As investors think about the impact of an inflection point in interest rates on their asset allocation calls, we provide some context for the deep pricing adjustment seen in European commercial real estate markets in the wake of rising interest rates. While it’s felt like a long journey, real estate investors are now asking themselves, “Are we nearly there yet?” and “Is it time to re-engage with the sector?”

A deeper look into valuations versus current fundamentals

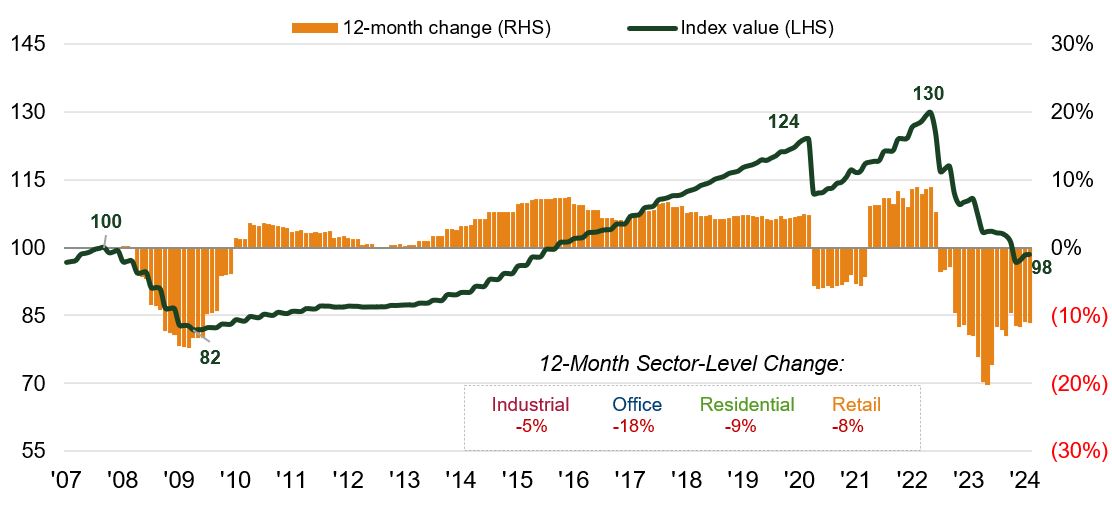

Data from respected real estate analysts Green Street seeks to provide a real-time view on the pricing of underlying real estate markets in Europe. The >25% decline in nominal asset prices, far higher in real (inflation-adjusted) terms, for average ‘grade B’ European commercial real estate highlights the magnitude of the correction seen in this downturn. As ever, averages can be misleading, with property sectors such as secondary offices seeing far greater declines (and still falling). Conversely, areas benefiting from structural growth such as student accommodation, rental housing and self-storage are seeing far shallower corrections (with many valuations already increasing again), supported by their stronger rental growth outlook.

Chart 1: Pan European B/B+ Quality Property Index

Source: Green Street Advisors European Commercial Property Monthly 1 February 2024. Green Street Pan European B/B+ Quality Property Index: preliminary estimated data to 1 February 2024. Green Street sector indices are built using the GDP weighted average price growth rates of individual markets rebased to respective ’07 peak.. There is no guarantee that past trends will continue, or forecasts will be realised.

