Market review

Broad global risk-off moves, reacting to global policy uncertainty, led to stronger bond returns. The Australian bond market, as measured by the Bloomberg AusBond Composite 0+ Yr Index, rose +0.93%.

Financial markets continue to forego momentum, reacting to evolving global policy, both monetary and geopolitical.

The Reserve Bank of Australia (RBA) commenced the easing cycle, lowering the cash rate 25 basis points (bps) to 4.10%. Three-month bank bills were down 13bps, to 4.12%. Six-month bank bill yields ended 9bps lower at 4.21%. Australia’s three-year government bond yields ended the month 8bps lower, at 3.74%, while 10-year government bond yields were 14 bps lower at 4.29%.

Financial markets continue to forego momentum, reacting to evolving global policy, both monetary and geopolitical. This led to yet another month of choppy moves, culminating in lower yields by month end. The rise in uncertainty surrounding broad trade policy is hampering business activity, shown by the drop in the global S&P purchasing manager services indices. US consumer confidence is also being tested by domestic uncertainties, which in turn is pressuring belief about future economic growth. Meanwhile, inflation gauges appear to have based offshore. The US Federal Reserve has noted that they are in no hurry to lower policy as a result. This created an environment of risk aversion and lower yields, favouring longer dated tenors.

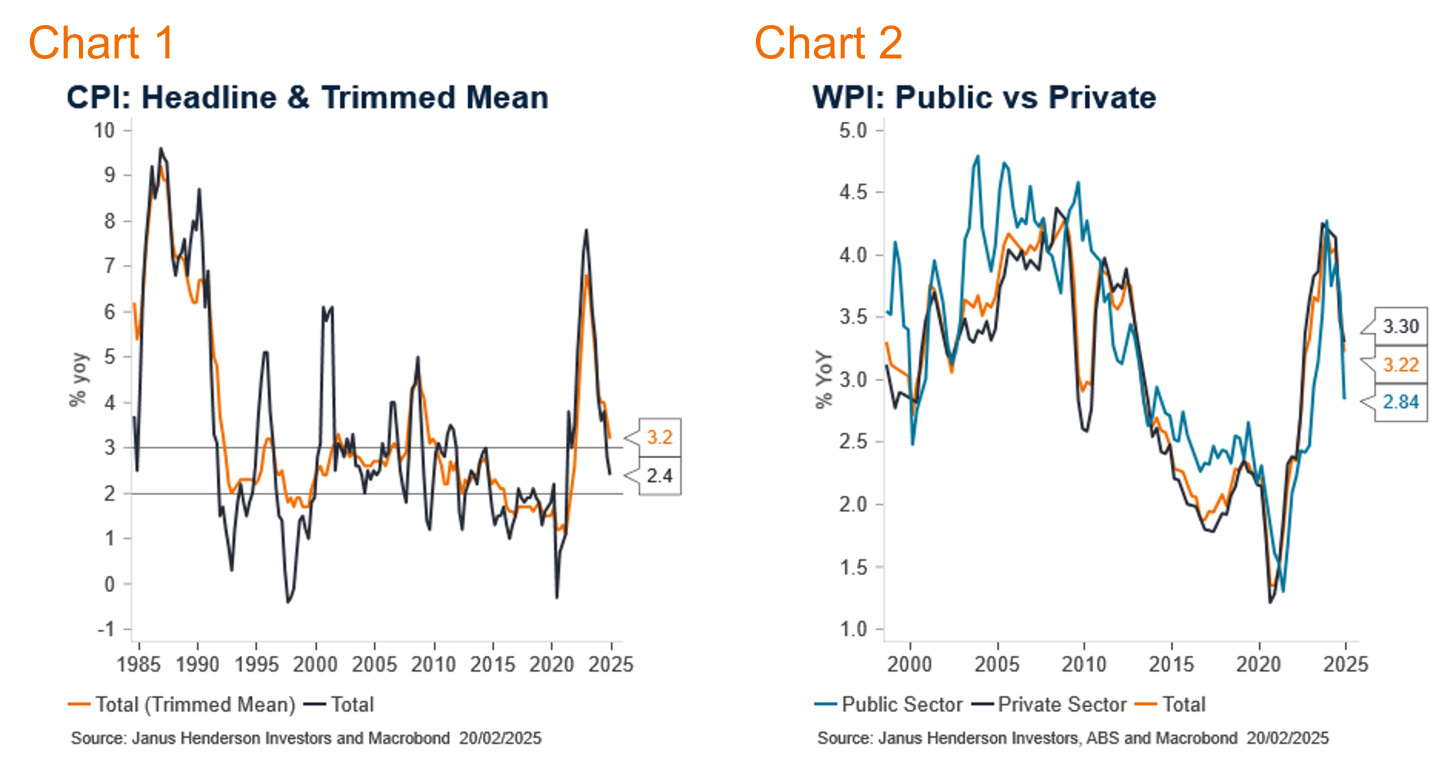

The RBA, having commenced easing, was in no hurry to promote the idea of further easing ahead. They have lowered their estimate of neutral policy and stated that they removed the insurance hike of late 2023, but need to see lower inflation, and fewer risks associated with the labour market, in order to ease again. With the unemployment rate at 4.1%, wages growth moderating to 3.2% year-on-year (yoy) and the monthly CPI coming in bang on target at 2.5%yoy, the economy was well behaved in the month.

Market outlook

Markets are likely to continue to be buffeted by global squalls amid policy uncertainty and crosscurrents. The domestic market, having seen the RBA commence easing, is likely beholden to the inflation outlook. We see the economy’s interest sensitive sectors starting to stabilise, and the absolute growth profile beholden to the fiscal outlook ahead of the Federal election.

Our base case is for the RBA to proceed with a modest easing cycle, of around 100bps in total to 3.35%, spread across 2025. We have assigned a 25% probability of the high case, in which fiscal policy is more expansionary and the RBA only ease twice for a total of 50bps. The low case is for more easing over the whole cycle. The market is pricing for a low in the cash rate of 3.44%. We believe there is limited value in targeted parts of the curve. We hold a modest duration position and look to adjust the position through market volatility.

Monthly focus – RBA finally eases – What’s next

The RBA lowered interest rates by 25bps in February, taking the cash rate to 4.10%. This was long anticipated by mortgage holders across the country, many of whom would like to see more of the same.

