Fact vs fiction: The European securitisation market in the post GFC era

The myth that securitisations cannot be easily understood emerged during the GFC. As part of a series on European securitised, Head of Secured Credit Colin Fleury looks at how securitisations work and how the industry has changed since the crisis.

8 minute read

Key takeaways:

- The myth that securitisations are ‘opaque’, ‘complex’ and ‘risky’ started in the Global Financial Crisis (GFC) era, where optimistic collateral default expectations and some securitisations’ leveraged risk to the housing collapse perpetuated this belief.

- The securitisation industry has undergone significant structural change since the GFC, as tightening of standards and better transparency has revived confidence in the market and improved its robustness.

- The European securitisation market has grown to be equal in size to the European high yield market and represents a diverse opportunity set in terms of jurisdiction and underlying collateral for multi-asset investors.

What are securitised assets?

Securitised debt’ is a term for financial securities which are secured by contractual cash flows from assets such as mortgages, credit card receivables and auto loans. The pool of underlying assets is financed by the issuance of bonds which are structured into slices, or tranches, with different risk profiles based on their ranking in the securitisation capital structure. Cashflows from the underlying loans (in the form of interest and principal payments) are then used to pay the interest and repay the principal on the various securitisation tranches – subject to the credit performance of the loan pool.

The process to turn these everyday assets into financial instruments is called ‘securitisation’. The term Asset-Backed Securities or ‘ABS’ is also often used as a catch-all term for these instruments. For simplification, we generally refer to ‘securitised’. As part of an educational series into European securitised, we separate fact versus fiction by showing how the process of securitisation is actually quite straightforward and credit quality can be improved through credit enhancement. We also consider how the industry has changed since the GFC.

How are assets securitised?

The securitisation process typically begins with a financial institution (or originator) selling a pool of assets to a special purpose vehicle (SPV). The SPV is a separate legal entity for which the sole function is to purchase those receivables. The SPV finances the acquisition of those assets by raising different tranches of debt and equity capital.

The SPV then utilises the cashflows generated by the purchased assets to pay back investors and provide them with a return. Securitisation creates ‘bankruptcy remoteness’, which ultimately transfers the risk of the securitised collateral away from the asset originator, with all exposure transferred to investors. This process generates efficiencies within the financial system by freeing up balance sheets to fund new lending activities.

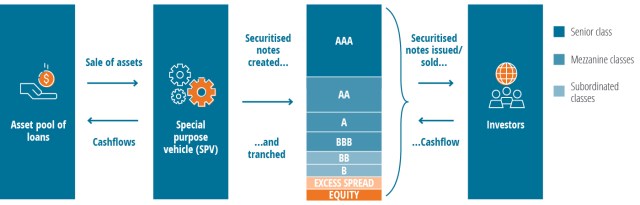

Figure 1: The securitisation process

For illustrative purposes only. Excess spread represents net interest earned on a loan portfolio after securitised debt interest and expenses.

The SPV issues securities in order of priority to sell to investors. Deal structures can range from simplistic single debt tranche structures to more complex multi-tranche offerings that span the credit spectrum, depending on their credit quality, cashflows and diversification. As seen in Figure 1, in the event of underlying loan portfolio defaults, the equity component of a securitised structure provides protection to the bonds, with losses only realised by the debt tranches in order of priority (AAA last) once the equity has been fully written off.

Improving credit quality

This form of credit enhancement, called ‘tranching’, also creates a waterfall structure, where cashflows are allocated to the higher-rated tranches first and work their way down to the lower-rated tranches. To compensate for the extra risk, investors in the junior-ranked tranches receive a better yield than those higher up the capital structure. Tranching also provides investors with the flexibility to tailor portfolios to specific risk-return objectives, as it determines the specific repayment and credit profiles for a particular bond in the structure.

Other forms of credit enhancement to improve the credit quality of securitised debt include the following:

- over-collateralisation, where the face value of the underlying assets in the collateral pool is higher than the bonds it backs, providing protection to all tranches.

- excess spread, often the first line of defence in absorbing potential losses, is where the interest earned on collateral pool exceeds the coupon payable on the securities and expenses.

- cash reserve funds, often funded by the originator designed to cover interest and expense shortfalls and losses in the collateral pool.

