Understanding Mortgage-Backed Securities (Agency MBS)

The housing market plays an integral role in the U.S. economy, historically contributing around 15%-18% to annual GDP. Underpinning the U.S. residential housing market are 30-year fixed-rate mortgages, the vast majority of which are guaranteed by one of three government agencies. These mortgages form the basis for a major global fixed income sector: Agency MBS.

Access MBS through our ETFs

Mortgage-Backed Securities ETF

For investors seeking above market total returns by modeling inefficiencies in borrower behavior.

Securitized Income ETF

For investors looking for income diversification and higher yield potential.

What are agency mortgage-backed securities?

Mortgage-backed securities are collections of residential mortgages with similar characteristics that are packaged together, or securitized, and sold to investors. The cash flows (principal and interest payments) from the underlying mortgage loans are passed through to investors.

Agency MBS are issued or guaranteed by one of three government or quasi-government agencies: Fannie Mae, Freddie Mac, and Ginnie Mae.

Size and history of the agency MBS market

Agency MBS have been around since the late 1970s. With their government backing, the market has grown into the second-largest and second most-liquid bond market in the world, behind only the U.S. Treasury market.

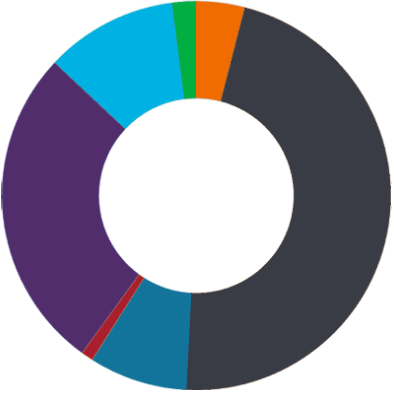

Agency MBS make up about 27% of the Bloomberg U.S. Aggregate Bond Index (U.S. Agg) and about 12% of the Bloomberg Global Aggregate Bond Index (Global Agg). Therefore, most investors with U.S. or Global Agg-like portfolios have exposure to agency MBS.

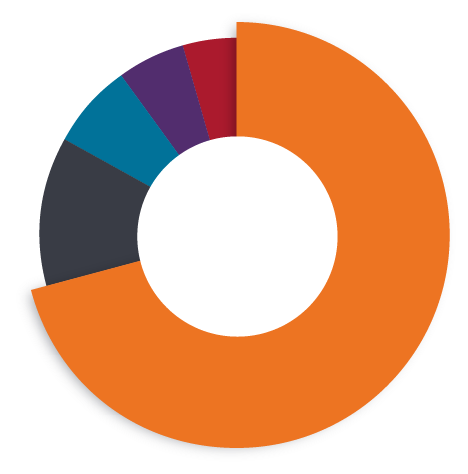

Agency MBS makes up a $9.1T portion of the $14.6 trillion U.S. securitized market

Source: Bank of America, as of December 31, 2024.

Key characteristics of agency MBS

1

Strong credit ratings

Due to their government guarantee, all agency MBS carry the U.S. government’s AA+ credit rating. Therefore, the risk of principal loss is negligible.

2

Improved absolute returns versus U.S. Treasuries

On an absolute basis, agency MBS have outperformed U.S. Treasury bonds over longer investment horizons due to their earning an additional yield, or spread, over Treasuries.

3

Defensiveness

In times of market stress, higher-rated, long-duration bonds such as agency MBS tend to outperform as investors seek safety. In fact, Agency MBS was one of the best-performing asset classes through the Global Financial Crisis, with the Bloomberg U.S. MBS Index recording annual returns of +6.9%, +8.4%, and +5.9% in 2007, 2008, and 2009, respectively.

4

Low correlation to equities

MBS have historically exhibited very low correlation to equities, making them a good diversifier for multi-asset portfolios.

5

Diversification of risk exposures

While government and corporate bonds expose investors to a single borrower, agency MBS are made up of millions of individual mortgages, providing investors with a high degree of borrower diversification.

Risk considerations for agency MBS

Prepayment risk is the primary fundamental risk for agency MBS, as borrowers may pay off or refinance their mortgage at any point, which would negate the future income on that mortgage. The uncertainty about when, or if, a borrower will prepay a mortgage is known as prepayment risk. MBS pay an additional yield, or spread, above the yield on a comparable U.S. Treasury to compensate investors for this risk.

Other risks affecting agency MBS include sensitivity to changes in interest rates, sensitivity to interest rate volatility, and changes in supply and demand.

Why Janus Henderson for MBS?

Expertise and leadership: We believe much of the value in active bond asset management comes from security selection. Characteristics of individual securities can vary widely, and it is the role of the asset manager – ideally armed with decades of experience and sophisticated analytic systems – to pick securities that offer better risk-reward potential and combine them into a portfolio with the yield and risk targets investors seek.

We offer access to the growing and complex securitized market through our single-sector and full coverage products.

Market dominance: In the U.S., Janus Henderson is the 3rd largest provider of active fixed income ETFs and also the 8th largest in the overall active ETF market.

Source: Morningstar Asset Flows as of December 31, 2024

$44.6B

Firmwide securitized assets under management

Source: Janus Henderson Investors as of December 31, 2024.

Note: Firmwide assets include securitized products available outside of the U.S. and securitized portions of other fixed-income strategies.

Dedicated MBS expertise

Global Head of Securitised Products | Portfolio Manager

Head of Structured and Quantitative Fixed Income | Portfolio Manager

Portfolio Manager | Securitised Analyst