Trump 2.0: Adapting fixed income to the uncertain path ahead

In the face of the Federal Reserve's recent strategic interest rate cut and the looming potential of a Trump administration's influence on economic policies, fixed income investors are navigating a complex landscape. Client Portfolio Manager Lead for EMEA, Kareena Moledina explores how investors could use different sector dynamics to their advantage.

13 minute read

Key takeaways:

- The US Federal Reserve’s modest interest rate cut reflects its attempt to steer the economy towards a ‘soft landing’, but the path ahead is uncertain given the incoming Trump administration and policy-making firepower from a Republican-controlled Congress.

- The potential resurgence of inflation due to fiscal policies under Trump could prompt the Fed to reassess its neutral rate, influencing long-term interest rate expectations.

- For fixed income investors, this suggests the potential need to prepare for a prolonged period of higher interest rates. Capturing balanced diversification, attractive yield, compelling relative value and high credit quality could help mitigate risks associated with market volatility and policy shifts.

The Fed continued to navigate its way to a ‘soft’ landing that would avoid recession by delivering a 25-basis point interest rate cut as markets expected in November. Justifying the more modest pace of easing compared to September, US Federal Reserve Chairman Jerome Powell claimed the central bank was not yet declaring a victory on inflation. He stated that there was no rush down to neutral rate – the interest rate where prices are stable and full employment is achieved – and the right way to find neutral is “carefully and patiently”.

Add to this concoction of what markets have had to contend with, a second Trump presidency and a Republican clean sweep across both houses could make the inflation conundrum tricky for the Fed. A Trump administration could see higher inflation and higher growth in the US, making it more challenging for the balancing act between employment and inflation. For fixed income investors, how can portfolios be positioned to ride out this uncertainty? And where is the elusive neutral rate?

Inflation still hot, but jobs cooling

As a reminder of the inflation risk – and precisely assuming it isn’t any risk anymore as we progress through easing cycles globally – US headline CPI annual inflation rate rose to 2.6% in October from 2.4% in September, but this was broadly as expected. Excluding more volatile food and energy prices, core monthly CPI rose by 0.3%, but the annual rate was steady at 3.3%. However, this was the third monthly consecutive rate of 0.3%.

After the inflation print, futures markets priced in a 76% probability of a rate cut at the Fed’s next meeting in December.1 However, long-end Treasury yields also rose which could possibly reflect inflation fears given the numbers and the Trump pro-growth agenda. The US inflation backdrop ultimately reflects the resilience of the US economy and a job market that has stayed afloat but cooled enough for the Fed to make its move. Powell highlighted in his press statement that further cooling of the labour market was not necessary to achieve its 2% inflation target.

If the labour market stays too strong – perhaps with a Trump-related boost – then the inflationary pulse means rates may have to stay ‘higher for longer’. Recent jobs data released in October has been softer, but has been distorted due to worker strikes and the hurricanes that hit the US south-east. On the flip side, the Fed can, and will in our view, respond with stimulative policy should we see a spike in unemployment or significant economic weakness. We believe this backdrop supports our base case of a ‘soft’ economic landing and may provide a cushion to the downside risks to fixed income sectors should the economy weaken more than anticipated. However, the risk of growth undershooting has receded with an incoming Trump administration, as he plans to stimulate US growth through tariffs, tax cuts and fiscal spending.

The Trump 2.0 effect

While the Fed would argue that the US leadership will have no impact on interest rate decisions, any changes in policy will undoubtedly impact the economic outlook. Trump has proposed wielding more influence over the Fed’s interest rate decisions, possibly pressuring them to push rates lower. Powell in his press conference was asked whether he would resign if Trump asked him to and there was a resounding “no” and reticence to discuss the incoming Presidency in any shape or form.