The RBA was able to lower the cash rate as inflation is moderating, and the headline rate is now back within the RBA’s target band of 2-3% year on year goal. While trimmed mean inflation, or the less volatile inflation series, remains above the RBA’s target band, it is moving lower. It is typical for the RBA to start easing policy before core inflation is at their target. This is because as long as monetary policy is still a headwind to the economy, inflation will slow. If you wait until core inflation is in the band, then you risk it undershooting in future given the long and variable lags associated with monetary policy.

How much further the cash rate will be lowered is a key question for those with a mortgage, but also bond markets. The most obvious impact of RBA easing is to lower mortgage payments, freeing up spending in the economy, and raising economic growth. But there are also impacts from switching asset preferences; earning less income on savings products pushes preferences towards spending, but also higher returning assets, such as credit. In turn, this raises investment, also boosting economic growth.

We believe the RBA will lower the cash rate a number of times this year, taking the rate to a low of 3.35%. The reason we are forecasting slightly more than the market is pricing, is that we place greater emphasis on the moderating inflation rate, than the stable unemployment rate. The RBA has dual goals: price stability and full employment.

Under current economic conditions we see the RBA meeting their price stability goals in the coming year. Demand driven inflation is currently moderating, and a range of sticky supply prices such as housing, are also moving lower. Household consumption is weak, which is easing price growth.

This is all occurring at a time where employment growth is strong. This suggests that an unemployment rate of 4.1% is not representative of full employment, it should be lower. The latest wage growth data backs this up, with wages growth moderating to 3.2%yoy. If the labour market was tight, then wages growth would be reaccelerating.

Given this, there is no need to maintain monetary policy above what is considered neutral, acting as a handbrake to economic activity. In the latest Statement on Monetary Policy (SoMP), the RBA outlined that their models are showing that the neutral policy rate is likely lower than their previous estimate of 3.5%. Analysis of the SoMP suggests their model average is close to 2.9%. This is aligned with our fair value process estimate of neutral cash rate.

This policy cycle is likely to be a shallow one, with the cash rate not getting to neutral. Fiscal policy is set to be a positive policy driver in the coming year, negating the need for a monetary policy fillip. The extent of that fiscal impetus is likely to be the final determinant of the full extent of the RBA’s easing cycle. We see our high case for the RBA path as having only two cuts and a long pause. Given the possibility of even greater fiscal spending from the upcoming Federal Budget, we assign a 25% probability to this upper case.

Views as at 1 March 2025.

All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson believe that the information is correct at the date of publication, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information.