U.S. election year: Prioritize trends over politics

Marc Pinto, Head of Americas Equities, and Chris Benway, Director of Research, consider how the U.S. election may influence markets leading up to November, discuss policies worth monitoring as the election draws near, and remind investors to prioritize quality in times of uncertainty.

7 minute read

Key takeaways:

- Despite typical investor anxiety around presidential elections, history shows equities can still generate positive returns in election years.

- This year, broader market drivers – including rates trajectory, economic growth, inflation, and corporate profits – are likely to shape the investment landscape to November, but we’re mindful that rhetoric on a potential contested election could cause uncertainty, and therefore volatility.

- Investors should prioritize companies with solid fundamentals and exposure to powerful secular trends that can transcend the political cycle and thrive regardless of the election outcome.

As the months of 2024 rapidly tick by, U.S. presidential campaign rhetoric is on the rise, and investor anxiety will likely follow suit. In fact, according to our latest Investor Survey, 78% of the mass affluent and high-net-worth investors who took part in the survey expressed concerns about how it will play out.

JHI

The good news is that, despite election jitters, stocks have historically gained ground during election years (see Figure 1). So far in 2024, the market reflects this trend, with the S&P 500® Index up 14.6% year to date as of 13 June.

Figure 1: Market returns during U.S. presidential election years (1937-2024)

Source: Janus Henderson Investors, as of 13 June 2024. Market performance based on S&P 500 Index for the period 1937-2024. “Election years” and “All years” include year-to-date performance through 13 June.

Source: Janus Henderson Investors, as of 13 June 2024. Market performance based on S&P 500 Index for the period 1937-2024. “Election years” and “All years” include year-to-date performance through 13 June.

Strong corporate earnings and secular growth trends have fueled the stock market’s gains this year. But could volatile political rhetoric and uncertainty surrounding November’s outcome disrupt this positive momentum over the next few months?

A risk worth watching: A contested result

One wild card risk to markets is a contested and/or prolonged election result. After all, the market hates uncertainty. Any commentary suggesting it’s a real threat could create bouts of volatility in the coming months, and that volatility would likely continue until a victor is announced.

Apart from the threat of a contested result, election rhetoric seems unlikely to weigh heavily on market sentiment, given both major candidates are offering known policy playbooks and other significant trends are in play this year.

Broader trends driving the market

We expect the year’s biggest market drivers – including the trajectory of interest rates, economic growth, inflation, and corporate profits – to continue shaping the investment landscape over the next several months. Additionally, powerful secular trends like advancements in artificial intelligence (AI) and the burgeoning obesity drug market are poised to maintain momentum, irrespective of the White House occupant.

Those factors, rather than the political race itself, will likely play a larger role in guiding whether investors continue rotating into stocks or take a more defensive posture in the ensuing months.

Policies with economic impact: Tariffs and immigration

Still, we know it’s critical to monitor policy rhetoric and be mindful of potential impacts to specific industries and company fundamentals, as well as the broader economy.

Tariffs, for example, are one area in which candidates have common ground. Both candidates have signaled potential tariff increases, which we’d expect to have inflationary effects, driving up costs of goods sold and prompting companies to raise prices to preserve margins. In general, tariffs could be a net negative for economic growth, acting as tax hikes that raise costs and disrupt supply chains.

Sectors like autos, electronics, and apparel/retail could feel the most pain under an aggressive tariff regime. Many companies are already seeking to mitigate impact by reshoring production or seeking low-cost sourcing alternatives to China via Mexico and Southeast Asia.

Conversely, tariffs may help protect young industries trying to build domestic capacity. Joe Biden’s recent 100% tariffs levied on Chinese electric vehicles (EVs) are aimed at helping U.S. automakers better compete as that market matures. The U.S. has also prioritized boosting domestic manufacturing capabilities in areas where China currently dominates, such as semiconductors and solar panels.

Immigration policy also has broad economic consequences. Restrictive policies could exacerbate already-tight labor markets, potentially leading to higher wages – a significant contributor to overall inflation. This risk appears generally higher under Donald Trump and could disproportionately affect low-wage industries like agriculture, construction, and food service.

Sector-specific considerations

At the sector level, we’ll be closely monitoring a number of policy discussions to assess their potential impact to company fundamentals:

- Healthcare: We expect both parties to make healthcare a priority, though no sweeping, wholesale overhauls are on the horizon. Proposals from both sides will likely aim to lower costs for consumers by targeting drug pricing, insurance markets, and Medicare reimbursement rates. We also anticipate continued debate over the future of the Affordable Care Act (ACA) and potential enhancements to premium subsidies. Depending on the outcome, legislative headwinds could arise for pharmaceutical and insurance companies.

- Financials: Under a Republican administration, investors could expect less stringent regulatory oversight, potentially resulting in more mergers and acquisitions as well as less restrictive policies for banks and other financial institutions. The non-bank lending space – from fintechs to private credit funds – is expected to continue expanding if fostered by fewer regulatory and capital hurdles, faster turnaround times, and more flexibility in creating tailored lending solutions.

- Technology: Persistent antitrust issues around the market dominance of Big Tech firms may linger, especially under a Democratic administration. However, both parties have favored restricting U.S. technology and intellectual property transfers to China, which could drive increased domestic technology capital investment.

- Energy: A second Trump term would likely result in fewer environmental restrictions on fossil fuel production and usage, a positive for traditional oil, gas, and coal companies. There is also some risk that a Republican administration could seek to curtail or walk back certain subsidies and tax credits in the Inflation Reduction Act (IRA), affecting areas like wind, solar, and EV end markets. Conversely, a Democratic presidential victory could bring a doubling down on the U.S.’s transition toward renewable energy sources and climate policy, with less government support for fossil fuels.