Securitised structures can be fully or partially amortising, where either immediately or after a period of time, repayments from the underlying collateral portfolio are used to repay principal. This can play an important role in risk reduction: the gradual repayment of debt tranches means investors take less borrower refinancing risk than corporate bonds, which typically have a large principal payment at maturity.

How has European securitised changed since the GFC?

Securitisation issuance began in the 1970s when home mortgages started to be pooled by US government-backed agencies. Banks then issued European securitisations in the late 1980s, as a funding tool to free up capital and transfer credit risk off their balance sheets. The market then experienced significant growth in the run up to the 2007/08 global financial crisis (GFC), with total outstanding placed securitised debt – issuance that is sold to investors rather than retained by issuing entities – in Europe reaching about €1 trillion in 20101. Since the crisis, annual European supply has hovered broadly around €100bn, with issuance down markedly from pre-GFC levels. However, this has recently begun ticking up with 2024 H1 primary issuance doubling to almost €104bn compared to the same period in 20232.

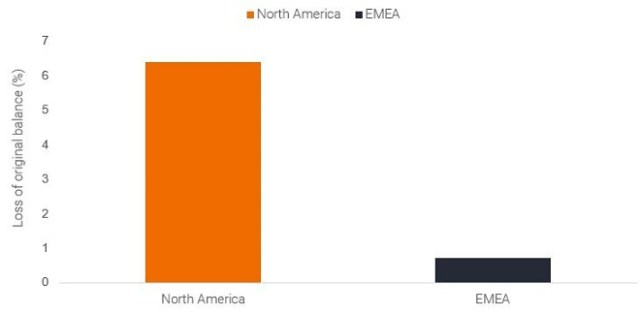

There’s no denying that the perception of securitised has been tainted by the performance of US residential mortgage-backed securitisations (RMBS) through the GFC. Back then, strong investor demand and overly optimistic collateral default expectations – backed by credit ratings agencies – fuelled unsustainable lending practices. A lack of appropriate checks and balances, particularly around some US sub-prime borrowers, resulted in large capital losses which spiralled upward through securitised structures. This was particularly the case for collateralised debt obligations (CDOs) – securitisations of certain financial assets – that purchased higher risk debt tranches of US mortgage securitisations, leveraging their risk to the US housing collapse that occurred. By contrast, European securitised performed significantly better, showing more resilience than US counterparts throughout the GFC (Figure 2).

Figure 2: European securitised fared better than North America through the GFC

Source: Fitch Ratings, February 2021. Losses shown are those of the 2000-2008 vintages. Losses in the charts include both losses realised and still expected to be realised at the time of the report. Past performance does not predict future returns.

Since the GFC, the industry has gone through significant structural change. There has been widespread focus placed on the risk management practices of investors, tightening of asset origination criteria, stronger transparency requirements, and tightening of rating agency standards, returning confidence to the market and increasing its robustness.

From 2019, the implementation of the European Securitisation Regulation (SECR) has further tightened requirements around the asset class. For example, originators are now required to have “skin in the game”, retaining at least a 5% stake of a securitised asset’s net economic interest3 to guard against the type of moral hazard seen in the lead-up to the GFC. The SECR regulation also established clear guidelines requiring the production of loan level data in standardised formats, with full disclosure of data required. It introduced a voluntary “Simple, Transparent, Standardised” label for securitisations4, where issuance of these high-quality straightforward structures has grown over the last few years5. Consequently, there has been increased standardisation and transparency in structures.

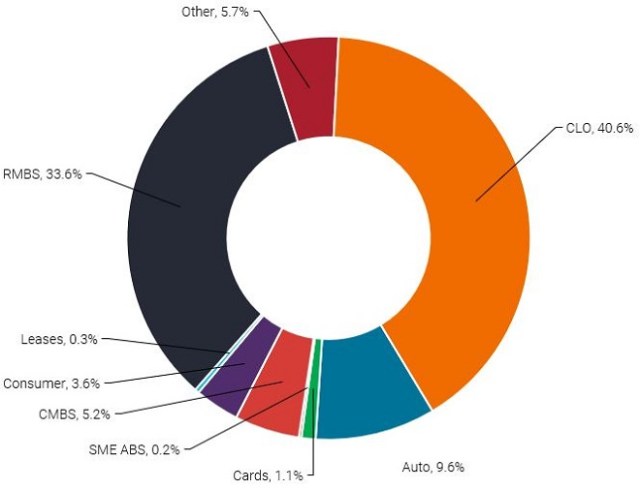

The European securitised market has since grown into a liquid, sizeable market. In Europe, outstanding placed issuance equated to €558 billion as at the end of March 20246, where collateralised loan obligations (CLOs) make up the largest proportion at 41% of the market (Figure 3). This is around the same size as outstanding debt of the European high yield market7.