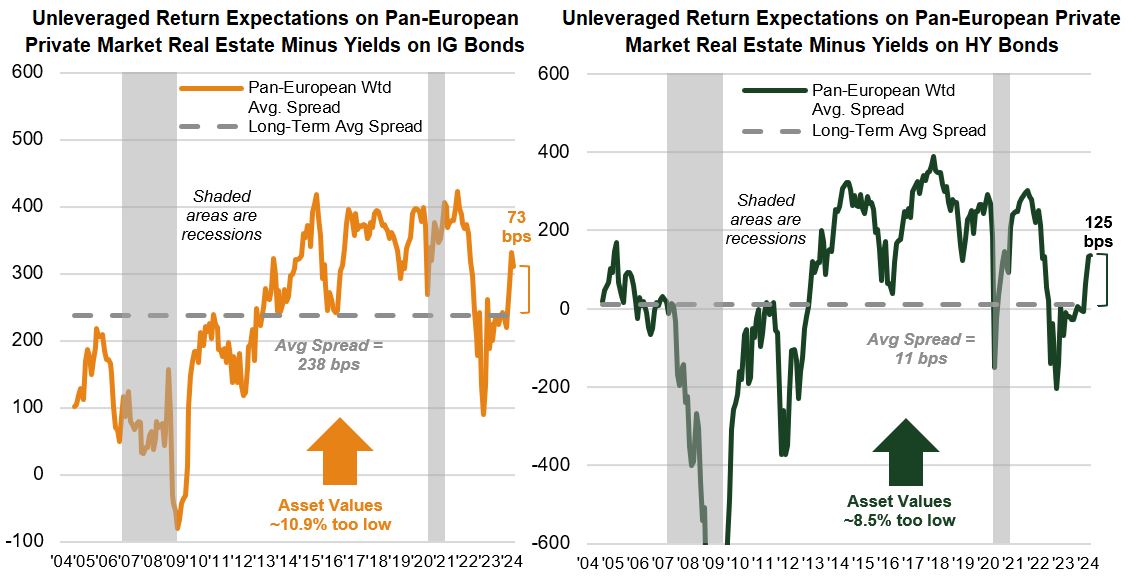

Rebuilding of real estate risk premiums

While we may have not yet reached the bottom for reported direct property market values, there are reasons to believe we may be approaching it. Real estate’s risk premium to bonds are being rebuilt to sit above long-term averages, with signs of investors returning to real estate markets – initially focused on areas of structural growth such as industrial/logistics assets and alternatives such as towers, storage and student accommodation.

Chart 2: Providing reassurance on returns versus debt costs

Source: BAML, Bloomberg, Moody’s, IHS Markit, Green Street. Green Street Advisors European Commercial Property Monthly 1 February 2024. Unleveraged return = difference in returns when financed with debt versus financed with equity (unleveraged). Spread = difference between private market real estate yield vs Investment Grade/High Yield bond yield. Bps= basis points. Past performance does not predict future returns.

A question of when, and not if

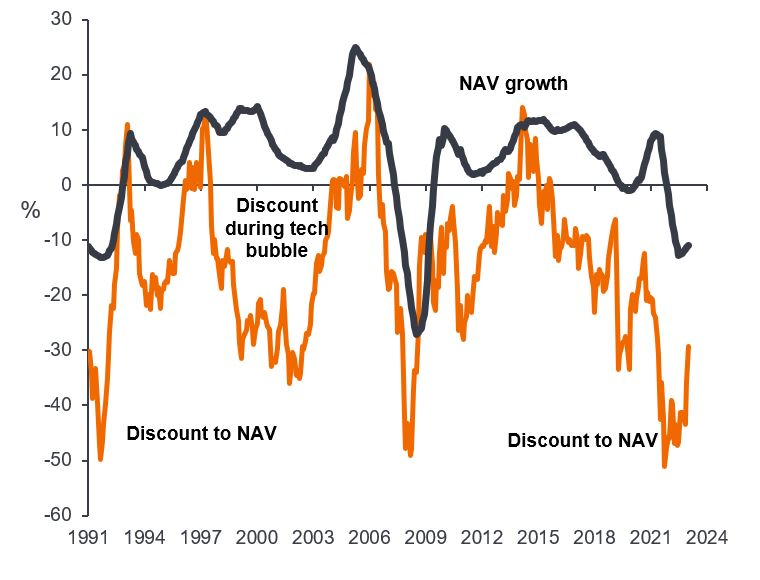

It is also important to reiterate that we invest in listed real estate markets, where prices are forward-looking, being set daily by stock market investors, and therefore they typically adjust more quickly to turning points in macroeconomic circumstances than backward-looking private real estate valuations. We saw this leading into the current downturn, with European real estate shares falling by >45% in the nine months to October 2022, well before direct property values were being adjusted materially lower.