Analysts, however, predict Trump’s pro-growth fiscal policies and tariff proposals could reignite inflationary pressures in the US, slowing the pace of interest rate cuts from the Fed. He has mooted up to 20% universal tariffs on all imports from countries outside the US and a 60% tariff on imports from China. Trump’s policymaking power has been strengthened in the Republican sweep across both houses, enabling policies that need Congressional approval to pass through more easily, such as the more stringent tariff measures.

Supply disruption from tariffs could also impact growth in the short term and boost inflation. However, it can be argued that such inflation effects could wash out, given growth readjusts as consumers purchase less with higher prices and as tariffs are a one-off (rather than persistent) price increase. The key for the Fed then is how sticky these dynamics and the second-order effects are – as to whether it looks through such inflation effects or pivots to a more hawkish direction to prevent higher inflation expectations being anchored. There is then the possibility that it drives the Fed to change their expectations around the neutral policy rate, pushing it higher than anticipated currently.

Futures markets now show policy rates settling around 3.8% by the end of 2025.2 Considering where the market is saying the neutral rate is there is a lot priced into the forward curve, but we’re not convinced it’s a smooth journey to that – particularly given that the inflation path in a Trump 2.0 era could be much bumpier. For fixed income investors, this could mean positioning for a potentially ‘higher for longer’ rate environment, such as through duration positioning or where yield is captured on the yield curve. For example, capturing attractive risk-adjusted carry at the front end of the yield curve through floating rate debt could help navigate a ‘higher for longer’ rate environment.