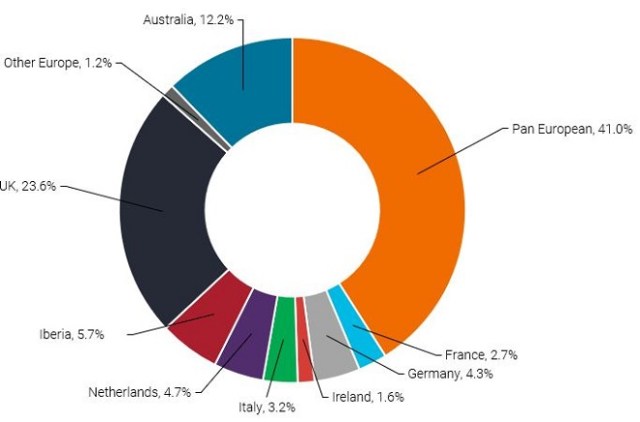

Figure 3 & 4: The European securitised market by sector and jurisdiction

Source: Source: Janus Henderson Investors, JPM & AFME, as at 31 March 2024. European placed issues outstanding. ABS = Asset-Backed Securities, CLO = Collateralised Loan Obligation, CMBS = Commercial Mortgage-Backed Securities, MBS = Mortgage-Backed Securities, RMBS = Residential Mortgage-Backed Securities, SME ABS = Small and Medium sized Enterprises Asset-Backed Securities. Allocations are subject to change without notice.

The opportunity set in the European securitised market is therefore diverse, offering access to many jurisdictions (and different macro drivers) and various underlying collateral types. Some collateral, like leases or credit card receivables, is linked to the consumer, offering ‘real economy’ exposures that are different from risk exposure in corporate credit. Investing in the European securitised sector can therefore help access diversification in portfolios and in our next instalment in the series, we look at the key features of the European securitised market in more detail.

Footnotes

1 Source: AFME, Q4 2010 report.

2 Placed issuance = €100bn. Source: AFME Securitisation Data Report Q4 2023 & 2023 Full Year, 28 March 2024. H1 issuance includes Australian debt denominated in Euros.

3 The interest measured at the origination, with the retention of no less than 5 % of the nominal value of each of the tranches sold or transferred to investors (ESMA).

4 Criteria on simplicity include requirements on homogeneity of the underlying exposures, underwriting standards and collateral credit quality. Standardisation requirements include early amortisation triggers, performance trigger-based reversion to sequential paydown, and “appropriate” mitigation of interest rate and currency risks. Transparency requirements include provision of a liability cash flow model and at least five years’ historical default and loss data for assets similar to the transaction’s underlying collateral. S&P Global. Meeting such criteria means the assets are eligible for preferential capital treatment.

5 Source: AFME, as at the end of 2023.

6 Source: Janus Henderson Investors, JPM & AFME, as at 31 March 2024.

7 Source: Bloomberg data, as at 27 August 2024. EU HY = €553 billion.

Residential mortgage-backed securitisations (RMBS): Collections of residential mortgages with similar characteristics that are packaged together.

Primary market/secondary market: Newly issued bonds are traded on the primary market, with issuers selling their bonds directly to investors to raise capital (borrow). The purchase or sale of any existing bond occurs in the secondary market, between investors.

Credit enhancement: A strategy in securitisation to improve the credit quality and ratings of asset-backed securities. It’s a key part of securitisation transactions and is used to reduce the risk of default for the issuer.

Collateralised Loan Obligation (CLO): Portfolios of loans – which tend to be rated below investment grade – issued to corporates.

Commercial Mortgage-Backed Securities (CMBS): Packages of commercial property mortgages spanning a range of sectors, such as shopping centres and retail parks; offices; industrials such as logistics warehouses; and the hospitality sector, including hotels.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.