Options markets’ answers to investors’ most pressing questions

Chief Investment Strategist Myron Scholes, Ph.D., and Global Head of Asset Allocation Ashwin Alankar, Ph.D., explain how signals within options markets indicate that artificial intelligence (AI) could be a boon for global productivity, leading to improved profitability and a higher range for real interest rates.

7 minute read

Key takeaways:

- Options markets see near-to-mid-term upside for riskier assets and bonds as a second wave of inflation seems unlikely.

- Given the historical interplay between corporate prospects, inflation, and real interest rates, it’s little surprise that the tidal wave of AI is expected to influence all three.

- With AI likely spurring higher nominal growth while keeping inflation in check through productivity gains, expectations for long-term real interest rates have the potential to rise.

Two questions top of mind for investors are whether there is more juice left in the growth-driven stock rally and whether monetary policy is sufficiently calibrated to engineer a soft landing without igniting a second wave of inflation. We believe a third related question – what is the trajectory and ultimate level of real (i.e., inflation-adjusted) interest rates – merits equal attention.

To gain insight into these issues, we turn to the options markets. In aggregate, these instruments contain powerful, crowd-sourced signals that we believe serve as an effective gauge of market sentiment over three-to-six-month horizons. Option prices accomplish this by measuring the potential for both upside and downside risk across a range of asset classes.

AI: More than just hype

The extended rally in riskier assets has been paced by the enthusiasm surrounding AI. Given that a handful of tech stocks closely associated with this transformative technology are responsible for the lion’s share of equity gains, one can rightly ask whether equities have entered bubble territory. The answer from an options perspective is an unequivocal no.

The near-term upside to downside risk for these leading stocks is skewed toward the former. AI has the potential to be a revolutionary – not evolutionary – technology that could deliver productivity gains not experienced since the adoption of personal computers and the Internet over two decades ago. Furthermore, the upside volatility – i.e., the prospect of future gains – for an equal-weighted basket of stocks is higher than that of market-cap weighted benchmarks. This tells us that investors recognize that AI’s inherent efficiencies will likely flow through the entire economy, aiding companies in developing new products, driving sales, and expanding margins through operational efficiencies. Importantly, this optimism extends to both value- and small-cap stocks, as their upside volatility currently clocks in at above-average levels.

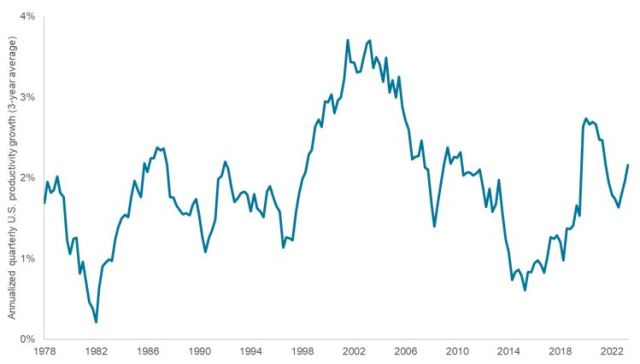

U.S. nonfarm labor productivity growth

After a computer- and Internet-led surge in the early 2000s, productivity downshifted for most of the post-Global Financial Crisis (GFC) era; AI has the potential to catalyze this key ingredient to economic growth.

Source: Bloomberg, as of 15 March 2024

Options are not just bullish on U.S. stocks. Signals embedded within these instruments’ aggregated prices indicate that other international developed markets, namely Japan, appear primed for near-to-mid-term gains. The same holds true for Europe, likely owing to the region’s attractive valuations.

Sticking the landing

With respect to a soft landing, options are signaling that the U.S., along with many other developed markets, is not at risk of recession. Information embedded in options referencing fixed income, real assets such as precious metals, and inflation-protected Treasuries indicate that inflation will continue along its downward path and that a second wave seems unlikely. We believe that the Federal Reserve (Fed) is on the right course by dialing down the dovish rhetoric it invoked in late 2023. While we expect rate cuts in 2024, we believe they will commence mid-year at the earliest. And why not, as the economy proves resilient and certain elements of inflation remain sticky.

Options are signaling favorable upside to fixed income across the yield curve. Particularly attractive are the shorter-dated securities that tend to be more tethered to policy rates. As declining inflation allows central banks to initiate rate cuts, we would expect to see bull steepening, meaning the curve ceases to invert and is replaced with a more normal shape where a term premium rewards investors for holding longer-dated issuance. Shorter-dated European bonds appear particularly attractive, as a sluggish economy indicates that the European Central Bank will be forced to cut before the Fed.