Importantly, we believe the same is now happening in reverse – listed real estate began its recovery in Q4 2023 as interest rate expectations shifted, with the question now ‘when, not if’ rates in Europe will be cut in the face of falling inflation and low growth.

Chart 3: Listed real estate valuations are forward-looking; private valuations are backward-looking

Source: Morgan Stanley Research, Janus Henderson Investors analysis, as at 31 December 2023. NAV= net asset value, the total value of an asset minus outstanding debt and fixed capital expenses. When an investment’s market price is lower than its NAV, it is said to be trading at a discount. Past performance does not predict future returns.

Seeing positive indicators

While year-to-date moves in 2024 highlight the futility of trying to time markets, we believe the pullback seen in share prices is presenting investors with “a second bite of the cherry”.

Key to this view is evidence that:

- Operating fundamentals remain healthy; high occupancy levels and rising rents, which have benefited from inflation in the economy, have been a common theme in the current reporting period. This, coupled with growth from developments and embedded reversion, provides a pathway for sustained rental and earnings growth for many, even with higher interest costs. Logistics landlord Segro recently reported their results, highlighting that “…in the next three years we expect to increase our passing rents by more than fifty per cent through capturing embedded reversion, leasing vacant units and developing new space.”

- Listed REIT debt markets have reopened in recent months, with issuance by property companies in both the domestic and international bond markets. For example, German residential landlord Vonovia (VNA) issued its first bond issue since 2022; a GBP400m 12-year bond in January this year, at a EUR cost of 4.5% – far lower than the implied yield on their bonds six or 12 months ago. This is key to providing confidence that debt maturities in coming years are manageable, and that select companies can be relative winners in a world of ‘haves and have nots’ in terms of cost and access to capital, potentially providing opportunity for growth in the future.

- Confidence in operating fundamentals and expectations for stabilising valuations is giving companies greater confidence in their ability to reward shareholders through dividends and dividend growth. Noteworthy is the return of dividends from retail landlord Unibail-Rodamco-Westfield (URW) after a three-year suspension to shore up its balance sheet.

Our mantra: selectivity is key

Clearly challenges and risks remain and not all will escape unscathed from a correction of this magnitude. Therefore it remains paramount to be highly selective, focusing on balance sheet strength, and finding those areas of the market where rental income streams can provide ‘real’ growth in the face of slowing economies and structural shifts that affect the real estate market.

However, in our view, it is also important to remember that a significant correction in property prices has already occurred, and it is likely that 2024 will see an inflection point, marked by an end to the downward trajectory of prices. With many listed REIT shares still priced for a very pessimistic outlook, we feel a return of investor attention to the asset class is warranted and potentially can soon be rewarded.

Balance sheet: a financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time, used to gauge the financial health of a company.

Bond yield: level of income on a security, typically expressed as a percentage rate. For a bond, this is calculated as the coupon payment divided by the current bond price. Lower bond yields means higher bond prices.

Implied yield: the yield on the underlying bond of a futures contract implied by pricing it as though the underlying will be delivered at the futures expiration.

Investment grade & high yield bonds: investment grade bonds are typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments, reflected in the higher rating given to them by credit ratings agencies. High yield bonds usually carry a higher risk of the issuer defaulting on their payments, so have a higher interest rate (coupon) to compensate for the additional risk.

Nominal vs real: nominal prices/values represent current values; real prices/values are adjusted for inflation.

Real estate risk premium to bonds: the excess return that investors demand for investing in real estate compared to investing in bonds (for example corporate or government bonds).

IMPORTANT INFORMATION

There is no guarantee that past trends will continue, or forecasts will be realised.

REITs or Real Estate Investment Trusts invest in real estate, through direct ownership of property assets, property shares or mortgages. As they are listed on a stock exchange, REITs are usually highly liquid and trade like shares.

Real estate securities, including Real Estate Investment Trusts (REITs) may be subject to additional risks, including interest rate, management, tax, economic, environmental and concentration risks.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.