footprint data can be embedded, improving resource utilisation and driving productivity.

Taking stock inventory with Impinj’s RAIN RFID handheld reader is about 25x faster than with a barcode reader. For example, in hospitals inventory can be tracked, enabling quicker finds, less inventory lost, which reduces cost, time, waste and ultimately could help save lives. Another example of RFID deployment is in public rail safety, where the technology can measure the friction each wheel exerts on the track as it passes by, assisting with maintenance, which helps reduce safety incidents.

RFID growth potential

Impinj saw a compound annual growth rate of almost 30% over the past 13 years.1 Mainly utilised in the retail and logistics sectors, RFID is seeing early adoption in areas like food and medicine where origin, standard and testing certification are becoming more important. While circular economy initiatives and widespread adoption are in the early stages, we have seen some strong case studies in healthcare and recycling, providing growing sustainability outcomes and drivers. Given lack of supply chain visibility and traceability are key barriers to decarbonisation, companies need to enhance their value chain knowledge to tackle this.

Strong regulatory tailwinds

Additionally, new regulation is expected to broaden RFID adoption across many sectors:

- Products sold by European manufacturers, retailers and those exporting products to the EU will be subject to the Digital Product Passport (DPP) sustainability product legislation, which aims to make products more durable and reliable, easier to reuse, upgrade, repair and recycle – all while using far less resources. Companies like Impinj with its RAIN RFID technology could be one of the DPP tagging solutions.

- Effective 1 February 2027, industrial or electric vehicle (EV) batteries sold in the EU market with a capacity of over 2 kWh will require a battery passport.2

- Ecodesign for Sustainable Products Regulation (ESPR) and the Packaging and Packaging Waste Regulation (PPWR) also require companies to consider the full life cycle of products.

ESG considerations

Impinj is a design-only (ie. non-manufacturing), fabless semiconductor company. We consider the company to have low ESG risk across both environmental and social factors. However, in terms of Impinj’s full value chain and true product footprint, some material environmental and social considerations present risks, but also opportunities, for the company to increase its competitive advantages:

- Continuous, meaningful and active ecodesign

We view this as a key strength. The Impinj M800 series, the most advanced tag chips, delivered 25% more die per wafer than the previous generation, reducing the carbon and material footprint significantly. RFID itself is a low-resource technology versus existing alternatives. Material usage, along with power and energy efficiency, are key focus design parameters.

- Supply chain stewardship

We believe Impinj can do more in terms of supply chain stewardship, given their technology can be an enabler of a circular, more transparent supply chain.

- Environmental disclosure, metrics, and targets

As a young, small, high growth, resource-light company, we encourage Impinj to increase ESG-related disclosure along with its scale and breadth of efforts.

Engagement

We have been actively engaging with Impinj since its inception. We have shared examples of best practice disclosure, and encouraged a focus on both ESG and sustainability areas to widen out the company’s competitive advantage, at a time of heightened regulatory scrutiny. With financial materiality in mind, areas of engagement include supply chain, product safety & security, net zero targets, Diversity, Equity & Inclusion (DEI), ESG-related disclosure and alignment with United Nations Global Compact (UNGC) principles, and the OECD Guidelines for Multinational Enterprises on Responsible Business Conduct (OECD MNE).

A growing and ageing population, resource constraints and climate change require technological innovation to boost productivity and to optimise the efficient use of scarce resources. We continue to identify and engage with companies like Impinj that are creating new ways to optimise productivity and efficiency, paving the way for a more sustainable, efficient and safer future.

1 Source: Impinj Investor presentation, 3Q 2024. Past performance does not predict future returns.

2 Source: https://circulareconomy.europa.eu/ Implementing the EU Digital Battery Passport, March 2024.

All RAIN RFID information sourced from Impinj.com.

Circular economy is an economy where markets provide incentives to reuse products and materials, rather than scrapping them and extracting new resources. All forms of waste are returned to the economy or used more efficiently.

ESG, or Environmental, Social and Governance (ESG) or sustainable investing considers factors beyond traditional financial analysis. This may limit available investments and cause performance and exposures to differ from, and potentially be more concentrated in certain areas than the broader market.

Net zero refers to cutting greenhouse gas emissions to as close to zero as possible to avert the worst impacts of climate change and preserve a liveable planet. To keep global warming to no more than 1.5°C – as called for in the Paris Agreement, emissions need to be reduced by 45% by 2030 and reach net zero by 2050.

OECD Multinational Guidelines for Multinationals (OECD MNE) reflect the expectations from governments to businesses on how to act responsibly. They cover all key areas of business responsibility, including human rights, labour rights, environment, bribery, consumer interests, as well as information disclosure, science and technology, competition, and taxation.

The UN Global Compact’s (UNGC) Ten Principles are derived from the Universal Declaration of Human Rights at Work, the International Labour Organisation’s Declaration on Fundamental Principles and Rights at Work, the Rio Declaration on Environment and Development and the United Nations Convention Against Corruption.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund follows a sustainable investment approach, which may cause it to be overweight and/or underweight in certain sectors and thus perform differently than funds that have a similar objective but which do not integrate sustainable investment criteria when selecting securities.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.