Diversification feels like a relatively new concept. It is often hailed as one of the main tenets of modern finance. But advice to diversify dates back thousands of years, and more modern notions may be missing some important nuances lost to time.

The Bible suggested cross-sectional diversification directly, thousands of years ago, in Ecclesiastes 11:2:

Invest in seven ventures, yes, in eight; you do not know what disaster may come upon the land.

Modern thinking about diversification tends to focus on this kind of cross-sectional diversification, or risk management across assets, as well, but often overlooks two other important dimensions.

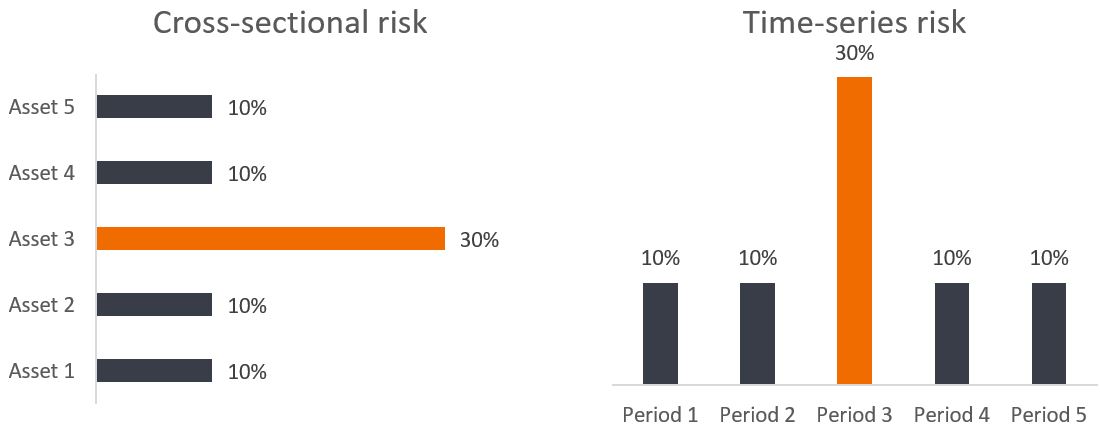

One of those overlooked dimensions is time. The benefits of diversifying across assets are simple: You do not want all your risk to come from one single bet. The benefits of diversifying across time are precisely the same. Exhibit 1 illustrates the similarity between cross-sectional and time-series risk. Just as you don’t want the bulk of your performance across assets to be determined largely by the performance of a single security, you also shouldn’t want the bulk of your performance over time to be determined largely by the performance during a single period.

Exhibit 1: Cross-sectional vs. time-series risk: Assessing risk across assets and time

Source: Janus Henderson Investors. Hypothetical example for illustrative purposes only.

Although modern diversification has focused more on diversification across assets rather than across time, the Bible mentioned both. In fact, time-series diversification was advised just two verses later, in Ecclesiastes 11:6: “Sow your seed in the morning, and at evening let your hands not be idle, for you do not know which will succeed, whether this or that, or whether both will do equally well.”

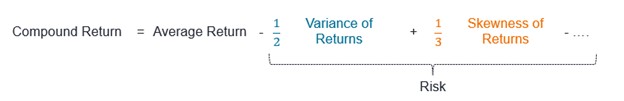

Diversifying across time is one key dynamic risk-management technique designed to potentially enhance the growth rate of the portfolio or, equivalently, its terminal value. Consider the mathematics of compound returns (Exhibit 2).

Exhibit 2: The mathematics of compound returns

Source: Janus Henderson Investors.

The math shows that there are two ways to increase compound return: Forecast the average return, which is difficult, competitive, and fragile; or dynamically forecast and manage risk, which can be feasible, scalable, and robust.

Time series diversification can help reduce the variance of returns and hence reduce the risk drag of compound returns, but the skewness of returns hints at the missing third dimension of diversification: direction.

All risk is not equal, however. Downside risk is different from upside risk. If you are told an asset has a volatility of 20%, you don’t have enough information to decide whether to buy or sell it. Is it mainly upside volatility, or downside volatility? Building a portfolio to maximize upside volatility while minimizing downside volatility can help enhance the skewness of returns, or the convexity of your portfolio, and hence lead to better compound returns.

This approach to enhancing compound returns based on mathematics, economic reasoning, and logic is the essence of our philosophy for adaptive diversification. Diversification of downside risk is good because it reduces the risk that one asset might dominate and bring you devastating losses that are hard to recover from. But diversification of upside risk may come at a cost because it limits the potential gains of a winning investment.

Of course, there may be nothing new under the sun. A verse right in the middle of the two verses above seems to hint at direction in diversification (down versus up, south versus north):

Whether a tree falls to the south or to the north, in the place where it falls, there it will lie.

Coincidentally, the phrase “nothing new under the sun” itself is from Ecclesiastes 1:9.

These, then, are the three dimensions of diversification: across assets, across time, and across direction. Many investment solutions do not diversify at all. Some diversify across assets. A few diversify across time. How many also diversify across direction?

Diversifying across direction is not easy; part of the challenge is the data source. Risks change every day, and what matters most are future expectations of those risks, not backward-looking realized risks from the past. You wouldn’t attempt to drive by looking in the rear-view mirror.

We have found an exceptional source of forward-looking risk signals: the options market. Options are essentially insurance contracts; investors pay premiums today to insure against the risk of experiencing future losses with puts, or against the risk of missing out on future gains with calls.

Both risks matter. Failing to sell before the bust hurts because of the tangible loss, but failing to buy before the boom hurts just as badly because of the opportunity cost.

Exhibit 3: The left tail risk of suffering a large loss and the right tail risk of missing out on a large gain

The data from options markets represent orders of magnitude more information than spot prices alone, and it is easily and publicly available. The risk information embedded in options represents important, valuable insights that can help steer a portfolio. Despite all this, most investment solutions do not incorporate options’ insights at all. That’s like driving in an unknown territory without GPS or crowd-sourced navigation.

It’s important to note that options do not have to be traded to take advantage of the secrets they contain. When they signal that equities have less downside risk and a higher ratio of upside risk to downside risk, a portfolio could adjust its equity holdings directly without necessarily trading any options at all. When the overall attractiveness of the portfolio is lower than average, its risk can be reduced. When certain regions appear more attractive than others, their weight can be increased. None of this requires trading in the options markets; it merely requires listening to them.

We call our approach adaptive diversification, and it aims to diversify appropriately across all three dimensions: assets, time, and direction. We have been following this approach for nearly a decade, and yet it is simultaneously a true innovation in modern finance – and an ancient timeless classic.

IMPORTANT INFORMATION

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Options (calls and puts) involve risks. Option trading can be speculative in nature and carries a substantial risk of loss.

Any risk management process discussed includes an effort to monitor and manage risk which should not be confused with and does not imply low risk or the ability to control certain risk factors.

Volatility measures risk using the dispersion of returns for a given investment.