Sifting the wheat from the chaff: a closer look at small cap opportunities

Unloved and undervalued – but with peak interest rates seemingly behind us in this cycle, are small caps well placed to benefit? The PCS Team considers the prospects for small caps.

6 minute read

Key takeaways:

- The market has for some time shunned small-cap stocks in favour of larger, more established companies. Yet, as we move further into the cycle of global interest rate cuts, stronger companies in the small-cap sector stand to benefit significantly.

- In an environment where the cost of capital has risen, the ability to discern the future winners from the losers within the small cap space is ever-more crucial.

- Careful analysis of both valuation and earnings growth is critical to maximise the potential within small cap investments. Tapping into the knowledge and analysis of small-cap managers could be a way for investors to find more wheat than chaff.

The marvel of innovation has continuously shaped our world, with the thresher being a prime example. Introduced in 1786, this machine revolutionised farming by efficiently separating wheat from chaff, allowing farmers to devote more time to harvesting valuable wheat. This process mirrors the work of small-cap fund managers today, who navigate through a vast array of stocks to identify future market leaders – akin to separating wheat from chaff.

Much like the thresher cannot function without its feeder unit, fund managers rely on a blend of data, thorough research processes and experience to identify today’s small caps that could be tomorrow’s Googles, Facebooks, and Amazons. Small-cap companies typically are in their nascent stages, with many yet to turn a profit.

In the current financial landscape, where the cost of capital has risen, creating a wider gap between successful companies and those that are struggling, the ability to discern these future giants becomes even more crucial.

Why focus on small caps now?

In a period characterised by near-zero interest rates, companies – even unprofitable ones – managed to navigate financial waters with relative ease. However, we are now entrenched in an environment where interest rates are expected to remain elevated for an extended period. The gap between successful companies and those struggling has become more pronounced.

The market, for a while, had largely shunned small-cap stocks in favour of allocating resources towards larger, more established companies – a strategy that has proven to be effective. Yet, as we navigate the initial stages of global interest rate reductions, with central banks either implementing cuts or signalling imminent reductions, the stronger companies in the small-cap sector stand to benefit significantly.

Conditions might prove to be favourable for small caps going forward, something that at the time of writing, the market seems to have recognised. Although a few observations do not make a trend, and this nascent rotation could dissipate, valuations point to small caps being more affordable than the broad-based market indices. Long-term investment success is highly dependent on the entry point. The current valuations on offer could indicate that this renewed interest in small caps is built on a solid foundation. However, it is well understood that undervalued assets might be undervalued for various reasons and could decrease further.

This brings us to the second determinant of future stock market performance – the anticipated growth in Earnings-Per-Share (EPS). In every market we looked at (see Exhibit 1), small cap indices are forecasted (Bloomberg market consensus) to experience double-digit earnings growth through to 2026, outpacing their market-cap weighted cousins.

Thus, the combination of lower valuations and the prospect of double-digit EPS growth offer a potentially enticing investment proposition.

Exhibit 1: Analysing small caps through PE ratios and projected EPS growth

Source: Bloomberg, Janus Henderson Investors. Data as of 28th June 2024. The chart illustrates the 12-month forward PE ratios of small caps relative to their 10-year averages, alongside projected EPS growth rates for 2024-2026, highlighting their growth potential relative to larger indices. There is no guarantee that past trends will continue, or forecasts will be realised.

The value of active management in high-dispersion environments

With the trend towards passive investment strategies extending to small caps, investors are essentially buying both the ‘wheat’ and the ‘chaff’. This is likely to become an even bigger concern as we enter a world of greater winners and losers.

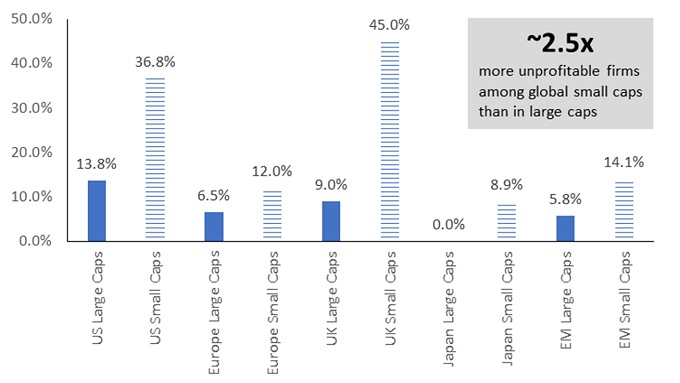

There is every chance that highly indebted, unprofitable companies could struggle to survive in a consistently higher rate environment, even as interest rates drop. While the small-cap space contains plenty of opportunities, it comes with a greater proportion of loss-making firms than typically found in large-cap indices (Exhibit 2). Long-term exposure to firms with negative earnings can have a profound impact on a portfolio’s overall returns, with greater dispersion in outcomes, underlining the importance of a curated stock selection process.