Navigating the uncertainty

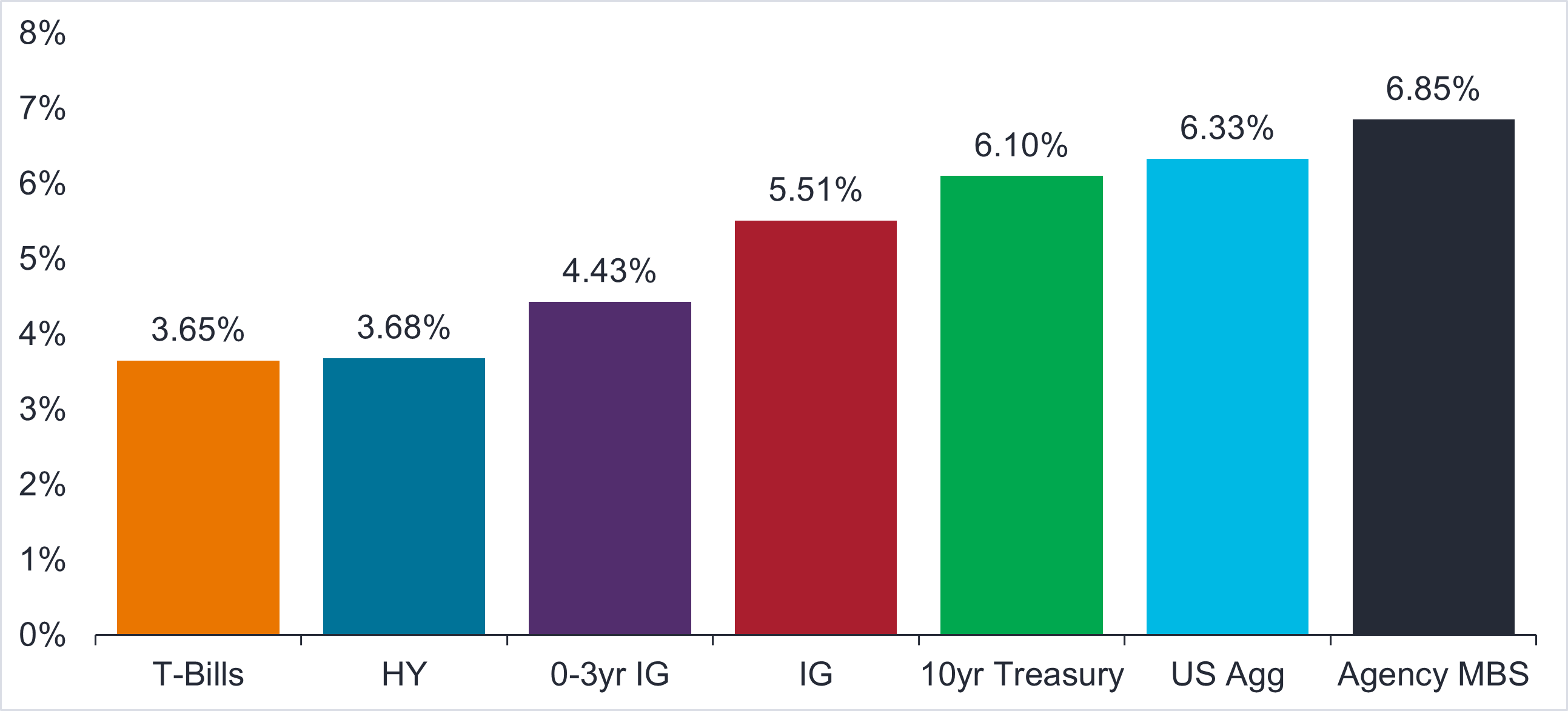

While uncertainty remains, what we can be sure of is that we are now in a rate-cutting cycle. For investors that are still sitting in cash, it makes sense to allocate out of cash into fixed income assets. Looking historically at returns in the first 12 months following rate cuts, most fixed income sectors have experienced positive performance (Figure 1). History shows that cash underperforms other fixed income instruments once the rate-cutting cycle begins. If you’re still parked in cash, you’re losing out on the income provided by higher-yielding bonds, as well as potential price gains as yields decline. So, with the Fed cutting cycle underway, it is not about whether you hold fixed income but how much and in which sectors.

Figure 1: The rate reset provides a better starting point

Fixed income 1-year returns after the first rate cut

Source: Janus Henderson Investors, Morningstar and Bloomberg as 31 December 31 2023. “T-Bills” represents the Bloomberg US Treasury Bill 1-3M Index, “IG” represents the Bloomberg US Corporate Bond Indices, “HY” represents the Bloomberg US High Yield Index, “Agency MBS” represents the Bloomberg MBS Index, “US Agg” represents the Bloomberg US Aggregate Bond Index and “10yr Treasury” represents the FTSE Treasury 10yr Index. The rate cut periods included for the 1-year average forward returns begin in July 1990, July 1995, September 1998, January 2001, September 2007 and August 2019.

Note: Past performance does not predict future returns. There is no guarantee that past trends will continue.

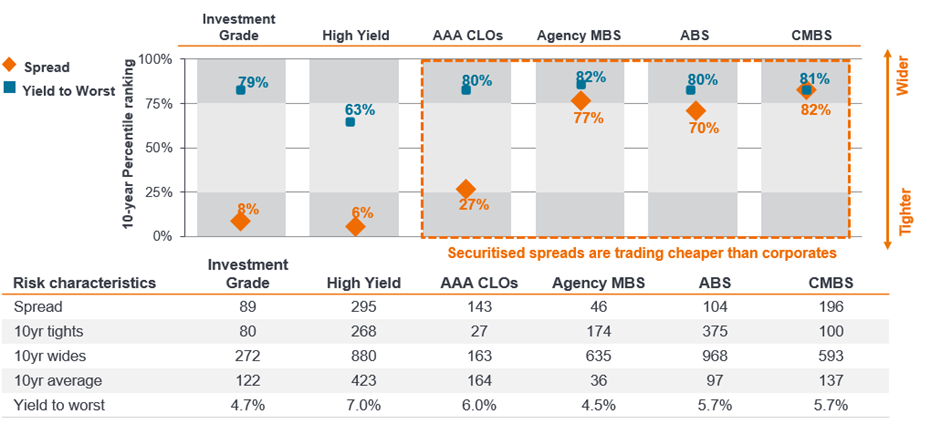

As yield spreads are now generally towards the tighter levels of historical averages across fixed income, capturing compelling relative value can help hedge against any spread widening that arises from market uncertainty. Capturing the high yields available across various fixed income sectors can also act as a buffer to portfolio performance during volatile markets.

