Top-of-mind market risks for U.S. equities

Portfolio Managers Jeremiah Buckley, Brian Demain, and Jonathan Coleman believe that uncertainties around job growth, consumer spending, and artificial intelligence (AI) capital spending warrant close attention.

5 minute read

Key takeaways:

- Our 2024 Investor Survey revealed decreased risk appetite among investors, with a large percentage expressing concerns about near-term issues including the U.S. presidential election, geopolitical events, and persistent inflation for late 2024 into early 2025.

- Our portfolio managers, while acknowledging these concerns, are focused on broader economic themes like narrow job growth and consumer spending that could create slowdown pressures, as well as uncertain AI capital expenditure returns, as potential market risks.

- While it’s important to be mindful of all risks on the horizon, staying invested in quality companies and maintaining diversified portfolios can help investors mitigate exposure to those risks.

Janus Henderson’s 2024 Investor Survey shows U.S. mass affluent and high-net-worth investors have a decreased risk appetite in 2024 compared to 2023. When asked about their top concerns for late 2024 into early 2025, over 70% of respondents cited the U.S. presidential election, geopolitical events, and persistent inflation.

In light of these findings, we asked three of our U.S. equity portfolio managers what they deem key market risks in the months ahead. While the worries investors cited in the survey are not among our portfolio manager’s top areas of concern, that is not to say they are not important when assessing today’s market environment.

The inflation picture has improved considerably in 2024, yet higher prices are still having an impact on consumer spending. Geopolitical risks – namely the Russia-Ukraine war, China-Taiwan tensions, and Middle East conflicts – form a constant backdrop. These events threaten to disrupt supply chains, increase inflationary pressures, and undermine investor confidence. However, predicting the likelihood of such events is challenging, and we’d instead advocate for a focus on quality companies and a diversified portfolio to help mitigate the potential impact.

The U.S. presidential election could also cause near-term volatility, but we believe broader economic drivers and company fundamentals will be the prevailing influence over the market’s ultimate winners and losers.

Our portfolio managers remain largely optimistic about economic and earnings outlooks, but they offered the following perspective on the risks they’re tracking closely in the months ahead.