Exhibit 2: Probability of being exposed to unprofitable firms is higher in the small-cap universe (%)

Source: Bloomberg, Janus Henderson Investors. Data retrieved on 24 July 2024 as per latest available reporting date for each of the index constituents. Loss makers assessed on Net Profit Margin as reported by Bloomberg. Indices used: US Large Caps = Russell 1000, US Small Caps = Russell 2000, Europe Large Caps = STOXX Europe Large 200, Europe Small Caps = STOXX Europe Small 200, UK Large Caps = FTSE 100, UK Small Caps = FTSE Small Cap Ex Investment Trusts, Japan Large Caps = TOPIX LARGE 70, Japan Small Caps = TOPIX Small, EM Large Caps = S&P EM Large, EM Small Caps = S&P EM Small.

Finding hidden kernels in small caps

Gaining exposure to small-cap stocks that are cheap and have strong earnings projections sounds like the obvious thing to do, yet some investors might not be paying enough attention to this space.

Investment analysts from asset management firms, investments banks and research houses have the task of studying companies and providing recommendations for portfolios. In some cases, more than 70 analysts around the world from different firms will cover a single stock! It is very hard to find outperformance opportunities if 70 other people are fighting over the same ground.

The MSCI World Small Cap Index sees an average of just nine analysts per stock, with about 25% of the firms in the index having a coverage of fewest than two analysts[1].

Imagine trying to harvest wheat in fields full of combine harvesters, compared to emptier fields where wheat could be plentiful, because only a handful of people are harvesting. This scenario illustrates how the often overlooked small-cap market provides a unique opportunity for active managers to identify undervalued gems. It highlights the critical role of careful analysis in both valuation and earnings growth to uncover the genuine promise that lies within the realm of small-cap investments.

It is harvest time

Recent weeks have seen attention return to small caps after being mostly ignored over many years. A blip does not make a trend and many things could alter the course of the latest small-cap rally, yet investors would do well to focus on relatively low valuations and the scope for robust earnings growth in this space.

Investment outcomes, just like harvests, are impacted by many factors out of our control. But just like farmers tending to their fields, who constantly seek out better ways to harvest more wheat and less chaff, active managers tending to their portfolios seek better ways to identify the winners and separate them from the losers. In a space like small caps, in which the probability of being exposed to unprofitable firms is higher, tapping into the knowledge and analysis of small-cap managers could be a way for investors to find more wheat than chaff in the markets.

[1] Source: Bloomberg, Janus Henderson Investors. Data as of 30th June 2024.

There is no guarantee that the past trends will continue, or forecasts will be realised. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned. Past performance does not predict future returns.

Cost of capital: The cost of funding the operations of a business, including debt financing. Interest rates can have a significant impact on cost of capital, as it directly relates to how much it costs a company to borrow.

Earnings per share (EPS): The bottom-line measure of a company’s profitability, defined as net income (profit after tax) divided by the number of outstanding shares.

Economic cycle: The fluctuation of the economy between expansion (growth) and contraction (recession), commonly measured in terms of gross domestic product (GDP). It is influenced by many factors, including household, government and business spending, trade, technology and central bank policy. The economic cycle consists of four recognised stages. ‘Early cycle’ is when the economy transitions from recession to recovery; ‘mid-cycle’ is the subsequent period of positive (but more moderate) growth. In the ‘late cycle’, growth slows as the economy reaches its full potential, wages start to rise and inflation begins to pick up, leading to lower demand, falling corporate earnings and eventually the fourth stage – recession.

Market-cap weighted index: A form of stock market index where each component stock is given weight equivalent to its total market capitalisation, relative to the total market cap value of all stocks in the index.

MSCI World Small Cap Index: A index that captures the performance of small cap companies across 23 developed market countries.

Passive investments: An investment approach that involves tracking a particular market or index. It is called passive because it seeks to mirror an index, either fully or partially replicating it, rather than actively picking or choosing stocks to hold. The primary benefit of passive investing is exposure to a particular market with generally lower fees than you might find on an actively managed fund.

Small cap stocks: Companies with a valuation (market capitalisation) within a certain scale, eg. $300 million to $2 billion in the US, although these measures are generally an estimate. Small cap stocks tend to offer the potential for faster growth than their larger peers, but with greater volatility.

Stock selection: An investment process based on the assessment of a range of factors, leading to the conclusion that a particular stock may meet the required parameters for investment (eg. income, growth, etc).

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.