| At Janus Henderson, we believe integrating environmental, social, and governance (ESG) considerations that financially impact returns makes us better investors. Our ESG approach is thoughtful, practical, research-based, and forward-looking. |

We live in an era characterised by dramatic changes in fiscal and monetary policy across the developed world (Japan the notable exception), political drama (US debt ceiling crisis, Brexit) and seemingly perpetual geopolitical jeopardy.

While the current environment might seem anomalous to many today, markets are hardly strangers to periods of higher interest rates and inflationary pressures. It might seem counterintuitive, but while this environment naturally comes with greater uncertainty, what we have seen in response is much more rational market behaviour. We attribute this to the end of a long period that was dominated by interventionist policy, such as quantitative easing (QE), and characterised by a low discount rate/low risk-free rate environment.

While interest rates continue to rise, it may be that we are not far from the ‘peak’, in terms of monetary policy. And while political drama seems never far away, uncertainty provides the opportunity for active investors to show their value. The financial ecosystem continues to evolve, and investors’ strategies should reflect that.

What is the rationale behind demand for alternatives?

Alternatives have grown steadily in prominence over the past few years – a trend that we expect to continue as the investment world adapts to innovative new applications and technology. The barriers to entry that previously prevented participation, such as the need for significant capital requirements, also continue to fall – increasing the ‘democratisation’ of alternatives. But as the range of tools to enhance portfolio construction has grown, the potential role that alternatives can play in a portfolio has evolved. We currently see three main categories.

First, we see alternatives being used as a substitute for the role traditionally played by long-only equity products. Generally, these investors are aiming to replicate, or at least achieve close to equity-like levels of return, but without taking the associated levels of risk.

The rationale for this strategy makes a lot of sense. It would be very hard to ignore the event-driven volatility and bear markets that have characterised markets over the past few decades. From Black Monday and the dot-com bubble, through the Global Financial Crisis, Brexit and COVID, periods of acute investor uncertainty have never been far away. An alternative asset class, with the potential to deliver equivalent levels of returns without the same levels of volatility, has obvious appeal.

Second, we have seen periods where alternatives have substituted in a portfolio for fixed income or similar assets. These investors tend to be operating on a risk-budget basis (looking to control their portfolio risk) rather than necessarily targeting a return.

Third, we see investors allocating more of their portfolio to alternatives as a diversifying asset class in its own right. This final category is probably the one we feel most comfortable with. A means by which investors can unlock and diversify new sources of uncorrelated returns, while also seeking to limit volatility and potential downside risk.

Alternatives as a mitigator

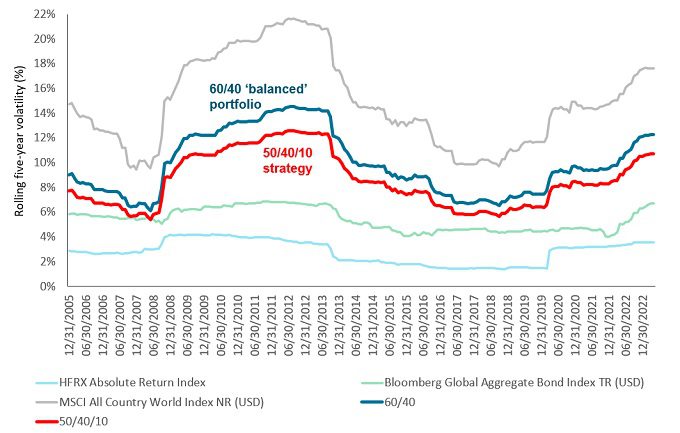

The use of alternatives as a potential ‘shock-absorber’ (via diversification) has been front and centre in the fight for investors’ attention over the past few years, a trend that we believe is accelerating. We have seen first-hand the mitigative impact on volatility of allocating to alternatives through pandemics, recessions, referendums, elections, and more. Even a small allocation to alternatives can potentially help to reduce overall volatility across a balanced portfolio over the longer term (Exhibit 1).

Exhibit 1: Alts can help investors to fine-tune their strategies

Allocating just 10% to alternatives can potentially help to reduce volatility

Source: Bloomberg, Janus Henderson PCS Research. Chart illustrates the rolling monthly five-year volatility of a portfolio split 50/40/10 between equities, bonds and alternatives, relative to a more traditional ‘60/40’ strategy allocated to just equities and bonds. The equities portion of this theoretical model is the MSCI All-Country World Index NR (USD). The bonds portion is the Bloomberg Global Aggregate Bond Index TR (USD). ‘Alternatives’ are represented by the HFRX Absolute Return Index. All underlying indices are shown for comparison.

Note: This chart does not reference any existing strategy. It is used here solely as an illustrative tool to indicate the potential impact of allocating to alternatives on portfolio volatility. Past performance does not predict future returns.

The final piece is alpha generation – the potential to deliver performance ahead of benchmark returns (when adjusted for risk). That is something that has attracted investors’ interest, in terms of allocating to liquid alternatives strategies. The potential to add a source of consistent, stable absolute performance can look pretty attractive in certain environments.

It is not necessarily a question of ‘knocking it out of the park’ when it comes to the performance of liquid alternative strategies. Consistency of process is absolutely critical, being able to deliver predictable return characteristics over a long period of time.

That consistency, during difficult markets, and difficult economic cycles, is where alternatives can truly justify investors’ interest. Picking the right strategy for your needs is paramount, but given the wealth of opportunities available to investors, at a time when the barriers to entry are lower than they have ever been, the future of alternatives looks bright.

Fiscal/monetary policy: Connected with government taxes, debts and spending. Government policy relating to setting tax rates and spending levels. It is separate from monetary policy, including interest rates, typically set by a central bank.

Quantitative easing (QE): An unconventional monetary policy used by central banks to stimulate the economy by boosting the amount of overall money in the banking system.

Risk-free rate: The rate of return of an investment with, theoretically, zero risk. Typically defined as the yield on a three-month US Treasury bill (a short-term money market instrument).

Discount rate: This measure “discounts” future cash flows to a present value. Measuring the present value of future earnings allows an investor to have a better idea of the value of a business today.

Long-only equities: Shares in a company that are purchased in the expectation that they will rise in value over time.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. Higher volatility means the higher the risk of the investment.

Bear markets: A financial market in which the prices of securities are falling. A generally accepted definition is a fall of 20% or more in an index over at least a two-month period.

Downside risk: An estimation of how much a security or portfolio may lose if the market moves against it.

Alpha: A measure that can help determine whether an actively managed portfolio has added value in relation to risk taken relative to a benchmark index. A positive alpha indicates that a manager has added value. Alpha is the difference between a portfolio’s return and its benchmark’s return after adjusting for the level of risk taken.

Liquid alternatives: Securities (in this case, alternatives) that can be easily bought or sold in the market.

Important information:

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

MSCI All Country World Index℠ reflects the equity market performance of global developed and emerging markets.

Bloomberg Global Aggregate Bond Index is a broad-based measure of the global investment grade fixed-rate debt markets.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.