Jeremiah Buckley

Area of coverage: U.S. large-cap growth

Notable risk: Narrow job growth participation

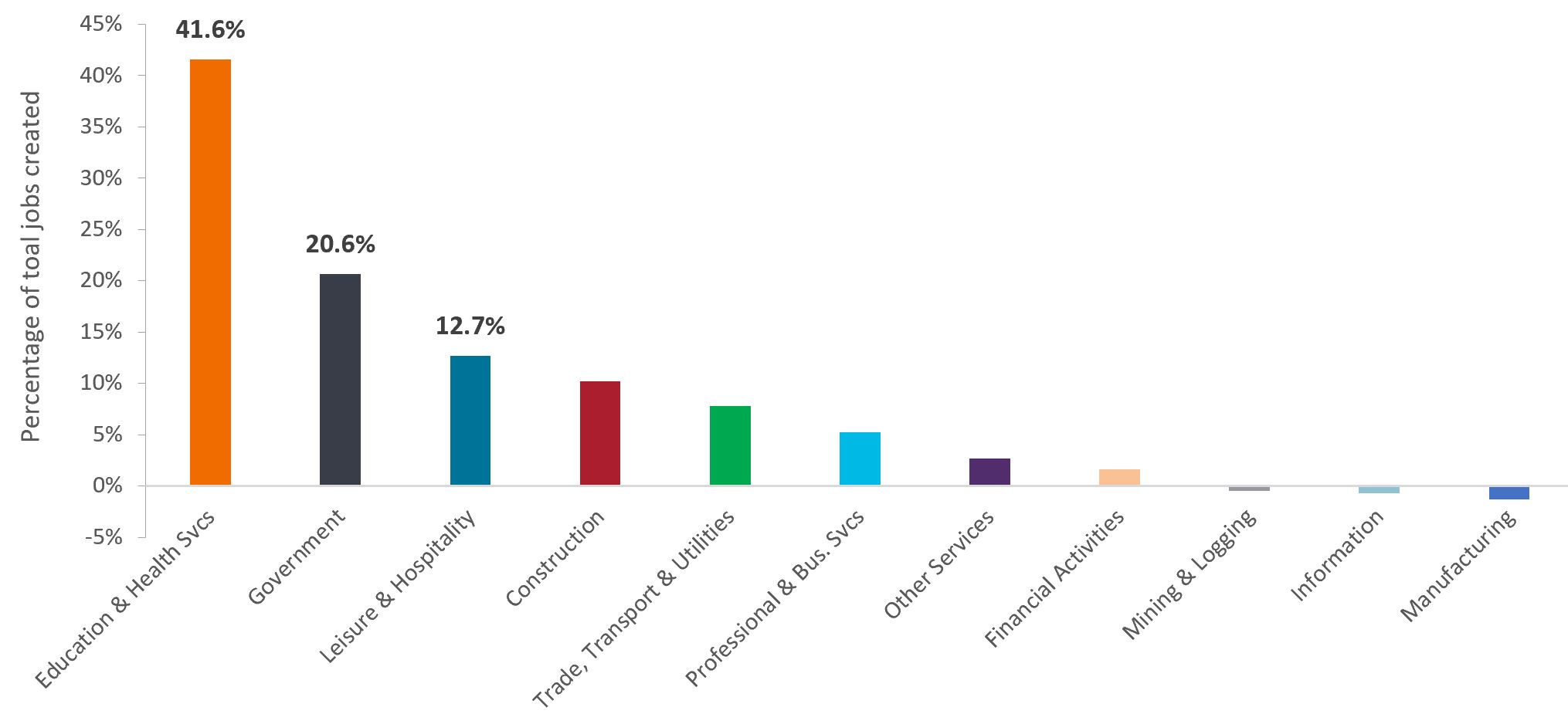

The U.S. economy continues to provide a solid foundation for investment opportunities, but cooling labor market demand is a key economic risk that warrants close attention. Recent job gains have been primarily limited to hospitality, healthcare, government, and construction, while other sectors have shown minimal or declining employment growth (Figure 1).

This narrow focus is concerning as we approach full employment in the hospitality and healthcare industries in the post-pandemic recovery. Leading indicators for the construction sector are also showing signs of weakness, which could soon flow through to jobs. The lack of broader participation across sectors could slow overall job growth.

Further, AI’s impact on hiring in knowledge-based industries adds uncertainty. AI’s role in the future workforce has led to hesitation in hiring for certain positions, potentially exacerbating the job market’s imbalance. Combined, these factors suggest employment growth could become a pressing issue, possibly leading to reduced consumer spending and pressure on economic growth.

On a positive note, we did see material margin expansion in second-quarter earnings. Positive company operating margins and margin leverage are typically leading indicators for labor market growth. Also, it is possible that moderate labor and income gains can continue to support consumer spending.

Figure 1: Nonfarm Payroll – Share of total jobs created in past 12 months

75% of total jobs created in the past year have been in the education and health services, government, and hospitality sectors.

Source: Bloomberg, Nonfarm payroll, as at 31 August 2024.

Brian Demain

Area of coverage: U.S. mid-cap growth

Notable risk: Uncertain return on AI capital spending

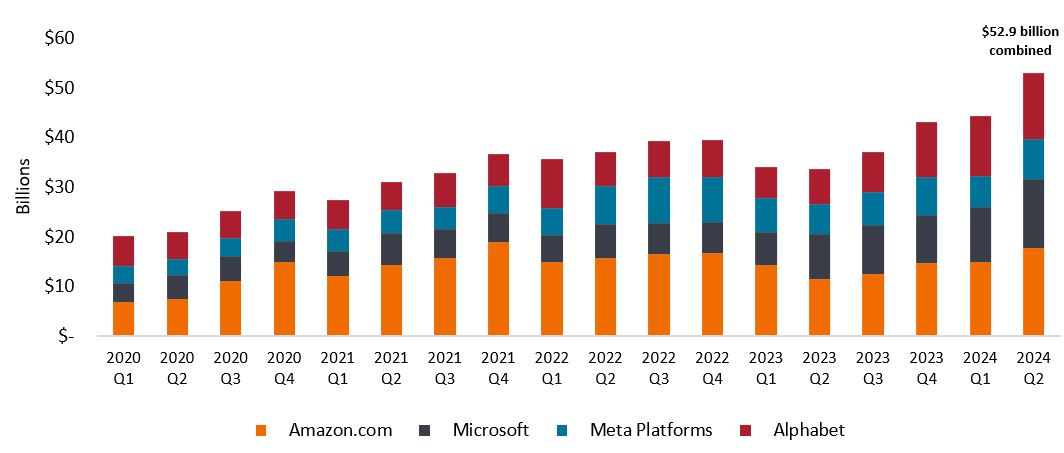

Debate surrounding the return on investment in AI capital spending is one of today’s most important market issues. While AI offers immense potential as a productivity tool, the vast capital invested in AI infrastructure by tech giants (Figure 2) needs to generate returns. This massive investment is fueling excitement for companies supplying AI-related hardware and software, from industry giants like NVIDIA to numerous mid-cap firms.