Figure 2: Relative value favours securitised over corporates

Source: Janus Henderson Investors, Morningstar and Bloomberg as at 30 September 2024. “Investment Grade” represents the Bloomberg US Corporate Bond Index, “High Yield” represents the Bloomberg US High Yield Index, “AAA CLOs” represents the JPM CLOIE Index, “Agency MBS” represents the Bloomberg MBS Index, “ABS” represents the Bloomberg ABS Index and “CMBS” represents the Bloomberg CMBS Index. There is no guarantee that past trends will continue, or forecasts will be realized. AAA CLO spreads (Discount Margin) experienced a one day spread widening of 26bps on 28 June 2023, when J.P. Morgan transitioned the referenced rate from LIBOR to SOFR. We adjusted spreads prior to this date in the calculation of spread percentiles. AAA CLO spread represents Discount Margin to Worst prior to 01 April 2024, and Discount Margin to Maturity after. Actual results may vary, and the information should not be considered or relied upon as a performance guarantee.

While investment grade (IG) corporate bond spreads are trading on the tighter side compared to their 10-year history, yields remain near historic highs (Figure 2). As many companies have deleveraged, corporate credit fundamentals are still in relatively good shape – with high interest coverage ratios in both investment grade and high yield compared to history.3 Default rates remain low, and we have seen improvements in credit quality at the lower end in the high yield space. The share of distressed debt in the dollar HY index – CCC rated – is just 4%, the lowest level in over 30 months.4 Consumer spending on the most part remains healthy and falling rates should help relieve refinancing pressure on corporate issuers. That said, potential volatility from geopolitical risks, data releases, or other risk-off events, means fundamentals and active security selection is key to identify issuers well-positioned for both cyclical and structural trends to generate alpha.

When rates are falling, investors also tend to seek out asset classes with higher spreads to compensate. For example, asset-backed securities (ABS) and collateralised loan obligations (CLOs), are among the few areas where both spreads and yields remain attractive. ABS spreads are trading around the 70th percentile (wider relative to history) over a 10-year period, versus 8th percentile for more mainstream corporate bond markets. In Europe, ABS is a floating rate asset class and therefore provides some hedge if we see the ‘higher for longer’ narrative play out and interest rate volatility. Relative to corporates, attractive yield is available without needing to compromise on credit quality.

Agency mortgage-backed securities (MBS) – issued or guaranteed by one of three government or quasi-government agencies: Fannie Mae, Freddie Mac, and Ginnie Mae – is another compelling sector that offers a lot of value. We’re seeing historically wide spreads relative to IG corporates, and where investors can access a yield advantage over Treasuries for an equivalent government-backed, AA-rated asset. A reduction in interest rate volatility, central bank support for the asset class at big dislocations, like we saw during the pandemic and bank buying in the space, are further positive technicals – supply and demand dynamics – that benefit the outlook for MBS. If the US hits a recession, a non-credit risk agency MBS allocation in a portfolio could provide a buffer for performance.

Carry is king

The current market is more of a “carry” and a bond pickers’ market, where investors will get rewarded by clipping still relatively high coupons and selecting individual bonds as opposed to making macro bets. Yields are attractive across multiple fixed income sectors, so the focus for investors, in our view, needs to be how to build that yield and carry, i.e. in a diversified, high-quality way, to prepare portfolios for the uncertain path ahead in terms of rates and other economic outcomes. While central banks are tackling a similar battle against inflation, we expect to see differences around the pace and destination of central bank rate cuts. We believe investors should be thinking globally to exploit the relative value opportunities created by diverging policy.

