Get Britain building again: housing associations key to delivery of Labour’s promise

Labour’s promise of delivering 1.5m homes necessitates the delivery mechanism of housing associations. Credit analyst Richard Taylor and portfolio manager James Briggs from the Janus Henderson Global Credit Team discuss how this has changed the prospects for the sector.

9 minute read

Key takeaways:

- The Labour government’s promise to deliver 1.5 million homes by 2030 could provide a boost to housing associations, even if not in the form of a cash injection.

- These companies have been expected to achieve more with less, which has eroded their credit and financial metrics – but the tide is turning.

- This punchy housing target spells opportunity, but also risk in additional pressure on the delivery of homes. We expect it to separate the better from the worse companies, which requires an active lens to evaluate opportunities.

An undersupplied market

The UK housing market has been undersupplied for decades. The current need is estimated at 240k houses per annum. Average housing starts over the last decade have been below the current estimated need at 184k per annum, which is 24% below the 75-year average of 242k per annum.1 Such pressure is driven by the growth in UK population, which has increased by around 4% over the last decade.2

The decline in housing starts has been driven almost exclusively by subdued social housing activity, with 36k homes built per annum versus the 75-year average of 92k per annum. In comparison, private activity is broadly unchanged versus the average over this period. Social housing therefore now makes up 20% of housing starts. The primary delivery mechanism is housing associations, rather than local councils. From the 1950s to 1980s, this was around 50%,1 although this of course must be viewed against a different economic climate characterised by lower home ownership (versus renting).

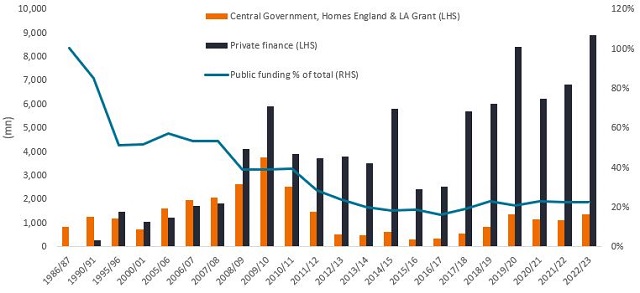

Housing associations were public bodies at that time, but they are now privatised. The government is core to the financial and credit profile of housing associations as well as their operational risk. What has changed over time is the funding supplied by central government, as reflected by Homes England grants falling from £2.5bn in 2010/11 to £1.1bn in 2020/21 (Figure 1).

Figure 1: Housing association gross investment expenditure, including private finance, in England

Source: Chartered Institute of Housing, 2024 UK Housing Review, DLUHC local authority level capital expenditure and receipts, Homes England annual report, National Audit Office (2022) Affordable Homes Programme since 2015 and authors’ estimates of private finance, which should be considered indicative only, 2024.

Labour’s promise

Given this reliance on social housing, political infrastructure is a key determinant in meeting housing targets. While the Conservative Government had to contend with the hangover from the Global Financial Crisis (GFC), COVID and the fallout from the Truss mini-budget, it is hard to argue that housing was a top priority despite the launch of the Affordable Housing programme in 2016. The UK has had 16 housing ministers since 2013, which has resulted in an absence of long-term housing policies and pressure to allocate the required funding. The newly elected Labour Party has been more vocal on making housing a priority, targeting 1.5 million new homes over the next five years, with Prime Minister Keir Starmer and deputy Prime Minister Angela Rayner both pushing this agenda:

Change the face of housing…..make no mistake, we need to reform housing in this country. Sir Keir Starmer

The next Labour Government will deliver the biggest boost to affordable, social and council housing for a generation. Angela Rayner

Starmer has pledged to ignore the protests from local residents, declaring himself to be a YIMBY (yes in my backyard). Chancellor Rachel Reeves has reaffirmed Starmer’s pledge to develop poor quality and ugly parts of the green belt, aka brownfield (the ‘grey’ belt). England’s ‘green’ belt makes up nearly 13% of its land.3 According to Knight Frank research, less than 1% of the ‘green’ belt can be defined as ‘grey’ belt.4 When ‘grey’ belt land is released, plans must target 50% affordable housing. Mandatory housing targets also look set to be introduced and councils which do not meet these could be forced to build on ‘grey’ belt land.

Doing more with less

So how has punchy housing targets and the absence of sufficient funding impacted housing associations? They have had to increase balance sheet debt (resulting in a higher loan-to-value – LTV – rates and lower interest coverage (ICR ratios), plus public debt issuance. This has materially eroded their financial and credit metrics, as margins have been squeezed, affecting free cashflow (FCF) and culminating in credit rating downgrades over the past two years.

Additionally, business risk has increased as they seek to cross-subsidise funding social housing starts with proceeds from market-facing activity, such as housing development. Consequently, their business model has expanded, from asset manager to manager, developer and service provider. There has been an accompanying reduction in SHL (social housing lettings) income, with the sector average on a downward trajectory over 2019 to 2023, according to Janus Henderson estimates.

Nevertheless, lower rental income has also depressed housing budgets and the ability to buy new sites for development. In the 2015 Summer Budget, social housing rents were reduced by 1% per annum from 2016 to 2020 and the housing benefit cap was reduced from £26-23k. This pressure coupled with costs to meet higher building standards from a safety and decarbonisation standpoint in energy performance certificate (EPC) performance. According to reports, the Local Government Association (LGA) and National Housing Federation (NHF) are also urging the government to open up the Building Safety Fund, which pays for the removal of dangerous cladding, to social housing providers. We have seen the cost of fire remediation work result in rating downgrades for housing association credits.

