ESG

integration

Responsible investing highlights

As investment professionals, our first responsibility is, and always has been, to our clients' interests and goals—growing and smartly managing their capital and fulfilling our fiduciary responsibilities. Client demand is also increasing for us to invest with processes that incorporate financially material ESG and sustainability factors. We are recognised as a corporate and as an investor for our strong Responsibility practices.

Principles for Responsible Investment Rating

>80/100 in all PRI

categories

Janus Henderson Group MSCI Rating

Maintained AAA

status

ESG

Integration

85% of AUM integrates

financially material ESG factors

UK Stewardship Code Member

Since the Code's

inception

All data as at 31 December 2024

Our ESG integration process

Global investment strength

With more than 350 investment professionals around the world, we benefit from a range of perspectives that we test and share as we seek to differentiate between the winners and losers on behalf of our clients.

ESG integration

Our in-house ESG subject matter experts conduct ESG research and proxy voting, oversee ESG data, thought leadership and regulations, and advise on ESG-integrated product development.

Our stewardship approach

Stewardship is an integral and natural part of Janus Henderson’s long-term, active approach to investment management.

Strong ownership practices, such as management engagement, can help protect and enhance long-term shareholder and bondholder value. Proxy voting practices can also influence long-term shareholder value.

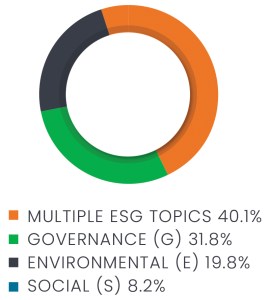

Our firmwide ESG engagements in 2024