Understanding Commercial Mortgage-Backed Securities (CMBS)

The commercial real estate sector is an integral component of the U.S. economy, supporting the development of the country’s office, industrial, retail, and housing infrastructure. CMBS provide access to capital for purchasers of commercial properties, while simultaneously giving investors the opportunity to invest in debt instruments linked to commercial real estate.

Explore how you can access CMBS through our ETFs

Securitized Income ETF

For investors looking for income diversification and higher yield potential.

What are commercial mortgage-backed securities?

Commercial mortgage-backed securities are collections of commercial mortgage loans that are bundled together, or securitized, and sold to investors. CMBS structures help to link the financing needs of real estate buyers with investors’ capital.

Like residential mortgage-backed securities (RMBS), CMBS can be classified as either agency or non-agency, depending on whether they carry a guarantee from a government agency.

Size and history of the U.S. CMBS market

The U.S. CMBS market is a large, well-established market that has been around since the early 1990s. At around $1.8 trillion in market capitalization, CMBS is bigger than the U.S. high-yield market and is the second-largest securitized market in the U.S. behind agency mortgage-backed securities (MBS).

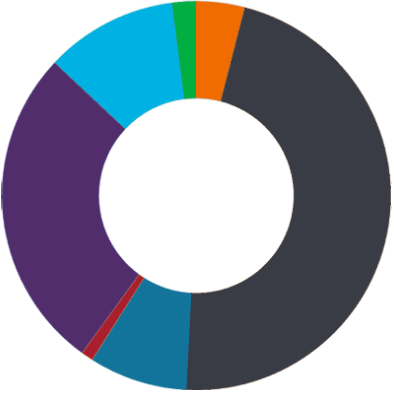

CMBS makes up a $1.8T portion of the $14.6 trillion U.S. securitized market

Source: Bank of America, as of December 31, 2024.

Key characteristics of CMBS

1

Compelling yield opportunities

CMBS may offer attractive yields compared to corporate bonds of similar credit quality and maturity.

2

Commercial real estate exposure

The U.S. CMBS market gives investors access to five main subsectors of commercial real estate: Multifamily housing (e.g., apartments, prefabricated homes), office, industrial (e.g., warehouses, data centers), retail, and hospitality (e.g., hotels, casinos, time shares).

3

Interest rate optionality

CMBS may allow investors to diversify their portfolio’s interest rate exposure by way of floating and fixed-rate securities.

4

Investor-friendly loan provisions

Prepayment penalties for borrowers ensure that prepayment risk in CMBS remains very low. When prepayments occur, investors may receive compensation from the borrower.

5

Strong credit ratings on offer

CMBS may help to increase a portfolio’s overall credit quality due to the availability of tranches with strong credit ratings.

Risk considerations for CMBS

Credit risk: Like other fixed income securities, CMBS are exposed to the risk of default.

Extension risk: If a CMBS loan matures in a difficult refinancing environment, the servicer may modify or extend the loan instead of foreclosing. In such scenarios, investors could get their principal back later than originally expected.

Recovery risk: Unlike residential real estate loans, commercial mortgages are non-recourse loans, meaning only the attached property can serve as collateral for the loan. This may result in lower recovery rates (i.e., the percentage of defaulted debt that can be recovered by a lender) for CMBS versus RMBS.

Why Janus Henderson for securitized investing?

Expertise and leadership: Our portfolio management team's nearly 60 years of combined experience, backed by a dedicated global team, stands as a testament to our success. This unparalleled expertise ensures we remain at the forefront of securitized investment management.

Market dominance: In the U.S., Janus Henderson is the 3rd-largest provider of active fixed-income ETFs and also the 8th-largest in the overall active ETF market.

Source: Morningstar Asset Flows as of December 31, 2024.

$44.6B

Firmwide Securitized assets under management

Source: Janus Henderson Investors as of December 31, 2024.

Note: Firmwide assets include securitized products available outside of the U.S. and securitized portions of other fixed-income strategies.

Dedicated securitized expertise

Head of US Securitised Products | Portfolio Manager

Head of Structured and Quantitative Fixed Income | Portfolio Manager