Changing fundamentals

A government that has housing starts as their priority and more generous funding should reduce pressure on housing associations’ business risk profiles, balance sheets and FCF margins. Such ‘generous’ funding does not have to translate into more funds, rather subsidising more of the new build cost. Money earmarked for social housing has actually been returned to government as housing association grant applications have declined due to them covering so little of the total building costs – and therefore risk. We analyse the prospects for the sector in the context of the following areas:

- Overall revenue: This is set to rise in our view as the pressure on rental income eases, given Labour’s comments on housing, and an increase in development, reflecting our view that housing associations will be the primary mechanism to implement Labour’s proposed new build plans.

- SHL Revenue: Higher social rents (return to inflation-linked increases for social rents from April 2024), providing an increase in highly visible stable income from SHLs.

- Operating Margin: Improvement is expected as revenue rises on a skinnier cost base. SHL margins also set to increase.

- Capex: Expenditures are likely to remain high due to increased fire safety costs/development, new carbon reduction targets and, more broadly, general maintenance costs, which have been postponed in the face of poor rental income and pressure to build more units. Additional funding could help to meet these costs.

- Credit fundamentals: LTV and ICR metrics are set to improve from additional funding to ease pressures and as development sales roll in.

Valuations are also key when assessing companies to invest in and their re-rating potential from upgrades. Given the sector’s purpose of providing housing to those who cannot access housing otherwise, there is also an ESG angle to investing in housing associations.

More than a social factor

Building a two-bedroom house takes around 80 tonnes of carbon, equivalent to 24 flights to Hong Kong. In addition, domestic use of fossil fuels to heat homes and water in the UK accounts for around 13% of the country’s total carbon emissions, which means that social housing contributes to 2.5% of this.5 However, it is worth noting that standards of energy efficiency are already higher in social housing compared to the private sector. Most social rented dwellings (70%) had an EPC rating of C and above, compared to 45% in private rental sector and 43% in owner-occupied.6 The government has set a target for all social homes to have a minimum EPC rating of C by 2030.

We believe that providing affordable and sustainable housing is a core function of a government in the western world and that the outsourcing of funding for this creates moral hazard and is arguably not practical. The interest rate environment and progressive cuts in government funding discussed earlier have raised legitimate concerns around the ability of housing associations to meet demands for greater, greener supply. We believe supporting housing associations in their engagement with the government is important. Their role goes beyond providing affordable accommodation to other functions such as helping to reskill unemployed people and debt management. Housing associations have a significant role in the community and aid social mobility.

Dispersion to increase

We believe that housing associations can play a pivotal role in solving the UK housing crisis and offer investors the opportunity to benefit from improving credit fundamentals alongside a positive ESG story. Housing associations typically haven’t defaulted in the past as the government has stepped in to encourage the takeover of distressed entities by stronger ones. But as we have seen with local councils, implied support is not equivalent to an explicit guarantee. With the new homes target from Labour in focus, this could pressure business models and separate the ‘wheat from the chaff’, the stronger from the weaker companies. This is why taking an active approach with focused credit research to investing in the sector makes sense. Given the better prospects, we are dialling up our risk within the HA sector in the investment grade space. We are focused on names with high social housing lettings (SHL) exposure, solid ICR, operating surplus and FCF, as dispersion in the sector is set to increase.

Footnotes

1 Source: Berenberg, 4 June 2024.

2 Source: Worldometer, 1 August 2024.

3 Source: UK government figures, 31 March 2023.

4 Source: Knight Frank, 26 January 2024.

5 Source: Climate Change Committee, 2019, based on social housing accounting for around 19% of UK’s total housing stock, according to JP Morgan.

6 Source: English Housing Survey 2022/2023, 18 July 2024.

Interest Coverage ratio: This financial ratio is used to determine how well a company can pay the interest on its outstanding debts.

Loan-to-value ratio: ratio of the value of the home you want to buy and the loan you’ll need to buy it, shown as a percentage.

Operating surplus: For an enterprise, this measures the difference between revenue and expenditure, – i.e. the surplus or deficit – accruing from production. It is calculated before taking account of any interest, rent or similar charges payable on financial or tangible non-produced assets borrowed or rented by the enterprise, or any interest, rent or similar receipts receivable on financial or tangible non-produced assets owned by the enterprise.

Free cashflow: This represents the cash that a company has left over after accounting for cash used to support operations and maintain its capital assets.

Operating margin: The final metric takes account of the profit a company makes on sales after accounting for the direct costs involved in earning those revenues. It is the ratio of operating income to ne sales, expressed as a percentage.

Capex: Capital expenditure is the money a company spends on long-term assets to support business growth and expansion.

Balance sheet: A financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time. Each segment gives investors an idea as to what the company owns and owes, as well as the amount invested by shareholders. It is called a balance sheet because of the accounting equation: assets = liabilities + shareholders’ equity.

Balance sheet strength: A company’s financial position.

Credit rating: An independent assessment of the creditworthiness of a borrower by a recognised agency such as Standard & Poors, Moody’s or Fitch. Standardised scores such as ‘AAA’ (a high credit rating) or ‘B’ (a low credit rating) are used, although other agencies may present their ratings in different formats.

Performance dispersion is the distribution of medium-term price trends in any chosen investment universe.

IMPORTANT INFORMATION

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

There is no guarantee that past trends will continue, or forecasts will be realised.

Past performance does not predict future returns.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- CoCos can fall sharply in value if the financial strength of an issuer weakens and a predetermined trigger event causes the bonds to be converted into shares/units of the issuer or to be partly or wholly written off.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.