INVESTING IN THE PRESENT FOR OUR FUTURE

Our Global Sustainable Equity strategy focuses on companies aligned to the development of a sustainable economy.

INVESTING IN THE PRESENT FOR OUR FUTURE

Our Global Sustainable Equity strategy focuses on companies aligned to the development of a sustainable economy.

Established expertise

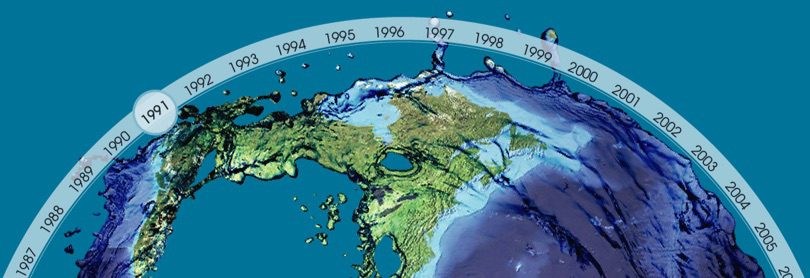

Built upon a 30-year strategy history, the Global Sustainable Equity Team are leaders in investing in global companies that support the development of a sustainable global economy.*

Investing with intentionality

Seeks to invest in companies that contribute to the development of a more sustainable global economy, through their revenue alignment with ten environmental and social themes.

High conviction, low carbon

The high conviction portfolio of 50-70 companies aligns each holding to the UN Sustainable Development Goals and carries a carbon footprint that is 85% less than that of the MSCI World Index.**

*The Global Sustainable Equity Strategy was launched in July 1991.

**Source: Janus Henderson Investors, ISS Climate Impact data, as at 31 January 2021.

“Our team has three objectives: to seek to deliver outstanding investment returns to clients; to be regarded as leaders in sustainable investing; and, as active investors, to play a part in making the world a better place.”

- Hamish Chamberlayne, Head of Global Sustainable Equities, Portfolio Manager

A process built on three decades of experience

Discover our funds

How to invest

Global Sustainable Equity Active ETF (ASX:FUTR)

FUTR can be bought and sold in the same way you buy or sell a share:

- Via your broker or a licenced financial adviser, or

- Directly through your online trading account

Global Sustainable Equity Fund

- Read the Product Disclosure Statement and

Additional Information Guide - Print and complete the Application form

- Send the completed application form to:

Janus Henderson Australia Client Services

GPO Box 804

Melbourne VIC 3001 Australia

Alternatively, speak to a financial planner.

Researcher ratings*

Fund facts

| Asset class | Equities |

| Benchmark | MSCI World Index (net dividends reinvested) in AUD |

| Exchange (ETF) | ASX |

| ASX code (ETF) | FUTR |

| Year end | 30 June |

| ARSN | 651 993 118 |

| Inception date | September 2021 |

| Investment Manager | Janus Henderson Investors UK Limited |

| Portfolio Manager | Aaron Scully, CFA Hamish Chamberlayne, CFA |

| Management fee | 0.80% p.a. |

| Performance fee | Nil |

| Indirect costs | 0.00% p.a. |

| Distribution frequency | Semi-annually (if any) |

| Distribution reinvestment plan (ETF) | Full participation available |

*For adviser use only. The Zenith Investment Partners (ABN 27 103 132 672, AFS Licence 226872) (“Zenith”) rating (assigned September 2021) referred to in this document is limited to “General Advice” (s766B Corporations Act 2001) for Wholesale clients only, as defined in section 761G of the Corporations Act 2001 (Cth). This advice has been prepared without taking into account the objectives, financial situation or needs of any individual and is subject to change at any time without prior notice. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Past performance is not an indication of future performance. Zenith usually charges the product issuer, fund manager or related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessments and at http://www.zenithpartners.com.au/RegulatoryGuidelines

*The rating issued 05/2022 is published by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec). Ratings are general advice only, and have been prepared without taking account of your objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and Lonsec assumes no obligation to update. Lonsec uses objective criteria and receives a fee from the Fund Manager. Visit lonsec.com.au for ratings information and to access the full report. © 2022 Lonsec. All rights reserved.

Key documents

Meet the experts

Hamish Chamberlayne, CFA

Head of Global Sustainable Equity | Portfolio Manager

- 18 years of financial industry experience

- London based

Aaron Scully, CFA

Portfolio Manager

- 23 years of financial industry experience

- Denver based

Related insights

Discover the latest expert insights from the Global Sustainable Equity Team.