Election outcomes and market reactions

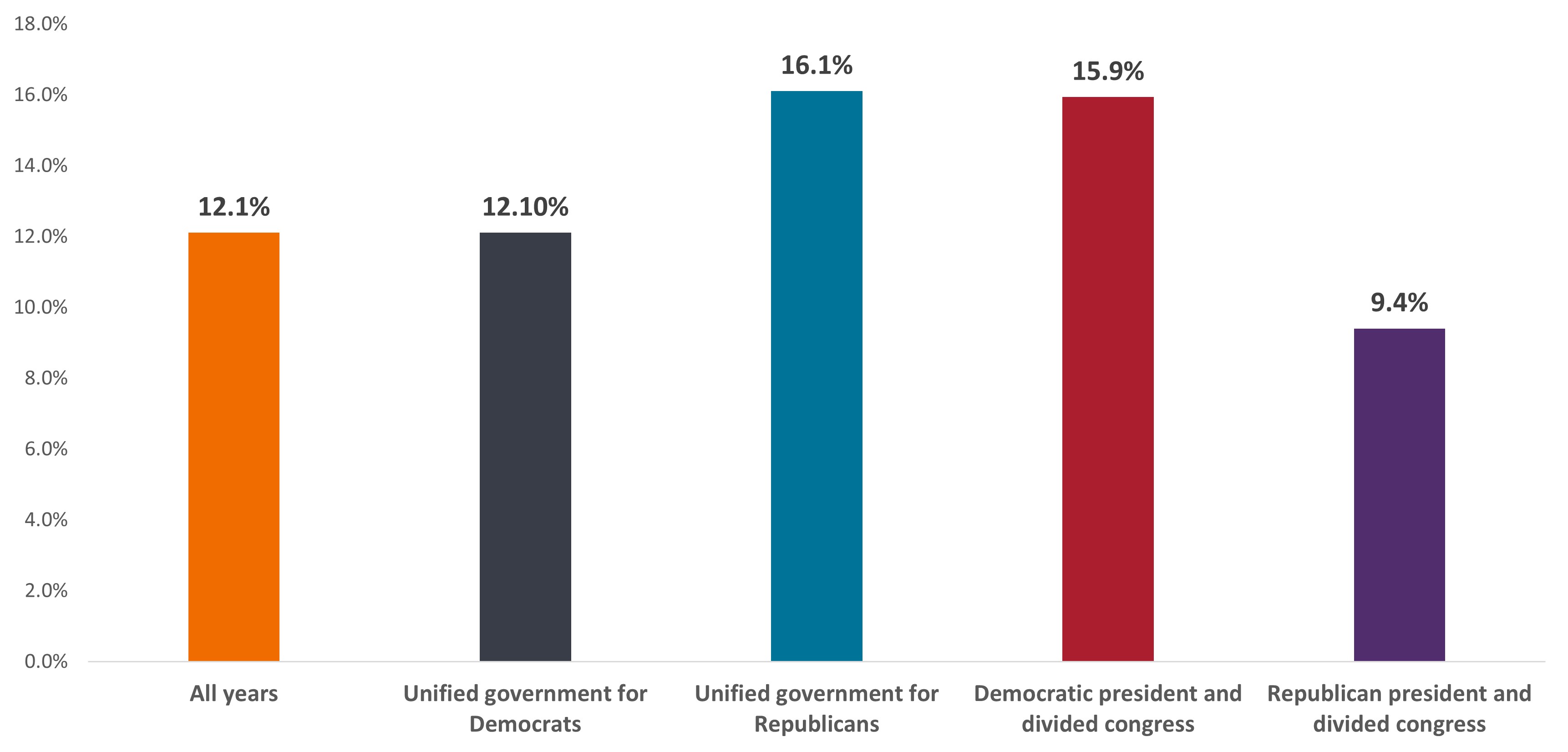

While the above sectors could see varying policy impacts, it does not appear that one party holds a clear advantage for the overall market. The market generally prefers congressional gridlock and a divided government, as it creates less disruption and fiscal policy uncertainty. Yet, S&P 500 performance data shows varying results under different party control scenarios (see Figure 2). This underscores that strong market performance hinges more on supportive economic fundamentals than political party dominance.

Figure 2: Market returns based on party control

Source: Janus Henderson Investors, as of 13 June 2024. Market performance based on S&P 500 Index for the period 1937-2024. Party control designated in the calendar year following elections. Unified government indicates that the party of the incumbent president also controls both houses of Congress. Divided government indicates that the party of the incumbent president does not control both houses of Congress.

Keep the big picture in focus

While proposed policies and contested-result rhetoric are worth monitoring in the coming months, given the range of plausible political outcomes, we think investors would be wise to focus on big-picture market drivers. Trends like productivity growth from digital transformation, AI, and automation advances; rising emerging markets demand; and healthcare and clean energy innovations may have a larger influence on the market’s ultimate winners and losers than who ends up occupying the White House.

In our view, investors should seek to identify companies best positioned to capitalize on those trends, which we expect to persist regardless of the election outcome. In particular, companies with quality fundamentals – low-cost leaders with substantial scale, strong balance sheets, and efficient capital deployment – will be better positioned to weather margin pressures under any political regime compared to weaker competitors.

The upcoming election season will undoubtedly bring substantial political noise. But maintaining a long-term perspective focused on company fundamentals can help investors effectively navigate this period of heightened uncertainty.

S&P 500® Financials Index comprises those companies included in the S&P 500 that are classified as members of the GICS® financials sector.

Volatility measures risk using the dispersion of returns for a given investment.

IMPORTANT INFORMATION

Health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

Energy industries can be significantly affected by fluctuations in energy prices and supply and demand of fuels, conservation, the success of exploration projects, and tax and other government regulations.

All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson believe that the information is correct at the date of publication, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information.