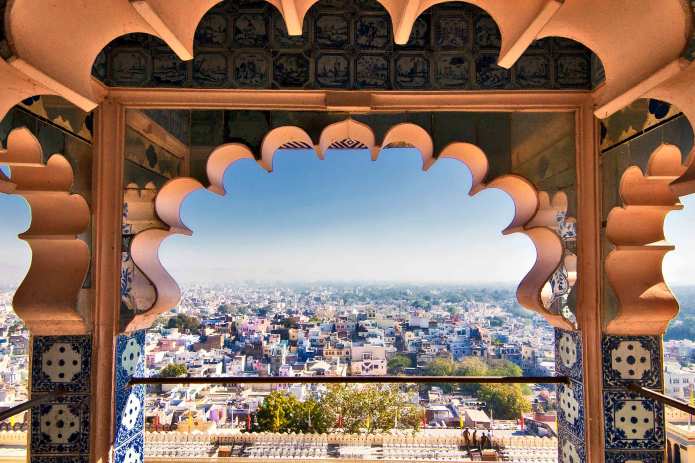

In an era where globalization appears to be on the wane, the landscape for investing in emerging markets (EM) is shifting. A dispersion of economic prospects should result in both winners and losers. Consequently, investors seeking to access the powerful secular growth themes embedded in emerging regions will have to be more discerning. We believe a sweet spot going forward will be EM countries that possess both a reformist government and an innovative private sector. India is one such country.

This nexus, along with India’s favorable demographics, aligns with the country, company, and governance approach that, in our view, serves as an effective framework for EM investors.

Within the EM asset class – especially during a period of economic and policy transition – investors may understandably place considerable emphasis on the macro. We have written extensively on the country aspect with respect to India’s reformist government and will provide a sufficient summary in this note, but our focus will be on the company level – namely the sectors in which well-positioned and innovative businesses thrive. Over the long term, one of the main determinants of equity returns is earnings growth. A favorable macro backdrop and robust corporate governance matter insofar as these factors set the stage for companies to invest, innovate, and grow.

Read more

Emerging market investments have historically been subject to significant gains and/or losses. As such, returns may be subject to volatility.

Foreign securities are subject to currency fluctuations, political and economic uncertainty, increased volatility and lower liquidity, all of which are magnified in emerging markets. Fixed income securities are subject to interest rate, inflation, credit and default risk. As interest rates rise, bond prices usually fall, and vice versa.

Volatility measures risk using the dispersion of returns for a given investment.

All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson believe that the information is correct at the date of publication, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information.