One route to achieving high-quality diversified carry is tapping both the primary and secondary markets to capture those opportunities with the most compelling risk-adjusted return potential. One example is investment grade CLO tranches which provide minimal credit risk and high-quality carry. As shown in Figure 3, Europe AAA CLO debt is offering yield pick-up equivalent to European BBB IG Corporates in the secondary market and superior in the primary market – so capturing higher quality assets for equivalent or better yield. However, each opportunity needs to be evaluated on its own merit.

Figure 3: Characteristics of European CLOs versus European investment grade credit

Source: Janus. Henderson, Bloomberg and ICE Indices (ER00 and ER10-ER40 subgroups). 3 – For CLO total yield is calculated as credit spread plus 4 year Euro SWAP rate for secondary CLO and 6 year Euro SWAP rate for primary CLO; for corporate credit used Yield to Worst. Source: Janus Henderson, Bloomberg and ICE Indices (ER00 and ER10-ER40 subgroups). 4 – For CLO used average life estimates; for corporate credit used Spread Duration. Source: Janus Henderson and ICE Indices (ER00 and ER10-ER40 subgroups) 5 – For CLO used total number of deals in the CLO universe, around 90 new deals were issued YTD 2024; for corporate credit used number of issues. Source: Janus Henderson and ICE Indices (ER00 and ER10-ER40 subgroups). 6 – For CLO used total outstanding of Euro 240bn of which around 60% are AAA CLO tranches; for corporate credit used market value. Source: Janus Henderson and ICE Indices (ER00 and ER10-ER40 subgroups)

Note: Data as at, 25 Oct 2024. Yields may vary and are not guaranteed. The above are the Team’s views and should not be construed as advice and may not reflect other opinions in the organisation. 1 – For CLO used Discount Margin, for corporate credit used Swap OAS. Source: Janus Henderson and ICE Indices (ER00 and ER10-ER40 subgroups). 2 – For CLO income is calculated as credit spread plus 1 year Euro SWAP rate; for corporate credit used running yield (coupon divided by current price).

The insurance portion of rates, if the US did enter a recession, is not being priced into the rates markets at this time. As interest rates decline, duration will benefit portfolios. It can be used for risk hedging purposes where duration can help to offset equity market volatility and hedge against downside risks. Shorter-maturity bonds are likely to benefit from interest rate cuts, as the yield curve typically steepens following rate cuts. Securitised assets also tend to have lower spread duration compared to IG corporate credit; the sensitivity of a bond’s price changes for a given change in its credit spread.

No landing or hard landing?

Despite some heightened inflationary risks with Trump 2.0, the soft-landing scenario is still our base case, but there are uncertainties on where the economy is heading. We are now seeing employment data soften – which is necessary to meet the Fed’s inflation target – but this is making us more cautious on the probability of a recession. A recession is not completely off the cards in our view. The Fed has potentially an even harder challenge in now navigating the ‘soft landing’ it anticipates given the impending policy changes.

Most yields and spreads are pricing in no recession on the horizon. For investors that have a broad investment universe, when compared to corporate bond spreads in the US, securitised assets are pricing in a greater probability of recession. For example, ABS sub-sectors such as auto and consumer finance are pricing in a much higher probability of a recession and continue to trade cheap.

Portfolio construction through dynamic asset allocation and security selection will be key going forward. To cushion against macro volatility and potential risk sell-offs, investors could diversify risk exposures through capturing a broader opportunity set. Investors could balance their portfolios by allocating to sectors that are pricing in recession risk versus those that are pricing in no-recession risk; and maintain high overall credit quality in portfolios. Having duration helps to balance a lower, but marginal probability of recession.

1Source: Bloomberg, 14 November 2024.

2Source, Bloomberg, as at 14 November 2024.

3Source: Factset, Goldman Sachs Global Investment Research, 10 October 2024.

4Source: Deutsche Bank, Bloomberg Finance LP, ICE Indices, 14 November 2024.