Over the next few years, the market’s direction may hinge on how the perception and reality of AI’s return on investment evolve. If AI proves to be a valuable productivity enhancer and delivers strong gains to those that have adopted it, the AI-spending boom will likely continue. We may even find current spending is too low. Conversely, subpar gains could significantly slow the pace of investment.

Given this uncertainty, we are carefully monitoring the commercial success of various AI applications, from Microsoft Copilot to emerging startups, to better understand potential returns on AI investments. Additionally, we are focusing on businesses with strong fundamentals and differentiated offerings to help mitigate risks associated with a potential slowdown in AI spending.

Figure 2: Overall capital spending

The global economy is witnessing an unprecedented influx of capital into AI, primarily driven by hyperscale cloud companies.

Source: Bloomberg, quarterly data, as at 23 September 2024.

Jonathan Coleman

Area of coverage: U.S. small-cap growth

Notable risk: Consumer spending trends

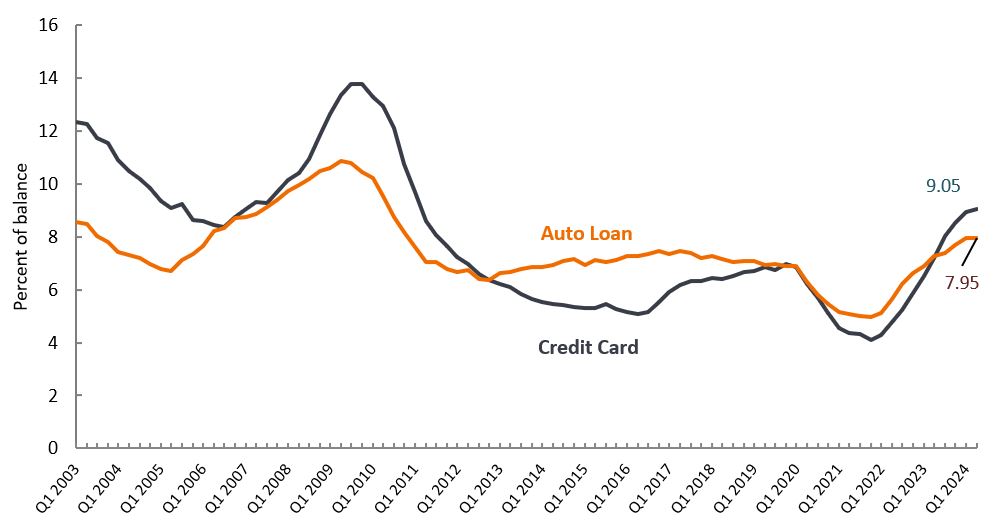

A further slowdown in consumer spending is one of the more pressing concerns in the economy today and one investors should be mindful of. While there’s no definitive evidence of this trend spreading from lower-income to middle- or higher-income households, indicators suggest increasing financial strain. For instance, delinquency rates on credit cards and car payments are approaching cyclical peaks (Figure 3), and the extraordinary savings rate from COVID-19 stimulus has dissipated.

Moreover, higher interest rates, particularly on mortgage payments, are likely to weigh on consumer sentiment and spending. Even as interest rates may stabilize or decline with the Federal Reserve rate-cutting cycle, the cumulative effect on household budgets could persist.

To mitigate this risk, we’ve adopted a cautious approach to consumer discretionary stocks. While we believe that many valuations in this sector are reasonable, we are carefully assessing whether the potential upside justifies the uncertainty surrounding consumer spending trends.

Figure 3: Transition into delinquency by loan type

The share of credit card and auto loan balances transitioned into delinquency have increased to their highest levels since the Global Financial Crisis.

Source: Federal Reserve Bank of New York. Percent of balance at least 30 days past due; quarterly data from Q1 2003 to Q2 2024, as at 31 August 2024.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Volatility measures risk using the dispersion of returns for a given investment.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.