Real rates: The global economy’s barometer

Real interest rates represent the true cost of capital – that is how much borrowers expect to pay and how much investors expect to earn. Real rates have turned positive thanks to aggressive monetary tightening and the subsequent decline in inflation. At present, there is little doubt that at 5.5%, the fed funds rate is at a restrictive level. Progress on inflation means that the U.S. and other developed markets, with the notable exception of Japan, will soon lower policy rates. But at what pace and to what neutral level? We believe the answer has shifted.

The Fed has been explicit that a 2.0% inflation target and a neutral policy rate of roughly 2.5% are appropriate to maintain price stability and maximize employment. We are not so sure – and the reason is AI. This technology’s potential to boost productivity may awaken developed markets’ economic growth from an extended stupor. Deglobalization is also likely to play a role, as regional supply chains and infrastructure must be reengineered to accommodate trade driven by geopolitical considerations rather than the ethos of the unfettered free flow of goods. While deglobalization is inflationary, the degree of onshoring and building is likely to boost nominal gross domestic product in many regions.

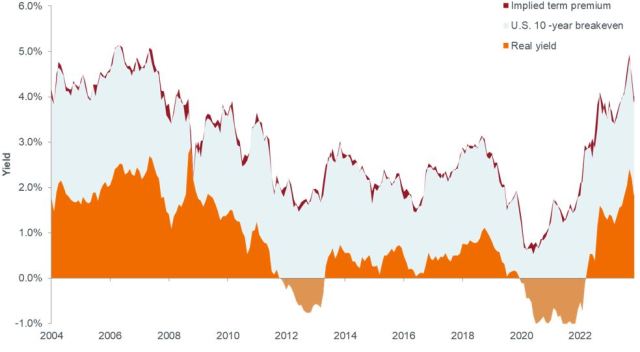

Nominal and real yields on 10-year U.S. Treasury

Inflation-adjusted Treasury yields across the curve have reached levels not seen since prior to the GFC.

Source: Bloomberg, as of 15 March 2024

The upshot is that stronger real economic growth may require real rates materially higher than what management teams and investors have grown accustomed to. We believe that the Fed will continue to pay lip service to 2.0% inflation and a 2.5% neutral rate while being willing to accept levels above these targets. There is precedent. During the initial wave of the early 2000s tech boom, the neutral rate climbed as high as 5.0% as the global economy basked in computing-based productivity gains. By the same token, a fed funds rate in the 3.0% to 3.5% range may appear restrictive but actually reflects an AI-enabled economy.

Connecting the dots

The global economy’s complexity and interconnectedness are on full display as the prospects of AI-centric growth stocks influence global productivity and, thus, inflation and real interest rates. Going forward, we believe that rather than cheap money being a central driver of investment returns, it will be productivity growth. Put another way, the reach for yield will be replaced by business model investing, which favors rigorous analysis, security selection, and active management.

While sanguine options markets indicate upside for riskier assets and Treasuries alike, low levels of implied volatility also mean attractive entry points for hedging risk across asset classes. Such positioning could prove prudent given myriad sources of geopolitical risk and many consequential elections in 2024.

IMPORTANT INFORMATION

Our Adaptive Multi-Asset Solutions Team arrives at its outlook using options market prices to infer expected tail gains (ETG) and expected tail losses (ETL) for each asset class. The ratio of these two (ETG/ETL) provides signals about the risk-adjusted attractiveness of each asset class. We view this ratio as a “Tail-Based Sharpe Ratio.”

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Foreign securities are subject to currency fluctuations, political and economic uncertainty, increased volatility and lower liquidity, all of which are magnified in emerging markets. Fixed income securities are subject to interest rate, inflation, credit and default risk. As interest rates rise, bond prices usually fall, and vice versa.

Hedging strategies attempt to minimize or protect against loss by strategically using instruments in the market to offset the risk of adverse price movements. It involves counterbalancing one transaction against another. Hedging does not prevent negative events, but attempts to reduce the impact of such events. A reduction in potential risk usually means a reduction in potential profits.

Options (calls and puts) involve risks. Option trading can be speculative in nature and carries a substantial risk of loss.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

10-Year Treasury Yield is the interest rate on U.S. Treasury bonds that will mature 10 years from the date of purchase.Inflation-linked bonds feature adjustments to principal based on inflation rates. They typically have lower yields than conventional fixed-rate bonds and decline in price when real interest rates rise.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Volatility measures risk using the dispersion of returns for a given investment.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields. An inverted yield curve occurs when short-term yields are higher than long-term yields.

All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson believe that the information is correct at the date of publication, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information.